Cracks in the Foundation

Why the U.S. Housing Market Is on Shaky Ground

Written by Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | September 19, 2025

The real estate narrative is about to change. Fast.

The headlines are still focused on mortgage rates and supply shortages, but if you dig just one layer deeper, the data is flashing red.

The U.S. housing market isn’t just softening — it’s signaling something far worse: a cascading impact from construction to jobs to the broader economy.

And the data this week confirmed what many of us have suspected: the cracks in the foundation are getting wider.

Let’s dive in.

Construction Employment: The Silent Signal No One’s Watching

Everyone tracks non-farm payrolls. Fewer people look at construction employment. But this sector often leads.

In the early 1990s? Construction jobs rolled over first.

During the GFC? Same story…it led by months.

Even today, we see this pattern. Construction employment has flatlined — after months of growth. That might sound benign, but historically, this is a leading indicator of broader labor market stress.

Why? Because housing is a credit-fueled cyclical beast.

When building slows, jobs disappear quickly. And this week, we got the first signs that the slowdown is turning into a full-blown contraction.

Construction doesn’t just build houses…it builds the cycle.

When that machine stalls, history says recession is next. The payroll numbers everyone obsesses over lag, but construction jobs whisper the truth first. And if this flatline becomes a drop, the rest of the economy won’t be far behind.

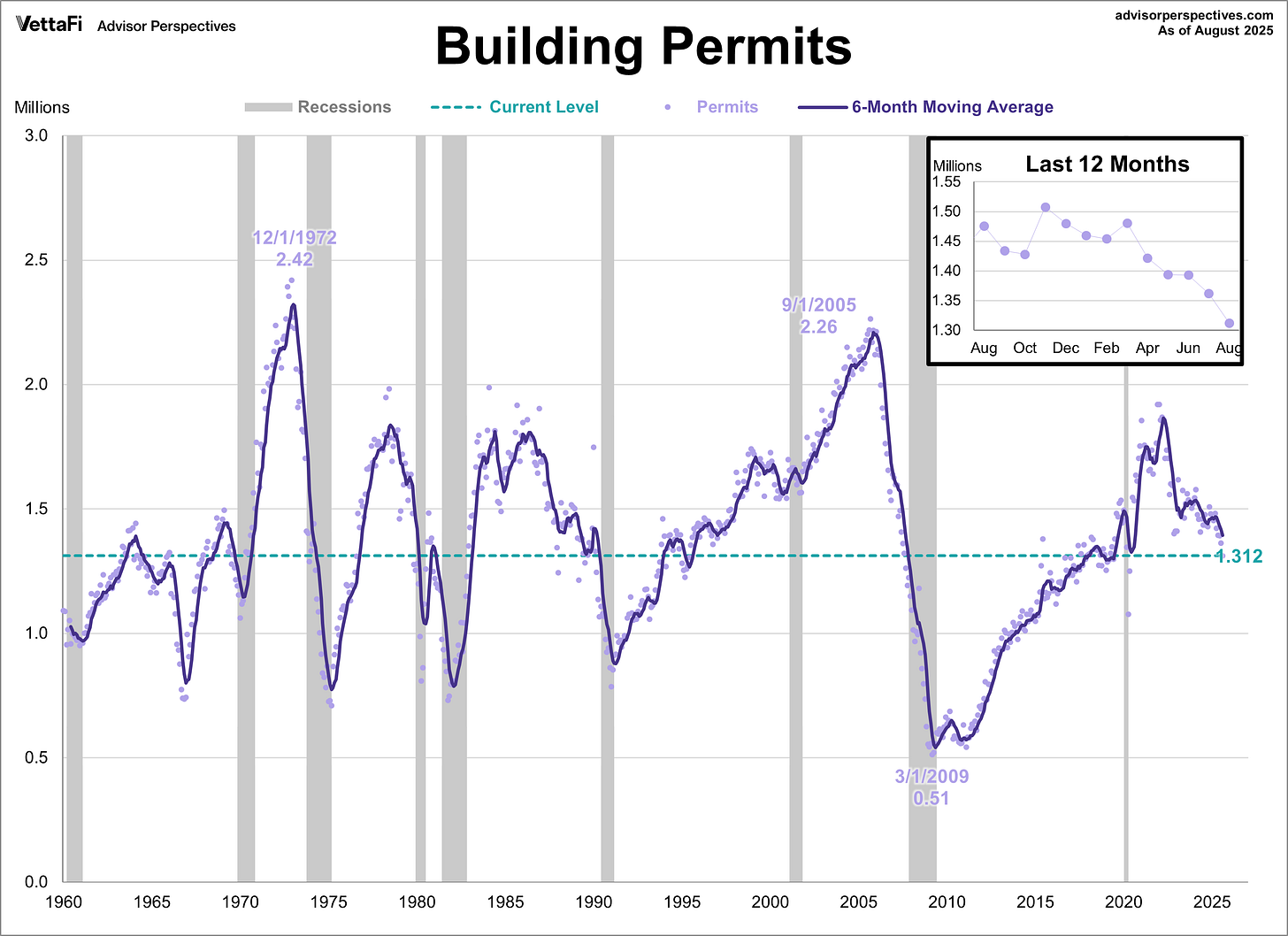

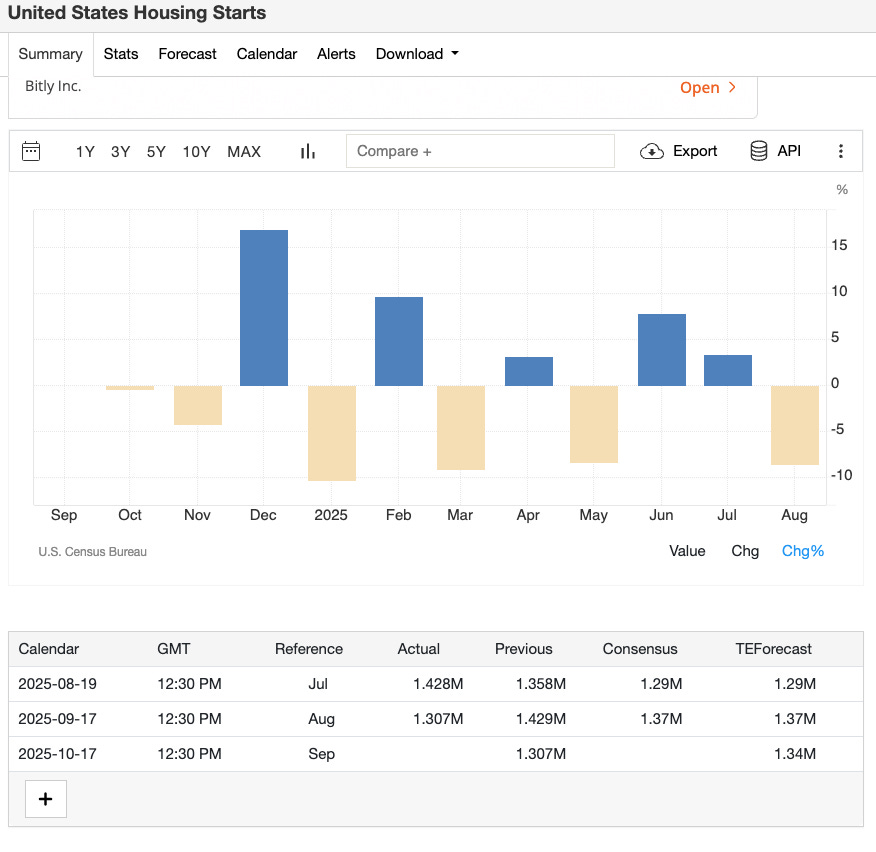

Housing Starts and Permits: Worst Print in Over a Year

This week’s data was a gut punch:

Housing starts down 8.5% MoM

Source: TradingEconomics.com Permits down 3.7% MoM

That’s not seasonal noise. That’s a collapse. And it wasn’t just bad — it crushed expectations:

Starts were forecast at -4.4%; came in at -8.5%

Permits were expected to rise 6%; instead, fell -3.7%

And it’s regional. Starts in the South fell 21%, the biggest drop of any region. Florida, in particular, is taking a beating.

This matters because builders don’t hire when they’re not building. And they’re clearly not building.

The South’s 21% plunge in starts isn’t a blip…it’s a flashing red siren. Builders are pulling back before the pain shows up in the headlines, and that means we’re staring at the early stages of a supply chain contraction.

But the bigger question is: what happens when this feeds into labor and credit markets at the same time?

Why the Mortgage Rate Narrative Is a Mirage

Some analysts are pointing to a 30% spike in mortgage applications last week as a bullish sign. That’s cute. But it misses the point.

Interest rates don’t control the economy…they reflect the economy.

Mortgage rates fall because the bond market sees recession, not because the housing market is healthy.

In fact, lower rates may do little if:

Jobs are being lost.

Credit is tightening.

Consumer confidence is falling.

Just like in the GFC, low rates don’t help if no one qualifies for a loan or if lending standards are rising. And if property taxes, maintenance, and insurance are rising faster than wages, even people with low fixed-rate mortgages may be forced to sell.

That’s the income trap no one talks about.

A falling mortgage rate doesn’t save an economy already slipping into contraction.

It’s like putting a fresh coat of paint on a house with a cracked foundation — the structure still fails.

The mainstream is cheering rate relief, but the smart money knows rates are falling for the wrong reasons.

Which begs the question: if cheap credit won’t save us, what can?

The Hidden Risk in "Locked-In" Mortgages

There’s this comforting narrative that homeowners are fine because they locked in 3% mortgages. But housing costs are more than just the mortgage.

Think about:

Property taxes (skyrocketing in many states).

Insurance (going parabolic in disaster-prone areas).

Maintenance and HOA fees (all rising).

Even with a fixed mortgage, if total monthly costs rise above income, people are forced to sell. Not because of a rate reset…but because of real cost-of-living pressure.

And if job losses pick up, it won’t matter how low your mortgage rate is if your income drops to zero.

The “I’m safe at 3%” crowd is ignoring the real pressure cooker: rising taxes, insurance, and maintenance costs.

These hidden expenses are already forcing quiet sales across the country.

But the real test hasn’t even hit yet…what happens when income shocks from job losses collide with these creeping costs?

Airbnb Boom to Bust: The Supply Tsunami Begins

Let’s talk about Florida.

Cities like Tampa, Miami, and Cape Coral are seeing outright price declines already. Why? One word: Airbnb.

During the pandemic, investors flooded into short-term rentals. Streets filled up with Airbnb properties. But now, with declining occupancy and rising costs, many of those investors are underwater.

And they’re starting to sell.

This is how supply shocks begin. Not from overbuilding…but from over-leveraged investors panicking.

The pandemic Airbnb rush was the perfect speculative mania…until it wasn’t.

Investors who once bragged about “cash-flowing properties” are now slashing prices to unload them.

What looks like a few forced listings today could easily snowball into a tidal wave of panic selling tomorrow.

And when the dam breaks in Florida, it won’t stay contained.

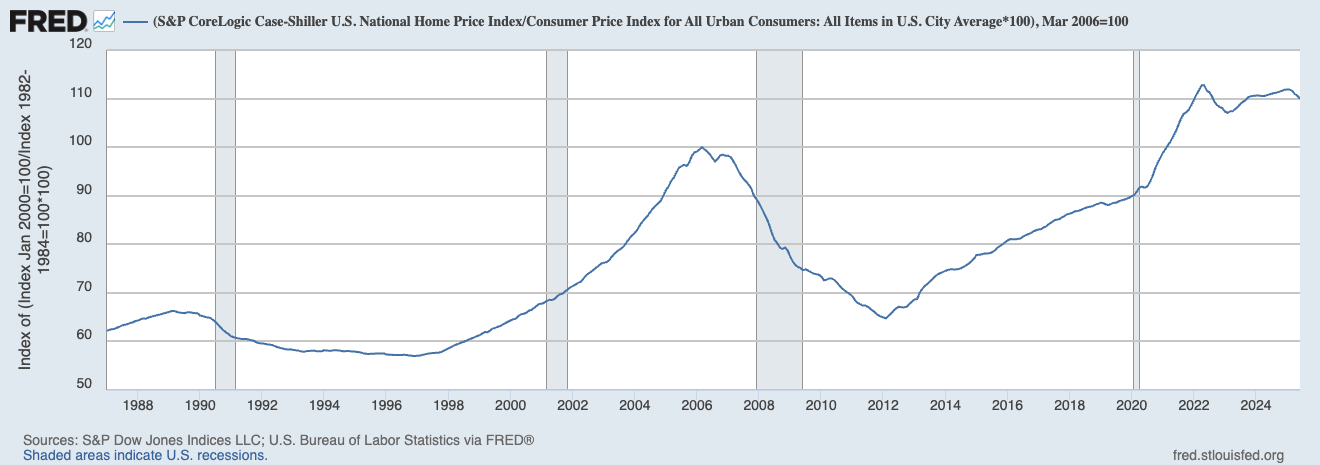

Inflation-Adjusted Prices Tell a Harsher Truth

The Case-Shiller Index, adjusted for inflation, shows a softening national trend. That matters. Because real purchasing power is what determines long-term asset value.

And in key markets, prices aren’t just stagnating…they’re falling in both real and nominal terms.

The nominal numbers make things look flat. Adjust for inflation, and the rot is clear: real housing wealth is already eroding.

That’s the kind of stealth bear market that sneaks up on households until they suddenly realize they’re underwater.

The question now is how fast this silent erosion turns into an outright collapse.

The Domino Effect: Construction → Jobs → Economy → Prices

This is the real sequence:

Housing starts fall.

Construction jobs stall, then decline.

Broader labor market weakens.

Consumer income drops.

Forced sales rise.

Prices decline further.

The sequence is in motion. Each domino falling makes the next one inevitable…from starts to jobs, jobs to income, income to forced sales.

And the final domino is prices, where perception turns into panic.

If history is any guide, by the time the mainstream admits housing is cracking, the economy will already be in recession.

We’re already at step 2. Step 3 is coming fast.

This is why watching construction data is so critical. It’s not just a real estate story — it’s a macro signal.

Watch the Foundations, Not the Facade

The housing market isn’t crashing…yet. But the setup is in place. All it takes is a nudge: a few more job losses, a few more distressed sellers, a few more policy missteps.

This is where forward-looking investors separate from the herd.

While the mainstream talks about mortgage rate dips, we’re watching labor dynamics, construction indicators, and forced supply.

This is where asymmetry emerges.

Trade Ideas: Getting Ahead of the Curve

1. Short Homebuilders (ITB, XHB): Especially vulnerable to sustained declines in starts and permits.

2. Long Gold and Miners: A weakening housing sector reinforces the recessionary narrative — bullish for gold.

3. Long Duration Bonds: As growth weakens, the bond market rallies. This trend is already in motion.

The housing market isn’t just “cooling.” It’s unraveling…and the ripple effects will hit everything from jobs to credit markets to consumer spending. By the time the headlines catch up, the opportunities to position yourself will be gone.

That’s why now is the time to go deeper. Paid subscribers to the Rebel Capitalist News Desk get exclusive access to George Gammon’s live weekly wrap-up this weekend — where he’ll break down these trends in real time, show you how they tie into global macro, and map out strategies the mainstream refuses to touch.

As a paid member, you’ll also unlock:

Subscriber-only whiteboard videos that simplify complex macro into actionable insights.

Deep-dive reports connecting the dots between Fed policy, global markets, and your portfolio.

First access to trade ideas and frameworks built for contrarian investors who refuse to be blindsided.

Thousands of liberty-minded investors are already using these tools to stay ahead. The question is…will you join them before the next domino falls?

👉 [Upgrade to paid today and get access before George’s wrap-up this weekend.]