Delinquencies Are Surging!

And They’re Telling a Very Different Story About the U.S. Economy

Written by Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | August 8, 2025

The headlines are still painting a picture of an economy that’s “resilient,” but if you look at the data the government can’t easily massage, a very different picture emerges…one that should have every investor paying attention.

Student loan delinquencies are skyrocketing to all-time highs. Credit card and mortgage late payments are climbing.

Auto loans aren’t far behind.

And unlike the BLS jobs numbers, which can be “revised” into oblivion, this data is coming straight from the private sector and the Federal Reserve’s own banking system reports.

In other words, it’s much harder to fudge. And what it’s saying is that U.S. consumers are cracking.

Student Loan Delinquencies: Straight Up, Parabolic

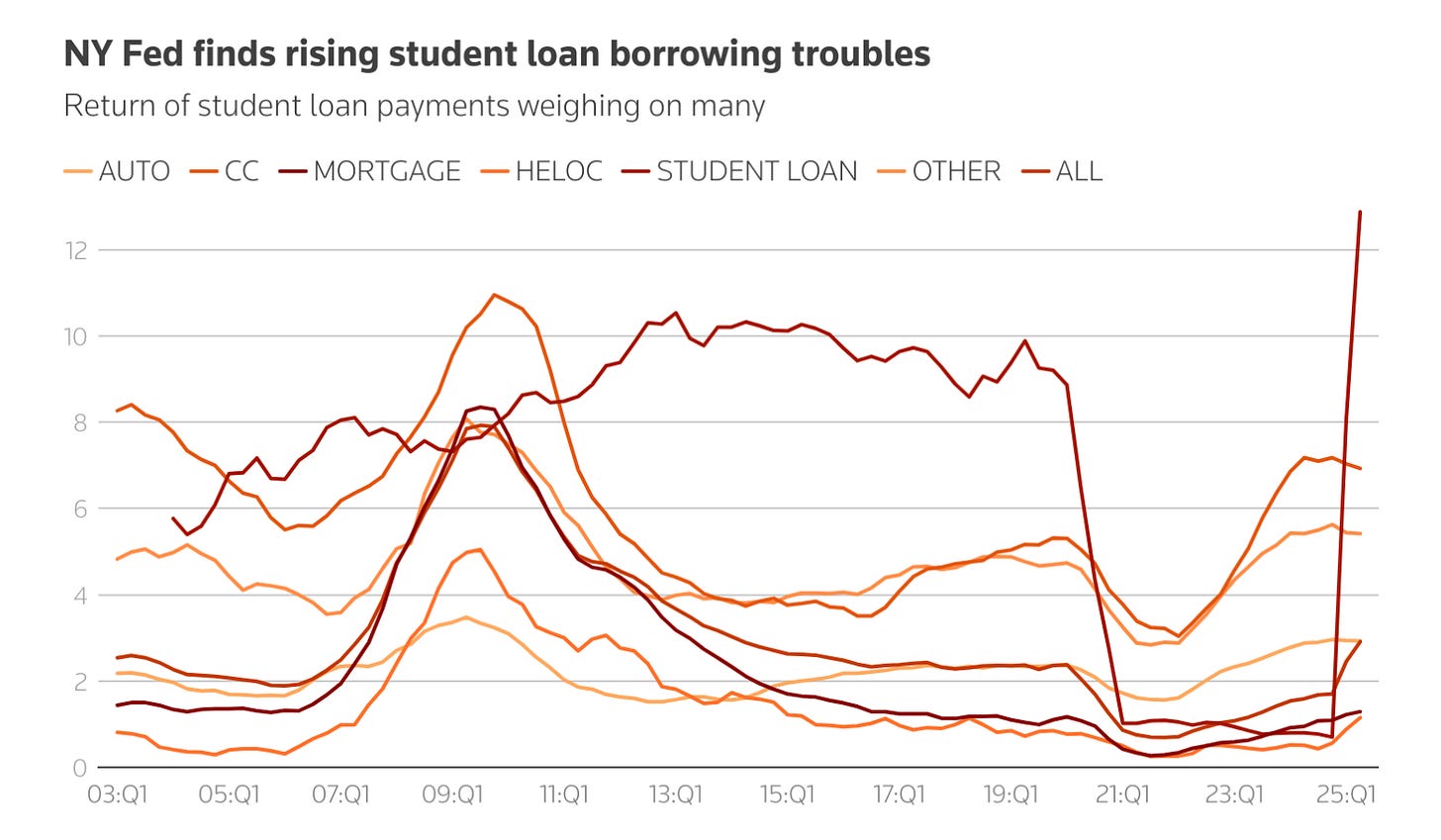

The New York Fed and TransUnion data are clear:

31% of student loan borrowers with a payment due are in late-stage delinquency as of April.

Nearly one-third of the 5.8 million newly delinquent borrowers could hit default status this summer.

Delinquencies have surged to the highest level ever recorded.

Remember…for years, borrowers weren’t required to make payments.

Interest kept accruing in the background.

Many people simply adjusted their spending habits around the extra $300–$500 they no longer had to send to the loan servicer each month.

Now that payments have resumed, it’s hitting household budgets like a brick wall.

And the damage doesn’t stop at the missed payments.

Falling credit scores will shut out millions from affordable borrowing…whether for homes, cars, or even small business loans.

If they do manage to get credit, the rates will be punishing, further squeezing disposable income.

This is the kind of self-reinforcing downturn economists call a feedback loop:

Delinquencies → Lower credit scores → Higher borrowing costs → Lower demand → Slower economy → More delinquencies.

The real danger isn’t just the missed payments…it’s how quickly this financial stress is bleeding into every other corner of the credit market.

And once you see the next set of numbers, you’ll understand why the pain won’t be contained to student debt.

It’s Not Just Student Loans

The New York Fed’s Household Debt and Credit report shows that every category of consumer debt has higher delinquency rates than before 2019.

Credit card late payments are creeping back toward Great Financial Crisis territory.

Mortgage delinquencies…while still low in absolute terms…are ticking higher, and that’s with home equity still positive for most borrowers.

And here’s the kicker: in certain parts of the country, negative equity is already back.

ZeroHedge recently highlighted five U.S. metro areas…all in Florida and Texas…where a majority of homeowners now owe more than their property is worth.

If this spreads, expect mortgage defaults to climb rapidly.

Combine that with already elevated FHA loan stress (the kind often used by first-time buyers with low down payments), and you’ve got a real housing market headwind.

What’s unfolding here isn’t an isolated housing or credit card problem…it’s a full-spectrum squeeze on consumer balance sheets.

And as we’ll see next, that squeeze is already beginning to show up in the one metric the economy can’t survive without: aggregate demand.

Aggregate Demand Is Rolling Over

The common denominator here is that purchasing power is falling. Prices have climbed sharply over the last three years, but incomes haven’t kept pace.

During the pandemic era, stimulus checks and payment pauses papered over the gap. Now those props are gone.

Once you add back $400/month in student loan payments, tack on higher interest costs for credit cards and car loans, and factor in persistent inflation on essentials, there’s just less left for everything else.

That’s why I’m paying close attention to indicators like:

The Restaurant Performance Index (hovering near contraction territory).

Corporate earnings from consumer-sensitive businesses like airlines, Airbnb, and major retail chains.

Oil and copper prices…both are quietly trending down despite OPEC+ supply cuts, a sign that demand is weakening globally.

The slowdown in real-world spending is only half the story.

The other half is far more troubling…because it reveals how the official economic narrative is increasingly divorced from reality, and why relying on government numbers could be one of the costliest mistakes investors make this year.

The Government Data Credibility Problem

The jobs market data from the BLS is looking increasingly unreliable, not just because of the giant revisions we’ve seen lately, but because of the political incentives in play.

When the July jobs report came in weak, President Trump fired the BLS Commissioner.

Whether you think that was justified or not, the precedent is clear: the next person in that seat will have a powerful incentive to “polish” the numbers.

That’s human nature, and it means investors need to find better signals.

That’s why delinquency rates matter so much.

They’re based on actual payments (or the lack thereof) tracked by banks and credit bureaus.

It’s hard to “seasonally adjust” a missed mortgage payment.

If you can’t trust the scoreboard, you need to find a new way to keep score.

That’s why the next section focuses on the handful of indicators that still cut through the noise…and why they might be the only thing standing between investors and a major blindside.

Real-World Indicators Beat Massaged Reports

To get a truer sense of what’s happening in the economy, I’m reprioritizing my own focus away from the heavily politicized data and toward these harder-to-manipulate metrics:

Delinquencies (student loans, credit cards, mortgages, auto loans).

Real-time spending measures like restaurant and travel bookings.

Commodities tied to industrial demand (oil, copper).

Airline passenger volumes and hotel occupancy rates.

Corporate earnings from discretionary consumer sectors.

If you combine those with longer-term market signals like the yield curve and credit spreads, you get a much clearer read on whether the economy is heating up or cooling down…without having to rely on questionable government statistics.

And when you line up those hard metrics against the Fed’s current policy stance, you see a collision course forming…one that could create both significant downside risk and rare asymmetric opportunities for prepared investors.

Market Implications: Risk Rising, Opportunities Emerging

If this trend continues…and there’s every reason to think it will…the Fed will face a dilemma.

Official inflation is trending down, growth is softening, and real-world consumer data is deteriorating.

At some point, the risk of crushing the labor market will outweigh the risk of a small inflation rebound.

That’s bullish for:

Treasuries (if the market starts pricing in rate cuts).

Gold (as trust in official data declines and real rates peak).

Select defensive equities (utilities, staples).

Cash-flow-positive commodities producers that can weather economic slowdowns.

It’s bearish for:

High-yield credit (defaults will rise).

Overleveraged growth stocks dependent on cheap capital.

Cyclicals tied to consumer discretionary spending.

Watch the Trend, Not the Spin

The key takeaway here is simple:

Across student loans, credit cards, mortgages, and auto loans, delinquencies are higher than they were before the pandemic…and rising.

That’s not what you see in an economy that’s “booming.”

That’s what you see in an economy that’s running out of road.

You can ignore it for a while. You can explain it away. But sooner or later, credit stress in the consumer sector shows up in retail sales, in GDP, in employment… and in markets.

The delinquency spike is the canary in the coal mine. If you’re not watching it, you’re flying blind.

If you want to stay ahead of the next pivot, next recession, and next opportunity, start by questioning everything you're told.

Join the thousands of liberty-minded investors on the Rebel Capitalist News Desk for real-time macro analysis, exclusive market insights, and the uncensored truth behind the numbers.