Consumer Confidence Just Broke the Tie

Why the Labor Market Is Telling the Truth and GDP Is Lying

Written by Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | February 1, 2026

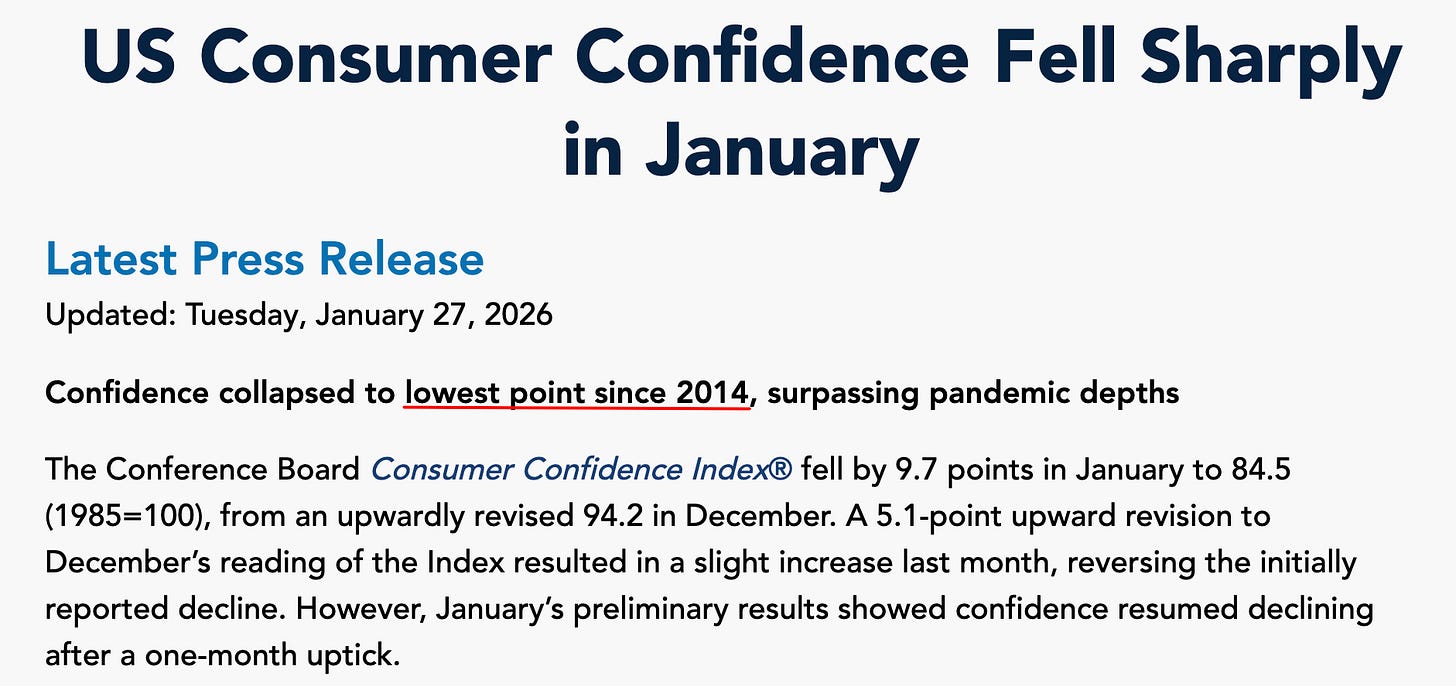

For the better part of the last year, macro investors have been stuck in a strange stalemate. On one side of the debate sits real GDP, printing numbers that suggest the U.S. economy is running hot...almost suspiciously hot. On the other side sits the labor market, quietly deteriorating beneath the surface with negative payroll prints, weak ADP data, and rising unemployment.

Both can’t be right.

And until now, it’s been easy for the bulls to wave away the labor data as “noise,” arguing that GDP is the ultimate scorecard. But the latest consumer confidence report may have just broken the tie...and it overwhelmingly sides with the labor market.

Consumer confidence has collapsed to its lowest level in 11 years, lower even than the trough during the COVID lockdowns. And this isn’t just a partisan story. Democrats, Republicans, and independents are all trending in the same direction: down.

That single data point reframes everything.

Why Consumer Confidence Matters More Than People Think

Consumer confidence is often dismissed as “soft data.” It’s emotional. It’s political. It’s survey-based. And in isolation, those criticisms are fair.

But confidence becomes powerful when it aligns with hard behavior.

And that’s exactly what’s happening now.

When confidence collapses, households don’t just complain...they change decisions. They delay purchases. They cancel contracts. They stop committing to long-term obligations.

Which brings us to housing.

Homebuyers Are Backing Out...Fast

According to recent data, more than 40,000 signed home purchase agreements were canceled in December, representing 16.3% of all homes under contract. That’s the highest cancellation rate in nearly a decade.

This is not theoretical pessimism. These are buyers who:

Had already agreed on a price.

Had already begun the closing process.

Had already locked in financing.

And then walked away.

That doesn’t happen in a booming economy. It happens when people look forward...and don’t like what they see.

Even more telling, there were 47% more home sellers than buyers in the market during December. That imbalance alone makes the bullish housing narrative extremely difficult to defend.

Mortgage Rates Didn’t Cause This

The go-to excuse from housing bulls is interest rates. High mortgage rates, they argue, are scaring buyers away.

But that explanation completely falls apart under even minimal scrutiny.

Mortgage rates didn’t spike in December. They fell.

The 30-year fixed mortgage rate dropped from roughly 6.9% earlier in 2025 to around 6.1% by year-end. That’s a massive tailwind for housing demand.

Yet cancellations surged anyway.

Which tells us something critical: this is not a rate problem...it’s a confidence problem.

People aren’t backing out because they can’t afford the payment today. They’re backing out because they’re afraid they won’t be able to afford it tomorrow.

Expectations Are Collapsing Faster Than Current Conditions

The consumer confidence report breaks sentiment into two components: present conditions and expectations.

Present conditions are still relatively elevated. People know they still have jobs...for now. They’re still paying their bills...for now.

But expectations? They’re falling off a cliff.

And historically, that’s the dangerous setup.

Recessions don’t begin when conditions are terrible. They begin when expectations collapse and behavior changes. That’s when hiring freezes start. That’s when investment slows. That’s when discretionary spending gets cut.

Confidence leads behavior.

This Isn’t a Partisan Story

One of the most revealing aspects of the data is how uniform the decline has been across political groups.

Yes, Democrats are pessimistic. That’s expected.

But Republicans...who were euphoric earlier in the year due to tariff optimism and reshoring narratives...have seen confidence roll over sharply as well. Independents are right there with them.

When sentiment deteriorates across all political affiliations, it’s no longer about ideology. It’s about lived experience.

People are feeling the squeeze.

Generational Breakdown Tells the Real Story

Perhaps the most striking part of the report is the generational breakdown.

Gen X confidence is at the lowest level of any cohort.

That matters.

Gen X is the core of the labor force. They’re the managers, engineers, accountants, and mid-level professionals. They’re also disproportionately exposed to white-collar disruption...from AI, automation, and corporate cost-cutting.

When Gen X confidence collapses, it usually signals job insecurity in the middle of the income distribution. That’s exactly where recessions do the most damage.

Baby Boomers are also increasingly worried, despite holding most of the assets. That suggests asset prices are no longer providing psychological comfort.

Gen Z, unsurprisingly, remains the least concerned...for now.

The GDP–Labor Market Disconnect Can’t Last

Here’s the core contradiction the market must resolve.

Real GDP is still printing strong numbers. But the labor market is telling a completely different story:

Negative non-farm payroll prints

Weak ADP reports

Rising unemployment

Falling hours worked

You cannot have sustained economic expansion without labor income growth.

One of these indicators has to give.

And based on probabilities...not wishful thinking...the most likely outcome is that real GDP falls to meet the labor market, not the other way around.

The odds of job growth suddenly accelerating from negative prints to 300,000 jobs per month...without a massive stimulus shock...are close to zero.

GDP is backward-looking. Employment is forward-looking.

The Fed Is Looking at the Wrong Dashboard

The Federal Reserve continues to emphasize GDP and inflation prints, insisting the economy is “resilient.” But resilience doesn’t look like collapsing consumer confidence and mass contract cancellations.

The Fed doesn’t control the economy. It reflects it.

Lower interest rates won’t magically restore confidence if households are worried about job security. Rates didn’t save housing in December...and they won’t save it in 2026 if labor conditions continue to deteriorate.

This is the same mistake the Fed has made in every late-cycle environment: focusing on lagging indicators while ignoring leading ones.

Confidence Is the Missing Link

Consumer confidence ties everything together:

It explains why housing transactions are collapsing.

It explains why retail demand is weakening.

It explains why labor market stress keeps spreading.

And most importantly, it explains why the GDP narrative feels increasingly detached from reality.

People don’t commit to 30-year mortgages when they’re confident things will get worse.

They wait.

Watch What People Do, Not What They Say

The economy is not what politicians claim.

It’s not what headline GDP suggests.

It’s not what the Fed hopes for.

It’s what people do.

Right now, people are:

Canceling home purchases.

Pulling back on big decisions.

Growing pessimistic about the future.

That behavior aligns perfectly with a weakening labor market.

The tie between GDP and employment has been broken.

And consumer confidence just told us which side is winning.

Prepare accordingly.

It seems the Fed is more than just a reflection of the economy. Since its inception in 1913 we have had skyrocketing inflation, trillions in debt, slavery to the IRS, state, and other disguised taxation. As we teeter on the tip off this precipice, the best bet is to hold one’s breath and wait.

Executives will never publicly admit that AI is already having a profound impact on unemployment. Middle management is DEAD! Automation is here. We must Upgrade our skill set or we too will suffer