OMG! New Report Uncovers Shocking Similarities Between Today And 1987

“Those who cannot remember the past are condemned to repeat it.” This adage, attributed to philosopher George Santayana, has never been more relevant. As we navigate the tumultuous waters of the financial markets in 2023, a chilling specter looms large: the Black Monday of 1987.

Is history repeating itself? Are we on the cusp of another catastrophic market crash?

The Unsettling Parallels

The financial markets are eerily mirroring the conditions that led to Black Monday in 1987. A recent Bloomberg report has ignited a firestorm of debate among investors and analysts. The report suggests that the current market conditions are not just similar but almost identical to those preceding the 1987 crash.

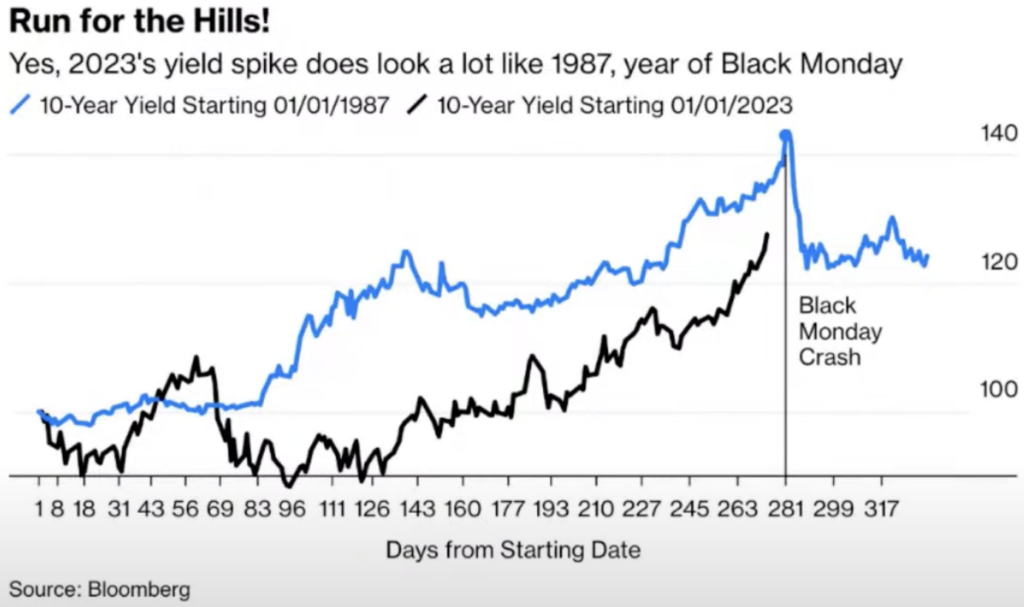

The Bond Yields: A Harbinger of Doom?

In 1987, bond yields were on a steady climb until they plummeted following Black Monday. Fast forward to 2023, and we see a similar trend. The 10-year Treasury yield has been rising, almost mirroring the 1987 trajectory. What’s even more concerning is the massive inversion of the yield curve today, a classic sign of an impending recession.

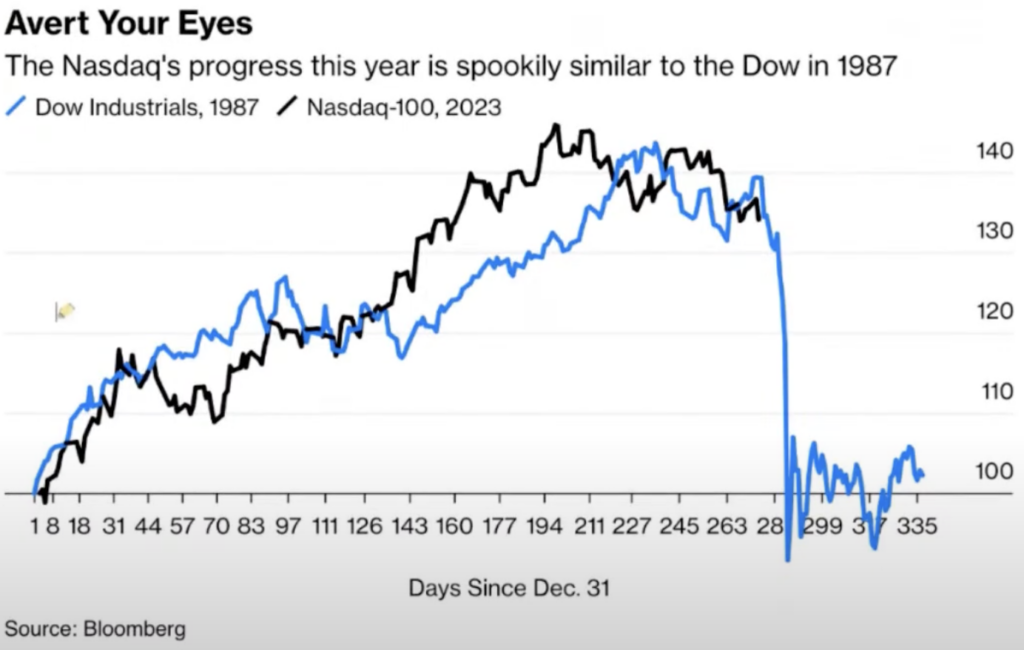

The Stock Market: Déjà Vu All Over Again

The NASDAQ 100 and the DOW Industrials are following a trajectory eerily similar to 1987.

The stock market is not just mimicking 1987; it’s also showing uncanny similarities to 1929, another year that led to a devastating market crash. Are we weeks, or even days, away from a similar catastrophe?

The Labor Market: A Softening Giant

The labor market, often seen as the backbone of the economy, is showing signs of fatigue. The Job Openings and Labor Turnover Survey (JOLTS) numbers have been on a steady decline since the start of 2022. This isn’t just a blip on the radar; it’s a red flag signaling a softening labor market.

In 1987, a similar trend was observed before the market crash. A weakening labor market can lead to reduced consumer spending, which in turn can trigger a domino effect across various economic sectors. Is the labor market’s current state another ominous sign pointing towards a 1987-like scenario? If so, the implications could be far-reaching, affecting everything from real estate to retail.

The Japanese Yen: An Odd Connection

At first glance, the relationship between the Japanese Yen and the U.S. dollar might seem unrelated to market conditions. However, history tells us otherwise. In 1987, fluctuations in the Yen-dollar relationship and interest rate differentials were precursors to the market crash.

Today, we’re witnessing a similar pattern. The Yen’s movements against the dollar and the shifts in interest rate differentials are echoing the conditions of 1987. Could this seemingly unrelated factor be the straw that breaks the camel’s back? Ignoring this correlation could be a perilous oversight for investors who think they’ve considered all risk factors.

The Earnings Mirage

Earnings reports can be seductive, luring investors into a false sense of security. While the S&P 500’s earnings and earnings expectations appear robust, it’s crucial to peel back the layers. These numbers are lagging indicators, often reflecting past performance rather than predicting future trends.

Moreover, the market’s optimism is far from uniform. It’s primarily buoyed by mega-cap tech companies like Google, Amazon, and Apple. But what about the rest of the market? For most other companies, the earnings picture is far from rosy. Is this narrow focus on a handful of companies setting us up for a catastrophic fall? A market that rises on the shoulders of a few giants is not just unstable; it’s a ticking time bomb.

Are we reading the signs, or are we choosing to ignore them? The clock is ticking, and the financial landscape is fraught with indicators that demand our attention. Ignorance is not bliss; it’s a one-way ticket to financial ruin.

The choice is yours, but remember, ignoring the signs is not just foolish; it’s financial suicide. Stand up for financial literacy, freedom, liberty, and free-market capitalism. Keep your eyes open, your ears to the ground, and most importantly, prepare for all possible outcomes.