Here’s The REAL Reason The Dollar Will Crash

Parsing the Dollar’s Fate: An Insightful Look at Currency Dynamics Amidst Recession Concerns

As market watchers debate the future of the U.S. dollar, a nuanced perspective suggests a complex interplay between domestic currency supply and international economic mechanisms.

Amidst widespread concern about the potential for a U.S. dollar crash, financial experts are engaging in a rigorous examination of the forces that could shape the currency’s trajectory. Brent Johnson, known colloquially as the “Dollar Milkshake Guy,” recently ignited a discourse with a thought-provoking analysis that challenges mainstream narratives about the dollar’s demise.

The graphic on the left explains how & why many believe the USD will go into hyperinflation.

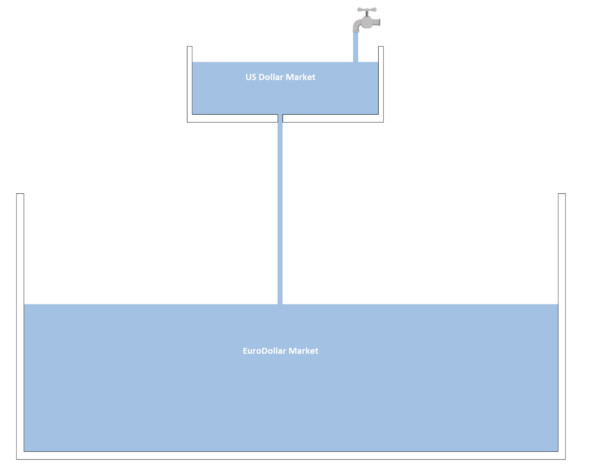

The graphic on the right explains how & why they are wrong.

It's a big world.

Best not to just focus on one part of it. 🫡 pic.twitter.com/3pLlfHBVWh— Santiago Capital (@SantiagoAuFund) November 19, 2023

Understanding the Dollar’s Dual Dynamics

Johnson, who is often seen as an ardent proponent of the dollar’s enduring strength, acknowledges the possibility of consumer price inflation within the U.S. while maintaining that the dollar could simultaneously appreciate against foreign currencies. This dichotomy is at the heart of the current debate: how can the dollar both weaken domestically and strengthen on the global stage?

The Case for a Strong Dollar Amidst Inflation

Recent data shared by Johnson via social media provides a visual analogy likening the U.S. economy to a container being filled with water, where the water represents currency units. The conventional fear is that an excessive supply of dollars will overflow the container, symbolizing hyperinflation. However, Johnson argues that this overlooks the essential outlets for the dollar — particularly, the vast and often opaque ‘eurodollar’ market, where U.S. currency circulates outside of America’s borders.

The Eurodollar Market’s Influence on Currency Valuation

The eurodollar market, a complex web of global financial transactions denominated in U.S. dollars, may be the key to understanding the currency’s resilience. With a significant portion of dollars created through international lending, there exists a substantial base of dollar-denominated debt outside the United States. This debt creates a foundational demand for dollars, which can act as a counterbalance to inflationary pressures within the U.S. itself.

A Counterintuitive Outcome: The Impact of Debt on Dollar Demand

Johnson suggests that if international faith in the dollar wanes — due, for example, to the diminishing role of the petrodollar or the emergence of alternative reserve currencies — the repayment of dollar-denominated debt could actually reduce the supply of dollars in circulation. Paradoxically, a decrease in the demand for holding dollars could precipitate an increase in their value, as debt repayment annihilates currency units.

The Prospects for U.S. Dollar Valuation

The current economic landscape presents a scenario where the dollar may depreciate in domestic purchasing power while appreciating against other currencies. This bifurcation underscores the nuanced dynamics at play and calls into question the linear narratives of currency valuation often espoused by pundits and the media.

The Role of the Federal Reserve and Global Central Banks

Central to this discussion is the role of the Federal Reserve and its counterparts around the world. As they navigate monetary policy in a globalized financial system, their actions will significantly influence the dollar’s path. Johnson’s insights compel market participants to consider a broader array of factors when predicting currency movements.

Moving Forward: Preparing for Currency Volatility

As investors and policymakers ponder these complex interconnections, it is increasingly clear that simplistic predictions of the dollar’s collapse may not hold water. Instead, the focus should be on understanding the undercurrents of international finance that will shape the dollar’s fate in the coming years.