Jobs Market Flashing Red

JOLTS and ADP Send a Recession Warning...

Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | September 5, 2025

For months, the mainstream narrative has been “the labor market is strong” and “the economy is resilient.” But this week’s jobs data is starting to tell a very different story.

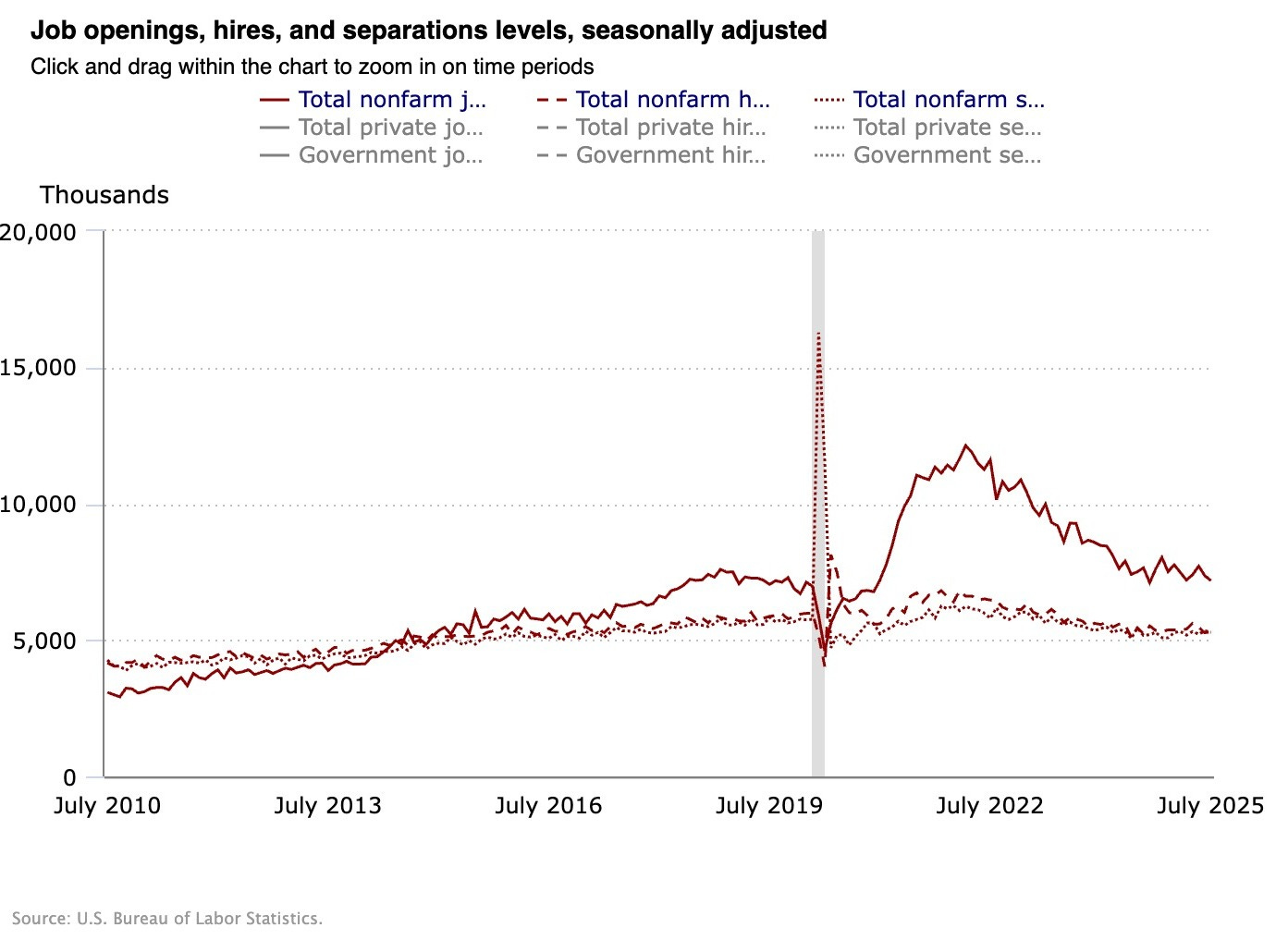

The JOLTS report showed job openings plunging to levels not seen since the depths of the pandemic. The ADP payroll numbers came in far weaker than expected.

And when you zoom out and look at the trends, the U.S. labor market has quietly crossed a critical threshold: for the first time since 2021, there are now more unemployed workers than there are job openings.

That’s not just a statistical blip. It’s the kind of signal that historically lines up with recessions. And when you layer in what the bond market is telling us, the probability that we’re already sliding into a downturn just shot higher.

JOLTS: The Supply-Demand Equation Just Flipped

The Job Openings and Labor Turnover Survey (JOLTS) is rarely front-page news, but investors who watch cycles closely know it’s one of the most important leading indicators of labor market health.

In July, job openings dropped to 7.18 million…well below expectations and the weakest reading since 2020.

Here’s why that matters:

For most of the past three years, the labor market was supply constrained… meaning there were more job openings than there were unemployed workers.

That gave employees bargaining power, kept wages elevated, and was a key reason the Fed insisted the economy could handle higher interest rates.

But as of last month, the U.S. labor market is now demand constrained…there are more unemployed workers than there are job openings.

That flip is a classic late-cycle signal. It means companies aren’t scrambling to hire anymore; they’re cutting back.

Companies aren’t scrambling for workers anymore…they’re retreating. But the real danger isn’t just fewer openings…it’s what the next set of payroll data reveals about how deep the slowdown runs.

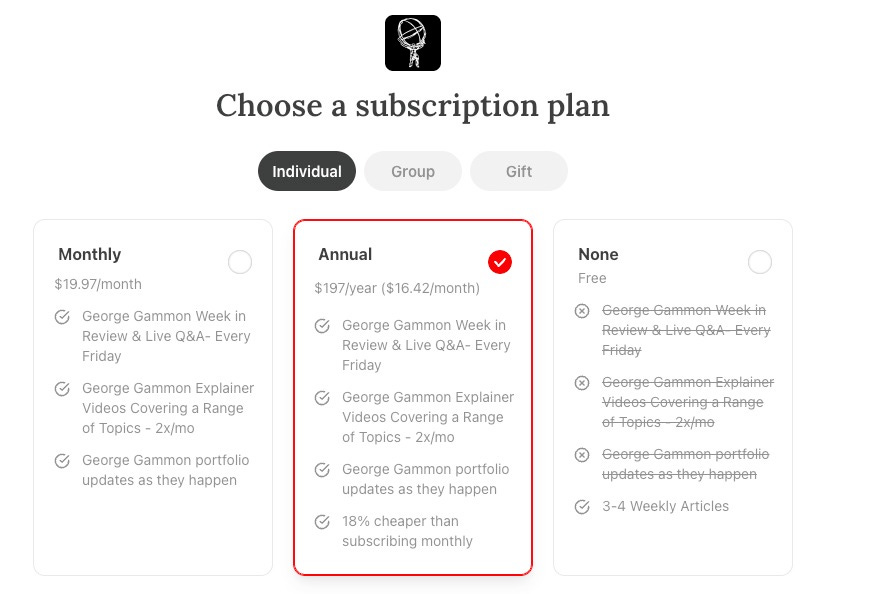

ADP Confirms the Slowdown

If JOLTS was the first red flag, the ADP payroll report confirmed it.

Consensus expected 75,000 new private-sector jobs.

We got just 54,000.

That’s not just a miss…it’s half the monthly average from earlier this year.

To put it in context: last month’s ADP number was already weak at 106,000. Now we’ve seen two back-to-back misses, and the trend is clearly downward.

When you combine this with the initial jobless claims, which ticked higher to 237,000 this week, the picture becomes clearer: layoffs are slowly rising, hiring is cooling, and momentum is fading.

Two weak reports in a row don’t just hint at cooling…they hint at something structural. But the real test isn’t in today’s snapshot; it’s in how those numbers get rewritten after the fact.

Revisions Matter More Than Headlines

For almost two years, the BLS’s nonfarm payroll reports have followed a predictable pattern:

A surprisingly strong headline number grabs the headlines.

A month later, it gets revised down…sometimes drastically.

In fact, the vast majority of months have seen downward revisions. That makes the upcoming revisions in today’s payroll report arguably more important than the headline itself.

If revisions turn deeply negative…especially if prior months are wiped out…it will be further confirmation that the “strong labor market” narrative is cracking.

If the “strong labor market” was always a mirage, tomorrow’s revisions could rip the mask off. And while Wall Street clings to the headlines, one market is already flashing the truth.

The Bond Market Is Already Pricing It In

Markets don’t wait for the NBER to declare a recession. They move when the probability shifts. And right now, the bond market is sending a very clear message.

The 10-year Treasury yield has dropped from 4.6% at the start of the year to 4.07% today.

The 2-year yield has fallen even more dramatically, from 4.28% to 3.48%.

That’s a classic bull steepener: short-term yields are falling faster than long-term ones. Translation? The market is saying the Fed will have to cut rates sooner rather than later.

A bull steepener doesn’t happen by accident. The last time we saw a move like this, the Fed was forced into emergency action. The dollar is now echoing the same warning.

The Dollar Confirms the Shift

At the same time, the DXY dollar index has weakened.

Why? Because if the Fed is forced to cut while other central banks hold steady, the interest rate differential narrows. That makes U.S. assets less attractive to foreign investors, pushing the dollar down.

A weaker dollar and falling short-term yields are exactly what you’d expect if the market was pricing in a recession…not an overheating economy.

Currency markets don’t lie…they front-run policy pivots. But the most dangerous myth isn’t about the dollar…it’s about why rates are falling in the first place.

Dispelling the “Rates Are Rising” Myth

One of the most persistent narratives you’ll hear on financial Twitter or in the mainstream press is that “interest rates are blowing out” because of the massive U.S. deficit and Treasury issuance.

But the data doesn’t support that.

The deficit has grown.

Treasury issuance has grown.

Yet yields have fallen.

The correlation is crystal clear: rates follow growth and inflation expectations, not supply of Treasuries.

Right now, growth expectations are falling. Inflation expectations are easing. That’s why yields are down.

If deficits aren’t driving yields higher, then what is? The answer is simpler, and more unsettling, than most investors want to admit…and it takes us straight into recession territory.

What This Means for Recession Risk

Taken together, here’s the picture:

Job openings have dropped below the number of unemployed for the first time since 2021.

Private payrolls are barely growing, with ADP showing just 54,000 new jobs.

Initial claims are rising.

Revisions have been consistently negative.

Yields are falling across the curve, especially on the short end.

The dollar is weakening.

That’s not a portrait of a resilient economy. That’s a portrait of one sliding toward recession.

The puzzle pieces fit too neatly to ignore. But the smartest investors aren’t just watching the labor market…they’re zeroed in on a handful of signals that could trigger the next leg down.

What Smart Money Is Watching Next

If you want to track where we go from here, focus on:

Nonfarm payroll revisions — if prior months get revised sharply lower, the recession call strengthens.

2s/10s spread — if the steepening continues, it’s a signal that rate cuts are coming.

Credit spreads — widening would confirm stress moving from labor markets to corporate balance sheets.

The dollar — further weakness will confirm shrinking interest rate differentials.

Those four indicators…revisions, spreads, credit, and the dollar…aren’t just gauges, they’re tripwires. And if they go off, the investment playbook flips overnight.

Investment Implications

If this is indeed the start of a labor market-driven slowdown, the market playbook looks very different from what most investors are positioned for.

Likely winners:

Treasuries — especially on the short end.

Gold — as rate expectations shift and the dollar weakens.

Defensives — utilities, staples, healthcare.

Likely losers:

Cyclicals — consumer discretionary, housing, travel.

High-yield credit — defaults rise when the labor market cracks.

Dollar-heavy trades — as DXY weakens, the FX landscape shifts.

Positioning defensively might look boring, but in a labor-market-driven downturn, boring is how you survive. The question isn’t whether the alarm is ringing…the question is how loud it gets from here.

The Recession Alarm Just Got Louder

The mainstream may still be talking about a “soft landing.” But the data…and the bond market…are pointing in the opposite direction.

When job openings fall below the number of unemployed, when payroll growth stalls, and when yields dive at the short end of the curve, that’s not noise. That’s a recession signal.

It doesn’t mean the economy collapses tomorrow. But it does mean the odds of a downturn just went up dramatically.

And the investors who take those signals seriously…instead of clinging to comforting narratives…will be the ones best positioned when the slowdown becomes undeniable.

The mainstream media will keep selling the “resilient economy” narrative until the very moment it breaks. By then, it’s too late. The investors who survive downturns… and profit from them…are the ones who read the signals early and adjust before the herd.

That’s exactly why we built the Rebel Capitalist News Desk. Every week, we cut through the noise and break down what’s really happening in the markets, the economy, and the political circus driving them.

And here’s the kicker: today at 4 PM EST is George Gammon’s live and unfiltered weekly wrap-up for premium subscribers.

If you’re a free reader, you’re missing the full story…and the chance to see George’s raw, no-holds-barred take on the data that’s shaking markets right now.

👉 Upgrade today and you’ll get access to the live stream and the replay…plus every premium deep dive going forward.

Join the thousands of liberty-minded investors already inside. Don’t wait for the recession headlines to hit…by then, the opportunity will be gone.