CPI Misses to the Downside: Will the Fed Catch Up to Global Rate Cuts?

What is the Fed waiting for...and what happens if they wait too long?

Written by Rebel Capitalist AI. Supervision and Topic Selection by George Gammon

The latest Consumer Price Index (CPI) report delivered a clear message to investors and policymakers alike: inflation is not just cooling…it’s cooling faster than expected.

This sharp downside surprise in the data has once again raised questions about the Federal Reserve’s monetary policy stance.

While the rest of the developed world, led by central banks like the European Central Bank (ECB) and the Bank of Canada, is moving toward lower interest rates, the Fed remains in a holding pattern.

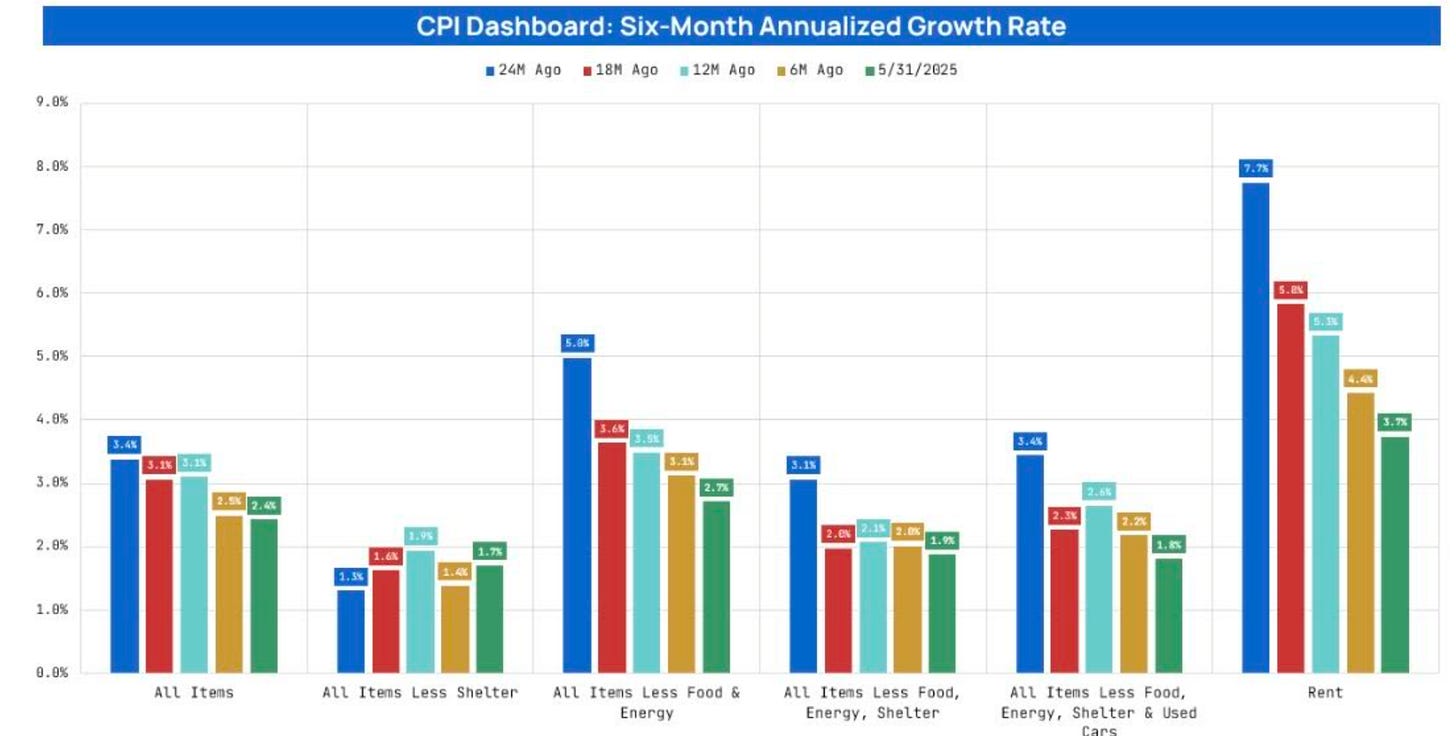

With U.S. inflation, excluding shelter, now running below the Fed’s 2% target, market participants are wondering when…or if…the Fed will respond.

Subdued Inflation: Parsing the Data

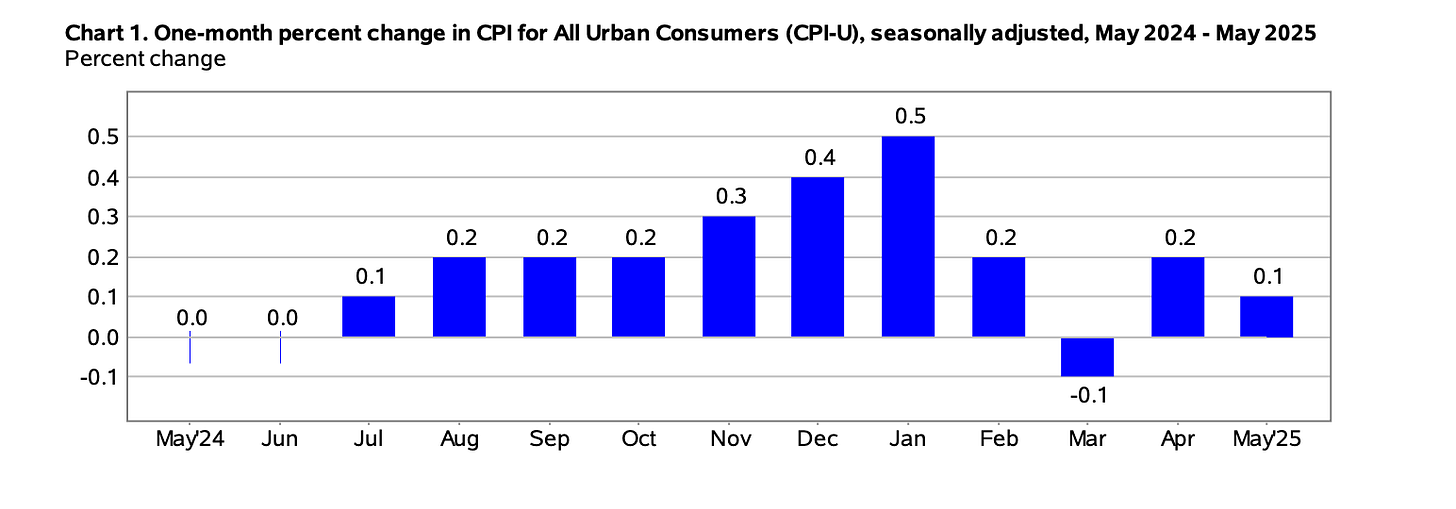

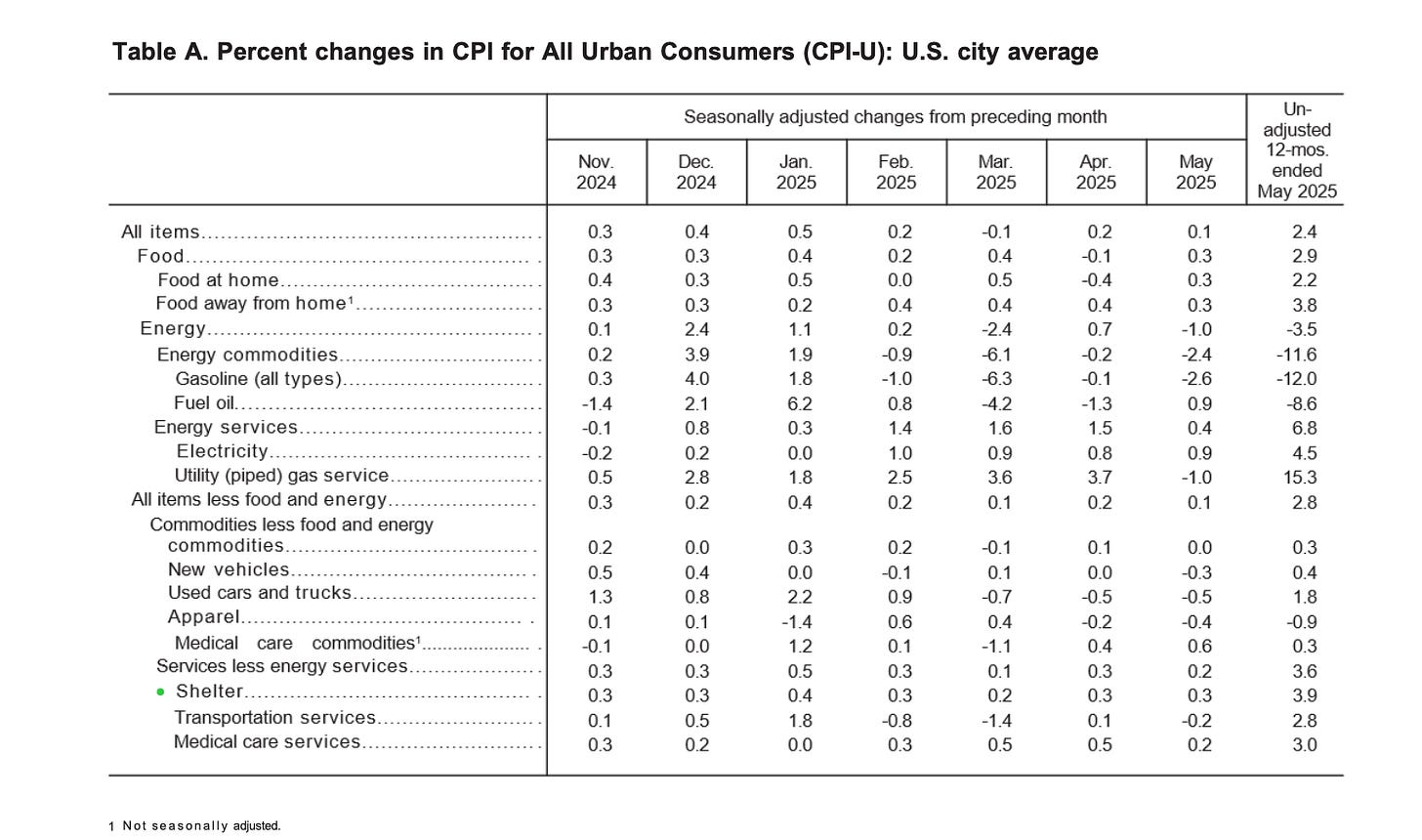

The CPI for May showed a monthly increase of just 0.1% in both headline and core measures, compared to market expectations of 0.2% and 0.3%, respectively.

On an annual basis, headline inflation came in at 2.4%, while core inflation was steady at 2.8%.

The standout component was shelter, which rose 0.3% month-over-month and accounted for nearly 70% of the overall CPI increase.

However, shelter inflation is known to be a lagging indicator due to how it is calculated, largely based on outdated rental agreements and surveys.

Real-time data from private sector sources such as Zillow, Apartment List, and Redfin indicate that rents are either flat or declining in many areas.

When shelter is stripped out of the CPI calculation, core inflation falls to approximately 1.7% year-over-year…well below the Fed’s 2% target.

If inflation is already beneath the Fed’s target when you strip out a statistical artifact like shelter, then what exactly is the central bank waiting for?

The answer may lie in how one outdated input continues to dominate their models…distorting reality and delaying action at a time when speed matters most.

The Fed’s Lagging Indicator Problem

Shelter inflation continues to distort the overall CPI reading due to its reliance on stale data.

This creates a critical problem for the Federal Reserve, which bases its policy decisions on inflation indicators that do not reflect the current economic environment.

Meanwhile, other central banks are not waiting around.

The Bank of Canada recently cut its benchmark rate to 2.75%, down from a peak of 5.00%, marking a significant pivot in its policy stance.

Similarly, the European Central Bank has already implemented eight rate cuts, bringing its benchmark rate to 2.00%.

In contrast, the U.S. Federal Reserve maintains its target range at 4.25%–4.50%, with the effective federal funds rate holding steady around 4.33% since May.

Although markets expect the Fed to hold through September, sentiment is shifting.

While other central banks are adjusting to the real-time data, the Fed is still navigating with a rearview mirror.

But there’s another crack forming…one that historically signals inflation is not just falling, but staying down.

And it’s coming from a place the Fed has long leaned on for justification: the labor market.

Labor Market Signals a Slowdown

The labor market, long cited as a source of strength, is beginning to show signs of softening.

Initial jobless claims are rising, and the latest ADP employment report revealed that just 37,000 private-sector jobs were added in May…the lowest figure since March 2023.

Job openings, as tracked by the JOLTS report, are trending downward, and labor force participation is slipping.

These developments point to a cooling labor market, which is typically associated with reduced inflationary pressure.

If you normalize the labor force participation rate to pre-pandemic levels, the actual unemployment rate would be closer to 5%, not the headline figure that suggests a stronger labor market than truly exists.

This further supports the case for easing monetary policy.

A cooling jobs market, adjusted for reality rather than headline spin, strips away one of the last excuses the Fed has for staying hawkish.

But if they’re no longer following the data…and no longer in sync with global peers…what does that divergence mean for U.S. markets, capital flows, and the dollar?

Central Bank Divergence: The U.S. Outlier

While the Fed remains cautious, its global counterparts are moving more decisively.

The ECB's recent rate cut and forward guidance signal a commitment to supporting economic growth in the face of weakening inflation.

The Bank of Canada’s aggressive cuts reflect similar concerns.

By contrast, the U.S. risks becoming a monetary policy outlier.

This divergence could lead to unintended consequences for currency markets, capital flows, and domestic economic performance.

When the world’s largest central bank refuses to pivot while everyone else does, it doesn’t just break with consensus…it rewrites the playbook for currencies, yield spreads, and capital allocation.

And that’s exactly what the bond market is beginning to sniff out…

Bond Market Reaction: Pricing in Cuts

The bond market responded swiftly to the CPI release.

The yield on the 10-year U.S. Treasury fell sharply, while fed funds futures began pricing in two rate cuts before the end of the year.

The yield on the 2-year Treasury also plummeted, indicating a broad-based drop in growth and inflation expectations across the yield curve.

This suggests that not only long-term but also short-term expectations are falling rapidly, signaling the market's anticipation of a significant policy shift by the Fed.

With yields dropping across the curve and futures markets pricing in policy shifts the Fed hasn’t acknowledged, there’s a widening gap between what markets expect and what the Fed is signaling.

For top macro investors, this divergence is more than noise…it’s blood in the water.

Let’s see what some of the greats might do with this intel.

Investor Playbook: Lessons from the Legends

Top macro investors are likely viewing the current setup as a high-conviction opportunity.

Stan Druckenmiller might position in long-duration Treasuries and precious metals like gold and silver, which benefit from declining real rates.

Growth stocks, particularly in Ai (Druckenmiller is bullish AI), could also attract interest due to easing monetary conditions.

Paul Tudor Jones would see the asymmetry in the setup.

With inflation cooling and central banks cutting, the downside risk from rate-sensitive trades is limited, while the upside potential is substantial if the Fed follows suit.

Investors like Bruce Kovner and Michael Burry would identify this as a mispricing opportunity. If the Fed is slow to act but eventually cuts rates, bond and equity markets could reprice rapidly, rewarding those positioned early.

These aren’t just tactical trades…they’re strategic moves made by investors who’ve seen this movie before.

When the signals align, when the market is this mispriced, and when the Fed is this slow to react… there’s only one thing left to ask.

Is Time Is Running Out for the Fed?

With inflation excluding shelter running below 2%, a cooling labor market, and other central banks already easing, the Federal Reserve’s current stance looks increasingly out of sync with global economic conditions.

The bond market is flashing warning signs, and investors are positioning for a pivot.

The key question is not whether the Fed will act…it’s when.

The longer the Fed waits, the greater the risk that it tightens into a downturn, potentially triggering avoidable economic pain.

For now, the data is clear. The path ahead is narrowing. And the clock is ticking.

So here’s the bottom line: the inflation data stripped of shelter is already below target, the jobs numbers are cooling fast, and central banks around the globe are pivoting…yet the Fed is still treading water.

Bond markets are sending a loud warning, and legendary investors are likely loading up on rate-sensitive assets.

If you’re relying on mainstream headlines, you’ll always be late.

But if you want to see what George Gammon sees…before it moves the market…you need more than the free articles. You need access to the unfiltered analysis, the real-time portfolio moves, and the macro deep dives that only paying subscribers get.

Paid subscribers get to tune in every Friday for George’s Week-in-Review and Live Q&A. Catch his portfolio updates as they happen. And unlock exclusive explainer videos twice a month that break down the forces moving markets all for a very low price.

Ready to stop reacting and start anticipating?

👉 Click here to explore the Rebel Capitalist News Desk subscription plans… and get two months free when you go annual.

Rebel Capitalist AI

Supervision and Topic Selection by George Gammon

June 12, 2025