AI’s Hidden Black Swan

The Energy Crunch No One’s Talking About

Written by Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | August 13, 2025

The conversation around AI is dominated by job losses, automation, and Big Tech valuations.

But there’s a looming black swan almost no one is discussing…one that has nothing to do with pink slips and everything to do with physics, energy markets, and your future standard of living.

If you zoom out, the story becomes crystal clear: AI doesn’t just require clever algorithms and faster chips…it requires massive, exponential amounts of energy.

And in a world where energy is the economy, that sets up a collision course between feeding the AI beast and keeping the lights (and air conditioning) on for everyone else.

Energy Is the Economy

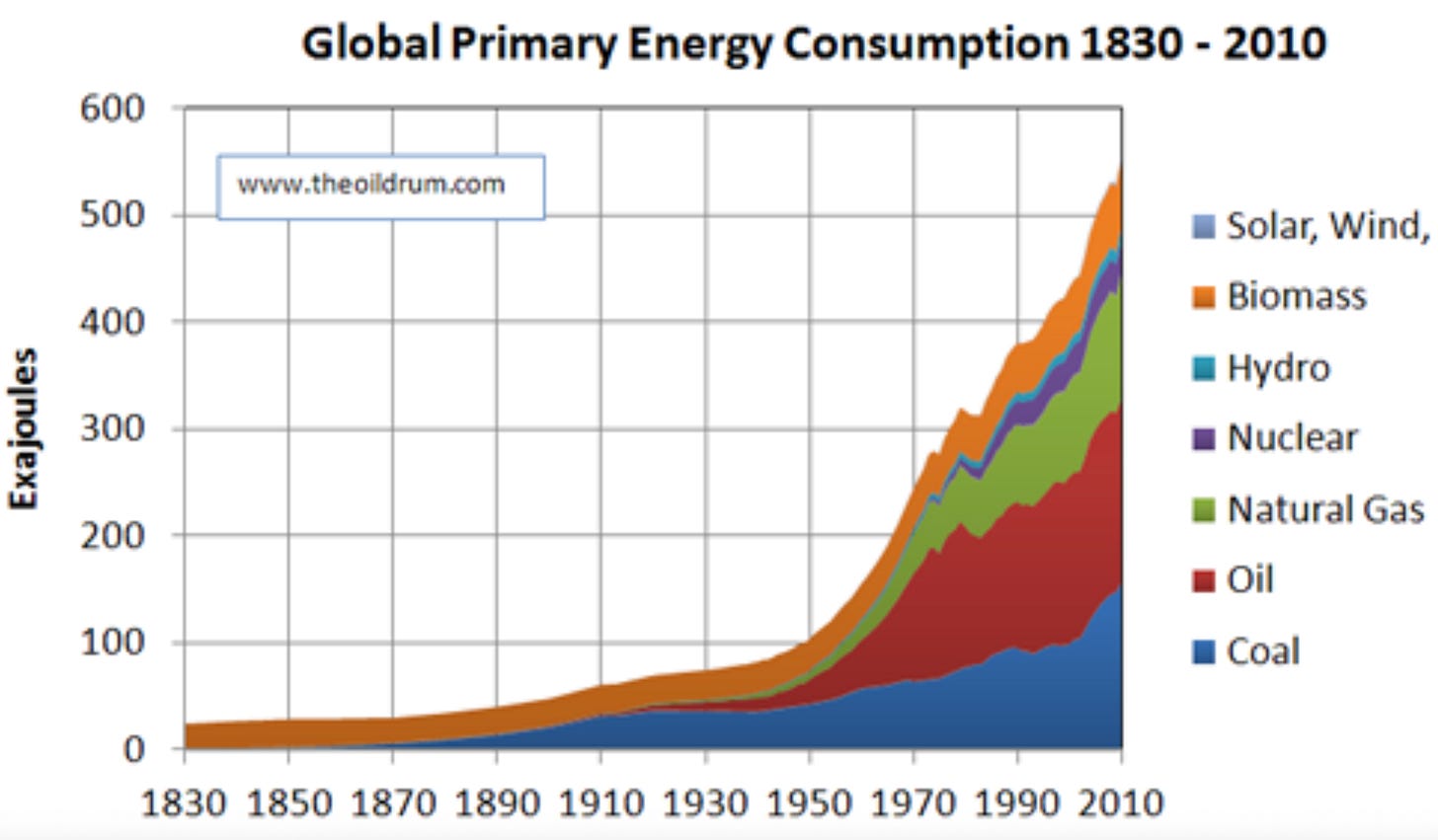

From 1830 to today, global energy consumption has followed an unmistakable exponential curve.

There are temporary dips…the Great Financial Crisis, the COVID lockdowns…but the overall trajectory is relentless.

Here’s the kicker: every “new” energy source we adopt DOES NOT replace the old ones, it stacks on top.

Coal didn’t go away when oil took off.

Oil didn’t shrink when natural gas exploded. Solar, wind, nuclear…all additive.

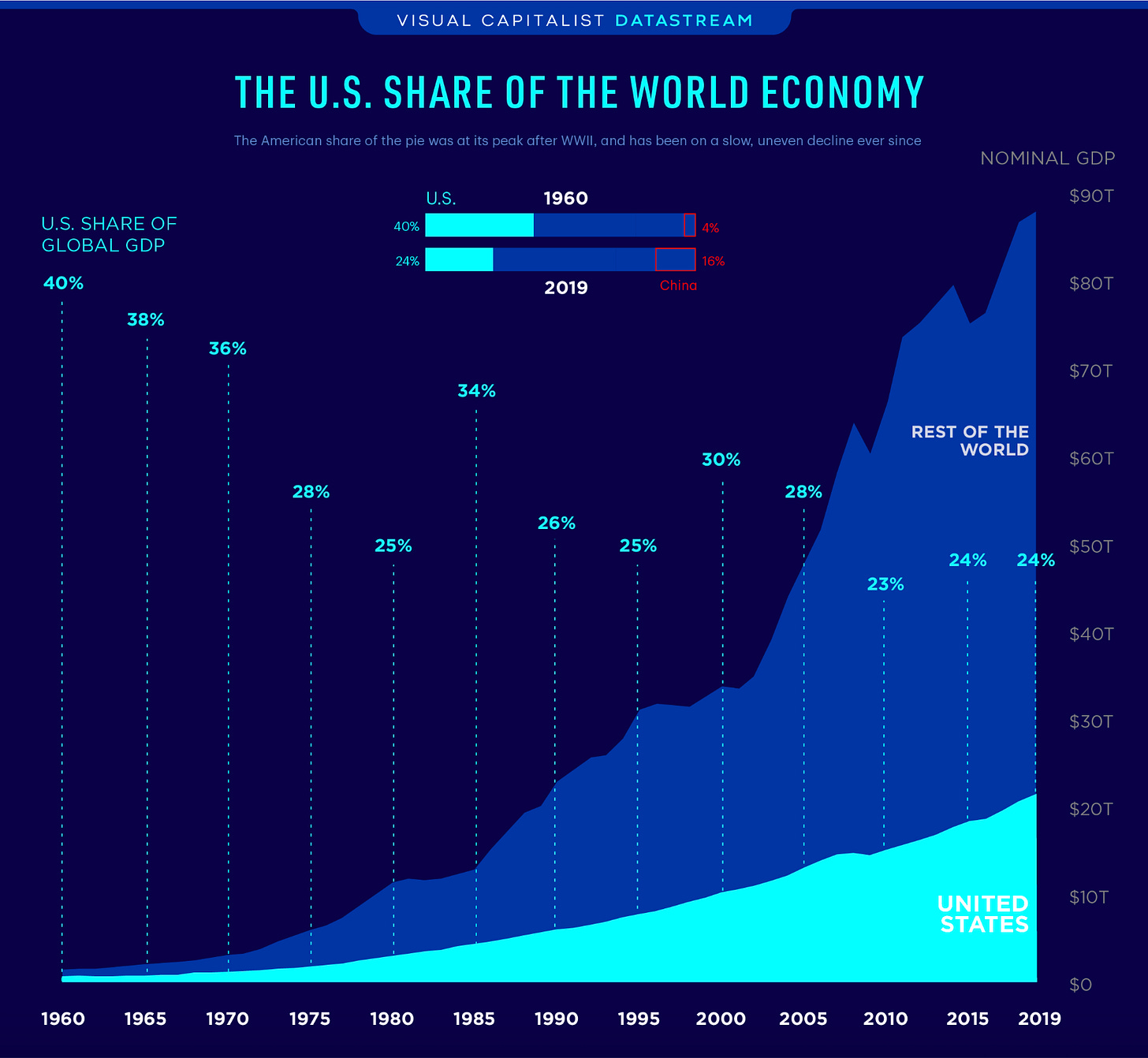

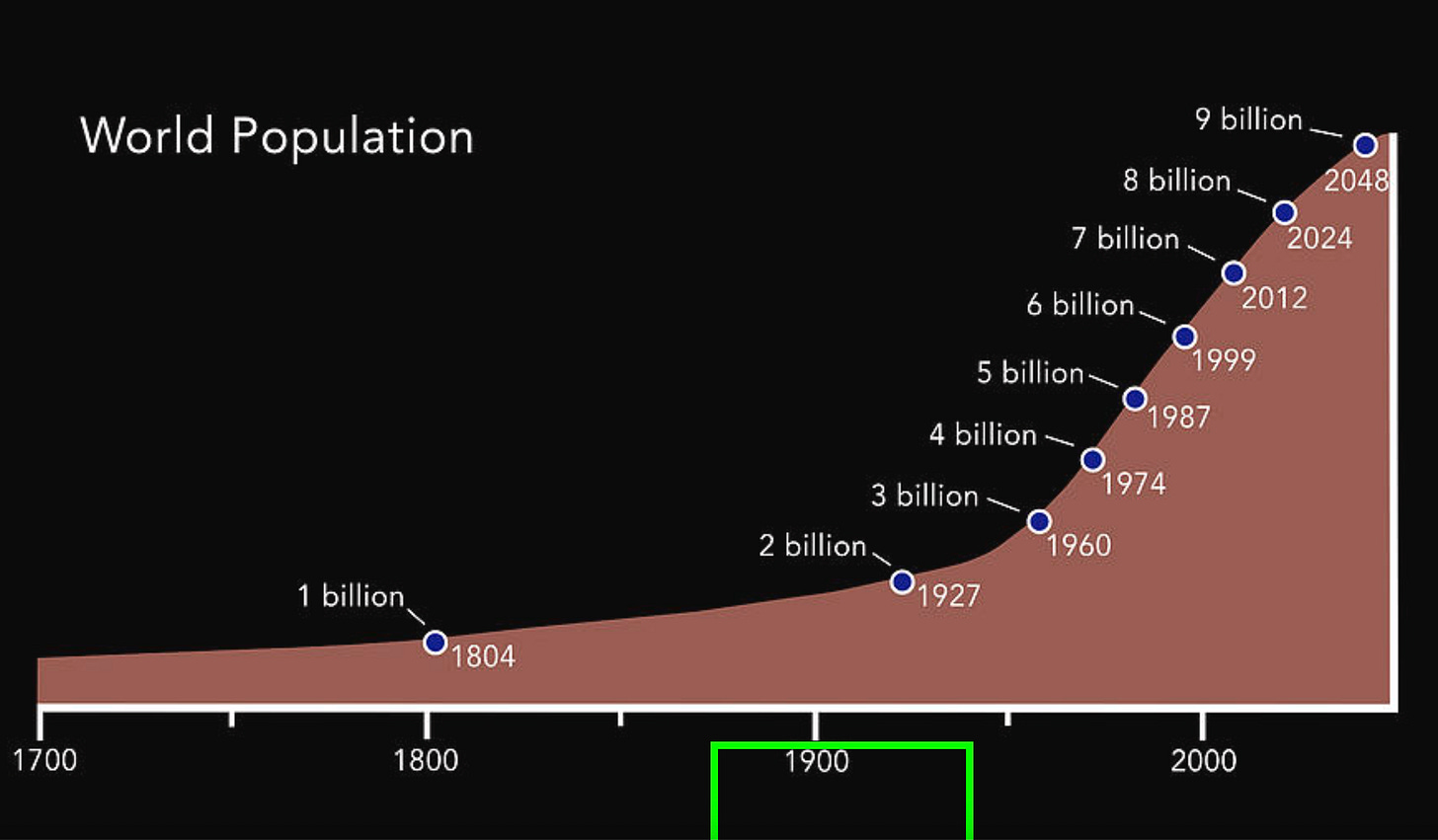

Energy use is tied at the hip to GDP and population growth.

Look at the charts and it’s eerie:

Energy demand goes vertical around 1950.

Global population does the same.

Global GDP follows the exact same slope.

If energy flattens or declines, living standards and population inevitably follow.

Every major boom in history…railroads, oil, the internet…looked unstoppable until it hit a hard resource limit.

The question nobody’s asking is what happens when AI slams into one that can’t be finessed with debt or printed away.

The early signs are already here…

AI’s Energy Appetite: Off the Charts

Right now, AI data centers are being built at a scale that makes NFL stadium projects look like backyard sheds. Some already consume as much power as mid-sized U.S. cities. And this is just the start.

Private sector: Big Tech is racing to outcompete rivals with bigger, faster models. Microsoft is buying nuclear plants. Others are locking up natural gas contracts.

Public sector: AI is already being framed as a national security imperative. It doesn’t matter who’s in the White House…the push to stay ahead of China, Europe, and Japan will keep the pedal down.

Combine both forces and the result is an exponential surge in electricity demand…on top of population growth, industrialization in the Global South, and baseline economic expansion.

If data centers are already competing with entire cities for electricity, what happens when the next generation of AI models requires 10x the compute power?

Insiders know the answer…and it’s a policy decision that could change your daily life overnight.

The Coming Allocation Dilemma

Here’s the uncomfortable part: even if we have the raw supply of natural gas, uranium, and copper, getting it out of the ground, refining it, and feeding it into the grid fast enough is a whole different challenge.

That sets up a fork in the road:

Allocate energy to AI (data centers, cooling systems, GPU farms)

Allocate energy to humans (homes, transportation, manufacturing, basic comfort)

If policymakers classify AI as “critical infrastructure” or “national defense,” don’t be surprised when you’re told to do your “patriotic duty” and cut back:

Rolling blackouts or brownouts.

Summer AC restrictions.

Water rationing (needed for cooling AI centers).

Limited airline travel.

The choice won’t be framed as AI vs. people…but that’s exactly what it will be.

Once AI is deemed “critical infrastructure,” the competition for energy won’t just be between corporations and consumers…it will be between nations.

And one country is already cornering the market in a way the West can’t match.

Global Positioning: China’s Energy Grab vs. America’s Short-Termism

While the U.S. is signing long-term LNG export deals with Europe (shipping out fuel we might soon desperately need), China is locking up oil, gas, and mining rights all over the world.

Example: China finances infrastructure in XYZ country…in exchange, it secures rights energy resources. They’re trading fiat for energy. We’re trading energy for fiat.

In a future of constrained supply and surging demand, guess who wins that trade?

When you trade your energy away for paper, you’d better hope the paper holds its value.

In the coming energy squeeze, it won’t…and that’s when the market will force a brutal repricing that few portfolios are ready for.

Portfolio Implications: The Release Valve Is Price

Even if supply can keep up in theory, in practice the ramp-up time is years. The market’s solution will be higher prices…potentially much higher.

Rick Rule’s view: Triple-digit oil could incentivize enough innovation and exploration to meet demand.

Chris Martenson’s view: The scale of AI-driven demand could overwhelm that incentive effect.

Either way, the path of least resistance is up for energy prices once we exit the next recession.

Triple-digit oil won’t be the “endgame” in this story…it’ll be the starting gun.

And when that moment arrives, the window to position will slam shut in weeks, not months.

What to Do Now

If energy becomes the chokepoint for both AI and human living standards, your investment framework should adapt:

Avoid the herd. Blindly buying the S&P 500 as an “inflation hedge” is a myth. History shows long periods where real returns were negative.

Focus on asymmetric bets. The biggest gains often come from getting the timing right, not just picking the right asset.

Diversify across scarce-resource plays. That means energy producers (oil, nat gas, uranium), key minerals (copper, lithium), and infrastructure enablers.

Have a sell strategy. Knowing when to get out is as important as knowing when to get in.

This isn’t a call to YOLO into copper or oil at today’s prices.

Smart rebel capitalists buy when assets are cheap.

But it’s a warning that, structurally, the next decade could be defined by an energy squeeze like we’ve never seen before.

The moment the AI boom collides with the energy ceiling, the scramble won’t just be for profits…it’ll be for access.

And the winners will be those who saw the power grab coming before the lights started flickering.

The Bottom Line

The AI boom is coming whether you like it or not. The question is whether the energy to power it will come at the expense of everything else.

If it does, the release valve will be price…in your electricity bill, your gas tank, your grocery store, and the assets tied to these resources.

Prepare now, while most people are still distracted by the “AI is stealing jobs” headline.

The real story is that AI might be stealing your power…literally.

🚨 Become a paid subscriber and join George Gammon on Friday for his unfiltered weekly wrap-up and more…

This Substack is supported by folks just like you! To receive new posts and support our work, please consider becoming a free or paid subscriber.

Brilliant analyses! However, the KEY question, since there are many companies in the stock market. WHICH SPECIFIC ones are best? ETFS for general investment, but even here WHICH ONES are best, as there are many even in each category.

More importantly for every category listed here as worthwhile investments, WHICH ONES are best and why????? There seem to be thousands of financial newsletters each screaming with the RIGHT ones, no? AND, of course, for a PRICE with fear and greed lengthy write ups, although with some good analysis, such as The International Man, Peter Schiff, etc.

To get wealthy and preserve wealth, one NEEDS money to buy the RIGHT stocks, etc.

Nothing is for free, except some analyses with the attached buy forms.

So, which are the best recommended places in terms of price and advice?

Would be great if one could buy THAT!

Why not try to fill the bill?

And many, many thanks for all your work, especially the One, Two, Three Step videos.

Kenneth Pollinger, ex-Jesuit, Ph.D. in Sociology (SUNY), founder of two Retreat

Centers hoping to help people with financial education, like MIKE MALONEY and George Gammon!!!!