Falling Yields Aren’t Good News

They’re Flashing Recession Red

Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | September 10, 2025

Most people hear that interest rates are dropping and breathe a sigh of relief. “Great news,” they say. “Mortgage rates will fall, stocks will rally, and the Fed has more room to cut.”

Unfortunately, that view is dangerously wrong.

Rates aren’t falling because the economy is strong. They’re falling because growth and inflation expectations are collapsing.

The bond market isn’t celebrating…it’s screaming that the U.S. economy is rolling over.

Let’s break down what’s really happening.

The 10-Year Treasury: Down Almost 100 Basis Points

The mainstream narrative insists there’s “no demand” for Treasuries, and that yields are rising because the government is drowning the market with supply.

But look at the actual data:

The 10-year Treasury peaked near 5% intraday earlier this year.

Today, it’s closer to 4.04%…a drop of nearly 100 basis points.

In just the past month, we saw a 25bp drop in a matter of days.

That’s not a market starved of buyers. That’s a market repricing growth and inflation sharply lower.

And it’s not just the 10-year.

The mainstream insists yields are high because of too much supply.

But if that’s true, why are buyers piling in at lower yields?

The answer lies not in supply, but in what the market sees coming next…and it’s a reality far darker than the headlines suggest.

Two-Year and Thirty-Year Yields: Both Headed Lower

The 2-year Treasury…which is ultra-sensitive to Fed policy…has dropped 75bps year-to-date, from 4.26% to around 3.5%.

Even the 30-year Treasury, supposedly anchored by issuance concerns, has fallen below where it started the year.

This isn’t what you’d expect if deficits and issuance were truly pushing yields “to the moon.” It’s what you’d expect if the bond market is bracing for recession.

When short and long rates both collapse, the message isn’t “all clear.”

It’s that the economy is losing oxygen at every level. And if the bond market is already gasping, what happens when the labor data finally catches up?

Lower Rates Don’t Mean a Stronger Economy

It’s tempting to cheer falling rates as bullish for housing and stocks. But that misses the key point:

Rates don’t control the economy…they reflect it.

If long-term yields are dropping, it’s because the market sees weaker growth and lower inflation ahead. That’s not the kind of backdrop you want for equities, employment, or consumer spending.

In fact, a strong economy would be consistent with higher rates and an upward-sloping curve…not collapsing yields across the board.

Every cheer for falling rates misses the point: rates don’t lead, they follow.

And if they’re following the economy lower, the next domino isn’t a rally…it’s recession. The proof is already hiding in the payroll revisions.

The Labor Market: Revisions Paint a Darker Picture

The real story is the labor market.

Headline payroll numbers have been revised downward month after month by the following amounts:

January: −32,000

February: −49,000

March: −108,000

April: −19,000

May: −120,000

June: −160,000

The trend is brutal. A headline positive often gets revised into a negative weeks later.

What looked like “resilience” at first glance is turning into contraction upon closer inspection.

And the July print…just 22,000…is almost guaranteed to go negative once revisions are finalized.

If that happens, we’ll likely see three straight months of negative payrolls, which historically coincides with recession.

Month after month, the glossy headlines vanish in a haze of negative revisions. What once looked like strength now looks like contraction. But the real reckoning arrives when the benchmark revisions expose just how deep the rot goes.

Why Revisions Matter More Than Headlines

The BLS will publish its benchmark revisions tomorrow, covering data from February 2024 to March 2025.

This is where the rubber meets the road: the government updates its estimates against real payroll tax filings.

If we see the kind of large downward revisions many expect, it will confirm what the bond market already knows…the U.S. economy isn’t creating jobs, it’s losing them.

And remember: the bond market is forward-looking. Falling yields tell us investors are bracing for a downturn, not celebrating lower rates.

The BLS can smooth the story for a few weeks, but payroll tax filings don’t lie. If the revisions confirm job losses, then the Fed won’t just be behind the curve…it’ll be trapped. And history shows what happens when central banks get cornered.

A Dangerous Misread: Comparing to 2024 Rate Cuts

Some argue that if the Fed cuts again, we could see long-end yields spike like they did after the September 2024 cuts.

But context matters. In late 2024, the labor market was still strong on paper, with non-farm payrolls over 300,000. Growth and inflation expectations were alive and well.

Today, the backdrop is completely different: payrolls are rolling over, revisions are ugly, and expectations are collapsing. That means further Fed cuts are unlikely to trigger higher yields…more likely, they’ll reinforce the downtrend.

Last year, the Fed cut into a strong labor market. This year, it’s cutting into a weakening one. That distinction isn’t subtle…it’s the difference between extending a cycle and ending one. The bond market knows it, even if investors don’t.

Revisiting History: Negative Payrolls and Recessions

Looking back through decades of payroll data, negative prints almost always line up with recessions.

There are a few exceptions…like the 1986 oil price collapse or temporary weather-related events in the 1990s…but those were one-off anomalies.

What we’re seeing now isn’t noise. It’s a clear trend down in hiring that looks far more like recessionary episodes than temporary blips.

History tells us negative payrolls almost never happen outside of recession. If July gets revised negative, we’ll be staring at a three-month streak that markets simply can’t ignore. The question isn’t if investors notice…it’s how they’ll react when they do.

The Reverse Repo Warning

Here’s another signal that something’s broken.

The reverse repo rate is 4.25%.

The 2-year Treasury yield is 3.5%…a full 75bps below the Fed’s supposed “floor.”

Why would big institutions buy a 2-year at 3.5% when they could park cash risk-free at the Fed for 4.25%?

Because Treasuries provide collateral in a liquidity crunch. Market participants are willing to accept a lower yield today because they expect collateral to be scarce tomorrow. That’s a clear sign of stress building in the system.

Why would Wall Street accept a worse yield than what the Fed offers for free? Because in a liquidity crunch, collateral is king. And when collateral starts to disappear, it’s not just a bond market issue…it’s a system-wide warning siren.

What the Market Is Really Pricing

Taken together, the bond market, payroll revisions, and the reverse repo anomaly all point in the same direction:

Growth is deteriorating.

The labor market is weakening.

Inflation expectations are falling, not rising.

Liquidity stress is building under the surface.

That’s not a bullish cocktail. That’s a recession warning.

Growth. Jobs. Inflation. Liquidity. Every arrow points the same way…down. The mainstream wants to spin falling yields as bullish.

But if you follow the trail of signals, they lead somewhere very different: a crisis that Wall Street is already preparing for.

Investment Takeaways

If this trend continues, we’re entering a period where risk assets could reprice sharply lower while safe-haven assets outperform.

Bullish for: Gold, long-duration Treasuries, high-quality collateral.

Bearish for: Equities at all-time highs, credit markets vulnerable to defaults, and cyclical sectors tied to consumer demand.

The mainstream narrative that “falling yields are good for stocks” is dangerously simplistic.

Falling yields mean the economy is in trouble.

The Bottom Line

The bond market isn’t fooled by spin. It doesn’t care about political talking points or optimistic forecasts. It trades on growth and inflation expectations…and both are cratering.

Falling yields aren’t a gift. They’re a warning.

The next time you hear someone celebrate lower rates as bullish, remember: the bond market is telling us the opposite. And history suggests it’s the bond market…not the headlines…that gets it right.

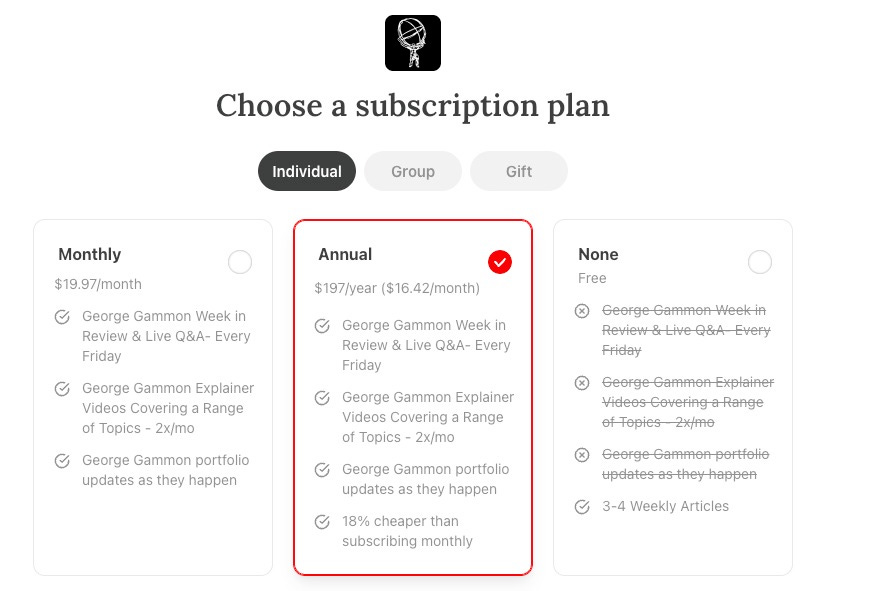

If you’ve found this breakdown valuable, now is the time to level up. Join the Rebel Capitalist News Desk on Substack, where thousands of liberty-minded investors are already getting the full picture behind the headlines.

Free subscribers only get part of the story.

Paid members get daily breakdowns, insider analysis, and access to George Gammon’s live and unfiltered weekly wrap-up this Friday.

If you want to watch live or catch the replay, you’ll need to upgrade now.

👉 Upgrade to Rebel Capitalist News Desk today and get the insights mainstream finance won’t give you — before Friday’s wrap-up goes live.