Gold Revaluation and the Debt Crisis

A Hidden Weapon in the Government's Arsenal?

Written by Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | July 10, 2025

A Federal Reserve manual quietly published in May 2025 may hold the key to solving the U.S. debt crisis…and triggering a gold price explosion that could reshape global financial markets overnight.

No, this isn’t a conspiracy theory or a ZeroHedge exaggeration. This is a plain-language accounting manual released by the Fed itself.

Inside, it outlines a powerful, little-discussed mechanism: the monetization of gold certificates.

If used, this tool could allow the Treasury to revalue its gold reserves to $20,000, $30,000, or even $40,000 per ounce…and use that new value to pay down trillions in public debt.

And it’s all completely legal.

But why would the Fed quietly publish such a powerful tool now—without a single mainstream headline? The answer lies buried in a little-known section of an obscure document most investors have never read…

What the Fed Manual Actually Says

The document in question is the Financial Accounting Manual for Federal Reserve Banks, updated in May 2025.

Tucked inside Section 2-10 is a revelation: the Treasury is authorized to issue gold certificates to the Federal Reserve.

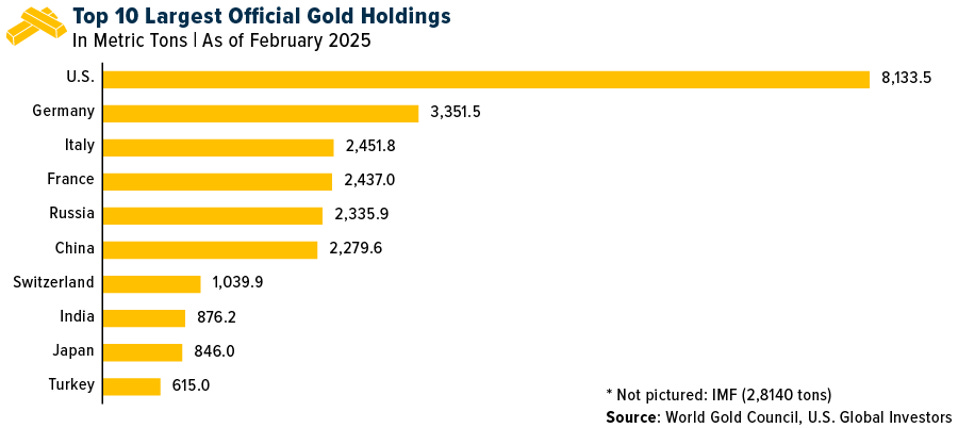

These are not sales of physical gold, but paper claims against the Treasury's gold holdings (supposedly around 8,133 tons, or 260 million ounces). The Fed can buy these certificates, adding them as assets on its balance sheet.

In return, it credits the Treasury General Account (TGA), effectively giving the Treasury "money" it can use to pay down debt.

This is legal and explicitly described as a normal function of inter-agency finance. It’s essentially a form of gold-based QE.

If this sounds like fantasy, think again.

The Fed has already run the numbers…and their own balance sheet gives away the playbook. But the real shock isn’t what’s possible…it’s what they’ve already prepared to do.

Why Would the Government Do This?

Simple: to escape the growing burden of $37 trillion in national debt.

Luke Gromen, a macro thinker who’s been ahead of the curve on this issue, has long argued that monetizing gold is a viable, if extreme, policy option.

His reasoning is straightforward: revaluing gold to $20,000/oz or more would allow the Treasury to instantly boost the value of its reserves by trillions, giving it the firepower to retire large chunks of debt without issuing new bonds.

This sidesteps the "doom loop" where higher debt leads to more issuance, which leads to higher rates, which makes debt even more unsustainable.

Gold on the Balance Sheet

The Fed’s example balance sheet in the manual lists gold certificates as the first line item, ahead of U.S. Treasuries and mortgage-backed securities.

This isn’t just symbolic; it confirms gold’s legal status as a legitimate reserve asset for central bank accounting.

This is not a backdoor policy idea. This is open playbook strategy, hiding in plain sight.

How It Would Work:

Revalue Gold: The Treasury announces it will revalue its gold holdings to, say, $20,000/oz.

Issue Gold Certificates: Based on the new value, it prints gold certificates worth trillions.

Fed Buys the Certificates: The Fed adds them to its balance sheet.

TGA Gets Funded: The Fed credits the TGA with the equivalent amount.

Treasury Pays Down Debt: When bonds mature, instead of rolling them over, the Treasury redeems them using its new TGA balance.

So why isn’t anyone talking about this? Maybe because the implications are too disruptive. Or maybe because the pieces are already in motion…and we’re only now seeing the first tremors.

The Inflation Side Effect

Of course, this isn’t a free lunch. Gromen argues this would unleash massive inflation. Why?

Existing debt holders get paid in newly created dollars, which they can now spend.

Gold holders suddenly have vastly more purchasing power.

Both groups increase demand in the real economy without an increase in supply.

The result? Prices rise. Nominal GDP jumps. And crucially, debt-to-GDP ratios fall, even if the debt isn’t reduced by much in absolute terms.

Strategic Implications

This scenario checks a lot of boxes for a debt-trapped government:

It’s legal.

It doesn’t require austerity.

It avoids default.

It works even if inflation rises.

It also explains why gold…and now even gold leasing platforms are gaining attention among macro-savvy investors.

The Revaluation Mechanics

If gold were revalued to $20,000 per ounce:

The U.S. gold reserve would go from $850 billion to $5+ trillion in value.

If the Treasury used all of that to buy back debt, it could reduce the outstanding total from $37 trillion to $32 trillion.

But the real kicker is the secondary effect: if that newly created cash boosts nominal GDP to $40 trillion, debt-to-GDP could fall to 80%, 70%, or even lower…putting the U.S. back in the "safe zone" in the eyes of international investors.

How They Could Pull It Off

The Treasury doesn’t need to buy all the gold in circulation. It just needs to set a credible bid.

During COVID, the Fed triggered massive corporate bond buying with just a small footprint. Same thing could happen here.

If the government announces a standing bid at $20,000/oz, the market will quickly reprice gold to that level without massive government purchases.

It’s a psychological anchor as much as a liquidity provision.

Potential Blowback

Nothing is free. Here are the risks:

Runaway inflation from too much liquidity.

Loss of dollar credibility if markets see this as desperate.

Massive capital gains taxes on gold holders.

Storage cost issues for gold owners (which can be offset by leasing programs).

Yet, in a world where the Fed has bought corporate bonds and is flirting with buying stocks, gold monetization is hardly a radical next step.

Why This Matters Now

Donald Trump and his likely Fed chair pick, Scott Bessent, are sounding the alarm on U.S. debt levels.

If they view the debt as a crisis, then monetizing gold isn’t just plausible…it’s likely.

Whether you agree with the policy or not, it's time to consider its implications. Because if the trigger is pulled, gold won’t just move higher.

It will moon.

🚨 Become a paid subscriber and join George Gammon for his Friday weekly wrap-up at 4 PM today…

If the Gov re prices gold like that do we really think they will use all that new cash to pay down the debt, LOL? And if they don't hyper inflation will be an understatement.

WTF? If the fed bits 20,000 per ounce of gold, won't anybody owning gold want to sell their gold for 20,000? Won't the Fed end up owning all the gold in the world in exchange for which the world will be given dollars printed out of thin air which will induce a hyperinflation?