ADP Jobs Report Shock...Hiring Slows and Yields Dive

By Rebel Capitalist News Desk

If you're looking for confirmation that the economy is slowing, today's ADP National Employment Report just sent a clear message: the U.S. private sector added only 37,000 jobs in May.

That’s the lowest monthly gain since March 2023.

And Wall Street took notice. The 10-year Treasury yield plunged as investors re-priced expectations for growth, inflation, and future Fed rate moves.

Let’s break down what happened, why it matters, and how investment legends might be reacting right now.

The Headline Numbers: Slowing Fast

According to ADP:

Private employers added 37,000 jobs in May.

That’s down from a revised 60,000 jobs in April.

It came in well below economist expectations of 110,000 jobs.

This wasn’t just a miss. It was a shock. And it could be the first hard signal that the labor market, the most resilient part of the U.S. economy, is finally bending.

The Fed has been waiting for signs of economic weakness to justify a pivot.

This might be the first undeniable one.

But here’s the kicker: the labor market isn’t supposed to roll over this quietly.

If this print is more than just noise, the entire “soft landing” narrative could unravel fast…

Sectors That Stalled

Job losses were broad:

Goods-producing sector: -2,000 jobs

Natural resources/mining: -5,000

Manufacturing: -3,000

Professional and business services: -17,000

Education and health services: -13,000

Trade, transportation, and utilities: -4,000

The only real strength came from leisure and hospitality, which added 38,000 jobs. That’s a strong number, but it can’t carry the whole economy.

When job losses start bleeding into sectors like professional services and healthcare…typically seen as “safe”…it’s not just a blip. It’s structural. And if these cracks widen, the dominoes won’t stop at the labor market…

What Businesses Are Saying

Small businesses (1-49 employees): -13,000 jobs

Large businesses (500+ employees): -3,000 jobs

Mid-sized businesses (50-499 employees): +49,000 jobs

Small businesses pulling back is a red flag. These are usually first to respond to tightening conditions. If they’re freezing hiring or cutting back, that could spread fast.

When small businesses start hitting the brakes, they tend to do it before anyone else. But here’s the real concern: what happens if the big guys follow?

We’ve seen this movie before…and the next scene isn’t pretty…

The Wage Picture

Despite the slowdown, wages are still rising:

Job-stayers: +4.5% YoY

Job-changers: +7.0% YoY

Wage growth hasn't cooled yet…but if hiring continues to slow, it probably will soon.

Rising wages in a slowing labor market?

That’s not a soft landing…it’s a paradox. And paradoxes don’t last long. If this dynamic holds, the Fed’s margin for error shrinks dramatically…

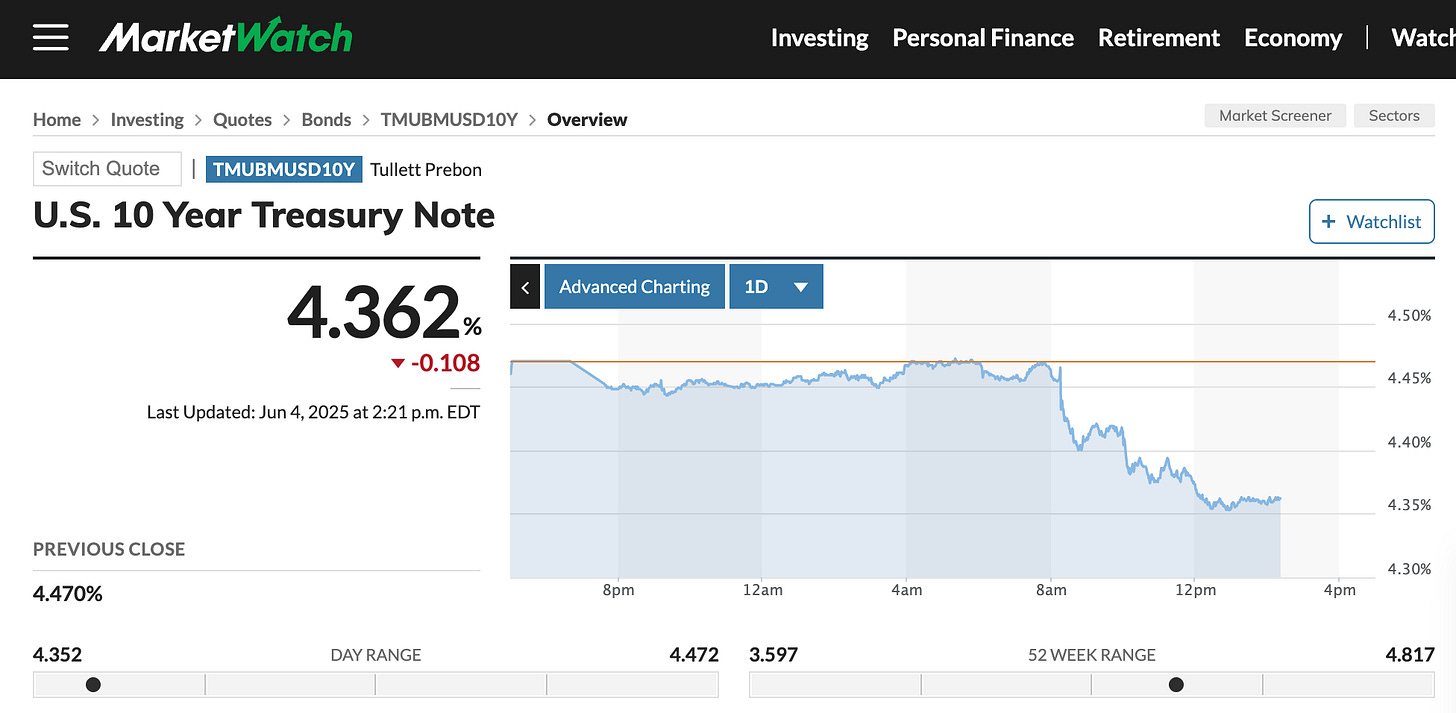

Bond Market Reacts: Yields Dive

The 10-year Treasury yield dropped sharply on the ADP news. Why?

Slower job growth = slower economic growth

Slower growth = less inflation pressure

Less inflation = less need for the Fed to keep rates high

Investors moved into bonds, betting that rate cuts are closer than the Fed is letting on.

This is not just a yield move. It’s a macro signal. The bond market is sniffing out trouble.

The bond market doesn’t care about press conferences…it reads the tea leaves in real time.

And right now, it’s screaming that the Fed is behind the curve. If yields keep falling, equity markets won’t be far behind…

How Investment Legends Might Play This

Paul Tudor Jones would likely look at today’s data and the yield drop and think: inflection point.

He might build positions in:

Long-duration Treasury’s.

Gold (as real rates fall).

Put spreads on cyclical stocks or financials.

Stanley Druckenmiller has talked often about watching the tape. He’d be looking at the labor weakness and the market reaction.

If he thought this was the start of a bigger move, he might go long defensive sectors and shift from growth to value.

Michael Marcus might trade momentum. Yields are falling. Bonds are rising. He’d be buying strength and riding the wave.

This Isn’t Recession. Yet.

Let’s be clear: this is one month of data. But it’s meaningful.

The jobs market has been the stronghold of the U.S. economy. If that’s changing, everything else could follow.

And this isn’t just a growth story. It’s a policy story.

This isn’t guesswork. The playbook is already open…just watch what the legends are doing.

Because when macro titans start repositioning, they don’t wait for confirmation. They move when the tape whispers…

Yes, it’s just one data point. But so was Bear Stearns before Lehman.

If the labor market has truly peaked, the lag effects of high rates could accelerate fast. And the next domino? Corporate earnings…

The Fed Factor

The Fed has said it’s watching the data. Today’s data says: slow down is here.

If Friday’s official jobs report from the BLS confirms the ADP trend, markets will start pricing in real odds of rate cuts…not in 2026, but maybe late 2025.

The Fed keeps saying “data-dependent.” Well, here’s the data. If Friday’s BLS print echoes this ADP shock, it won’t just shift expectations…it could start a stampede…

This Could Be the Pivot Point

Don’t ignore today’s jobs data. This was a meaningful deviation from trend, from expectations, and from the story the Fed is still telling.

Growth is slowing

Yields are falling

The market is signaling something new

The smart money will be watching the next few labor prints very closely.

Because this could be where the story changes.

Every cycle has a moment where the narrative breaks. This might be it. The labor market has been the last pillar holding the “no landing” crowd together.

If that pillar cracks, the floodgates open.

The smart money isn’t waiting to find out…they’re already watching the next jobs print like hawks.

Markets are shifting, the data is breaking trend, and smart investors are recalibrating fast. If you’re relying on CNBC headlines and FOMC soundbites, you’ll be three steps behind.

Join thousands of liberty-minded investors at the Rebel Capitalist News Desk for exclusive market breakdowns, real-time data interpretation, and actionable macro insights.

👉 Subscribe now on Substack… and never get blindsided by “unexpected” data again.

Rebel Capitalist News Desk

June 4, 2025

Jobs report today was much better than ADP and much better than those experts were expecting.