Housing Just Cracked

And Commercial Real Estate Is Next

Written by Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | February 14, 2026

Big news just hit the housing market.

And it’s ugly.

Existing home sales came in at 3.91 million, marking the largest monthly decline in nearly four years.

The mainstream explanation?

Snowstorms.

High home prices.

“Stubbornly elevated” mortgage rates.

We’ve heard this script before.

But once you strip away the narrative and look at the mechanics, something much more important is happening.

This isn’t about weather.

This isn’t about a few basis points on a mortgage rate.

This is about income.

This is about confidence.

This is about a labor market that is quietly deteriorating.

And housing is simply the first place it’s showing up.

The Mortgage Rate Excuse Is Getting Old

Every time housing weakens, the media defaults to the same talking point: mortgage rates are too high.

But let’s look at the numbers.

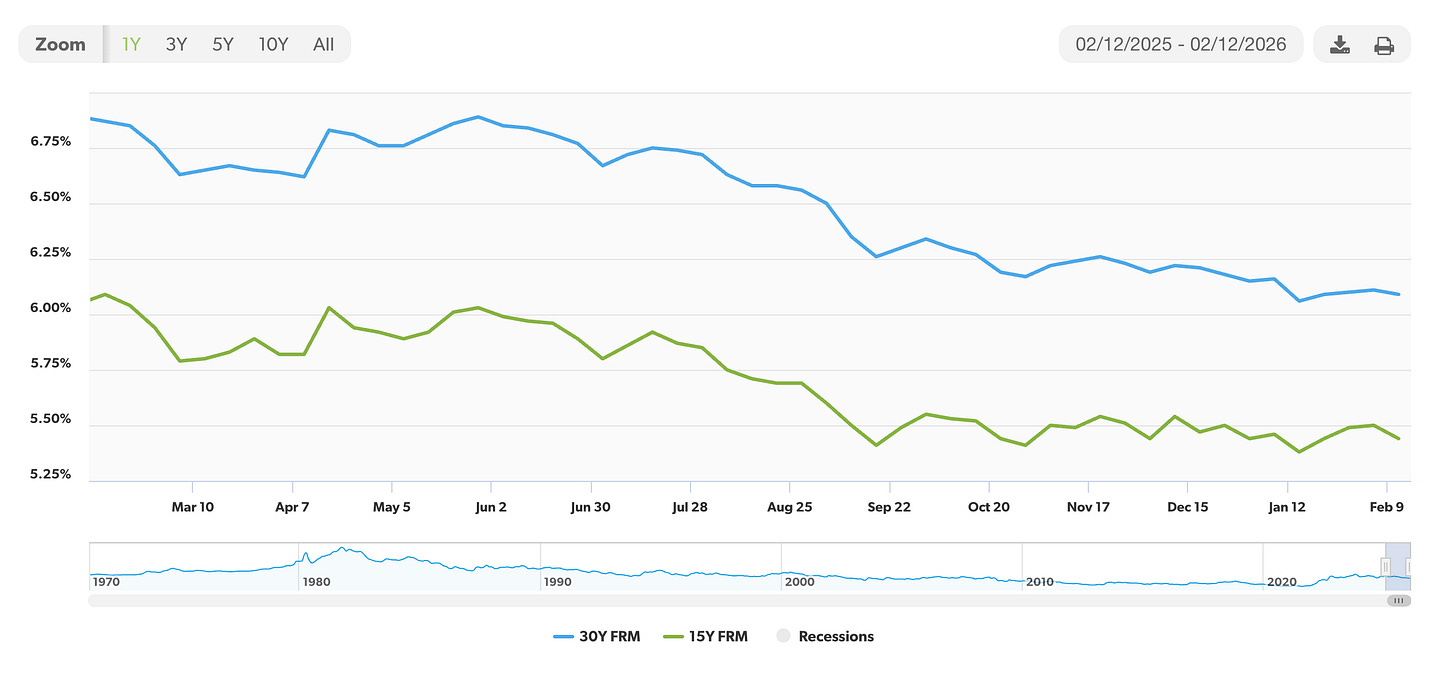

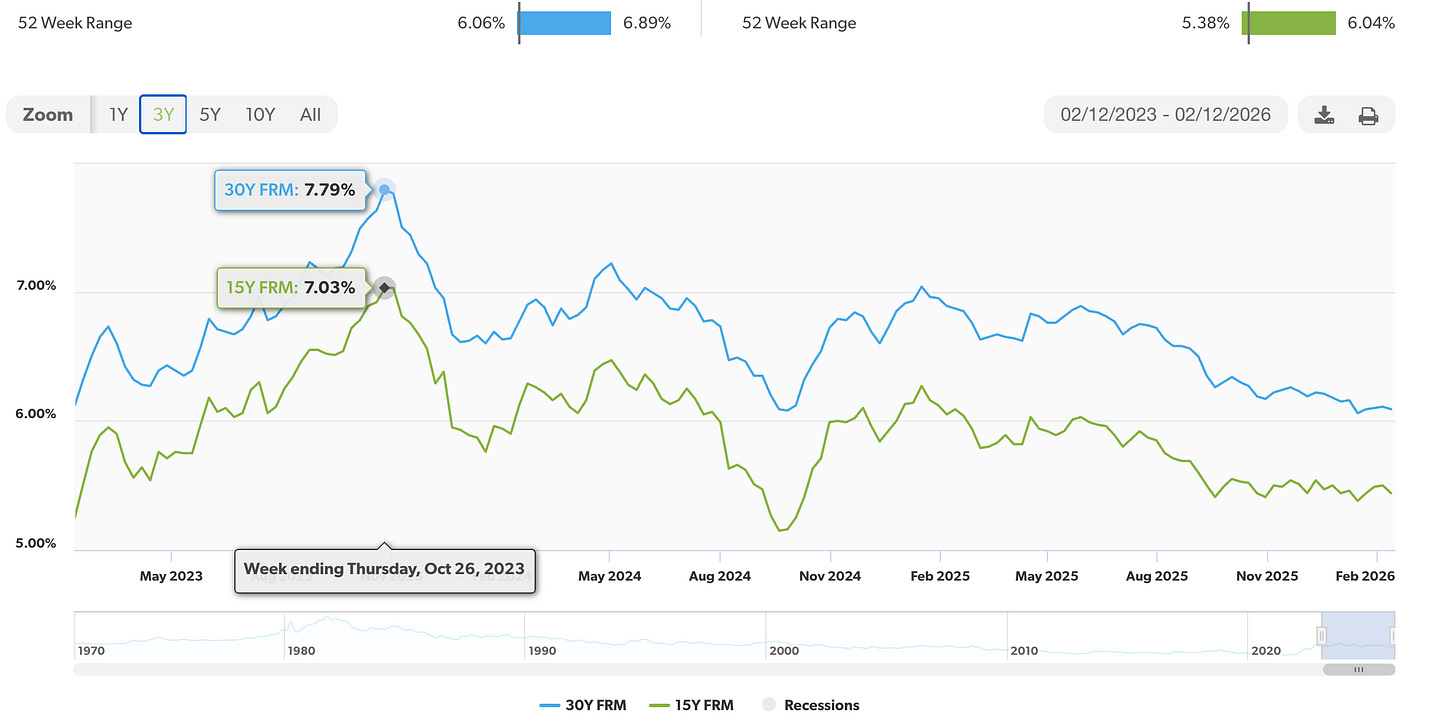

According to Freddie Mac data, 30-year mortgage rates have fallen from roughly 6.87% to 6.09% over the past year.

Zoom out further and rates were near 7.79% in late 2023.

That’s a 170-basis-point drop from peak levels.

If mortgage rates were the true driver, activity should be stabilizing…not collapsing.

Lower borrowing costs are supposed to stimulate demand.

Instead, existing home sales just posted their sharpest monthly drop since February 2022.

When reality contradicts the standard explanation, it’s time to question the explanation.

“It Was the Weather” Is Not Analysis

The other excuse? Bad weather.

But economists already factor seasonality into expectations. January is cold every year. Snowstorms are not a surprise variable.

More importantly, existing home sales reflect contracts negotiated weeks…often months…earlier.

You don’t sign a contract because it’s sunny on closing day.

When analysts reach for weather as the primary explanation for the largest monthly decline in four years, it usually means they don’t want to discuss the real cause.

Housing Runs on Confidence…Not Just Rates

Buying a home is not just a financial decision.

It’s psychological.

You don’t take on a 30-year liability unless you believe:

You have a stable job.

Your income will continue.

The future looks reasonably secure.

And right now, that security is eroding.

Yes, the latest jobs report showed a headline beat. But buried inside it were massive downward revisions. The benchmark revision for 2025 alone was roughly 900,000 jobs, implying about 400,000 fewer jobs created than previously reported.

That’s not a rounding error.

That’s structural weakness.

The bond market saw it immediately.

The Bond Market Is Telling You the Truth

After the headline jobs “beat,” yields initially spiked.

Then they reversed sharply.

The 10-year Treasury yield dropped back toward roughly 4.1%, falling about 7–10 basis points in short order.

That is not what a booming economy looks like.

That is what deteriorating growth expectations look like.

If debt, deficits, and foreign “dumping” were driving rates higher…as some commentators constantly claim…yields wouldn’t be falling.

Markets don’t hide stress in the most liquid bond market on Earth.

They price it immediately.

More Than 1 Million Homeowners Are Underwater

Now layer in another data point.

More than 1.1 million homeowners are underwater on their mortgages, a seven-year high.

That represents about 2.1% of mortgage borrowers, and the number of underwater homeowners has increased nearly 60% year-over-year.

Some will dismiss this as small relative to 2008.

But cycles turn at the margin.

The important variable isn’t the level.

It’s the direction.

If negative equity is rising rapidly…particularly in Sunbelt markets like Florida and Texas…that tells you prices are already softening where speculation was most intense.

And underwater borrowers behave differently.

They don’t spend aggressively.

They can’t refinance.

They’re vulnerable to job loss.

If unemployment ticks up even modestly, those homes move toward short sales and foreclosures…pushing comps lower and dragging more homeowners underwater.

That’s the feedback loop.

Demand Is Already at Cycle Lows

Here’s the overlooked piece.

At 3.9 million annualized sales, turnover is extremely low.

When demand is already near cycle lows, it doesn’t take much additional pressure to tip prices lower.

A small increase in supply…from job losses, relocations, or investor selling…can overwhelm weak demand.

And if labor markets continue to soften, supply pressure becomes inevitable.

Housing doesn’t need a crash to matter.

A nationwide nominal decline of 3–5% would be enough to:

Increase negative equity

Tighten credit conditions

Reduce consumer confidence

Lower household spending

Housing is the transmission mechanism.

Commercial Real Estate Is Flashing Red

And now we move to the part that should really get your attention.

Commercial real estate equities are getting hammered.

CBRE fell 13% in a single session, on top of a similar decline the day prior.

That’s not a small move.

That’s stress.

Yes, headlines blame AI disruption. But AI isn’t the root cause.

The underlying fundamentals were already fragile.

Commercial real estate sits at the intersection of:

Employment

Corporate profitability

Bank balance sheets

Credit availability

When labor demand weakens, office usage falls.

When consumer spending slows, retail properties suffer.

When refinancing becomes harder, valuations compress.

The AI narrative may be the catalyst.

But the structural weakness has been building for years.

As George said in the transcript, markets often ignore cracks in the dam…until the dam bursts.

By the time share prices collapse, the damage is already done.

“Tappable” Equity Isn’t Always Tappable

One more critical point.

Homeowners currently have roughly $17 trillion in total equity, with about $11 trillion considered tappable.

Sounds comforting.

But equity only matters if banks are willing to lend against it.

In deteriorating economic conditions, credit standards tighten…not loosen.

Lower rates during a slowdown don’t mean easy money.

They often mean tight money.

You can have theoretical equity and still be unable to access it.

That’s how balance-sheet stress spreads quietly.

This Isn’t 2008…But It Doesn’t Have to Be

To be clear:

This is not 2008.

There isn’t widespread subprime securitization blowing up the system overnight.

But that doesn’t mean everything is healthy.

A grinding housing slowdown combined with commercial real estate stress can:

Squeeze regional banks

Tighten credit standards

Reduce construction employment

Weaken household confidence

Drag on nominal GDP

You don’t need a financial apocalypse to enter a recession.

You just need income growth to falter.

Housing Doesn’t Lie

You can spin CPI.

You can revise payrolls.

You can reinterpret GDP.

But you cannot fake a contract that never gets signed.

Existing home sales just posted their biggest monthly decline in nearly four years.

Underwater mortgages are rising sharply.

Job growth has been revised down significantly.

Commercial real estate stocks are cracking.

The bond market is signaling slower growth.

That combination is not random.

Housing just fired a warning shot.

The only question now is whether the rest of the economy listens.

Prepare accordingly.

The big boomer die off and sales by their heirs is only just getting started.