America's Credit Card Problem Is Getting Worse—And It's a Warning Sign for the Economy

More Americans...rich and poor...are missing credit card payments, and delinquencies just passed 2008 levels. Could this be the first crack in the facade?

By Rebel Capitalist News Desk

There’s a quiet crisis brewing in American households, and it's happening inside your wallet.

According to a brand-new report from the St. Louis Federal Reserve, more Americans are falling behind on their credit card payments. And it’s not just a small bump…this trend has been going on for nearly four years now, and it’s getting worse.

In this article, we’ll break down the key points from the St. Louis Fed report, explain why credit card delinquencies matter, and why they might be sending a serious warning about where the economy is heading.

What’s Happening? More People Are Falling Behind on Credit Card Payments

First, let's talk about what the report shows. The Fed looked at data from the first quarter of 1999 through the first quarter of 2025. They tracked two important things:

The percentage of people who are late on their credit card payments by at least 30 days.

The percentage of total credit card debt that is delinquent by 30 days or more.

And the results? Both numbers have been rising sharply since early 2021.

Key facts:

From Q2 2021 to Q1 2025, the percentage of people 30 days delinquent rose by 63% in the lowest-income areas and by 44% in the highest-income areas.

Delinquency rates grew faster in poorer areas, but even wealthy areas saw a big jump.

Even though the growth in delinquencies has slowed down since early 2024, the overall level is still climbing.

In plain English: More people, no matter where they live or how much they make, are struggling to pay their credit cards on time.

But 30 days late is just the beginning. The debt is piling up on the lender side too—and that’s where systemic risk really starts to show...

Delinquent Debt Is Climbing on Lenders’ Balance Sheets Too

It's not just more people falling behind. The amount of debt that is delinquent is also growing fast.

Here’s what the data says:

In the wealthiest 10% of ZIP codes, the delinquency rate on credit card debt jumped from 4.8% in mid-2022 to 8.3% in Q1 2025. That’s a 73% jump.

In the poorest 10% of ZIP codes, it grew from 14.9% to 22.8% over the same period, a 53% increase.

That means banks and credit card companies are seeing a bigger chunk of their portfolios go bad—and that puts stress on the entire financial system.

And if you think that’s bad, wait until you see the numbers on people who are 90+ days late. This isn’t just a bump in the road. It’s a full-blown slide into insolvency...

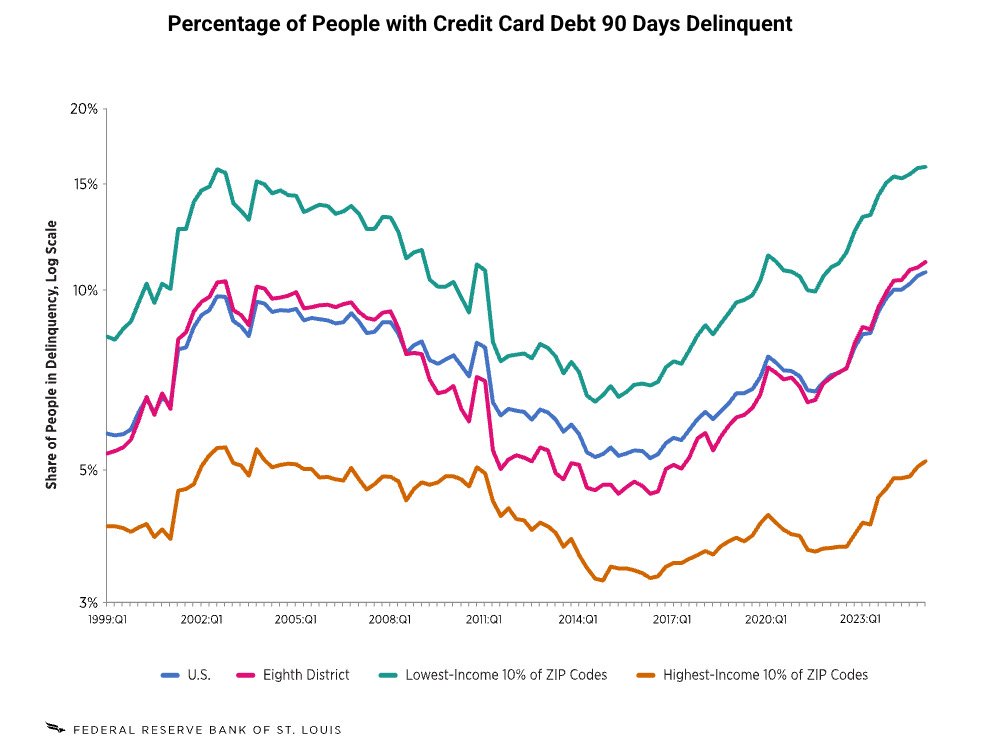

People in Deep Trouble: The 90-Day Late Payments

The Fed didn’t just look at people 30 days late. They also checked people who are 90 days or more behind—a sign that they’re in serious financial trouble.

Findings:

Since mid-2021, 90-day delinquencies have risen over 40% across the board.

In high-income ZIP codes, the rate jumped 80% from its low point in late 2022.

In the poorest areas, the rate increased 59% over the same period.

This shows that even people who live in rich areas are now falling into deep delinquency, not just missing one or two payments, but three months or more.

The last time we saw numbers like this? 2008. And that brings us to a chilling comparison...

How Bad Is It? Worse Than 2008

Here's the scariest part: The share of people in delinquency today is now higher than during the 2008 financial crisis.

And the share of debt that’s delinquent is reaching levels seen during that same crisis.

This is shocking because back in 2008, the economy was falling apart, the stock market was crashing, and millions were losing their jobs.

Today? The labor market is still strong—but people are still falling behind.

The Fed doesn’t know exactly why this is happening yet. But they do suggest that during COVID, many people’s credit scores improved because of stimulus money and relief programs. Now that those are gone, the true financial stress is being exposed.

So what does this mean for the broader economy? The answer lies in the hidden signals buried within this data...

Why Should You Care?

You might be wondering, “What does this mean for me?”

Here’s why this matters for every American and the broader economy:

It Shows Financial Stress Is Growing

Credit card delinquencies are like a warning light on your car dashboard. When they go up, it means more people are under pressure.It Could Signal a Coming Recession

Historically, when credit card delinquencies rise, recessions often follow. This is because people stop spending, and businesses pull back.It Hurts Bank Balance Sheets and Could Tighten Credit

If banks see more delinquencies, they may get stricter about lending, which makes it harder for everyone to get loans for homes, cars, or businesses.It Could Create a Feedback Loop

People fall behind →

Banks tighten credit →

Spending slows down →

The economy weakens →

More people fall behind.

That’s how small cracks can turn into big problems.

But here’s the twist: if unemployment is still low, why is this happening at all? The answer reveals just how unstable this recovery might really be...

Why Is This Happening Even Though Unemployment Is Low?

This is the million-dollar question.

If people have jobs, why are they falling behind?

Some experts think:

Cost of living is still high. Food, housing, and energy might not be rising as fast, but they’re still expensive.

People leaned hard on credit during inflation peaks, and now the bills are catching up.

During COVID, credit scores went up artificially because of stimulus money and debt relief—but those supports are gone now.

In short: People are running out of room to borrow more, and their incomes aren’t keeping up.

And if that’s true, investors need to start thinking very differently about which parts of the market are most exposed...

What Should Investors and Regular Folks Do?

If you’re a retail investor, this is a signal to:

Be cautious about consumer-driven stocks. Companies that rely on Americans spending on credit (like retail, travel, or entertainment) could face trouble.

Watch bank stocks carefully. If credit card defaults rise, banks could face bigger losses.

Think about your own financial safety net. Pay down expensive credit card debt and build up cash buffers where possible.

Because if this trend continues, the ripple effects won’t just hit Main Street—they’ll slam into Wall Street too...

Final Thoughts: A Canary in the Coal Mine?

The rise in credit card delinquencies is a canary in the coal mine for the U.S. economy.

It tells us that under the surface, many American households are still struggling—even if the headlines say the economy is strong.

History shows that these kinds of trends often lead to bigger problems later on, especially if banks react by pulling back on lending.

So, while the stock market is celebrating softer inflation and trade deals, this hidden stress in consumer debt might be the real thing to watch in 2025.

Join thousands of liberty-minded investors on the Rebel Capitalist News Desk. Get access to exclusive charts, macro insights, and deep-dive breakdowns that the mainstream media refuses to touch.

Subscribe now on Substack and start seeing the world through a different lens.

☝️ Join the Rebel Capitalist News Desk

Reporting by Rebel Capitalist News Desk