CPI Was a Decoy...This Data Bomb Lit the Fuse on Yields

It’s clear the move in the 10-year yield wasn't about CPI at all. The mainstream is struggling to explain this reaction…but we won’t.

Written by Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | July 16, 2025

Wall Street woke up yesterday morning expecting a mild inflation print. What it got instead was a wake-up call…not from the CPI itself, but from what followed: a shock surge in Treasury yields and a bond market scrambling to reprice reality.

The CPI report for June came in as expected, with core CPI even slightly below forecasts. But that didn't stop the 10-year yield from exploding nearly 10 basis points in just a few hours.

The mainstream is struggling to explain this reaction…but we won’t.

This is where understanding market psychology, yield curves, and the data beneath the headlines matters.

And when you dig a little deeper, it’s clear this wasn't about CPI at all.

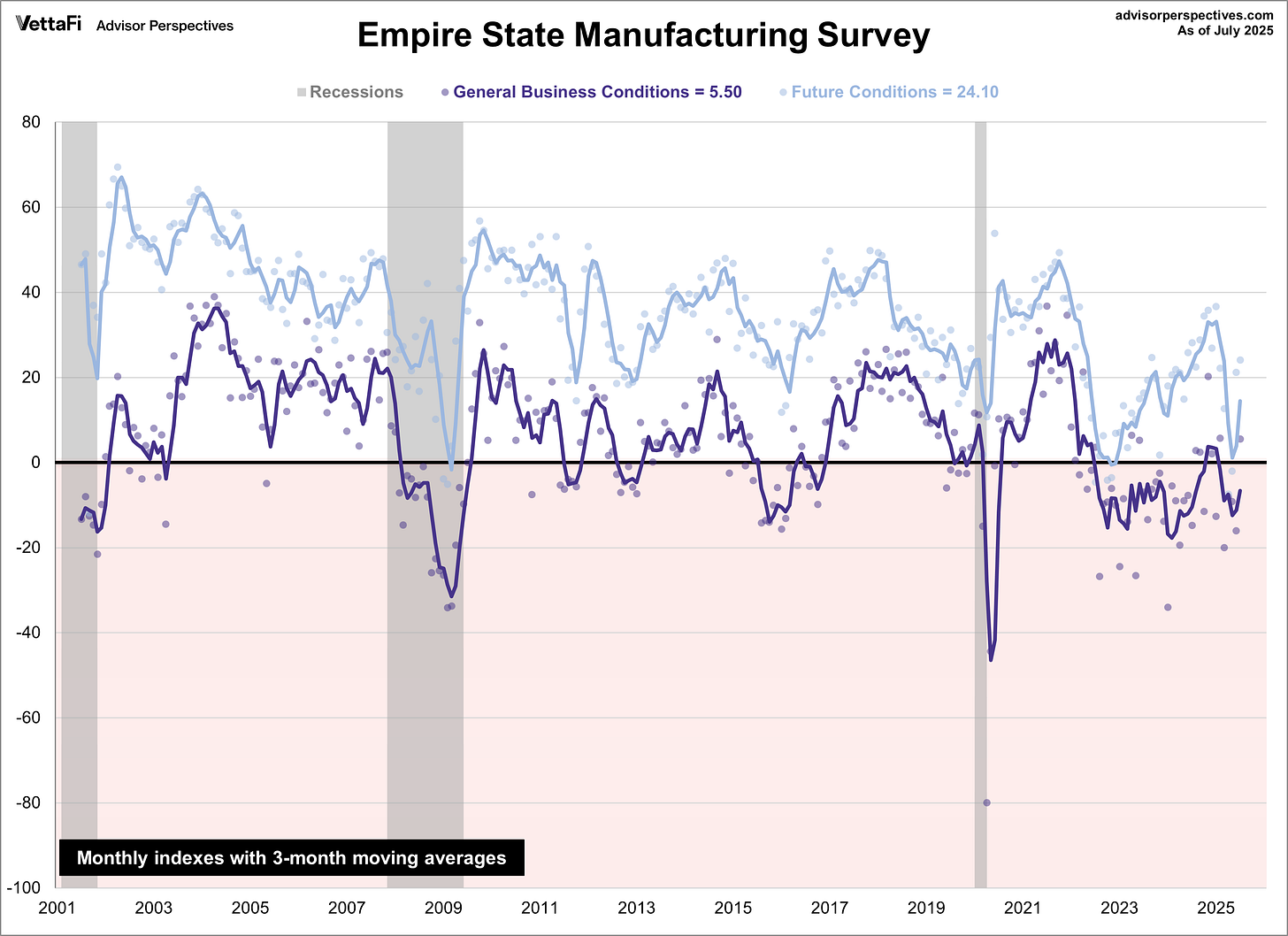

The Empire State Manufacturing Index is the real story, and the market reaction says more about inflation expectations than inflation itself.

CPI in Line, But Not the Whole Story

Let’s start with the basics.

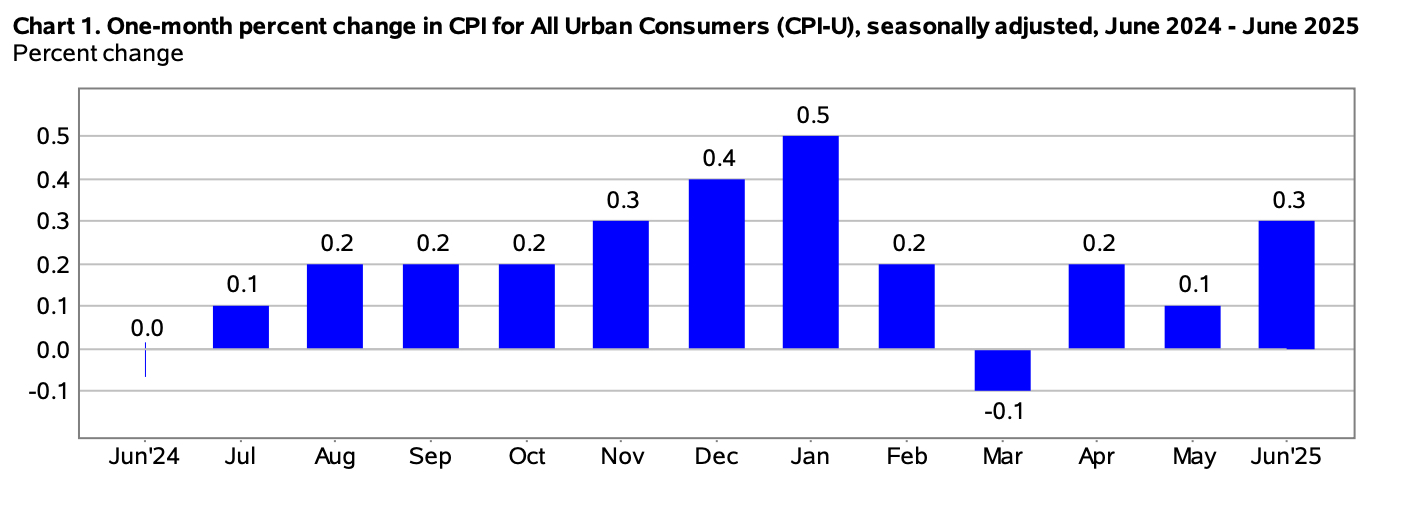

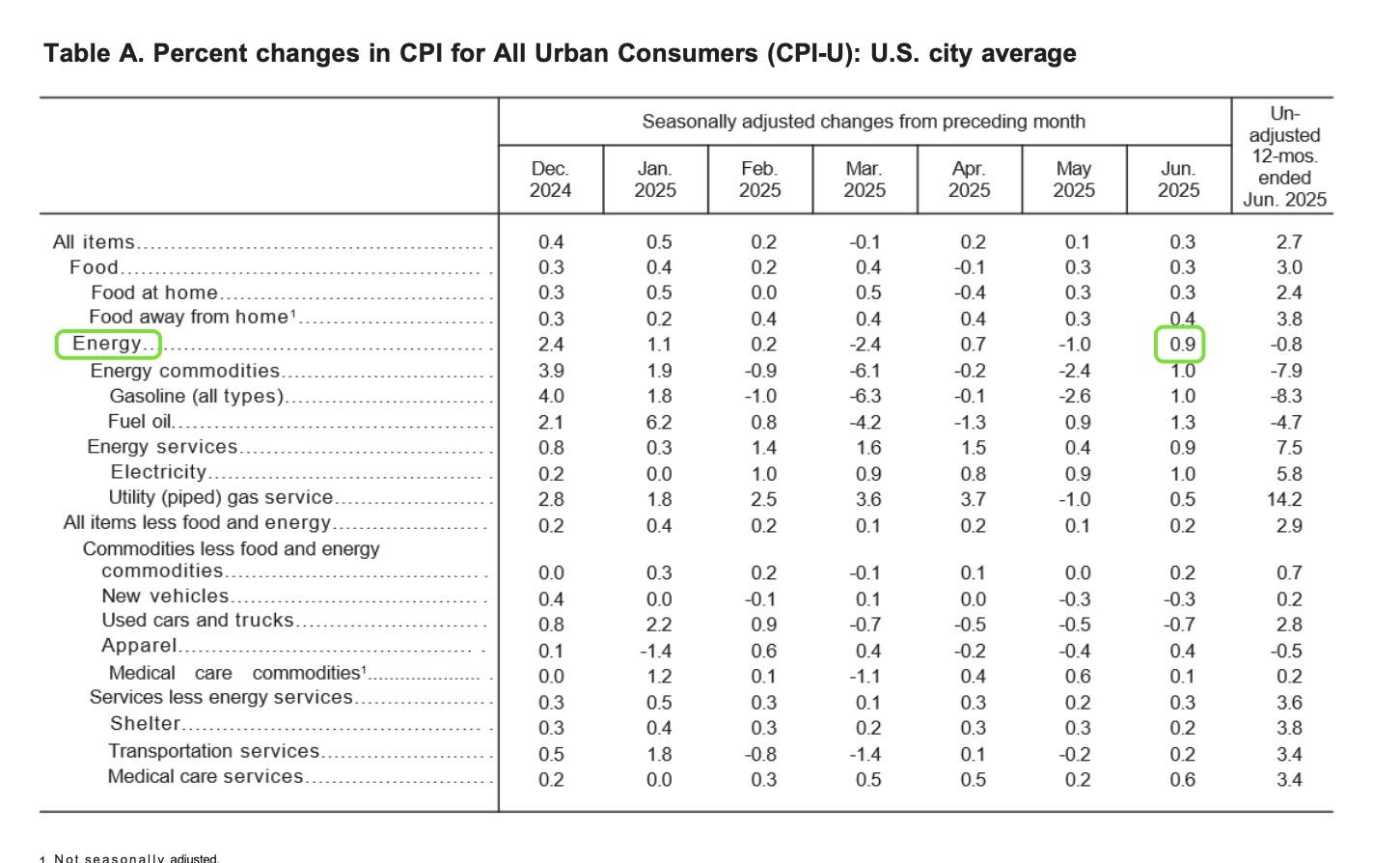

The June CPI report came in at:

Headline YoY: 2.7% (expected)

Core YoY: 2.9% (vs. 3.0% expected)

Month-over-month: 0.3%

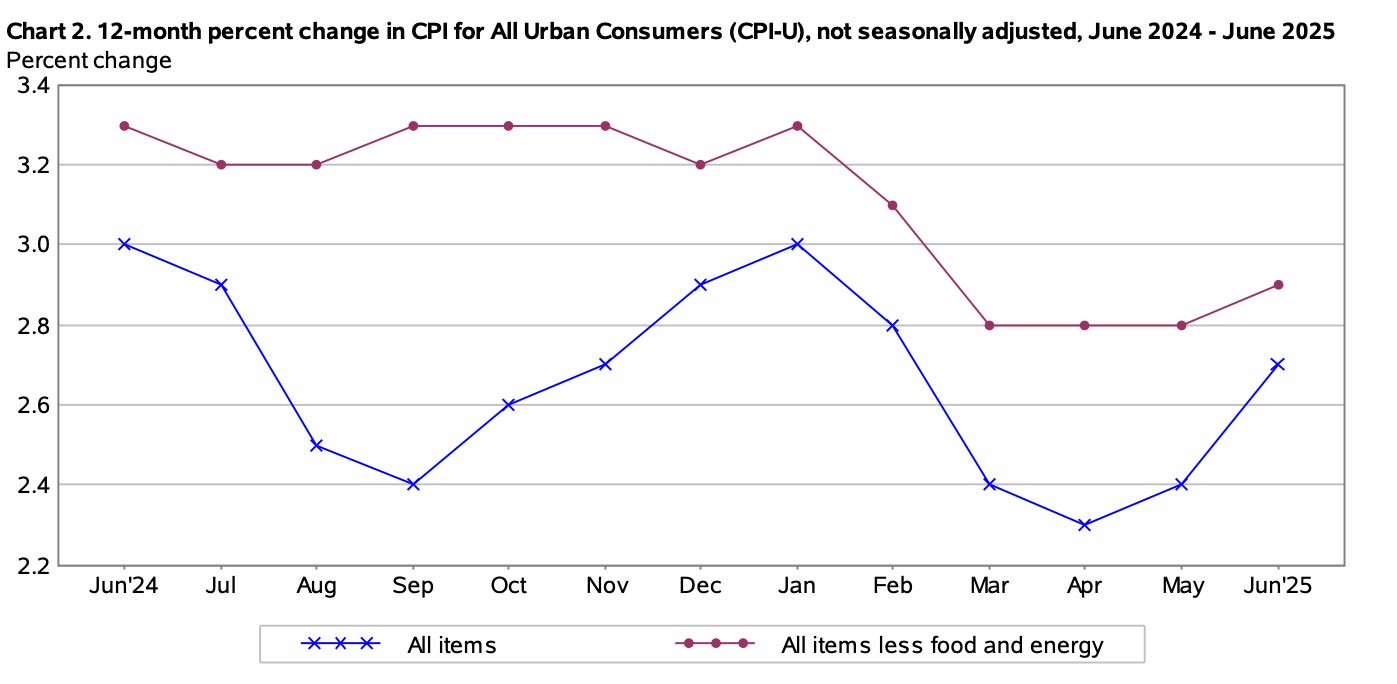

Superficially, these numbers suggest inflation is steady…certainly not reaccelerating.

The monthly jump was driven mostly by base effects (we dropped a 0.0% month from June 2024) and a spike in oil prices, which moved from the $50s to $75 during the month due to Middle East tensions.

Energy and food bumped up slightly, but shelter…the elephant in the CPI room…continued its slow descent, rising just 0.2% MoM.

Assuming that trend holds, base effects will likely bring shelter inflation down further by year-end.

But if inflation came in as expected or even slightly soft, why did yields jump?

Empire State Manufacturing: The Hidden Catalyst

Buried in the calendar behind the CPI data was the Empire State Manufacturing Survey, which came in scorching hot at +5.5.

Compare that to:

Last month: -16.0

Expected: -9.0

This was a blowout beat, and markets weren’t ready for it.

While CPI confirmed inflation is not spiraling, Empire State threw a wrench into the disinflation narrative by suggesting growth may be rebounding.

Remember: bond yields aren’t only about inflation…they’re about growth and inflation expectations combined.

That’s why this surprise survey result sent the 10-year yield screaming higher. The bond market didn’t react to the present. It reacted to what might come next.

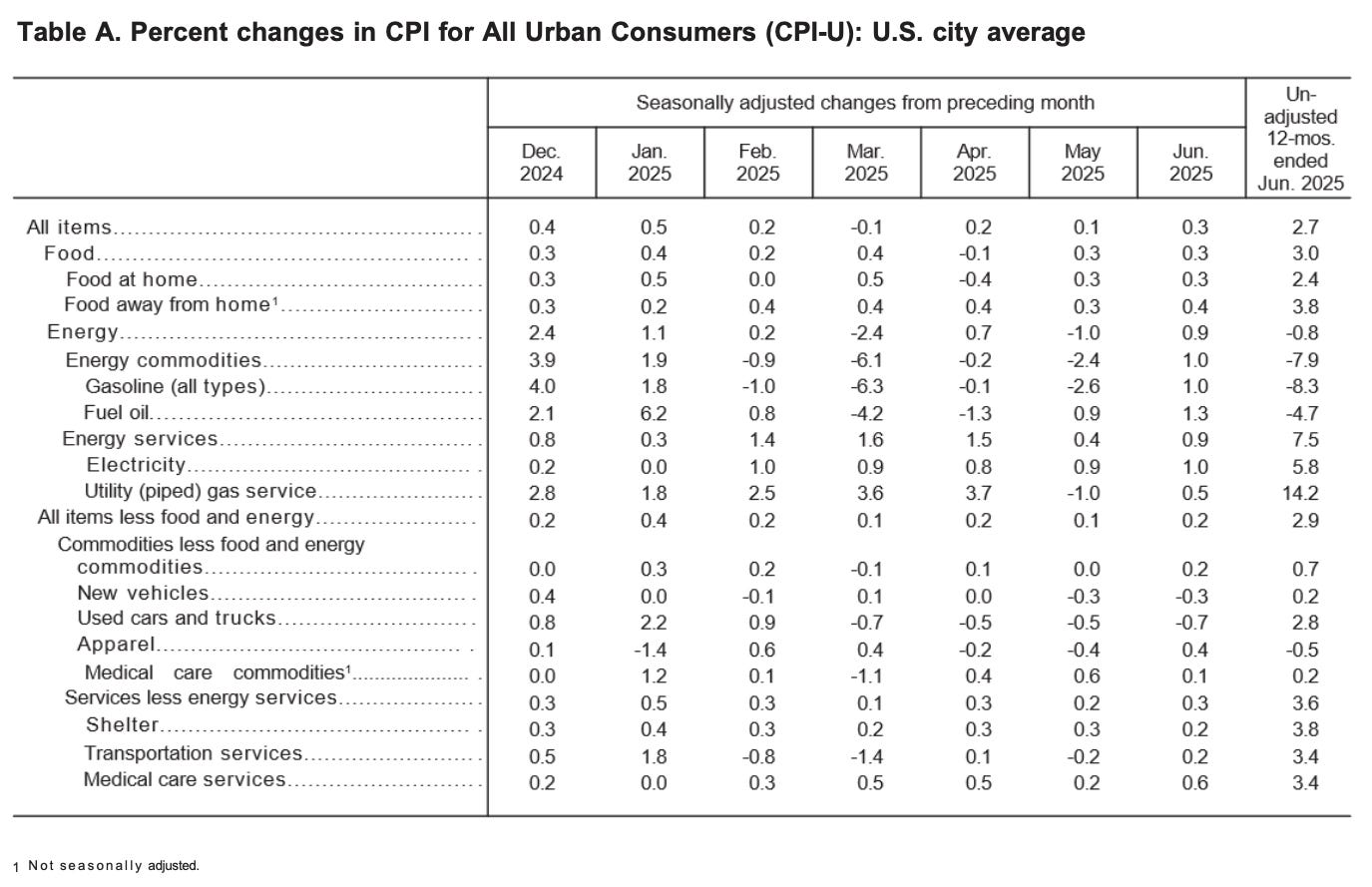

Energy’s Temporary Distortion

Part of the confusion stems from energy’s influence on the June CPI print.

Month-over-month, energy prices jumped 0.9%, contributing to the headline surprise. But year-over-year, energy remains deeply negative.

This tells us June’s bump is likely a one-off, driven by geopolitical shocks rather than a trend shift. And when you look at used cars, apparel, and other categories, you see disinflation remains intact.

Even shelter, which is notoriously sticky, appears to be softening. As those high prints from mid-2024 roll off, CPI should continue drifting downward…unless a major trend reversal occurs in services or wages.

Strip out the headline noise, and the inflation story still looks soft.

But with energy volatility muddying the waters, the question becomes: are we looking at a false signal…or the start of a more dangerous divergence between growth and inflation expectations?

Base Effects Still Matter

Let’s not forget base effects. The CPI gain this month looks more dramatic than it is because we’re comparing to a 0.0% month in 2024. If that had been 0.4%, this month’s CPI would look lower YoY, not higher.

This is why parsing CPI in isolation leads to bad analysis. The real insights come from understanding the moving parts…especially those under the hood.

That’s why you can’t trust top-line numbers without understanding what they’re built on.

The real story isn’t the percentage…it’s the composition.

But if base effects are already distorting the data, how should we interpret the bond market’s sudden pivot to growth?

Growth Expectations Driving Yields

The big takeaway today isn’t that inflation is back. It’s that growth might be surprising to the upside…at least in certain pockets.

That’s enough to shift bond market sentiment, especially when you consider how tightly rates have been pinned lately by disinflationary expectations. One strong manufacturing print was all it took to trigger a repricing.

That doesn’t mean a full re-acceleration is underway. But it does mean the bond market is alert, sensitive, and responding in real time…not to politics or Treasury issuance, but to actual data.

One beat on a manufacturing survey doesn’t equal a recovery. But when expectations are priced for stagnation, even a flicker of upside growth becomes a spark in dry grass. Still, the curve holds clues about what markets truly fear next…

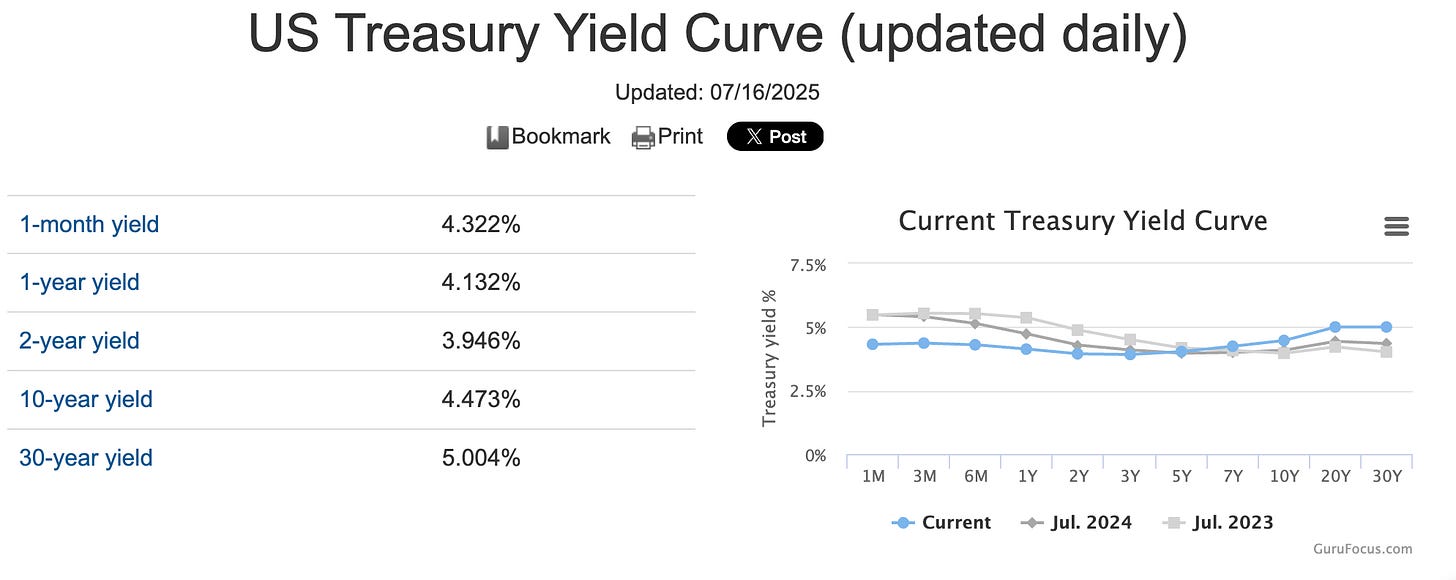

Don’t Ignore the Curve

What happened on the yield curve matters too.

The 2-year yield popped aggressively, but so did the 10-year…meaning the curve flattened slightly. That suggests markets are now thinking the Fed might not cut as quickly, especially if growth bounces.

But don’t forget the broader context: we’re still in an environment where core inflation is sub-3%, money supply is flat since 2022, and oil spikes in weak economies tend to be disinflationary, not inflationary.

A flattening curve in a “soft landing” narrative is a red flag hiding in plain sight.

If markets are walking back rate cut bets, it’s not because inflation is back…it’s because they think Powell might miss the exit ramp entirely. Which brings us to the bigger risk no one’s pricing in…

The Broader Macro Picture

Yesterday’s reaction feels big…but it’s also fragile. One hot data point doesn’t make a trend.

In fact, if today’s PPI or Thursday’s jobless claims disappoint, yields could just as easily snap back down.

This is a data-driven environment, and the Fed is watching every print closely.

Right now, inflation is not the primary risk. The primary risk is the Fed misreading the data, staying too tight for too long, and triggering a deeper downturn. That’s the message from personal consumption, income growth, and credit markets.

Growth expectations may have nudged up today, but they’re still walking a tightrope.

A single data point doesn’t make a trend…but it can sure make a mess. And unless the next few prints confirm this growth surprise, we could be looking at another round of yield whiplash.

Meanwhile, equity markets are sending a very different message…

Equity Markets: Mixed Signals

Interestingly, stocks didn’t respond with a clear message. The Dow dropped over 300 points, while the Nasdaq climbed…likely buoyed by Nvidia and tech momentum.

That’s not a cohesive growth signal. That’s rotation.

Meanwhile, Bitcoin pulled back sharply, and gold stayed soft. That suggests markets are not embracing a new inflation regime…they’re grappling with uncertainty.

If this were a true growth breakout, we’d see uniform upside. Instead, we’re getting fragmentation and flight to narrative…classic signs of macro confusion. And that’s exactly when headline-driven investors make their worst decisions…

Ignore the Headlines

Yesterday’s CPI print doesn’t justify the yield spike on its own. The Empire State Manufacturing surprise was the real driver, and the market’s response makes perfect sense when you view it through the lens of growth expectations.

But don’t expect this narrative to stick unless it’s reinforced by more data. If upcoming reports revert to weakness, the bond market will pivot again…and so will the Fed’s tone.

In the meantime, don’t get whiplashed by the headlines. The underlying trend still points to disinflation, slowing growth, and an over-tightened monetary policy.

The next few weeks will be crucial in determining whether this was a blip or the beginning of a new trend.

For now, stay nimble, stay skeptical, and…above all…stay focused on the data.

🚨 Become a paid subscriber and join George Gammon for his Friday weekly wrap-up and more…