Mortgage Rates Could Be Headed To 20% (Here’s How)

Brace yourselves, rebel capitalists! Could you fathom a world where mortgage rates skyrocket to an unprecedented 20% or more? It may sound like the stuff of financial horror stories, but the current trajectory suggests this chilling scenario might be closer to reality than fantasy.

The Stage is Set: Assets Move to the Fed

In our most recent discussion, we explored the very probable fate of numerous assets migrating to the Federal Reserve’s balance sheet. Remember the financial meltdown of Silicon Valley Bank and other similar entities? Their financial distress, although cushioned, was not without consequences. Banks, in their desperation, transferred assets to the Federal Reserve, gaining full value in return. While this move didn’t spell the nationalization of our banking system, it pushed us closer to a precarious brink.

The Participation Trophy Economy

Imagine an economy where everyone gets a medal just for showing up. That’s where we stand. The current economic model refuses to let big banks or mammoth corporations go belly up. Tragically, it’s the average Joe and Jane and the small-to-mid-sized businesses that bear the brunt. Creative destruction, as Schumpeter called it, is obstructed. Now, what happens when this philosophy collides with reality?

The Whiteboard Visualization: A Dire Prediction

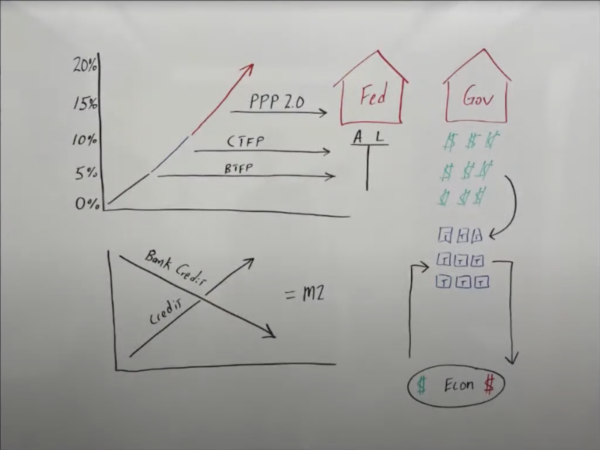

Visual aids always help, so let’s delve into this hypothetical yet alarmingly plausible scenario:

- The Black Line (0%-5% Interest Rate): The initiation phase. With interest rates climbing to 5%, the Bank Term Funding Program kicks in. Although these assets are technically on the bank’s balance sheet, the Fed would inherit them in a default scenario.

- The Blue Line (5%-10% Interest Rate): Tension mounts. If rates surge to this level, we’ll witness more bankruptcies, and not just from banks but also from corporations.

- The Red Line (10%-20% Interest Rate): Code red! Businesses are collapsing. The unemployment rate is off the charts. The Fed intervenes, attempting to stabilize an economy on the brink of disaster.

The question is: are we really prepared to handle this level of economic turbulence?

The Impact on Money Supply (M2)

Delving into the nuances, when bank credit contracts, it might lead to a decline in the money supply (M2). But let’s not descend into that rabbit hole just yet. The crux? If M2 dwindles, society’s overall purchasing power could take a significant hit. And if the Fed starts to issue credit, especially through a Central Bank Digital Currency (CBDC), the economic landscape could shift dramatically.

The Cost of Green:

Imagine standing at the helm of an economic ship in the middle of a monetary tempest. The waves crashing against the bow are represented by green dollar signs. These signify government deficits, an integral part of the fiscal landscape. Yet, every wave has a ripple effect. To sustain these deficits, treasuries are released, pulling back the very dollars that drive the economy, as represented by the black arrow. Now, picture a dollar metamorphosing from green to red, as it transforms from dormant savings to active, high-velocity cash. It’s as if one switched from being a spectator in the stadium to actively playing on the field. What happens when savings – often low-velocity and stagnant – are converted into high-velocity capital? It races back into the economy, not to its original owner, but likely to someone living paycheck-to-paycheck or to entities that will spend without hesitation.

The Inflation Paradox:

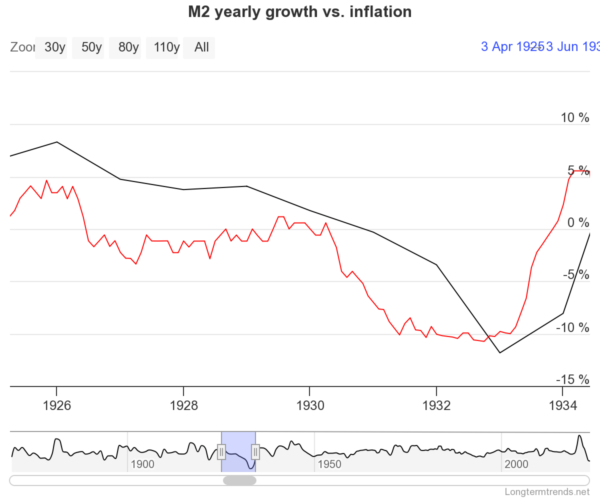

Contrary to popular belief, even if the mtwo plateaus or dips, inflation could still soar. High interest rates, the usual combatants against inflation, work by inducing recession, elevating unemployment, and causing businesses to fold. But what if most of the inflation is a result of supply-side issues?

The Domino Effect:

Reflect upon the banking crisis of March 2023. The only safety net was the Federal Reserve’s bank term funding program. If this is the only answer to every economic quandary, where does it lead us?

The Federal Reserve’s continuous interventions seem like an ever-spinning carousel. Inflation rises, prompting higher interest rates. But higher rates risk breaking the fragile economic structures. To prevent total collapse, more bailouts are implemented. With the Fed Funds potentially skyrocketing to 20%, mortgage rates might just follow suit. And while a steep hike in mortgage rates might stunt demand, it’s precisely the economic pinch the Federal Reserve seems to aim for.

The Perfect Financial Storm

Economic indicators are like storm clouds gathering on the horizon. We need to be vigilant and prepared. When interest rates rise to perilous heights, it won’t just be about numbers on a chart—it will be about the survival of businesses, financial institutions, and the very fabric of our economic structure. The economy is an intricate web, woven with threads of various financial tools. A tug here can send ripples elsewhere. But in trying to steady the ship amidst the tempest, are we inadvertently heading straight into the eye of the storm?