Manufacturing Orders Just Dropped...What That Really Means for the Economy

Shipments are down. Inventories are falling. Orders just cratered. This isn’t noise...it’s a signal.

By Rebel Capitalist News Desk

New orders just dropped $22.8 billion…and almost nobody’s talking about it.

While markets debate what the Fed will do next, the real economy may already be tipping its hand. This week’s manufacturing report didn’t just blink…it flared red.

Every time we’ve seen a supposed recovery, manufacturing has stepped in with the truth. Guess what just happened?

Let’s unpack why this matters more than the headlines… and how smart money is quietly repositioning before the next leg down.

If you want to know where the economy is headed next, you don't need to guess. Just follow the orders.

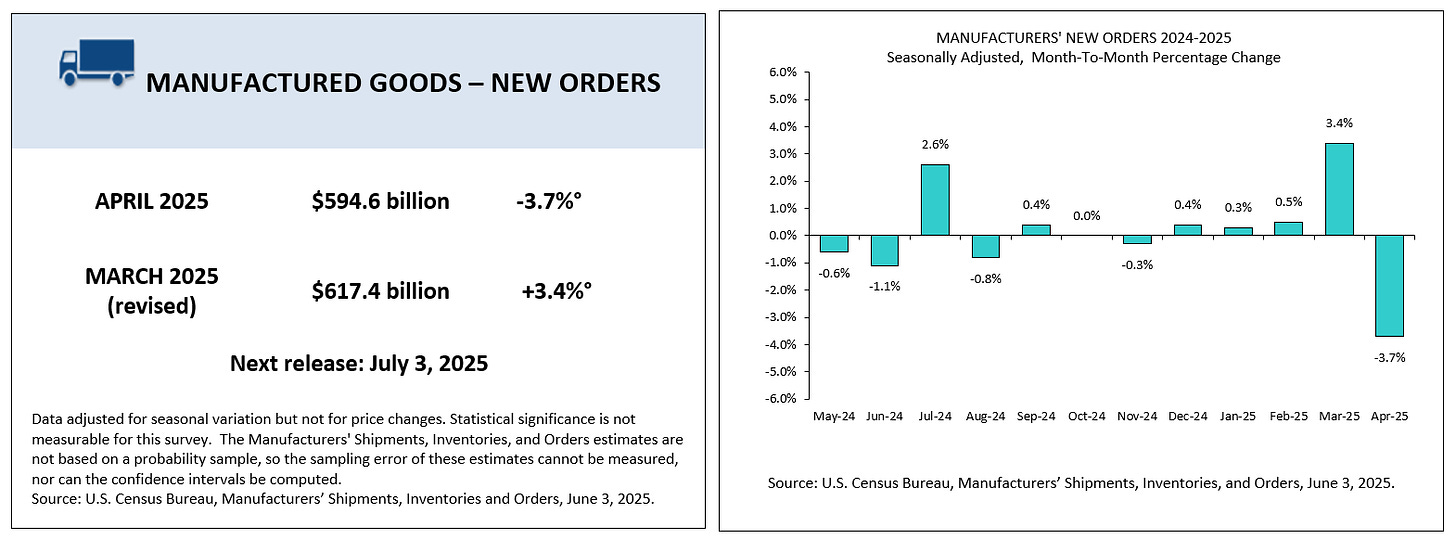

This morning, the U.S. Census Bureau released its Monthly Full Report on Manufacturers’ Shipments, Inventories, & Orders for April 2025.

And let’s just say it wasn’t pretty:

New orders fell 3.7% to $594.6 billion.

That’s a $22.8 billion drop.

It ends four straight months of increases.

Let’s break down what this means, why it matters, and what today's smart investors should be watching next.

A Sudden U-Turn

March 2025 saw a strong rebound in new orders: +3.4%. That looked like momentum.

But now? The entire gain…and then some…has been erased.

Some analysts believe that March’s big number was inflated by businesses front-running potential tariffs… ordering more ahead of expected cost increases.

If that’s true, then April’s steep drop may not just be weakness, but a reflection of demand being pulled forward a month earlier.

While a part of the drop can be explained by front running tariffs, be careful not to dismiss this huge negative number altogether.

New orders fell sharply in April, and that kind of swing may not be just noise—it could be a signal.

This isn’t just about less stuff getting ordered. This is about a possible shift in business confidence and forward expectations.

When manufacturers pull back, they’re not guessing.

They’re responding to:

Weaker demand

Tight credit

Softening retail and wholesale trends

They’re looking at their pipelines and saying: "We need to slow down."

That’s not bullish for the real economy.

And here’s the real concern: when businesses start pulling back before the headlines catch up, it’s often because they’ve seen the future…and it doesn’t look great.

Shipments and Inventories Confirm the Story

Shipments, which show what’s actually going out the door, fell 0.3% in April…the second monthly decline in a row.

Inventories also dropped slightly for the sixth straight month. That suggests companies are:

Selling off what they already have

Hesitating to restock

Preparing for leaner months ahead

This isn’t panic. But it is caution.

And that caution is now showing up in hard data.

The playbook is clear: when shipments and inventories both decline, businesses aren’t betting on growth…they’re bracing for contraction.

That’s when opportunity shifts from offense to defense.

Unfilled Orders: The Last Holdout?

Unfilled orders did rise slightly—by $0.7 billion. But that’s barely 0.05% of the total backlog.

And the unfilled orders-to-shipments ratio dipped to 6.77, from 6.86 in March.

Translation? Even the backlog is starting to look a little less reliable.

When manufacturers start burning through their unfilled orders without replenishing them, it usually signals we’re late in the cycle.

In every cycle, there’s a point where the backlog becomes a mirage.

When it starts shrinking without fresh demand behind it, the “soft landing” crowd suddenly gets very quiet.

Zoom Out: What This Means for the Broader Economy

This report isn’t a headline-grabber like jobs or inflation. But it matters…a lot.

Because manufacturing orders are a leading indicator. They show how confident businesses are about the future.

Falling orders mean:

Fewer raw materials being bought

Less work for suppliers

Slower hiring

This ripple effect travels through the economy. It can show up in trucking, warehousing, steel demand, and more.

When this goes negative, it’s often a warning sign.

Want to know where the economy’s headed? Watch the trucks, not the tweets. Orders slow first…then the slowdown spreads.

We’re at that pivot point right now.

How Investment Legends Might Play This

Stanley Druckenmiller would look at this and immediately think about positioning. If manufacturing is rolling over, and inflation is cooling, the Fed might be done. He could look at:

Long bonds (especially on weakness)

Defensive equity sectors

Short positions in overextended cyclical stocks

He’d also be watching earnings downgrades in industrials.

Paul Tudor Jones would look for an inflection point. He’d ask: is this a temporary dip or the start of a trend reversal?

If he believed the trend was breaking down, he might play it with:

Put spreads on industrial ETFs

Long volatility

Long gold (as the slowdown reinforces risk aversion)

Bruce Kovner might zoom out further. He’d look at global PMI data, compare U.S. weakness to Europe and China, and then:

Trade currency pairs based on relative growth

Look at commodity demand fading across the board

This data could confirm a broader slowdown theme he’s been watching.

The pros aren’t waiting for confirmation…they’re triangulating.

And if they’re seeing the same thing this report is saying, don’t be surprised if the big moves are made before the retail crowd catches on.

This Is Not Doom. But It’s a Warning.

A 3.7% drop in new orders doesn’t mean we’re in recession tomorrow.

But it does mean the soft landing narrative just took a hit.

Because this data is backward-looking and forward-looking:

Backward: it shows what actually happened to orders in April.

Forward: it tells us what manufacturers expect in the months ahead.

And right now, they’re not exactly optimistic.

Every warning starts quiet. This is your chance to listen before the alarm gets louder… and while there's still time to move.

Stay Ahead of the Herd

Markets usually wait for headlines to react. But traders who watch real data get the signal first.

Today’s manufacturing report is one of those signals.

It says:

Growth is slowing.

Businesses are getting cautious.

The cracks are spreading.

So keep your eyes open. Stay flexible. And remember:

The data whispers before the headlines scream.

If you found this breakdown valuable, you’ll get even more by joining the Rebel Capitalist News Desk on Substack.

We break down the real economy before the headlines hit. No hype. Just data, analysis, and asymmetric investing insights that actually move the needle.

Join thousands of contrarian investors already subscribed.

Get ahead of the herd. Stay informed. And protect your capital in a world of noise.

Because by the time the Fed admits what’s coming, it’ll already be too late.

Rebel Capitalist News Desk

June 3, 2025