April CPI Report Shows Inflation Cooling: What This Means for Your Money

“Inflation is dead.” That’s the new Wall Street narrative. But is it true—or just another head-fake before the next economic whiplash?

By Rebel Capitalist News Desk

Today’s Consumer Price Index (CPI) report for April 2025 was released, and the results surprised many investors.

Inflation came in softer than expected.

While that might sound like good news, it’s important to break down what it really means for regular folks trying to protect and grow their money.

In this article, we'll explain today's CPI numbers in plain English, why the market reacted the way it did, and what smart investors might want to consider doing next.

What Did the CPI Report Show?

CPI is a measure of how much prices for things like food, gas, housing, and clothes are going up or down. It's one of the key numbers that tells us whether inflation is hot or cooling off.

Here are the important numbers from today’s report:

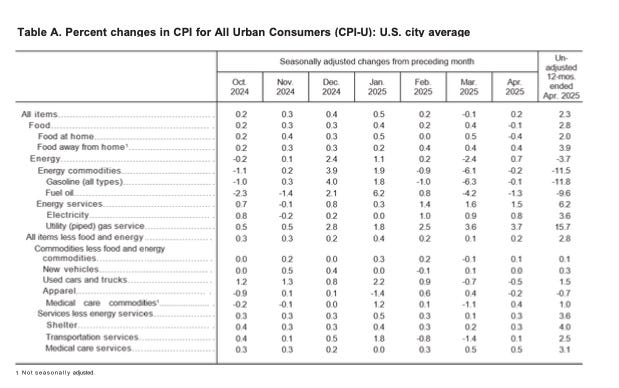

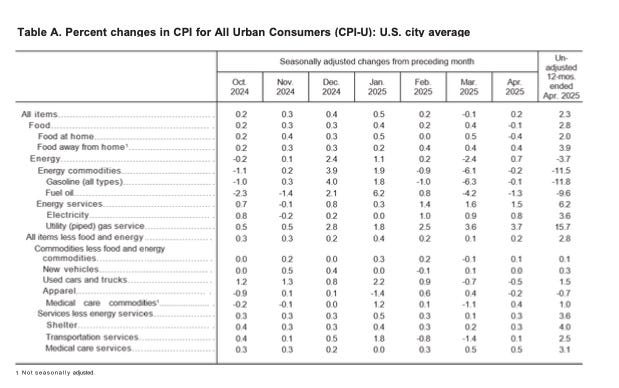

Overall CPI (all items): Up 0.2% in April, which is lower than the expected 0.3%.

Core CPI (which takes out food and energy): Up 0.2%, also below the 0.3% expected.

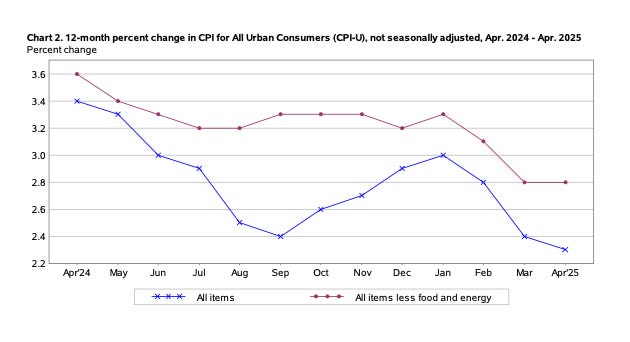

Year-over-year inflation (headline CPI): 2.3%, the lowest since early 2021.

Breaking down the categories from the BLS April 2025 report:

Food at home: Down 0.4% MoM, with declines in cereals, dairy, and fruits and vegetables.

Food away from home (restaurants, takeout): Up 0.4% MoM, continuing its steady rise.

Energy commodities: Down 0.2% MoM, with gasoline down 0.1%.

Energy services (like electricity and gas utilities): Up 1.5% MoM, reflecting sticky utility costs.

Shelter (housing costs): Up 0.3% MoM, now slowing but still +4.0% YoY.

Used cars and trucks: Down 0.5% MoM, extending recent declines.

Medical services: Up 0.5% MoM, showing persistent services inflation.

Prices are still going up, but the biggest drops were in groceries, used vehicles, and some energy goods, while shelter and medical services stayed sticky.

In short: Prices are still going up, but not as fast as the market expected.

Inflation is cooling…but not everywhere, and not for everyone. And the categories that remain sticky could tell us more about what comes next than the headline number itself…

Why Is This Important?

Inflation affects everything. When inflation is high, your money buys less. When it’s low, your money holds its value better.

Today’s lower CPI reading tells us inflation is cooling off faster than the market expected. That could mean the Federal Reserve might be more willing to cut interest rates sooner.

Lower rates usually make it cheaper to borrow money for things like cars, homes, and businesses, and they can also help stock prices go up.

But here’s the trap: falling CPI doesn’t always mean the Fed will cut. What if Powell’s more worried about asset bubbles than consumer prices? What happens then?

How Did the Market React?

As soon as the CPI report came out, markets reacted positively:

Stocks went up because investors think lower inflation means the Fed might cut rates sooner.

Treasury bond yields dropped, especially on short-term bonds, which is a sign that the market thinks the Fed might start cutting rates by the summer.

The U.S. dollar weakened slightly because lower rates make the dollar less attractive compared to other currencies.

Gold prices rose, as investors saw the lower inflation and weaker dollar as bullish for precious metals.

Everyone cheered today’s data…but remember: markets don’t price in what’s true. They price in what’s expected. The moment reality diverges, things can snap violently in the other direction…

What Does This Mean for Retail Investors?

Let’s break it down into simple takeaways:

1. Stocks Could Keep Rising (But Caution is Warranted)

Lower inflation is good for stocks in the short term. Lower rates make it easier for companies to borrow and invest, and investors are willing to pay more for stocks when inflation is low.

But be careful. Markets are already priced for perfection. The CNN Fear & Greed Index is at 70, which shows investors are feeling very confident. Historically, when the index gets above 80, markets often pull back.

2. Bond Yields Might Keep Falling (Which Means Bond Prices Go Up)

If the Fed is seen as cutting rates soon, short-term and long-term Treasury yields could fall further. That would make Treasury bonds more attractive for investors looking for safety and steady returns.

3. Gold and Silver Could Benefit

Precious metals like gold and silver tend to do well when inflation falls but the Fed stays easy. A weaker dollar and falling real interest rates make gold more appealing.

4. The Dollar May Stay Weak Against Other Currencies

If inflation keeps falling, and the Fed cuts rates, the U.S. dollar could weaken against currencies like the euro, yen, or emerging market currencies. This could boost foreign stocks and commodities.

5. Housing Is Still a Problem Area

Even though inflation is cooling, shelter costs are still rising. This could mean problems for renters and homebuyers are not going away quickly, even if overall inflation cools down.

The good news? Some assets look ready to run. The bad news? Everyone knows it. Which means the next surprise…up or down…could hit harder than anyone expects.

Risks to Watch

Even though today’s CPI is good news, there are risks investors should not ignore:

Sticky inflation in services remains a concern, with medical services up 0.5% in April, showing that core services inflation is still not fully cooling.

Shelter costs rose 0.3% MoM and remain up 4.0% YoY, keeping pressure on consumers and core inflation levels.

If the market gets too excited and starts assuming aggressive Fed cuts, stocks could overshoot and become vulnerable to pullbacks.

Geopolitical risks, credit risks, and market liquidity conditions are still fragile beneath the surface.

Lower-than-expected CPI could also be a sign that the economy is slowing faster than expected, especially considering the significant drops in food at home (-0.4%) and used cars and trucks (-0.5%), which may reflect weaker consumer demand rather than healthy disinflation. This could weigh on corporate profits and jobs in the coming months.

When prices fall for the wrong reasons…like demand destruction instead of efficiency gains…that’s not good disinflation. It’s recession warning flare. And we’re starting to see the smoke…

Final Thoughts: Good News, But Stay Sharp

Today’s CPI report shows that inflation is cooling faster than expected, which is good news for markets. But investors should not get too comfortable.

The last time the market got overly excited about falling inflation, it overlooked other risks that eventually led to pullbacks.

As always, it’s important to look beyond the headlines. Stay diversified, stay cautious, and be ready to adjust if the facts change.

Don’t trade what you hope. Trade what is—and always be ready for what’s next.

If this kind of breakdown helps you cut through the noise, join thousands of liberty-minded investors who subscribe to the Rebel Capitalist News Desk on Substack.

We track inflation, interest rates, and global market dynamics in real time…with zero sugarcoating.

👉 Subscribe now for exclusive access to our analysis and commentary before the heard catches on.

You’ve seen the headlines. Now it’s time to understand what they really mean.

Reporting by Rebel Capitalist News Desk