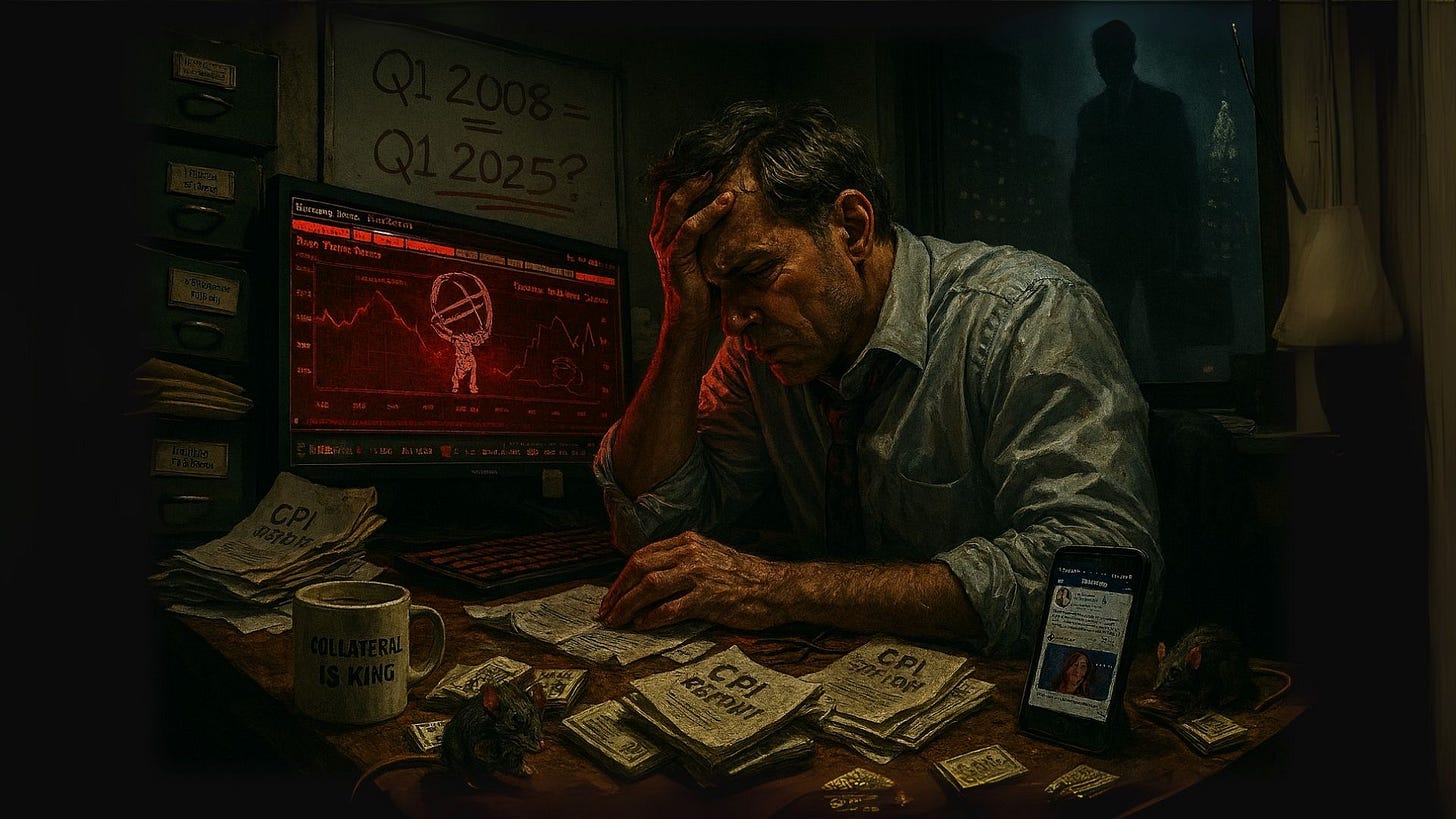

Broker-Dealer Balance Sheet Surge

Wall Street is positioning for risk-off in a major way.

Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | July 15, 2025

This week, a quiet but alarming shift in the financial system came to light.

Thanks to Caitlin Long’s tweet and an analysis by the Credit Bubble Bulletin, we now have confirmation that broker-dealer balance sheets have surged in a way eerily reminiscent of pre-crisis periods…most notably Q1 2008 and Q1 2023.

While the mainstream media remains fixated on political horse races and tech IPOs, the real drama is unfolding behind the scenes in the repo markets and the under-appreciated world of collateral dynamics.

The message from the data is simple: Wall Street is positioning for risk-off in a major way.

A Hidden Surge in Broker-Dealer Assets

According to the latest Fed data, broker-dealer assets surged by $490 billion in Q1 2025, representing a 37.2% annualized increase.

That’s the highest growth rate since Q1 2007 and takes total assets to levels not seen since Q3 2008…the quarter Lehman Brothers collapsed.

If history is a guide, this is not a bullish signal.

More specifically, broker-dealer repo assets jumped by $230 billion (56% annualized), while debt security holdings increased by $145 billion.

Agency securities (such as mortgage-backed securities) ballooned by 91% annualized, and treasury holdings rose $33 billion in Q1 alone.

This is not a bet on economic acceleration or stock market euphoria. This is strategic positioning for collateral…what banks and dealers need most when financial markets seize up.

But what if this surge isn’t just some cyclical quirk—but a deliberate, system-wide repositioning? To understand what these institutions are really bracing for, we need to follow the trail of collateral…

Why This Matters: The Role of Collateral

Most people hear "balance sheet expansion" and assume a bullish interpretation…stocks must be going up! But this isn’t about piling into equities. It's about securing high-quality collateral, mostly short-term government debt.

And why would broker-dealers hoard collateral?

Because in times of crisis, collateral becomes gold.

When liquidity vanishes, institutions scramble to get their hands on treasuries and T-bills to meet margin calls, access funding, or survive systemic shocks. Those holding this collateral can lend it out at massive premiums.

It’s a big bet. But if it pays off, the profits are enormous.

This isn't just about treasuries or safety…it's about survivability. And the institutions making these moves aren't betting on sunshine. The next question is: how exactly are they pulling it off behind the curtain?

How They’re Pulling It Off

Here’s the playbook:

Borrow money via repo markets, often from money market funds.

Use that money to buy treasuries or other high-quality collateral.

Keep the collateral on balance sheets while still leveraging it in repo or rehypothecation schemes.

Even without upfront cash, these broker-dealers can borrow first and buy later. That’s not a bug…it’s a feature of modern finance.

The system allows institutions to accumulate the most sought-after collateral using borrowed money, then profit massively if and when demand for that collateral spikes.

In other words, Wall Street is building a war chest…not for offense, but for defense. And that playbook? It’s one we’ve seen before. Let’s rewind the tape to the last two times they made moves like this…

It’s 2008 All Over Again… Or 2023

The last two times we saw this kind of broker-dealer activity were:

Q1 2008: Right before the GFC unraveled the global banking system.

Q1 2023: During the Silicon Valley Bank crisis, when regional banks required a backstop from the Fed.

In both cases, this activity preceded major risk-off events. Could we be staring down a similar crisis today?

While we can’t know the future, the pattern is unmistakable—and concerning.

Twice before, these shifts foreshadowed system-wide stress. Could it be happening again right under our noses? The real tell may lie in what’s happening to the shortest end of the yield curve…

Risk-Off, Not Risk-On

There are three primary explanations for this activity:

Prepping for a Storm: Broker-dealers believe financial conditions will deteriorate, and collateral will become scarce and expensive. Like buying insurance in advance, they’re preparing to profit from crisis.

Safe Haven Allocation: With macro data weakening and recession probabilities rising, they’re allocating capital to "safe" assets rather than chasing speculative returns.

Capital Appreciation: If the Fed cuts rates unexpectedly (possibly as soon as July), long-duration treasuries could soar. This could be a bet on capital gains from a dovish pivot.

All three scenarios are defensive. Not one of them implies Wall Street sees boom times ahead.

None of these strategies signal optimism. They signal preparation. But one bizarre distortion in the bond market shows just how far this collateral panic may already have gone…

The Four-Week Mystery: Collateral Demand and Yield Inversion

Here’s where things get even stranger. Recently, the yield on four-week T-bills dipped below the reverse repo rate offered by the Fed.

Think about that.

Any institution could park cash at the Fed and earn 4.25% risk-free. Instead, they’re buying four-week T-bills yielding less. That means they're willing to take a loss just to hold the collateral.

Why?

Because in a crisis, that T-bill isn’t just a yield generator…it's a lifeline. You can lend it out, post it in repo, or pledge it for emergency funding. Its value isn't just in the yield…it's in the optionality.

This behavior only makes sense if these players believe there's a decent probability of financial stress where holding T-bills becomes a survival advantage.

If Wall Street is willing to lose money just to hold T-bills, what does that say about their view of coming volatility? To find the answer, we need to explore the dark mechanics of rehypothecation…

Rehypothecation Games and the Dark Side of the Repo System

Another red flag? The mechanics of collateral rehypothecation.

Money market funds hand over cash in exchange for treasury collateral. But what if that collateral is already pledged 14 times elsewhere?

That’s not a hypothetical…it’s standard practice.

The risk here is that during a crisis, the same piece of collateral is claimed by multiple parties. Untangling that web becomes nearly impossible, and the system locks up.

This is why the repo market is so opaque and dangerous. It's not just leverage…it's leverage on leverage. And it only works when everyone believes everyone else is playing by the rules.

Spoiler alert: they’re not.

The collateral everyone’s scrambling for? It might already be claimed 10 times over. And when trust cracks in this shadow system, the fallout isn’t just theoretical—it’s systemic. So where are the regulators in all this?

What About Regulation?

Basel III? SLR requirements?

Please.

The idea that minor regulatory tweaks are going to corral these balance sheet behemoths is laughable. The banksters are essentially laughing at these regulations.

They’ll play nice at quarter-end when it's time for window dressing. The rest of the time, they’re optimizing for profits, not compliance.

And in that pursuit, they’re loading up on the financial equivalent of oxygen…collateral.

They’re either asleep at the wheel…or playing catch-up with institutions two steps ahead. But while the regulators posture, the market’s preparing. And what happens next might depend entirely on one key data point…

What Happens Next?

The data tells us broker-dealers are preparing for something. Whether it's a liquidity crisis, a Fed rate cut, or a sudden economic downturn, their balance sheet decisions speak louder than any FOMC press conference.

The next major data release, particularly the upcoming CPI print, could further tilt the odds toward a Fed pivot. If inflation comes in light again, markets will reassess rate cut probabilities—possibly to 50/50 odds, per Jeff Snyder’s latest take.

That’s why all eyes should be on both the inflation data and the yield curve. Any steepening (particularly in short-term yields falling faster than long-term) would confirm market expectations of imminent easing.

One CPI print could flip the script on the entire rate path narrative. And if it does, these dealer positions could suddenly look like a masterstroke—or a panic move confirmed. Here’s how to prepare, before the pivot happens…

Final Thoughts

This isn’t about fear mongering. It’s about pattern recognition.

Broker-dealers don’t shift $500 billion in assets for no reason. The last two times they did this, we got a financial crisis. And this time, they’ve surpassed those historical levels.

It doesn’t mean a crisis is guaranteed. But it does mean the risk is higher than the average investor realizes.

So what can you do?

Stay informed. Monitor repo markets, yield curves, and central bank actions.

Consider collateral dynamics when evaluating risk assets.

Hedge where appropriate…because if this collateral scramble is a signal, the next liquidity crunch might already be brewing.

🚨 Become a paid subscriber and join George Gammon for his Friday weekly wrap-up and more…