PPI Shock: Inflation Jumps Most in 3 Years

But the Real Mystery Is Who’s Paying for It

Written by Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | August 16, 2025

The markets just got hit with a surprise that has traders and economists shouting the “S” word: stagflation.

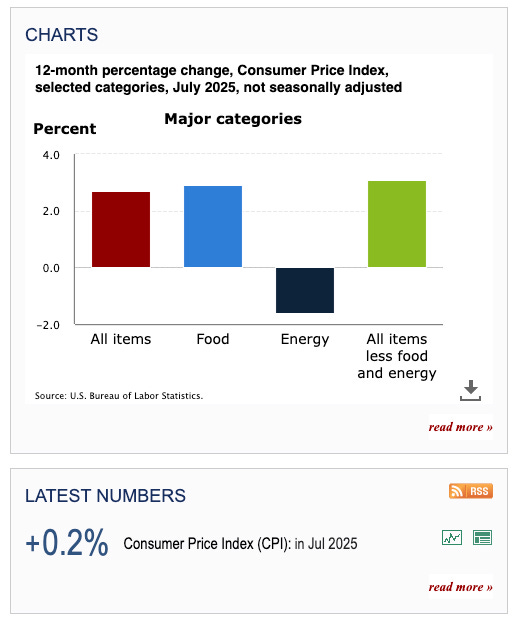

This week’s CPI numbers were a bit of a yawner…slightly below expectations.

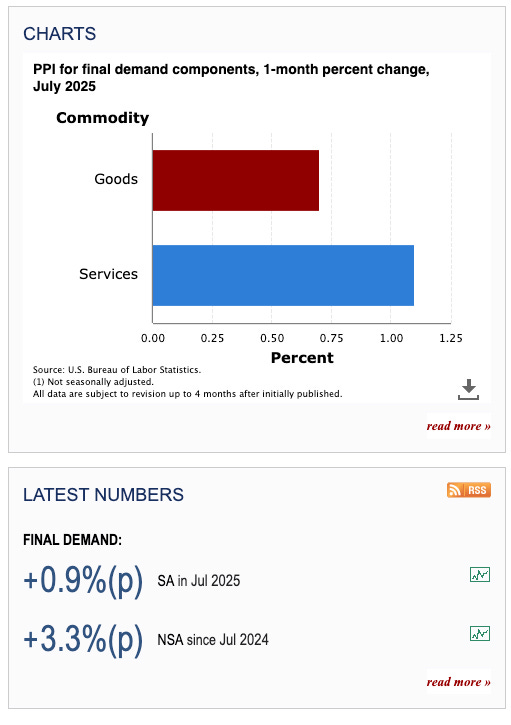

But the most recent Producer Price Index (PPI) came in hot… very hot.

In fact, it was the biggest month-over-month jump in three and a half years.

And it’s got everyone debating whether this is the first real sign that tariffs are slamming the U.S. economy.

The big question: is this the start of an inflation acceleration, or just a one-time price adjustment that will fade?

And maybe an even bigger question…who’s actually paying the tariff tax?

The Numbers: 0.9% in a Single Month

The July PPI was expected to rise just 0.2% from June. Last month it was flat. Instead, it came in at 0.9%.

On a year-over-year basis:

Headline PPI jumped from 2.3% to 3.3%.

Core PPI rose from 2.5% to 2.8%.

For context, if you annualize that 0.9% monthly gain, you’re talking about a double-digit inflation rate at the producer level.

And it’s not just goods.

Services PPI rose 1.1%, compared to a 0.7% increase for goods.

That’s awkward for the “this is all tariffs” crowd…because while tariffs hit imported goods directly, it’s harder to explain why service prices are jumping at an even faster pace.

If producer prices are ripping higher at a double-digit annualized pace while consumer prices barely budge, the real question isn’t whether inflation is “back.”

The real question is: how long before someone…either the Fed, corporate America, or households…pays the price?

Why the Fed Can’t Fix This

Some analysts are already calling for the Fed to delay rate cuts because of this data.

But here’s the reality:

If this is primarily a price adjustment from tariffs, there’s nothing the Fed can do about it.

Raising the federal funds rate won’t make Toyotas from Japan cheaper when they’re being hit with a 25% import tax.

It won’t lower the cost of Chinese-made components going into Caterpillar tractors. Monetary policy doesn’t work on that kind of supply-side tax shock.

If the Fed overreacts here, it risks crushing an already weakening labor market for no real inflation benefit.

So if the Fed’s primary weapon is useless against a tariff-driven shock, what happens when the market starts demanding action anyway?

The answer might tell us more about politics than economics.

M2 and Money Printing: Not the Culprit

Could this be “money printing” finally showing up in prices? The M2 money supply says otherwise.

M2 has been essentially flat since 2022, and the recent uptick is nowhere near the spike we saw during the pandemic stimulus binge.

In fact, it’s tracking more like the low-inflation 2010s than the high-inflation 2021–2022 period.

The Fed’s balance sheet is also shrinking thanks to ongoing quantitative tightening. So the “too much money chasing too few goods” argument doesn’t hold up here.

If money supply isn’t driving this spike, then the traditional inflation playbook is out the window.

Which means the real driver of these numbers is hiding somewhere else…and the consequences could be far more destabilizing than the Fed wants to admit.

The Tariff Transmission Puzzle

If it’s not money supply growth, then tariffs are the most obvious suspect. But here’s where it gets tricky.

There are three possible payers of the tariff tax:

Foreign exporters (China, Japan, etc.) lower their prices to absorb it.

U.S. importers/producers pay more for inputs and eat the cost.

U.S. consumers pay higher retail prices.

The White House claims foreign producers are footing the bill.

But if you look at a chart of import prices it hasn't gone down which shows foreigners ARE NOT paying the tariffs:

Looking at the CPI data the taxes likely aren't entirely coming out of the pocket of the American consumer, therefore it must, to a large degree, American importers and retailers.

As an example, Caterpillar expects $400–$500 million in tariff costs this quarter alone, and up to $1.5 billion for the year.

Their operating income is down 18% because they’re eating those costs rather than passing them on… for now.

If Caterpillar is eating billions in tariff costs today, how long before Wall Street’s patience runs out and those costs spill over into consumer prices tomorrow?

That tipping point is closer than most investors realize.

The CPI–PPI Divergence

What makes this so strange is that consumer prices (CPI) aren’t moving in lockstep. The latest CPI was just 0.2% month-over-month, basically in line with the Fed’s 2% annualized target after adjusting for base effects.

So we have producer prices soaring while consumer prices stay calm.

Historically, that gap doesn’t last. Either producers pass the costs to consumers… lifting CPI in the months ahead…or they take a permanent hit to profit margins.

The first outcome is inflationary, the second is recessionary. Neither is bullish for the economy.

Producer inflation without consumer inflation is a short-lived illusion.

The only suspense is whether the pain shows up first in your grocery bill…or your 401(k).

Why It Matters Who Pays

If foreign exporters are paying, it’s mostly a geopolitical chess move with limited domestic economic impact.

If U.S. producers are paying, profit margins shrink, corporate earnings suffer, and layoffs follow.

If U.S. consumers are paying, retail inflation rises, disposable income falls, and demand destruction hits.

That last scenario is the one that risks turning a slowdown into a recession…much like what happened in 2008 when oil prices spiked and drained household budgets just before the crash.

And here’s the catch: whichever group takes the hit…foreign exporters, U.S. producers, or U.S. consumers…the fallout doesn’t stay contained.

The knock-on effects ripple through earnings, jobs, and spending in ways the headlines still aren’t pricing in.

Possible Outcomes

Right now, the market is guessing:

Best case — This is a one-time spike as tariffs reset certain prices, and PPI stabilizes.

Base case — Higher input costs slowly work their way into consumer prices, giving us a mini-inflation bump.

Worst case — PPI stays hot, CPI catches up, the Fed panics, and we get a 1970s-style stagflation scenario.

Given the weakening labor market, the Fed’s tolerance for the “worst case” is low — but politics may pressure them to act if CPI starts rising sharply.

But markets don’t wait for clarity…they price probabilities today.

And right now, the odds of a stagflation surprise are climbing fast.

The real question: who gets blindsided first, Main Street or Wall Street?

What to Watch Next

Next two CPI and PPI releases — Do these numbers normalize or keep accelerating?

Corporate earnings calls — Look for mentions of “margin pressure” and “tariff impact.”

Import price index — Is the cost of foreign goods quietly rising?

Consumer spending data — Especially in discretionary categories like travel, dining, and retail.

Because if the next data drop confirms this wasn’t a one-off, the entire “soft landing” narrative collapses overnight.

And when that happens, the scramble to reprice risk will make today’s surprise look tame.

Bottom Line

The July PPI report is a genuine shock…and not the kind you can brush off as “just noise.”

The size of the jump, the services component, and the CPI-PPI divergence make this one of the more puzzling inflation prints in recent years.

The fact that we can’t even say with confidence who’s paying the tariff bill makes it even murkier.

If producers start passing costs to consumers, expect CPI to rise and recession risks to climb. If they don’t, expect earnings to drop and layoffs to increase.

Either way, the U.S. economy just hit a new patch of turbulence.

👉 Want the full breakdown? Last night’s Weekly Wrap-Up covers exactly how this PPI shock ties into markets, politics, and your portfolio.

If you missed it, don’t wait…watch the replay now before the next data drop hits and Wall Street scrambles to catch up.

Note, the weekly wrap-ups are for our premium subscribers…