America’s GDP Is Quietly Going Soviet

And No One Seems to Notice...

Written by Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | August 12, 2025

When most people imagine a country sliding toward communism, they think of tanks in the streets, ration cards, and drab state-run factories.

What they rarely think about is a slow-motion process…one that doesn’t make headlines…where the government gradually becomes the economy.

That’s exactly what’s happening in the United States right now.

And if the current trajectory holds, we could be looking at a U.S. economy that’s 70–75% government-driven before the decade is out.

This isn’t a conspiracy theory, and it’s not partisan politics…it’s simply the numbers and historical patterns staring us in the face.

The 46% Red Flag Nobody’s Talking About

We all hear about the $37 trillion national debt. It’s the talking point politicians love to fight about.

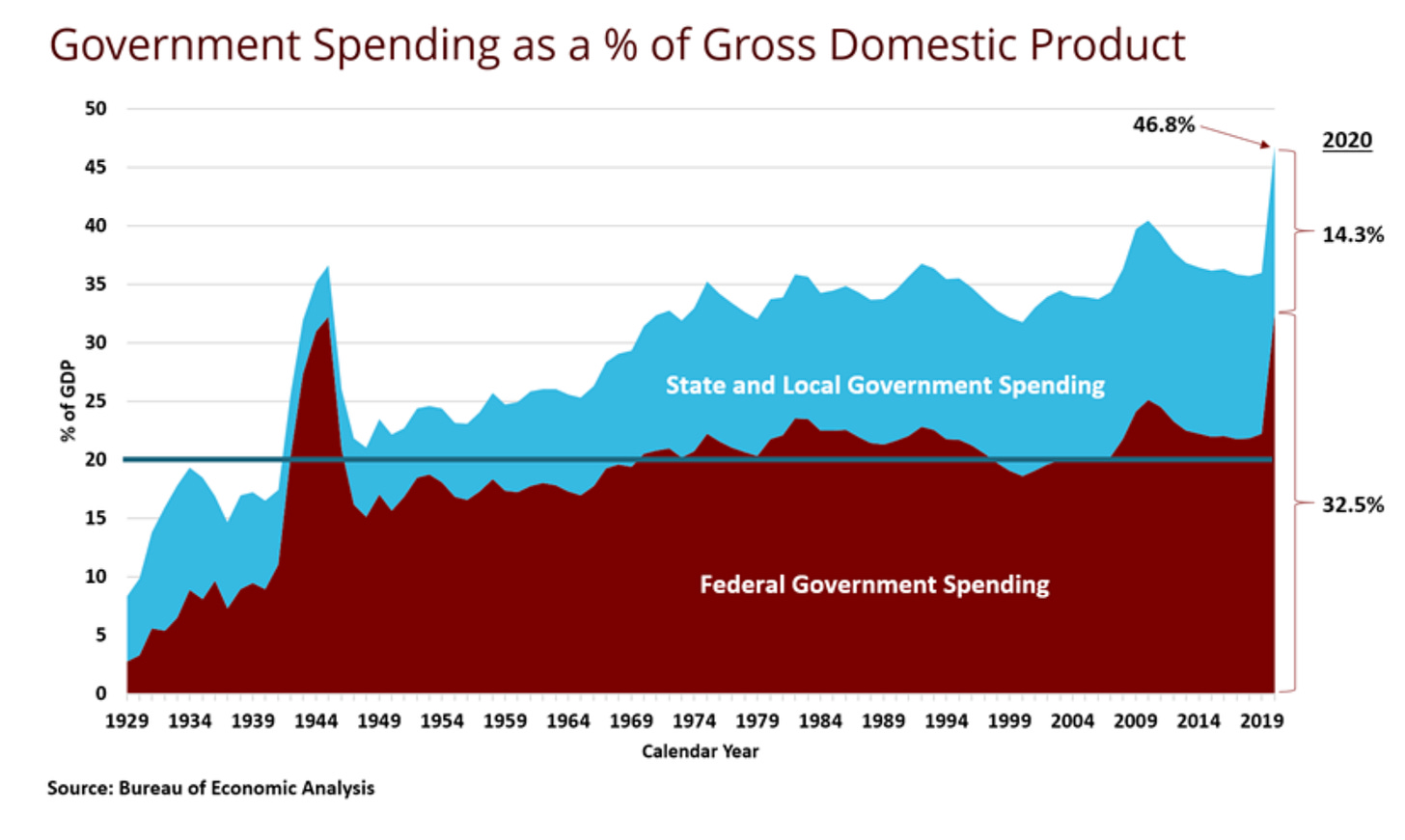

But another figure should be getting just as much attention: the share of U.S. GDP coming from government spending.

Right now, it’s roughly 46%.

That means almost half of the entire U.S. economy is directly dependent on federal, state, or local government outlays…in a time with no declared recession, no pandemic emergency, and supposedly “strong” private-sector activity.

In the 19th century, this number was in the single digits. Even during the Great Depression, it was far lower than it is today.

The long-term chart is a one-way street: each decade starts from a higher baseline than the last, and each crisis ratchets that baseline up even further.

If nearly half the economy already runs on government fuel during “good times,” what happens when the next real crisis forces the engines into overdrive?

The Crisis Ratchet Effect

Here’s the pattern history keeps repeating:

Crisis hits…war, financial collapse, pandemic.

Government spending surges to “stabilize” things.

Temporary measures become permanent.

New baseline never goes back to pre-crisis level.

World War II? Spending over 50% of GDP.

2008–09? Stimulus, bailouts, and massive Fed interventions.

2020? COVID pushed spending to record highs thanks to unprecedented fiscal packages.

The problem isn’t just the spike…it’s that after the crisis passes, the economy never shrinks the government’s role back down.

Instead, the next crisis starts from a bigger, more entrenched base.

History says the ratchet only turns one way…but the next turn could lock us into an economy where the state calls nearly every shot.

The Road to 70–75% by 2030

If we get a recession or geopolitical shock in the next few years…and history says we will…the government’s share of GDP could leap well past 60%.

Another round of “emergency” programs could push it to 70% or more before the end of the decade.

At that point, you’re no longer operating in a free-market economy.

The government is the primary allocator of resources. That’s central planning…not capitalism…even if the storefronts still look private on the surface.

And here’s the kicker: even if Washington somehow fixed the debt problem tomorrow, it could still accelerate us toward the very outcome everyone fears.

Why This Matters More Than the Debt

Oddly enough, if the debt-to-GDP ratio fell…say, through inflation or an asset revaluation…it could make things worse.

High debt at least forces politicians to pretend to be cautious. Remove that optical constraint, and spending could ramp up even faster.

Entire industries would grow around government contracts and subsidies, locking in political incentives to expand rather than shrink the state’s role.

Because when debt stops being the brake, there’s nothing left to slow the swelling tide of government control…and the private sector pays the price first.

Crowding Out the Private Sector

When government spending swells, the private sector’s share of GDP necessarily shrinks.

That’s not just accounting trivia…it reshapes the economy’s DNA:

Productivity drops as political allocation replaces competitive efficiency.

Innovation slows when capital chases subsidies instead of customers.

Living standards stagnate as fewer goods and services are produced per person.

Once enough businesses and households depend on government flows, the political will to reverse course disappears.

By the time the storefronts and logos still look the same, the incentives behind them may have already shifted…permanently.

The “We’re Not the USSR” Fallacy

Skeptics will say, “We’re still capitalist…Washington doesn’t own the factories.”

True, for now.

But the danger isn’t an overnight switch to full communism…it’s the gradual flip of incentives:

Companies focus more on winning government contracts than serving customers.

Households rely on transfer payments instead of market wages.

Voters demand benefits over growth because their livelihood depends on it.

Once that tipping point is reached, the system reinforces itself…just as it did in the U.K. in the 1970s and Argentina in recent decades.

Other nations have told this same story before us. The ending isn’t a mystery…but the U.S. still thinks it’s writing a different book.

Historical Warnings

History offers plenty of cautionary tales:

U.K., 1970s…High government spending, state-owned industries, and labor unrest led to stagflation and IMF bailouts.

Soviet Union, 1980s…Central planning bred inefficiency and collapse.

Argentina, modern era…Populist spending cycles trap the economy in stagnation.

The U.S. has advantages…a global reserve currency, deep capital markets…but none are immune to the corrosive effect of an ever-expanding government footprint.

If the political arc is set, survival won’t be about changing the system…it’ll be about sidestepping its grip on your wealth.

How to Position Yourself

If the trend continues, here are some guiding principles:

Diversify globally…Reduce reliance on one country’s policy whims.

Own real assets…Land, commodities, and cash-flowing businesses can survive policy distortions.

Stay nimble…Large bureaucracies are slow; opportunities emerge in their blind spots.

Watch policy direction…Party politics matter less than the fiscal and regulatory arc.

Because once the slide becomes visible to everyone, the options to escape its pull will have already narrowed to a fraction of what they are today.

The Quiet Slide

A government at 46% of GDP is already a warning sign. A government at 70–75% is a different country altogether.

The slide doesn’t come with a dramatic revolution. It comes from the steady, unopposed growth of the state during each crisis…growth that never fully recedes.

The next downturn could be the accelerant that takes us to the tipping point. If you wait until then to notice, it will be too late to prepare.

Oh, please…