Did You See This!? Another Ominous Warning

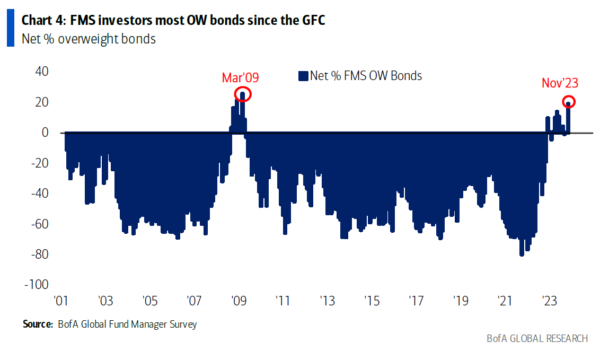

In the wake of the Global Financial Crisis (GFC) of 2008, the financial markets have been a subject of intense scrutiny and debate. As we turn our gaze towards the data points from that tumultuous period, a disturbing pattern emerges—a pattern that reflects today’s market conditions. The latest development to cause a stir is the bond market behavior, which echoes the crisis era. A recent Bloomberg article, derived from a Bank of America survey, highlights a notable shift: investors are diverting cash into bonds with a fervor not observed since 2009. The motivation behind this move is a widespread belief that interest rates will decline in 2024, indicative of a “soft landing” for the economy.

This narrative, however, is fraught with contradictions. While mainstream financial discourse promulgates the idea that lowering rates is synonymous with achieving a soft landing, the practicality of this theory is questionable. Historically, a 5% interest rate has been the norm for a healthy economy—not an indicator of draconian monetary policy. Therefore, the assumption that rates would revert to zero once inflation aligns with the Federal Reserve’s target seems unfounded. Zero percent rates are far from normal; they suggest a defensive stance against deflation, not a neutral position in a balanced economy.

The recent bullishness on bonds, predicated on this flawed logic, is akin to making financial decisions based on astrology rather than sound economic principles. It’s as if the market is buying bonds because “Aquarius is in the fourth moon,” so to speak—a rationale as whimsical as it is unfounded. Yet, despite the dubious reasons, the market’s pivot towards bonds may not be entirely misguided. The concern arises from the fact that this shift reflects not just a belief in the necessity of owning bonds but a fundamental misunderstanding of the economic signals being sent.

Moreover, there’s a puzzling dissonance in market behavior: investors are bullish on both bonds and equities. Historically, these asset classes don’t rally concurrently in the manner currently anticipated. The divergence in the underweighting and overweighting of bonds is a trend reminiscent of the GFC, suggesting that the market is perhaps correctly bracing for a recession, albeit for all the wrong reasons.

The situation becomes even more perplexing when considering China’s role in the global economy. A bet against Chinese equities seems to imply a prediction of decreased demand for their manufactured goods—a leading indicator of global economic health. However, the market’s simultaneous bullish stance on US equities suggests a failure to connect the dots; a slowdown in China could foretell a similar fate for the US economy, given the interlinked nature of global commerce.

In this complex financial landscape, where conventional wisdom is being upended, the role of the Federal Reserve’s rate decisions becomes even more crucial. The survey indicates that investors are gearing up for a scenario where peak Fed rates will prompt a shift in strategy, favoring bonds and forecasting lower rates in the near future. Yet, this strategy appears to be built on shaky ground, conflating a potential economic downturn with a misguided expectation of rate cuts.

Despite these confounding market signals, one sector appears to be a consensus pick for the most likely source of a credit event: commercial real estate in the US and European Union. Here, the market seems to be grasping the potential for significant disruptions.

In sum, the current financial climate is a conundrum of competing narratives and market signals. Investors are leaning towards bonds with an intensity last seen during the GFC, driven by a perplexing blend of justified caution and questionable logic. This raises important questions about the future of financial markets and the potential for a forthcoming economic adjustment, soft or otherwise. As always, the importance of a free market approach grounded in solid economic understanding cannot be overstated in navigating these uncertain times.