Inflation’s Last Gasp: Why Walmart’s Price Hike Signals a Disinflationary Collapse, Not True Stagflation

Walmart’s hiking prices...but not because you’re buying more. If inflation’s dying breath is here, what’s lurking behind the numbers the Fed fears to see?

By Rebel Capitalist News Desk

Walmart just announced it’s raising prices this summer.

On the same day, we learned that U.S. retail sales barely grew in April—just +0.1% month-over-month.

At first glance, this might seem like business as usual. But if you look closer, this could be a warning sign that inflation is on its “last gasp” before the economy slows down hard.

If you look beneath the surface, you’ll find the kind of signal markets tend to ignore…until it’s too late. What’s hiding behind those weak numbers?

This isn’t the kind of inflation that comes from a booming economy where people are spending like crazy. This is cost-push inflation—driven by tariffs, not demand. And when you combine rising prices with weak spending, it spells trouble.

Let’s break this down.

Walmart is the biggest retailer in America. When they raise prices, it affects nearly every household. But here’s the problem: people are already pulling back.

The weak retail sales numbers show that consumers are tightening their wallets. Higher prices will only make that worse.

The main reason for Walmart’s price hikes? Tariffs from the ongoing U.S.-China trade battle.

These tariffs are raising Walmart’s costs, and the company is passing those costs to customers.

This isn’t “good inflation” caused by strong demand. It’s an external cost being dumped on consumers.

This is where the feedback loop kicks in.

Higher prices → less spending → weaker business earnings → job cuts → even less spending.

It’s not stagflation, where inflation stays high because of strong demand and supply constraints. This is different. This is a disinflationary slowdown masked by sticky headline CPI.

Yet, experts will still yell “stagflation!” when they see rising prices and soft growth. But true stagflation needs robust demand keeping prices elevated.

Right now, credit growth is slowing, consumers are maxed out, and wage gains are flattening. It just looks like stagflation on the surface.

From a monetary plumbing perspective, the real driver of inflation is credit creation.

When credit expands, demand and inflation rise. But when credit slows, like we’re seeing now, demand falls and inflation should cool.

Walmart’s price hikes are not the result of new credit creation.

They’re a forced response to tariffs. Consumers will likely respond by cutting back even more.

This slows velocity of money—how often money changes hands in the economy. Even if prices spike temporarily, the underlying activity is slowing.

This is classic disinflationary behavior.

Recent data supports this view:

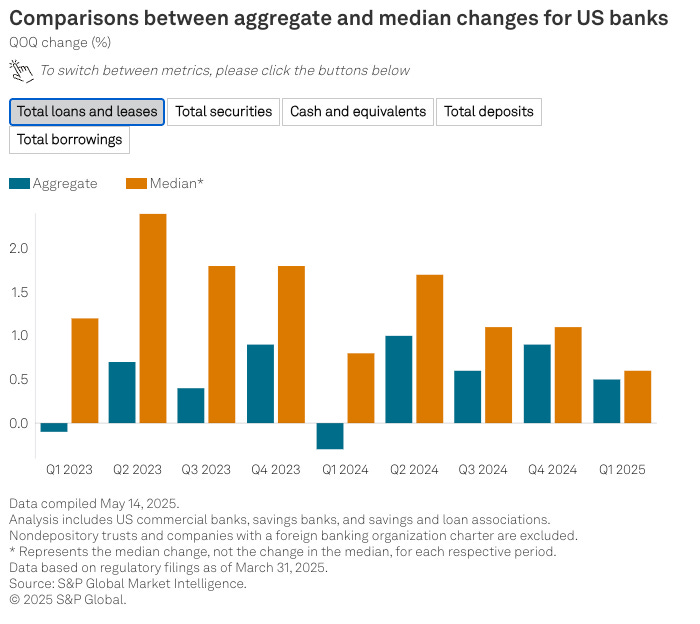

U.S. bank loan growth slowed to just 0.5% in Q1 2025, the weakest in over a year. (S&P Global Market Intelligence).

The Fed's May 2025 loan officer survey showed declining credit demand from businesses and consumers, especially small firms. (Reuters).

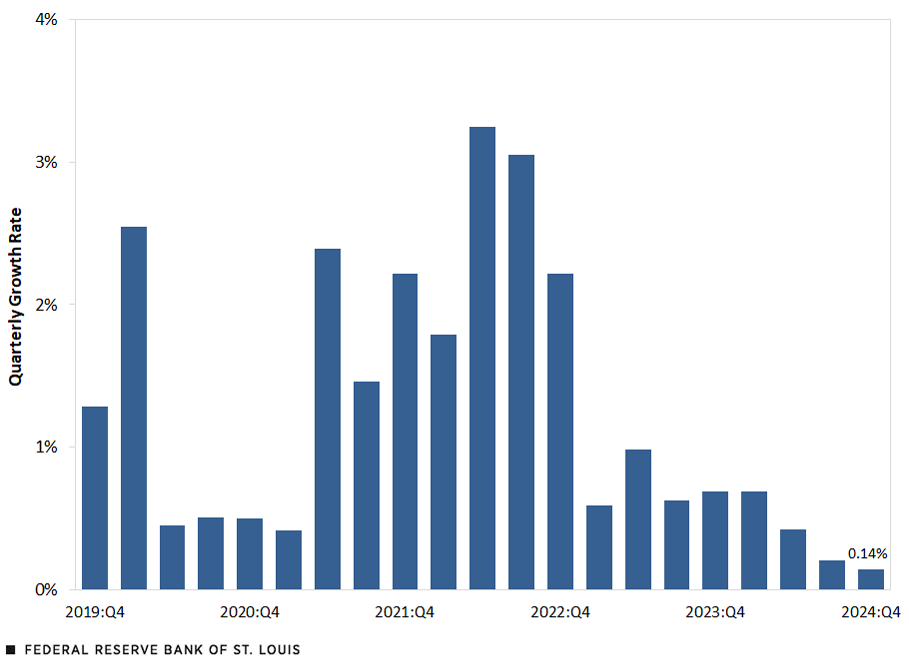

Commercial real estate lending growth dropped to an 11-year low, increasing just 0.14% quarter-over-quarter. (St. Louis Fed).

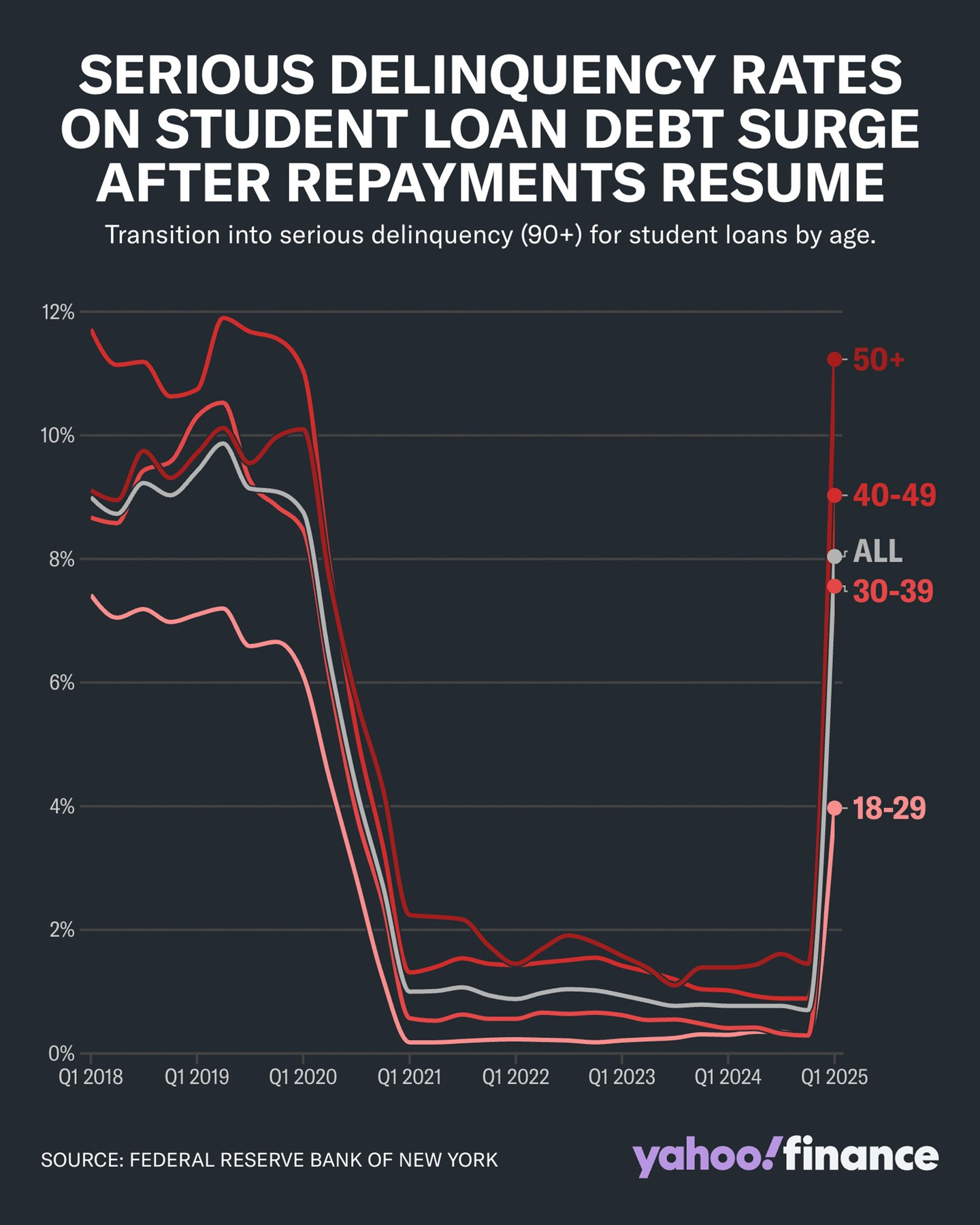

Student loan delinquencies surged to 8% in Q1 2025, the highest since the pandemic pause ended. (Barron's).

The Federal Reserve now faces a dilemma. If CPI rises due to Walmart’s price hikes, the Fed may feel pressure to stay “hawkish” and keep rates high. But if they do this while the economy is slowing, they risk making a big policy mistake.

Credit and demand are already slowing beneath the surface. Tightening into that slowdown would amplify the downturn.

For the average American, this means higher prices at Walmart, but fewer job openings and slower wage growth.

For investors, it means being careful with consumer stocks and keeping an eye on credit indicators rather than just CPI headlines.

Bond yields might fall as growth concerns mount, even if CPI stays elevated in the short term.

In the bigger picture, Walmart’s price hikes are not the start of a new inflation wave.

They’re the last gasp of the old one.

This is a supply-side cost shock, not a demand boom. The economy is running out of momentum. Prices might lurch higher briefly, but the slowdown is already in motion.

The key takeaway? Watch credit, not CPI. Credit growth, consumer behavior, and money velocity will tell you more about where we’re headed than headline inflation numbers.

So while the media focuses on “sticky inflation,” the real risk is a disinflationary collapse hiding underneath.

This is inflation’s last gasp.

Reporting by Rebel Capitalist News Desk