Rents Are Falling, And So Will The CPI

The Real Deflation Nobody’s Talking About

Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | November 14, 2025

When people think about deflation, they imagine collapsing stock prices or falling wages. But in 2025, we may be seeing deflation creep in through a much quieter but massively influential back door: rents.

That’s right. Despite persistent inflation in food and services, the latest data shows apartment rents are now declining nationwide. And that matters a lot more than people realize, because rent makes up roughly one-third of the Consumer Price Index (CPI).

Let’s walk through what’s happening, what’s driving it, why the Fed is probably misreading it, and what it could mean for interest rates, the economy, and your investment portfolio.

If the CPI is the smoke, rents are the fire...and that fire’s going out fast. The only question is: what else gets cold next?

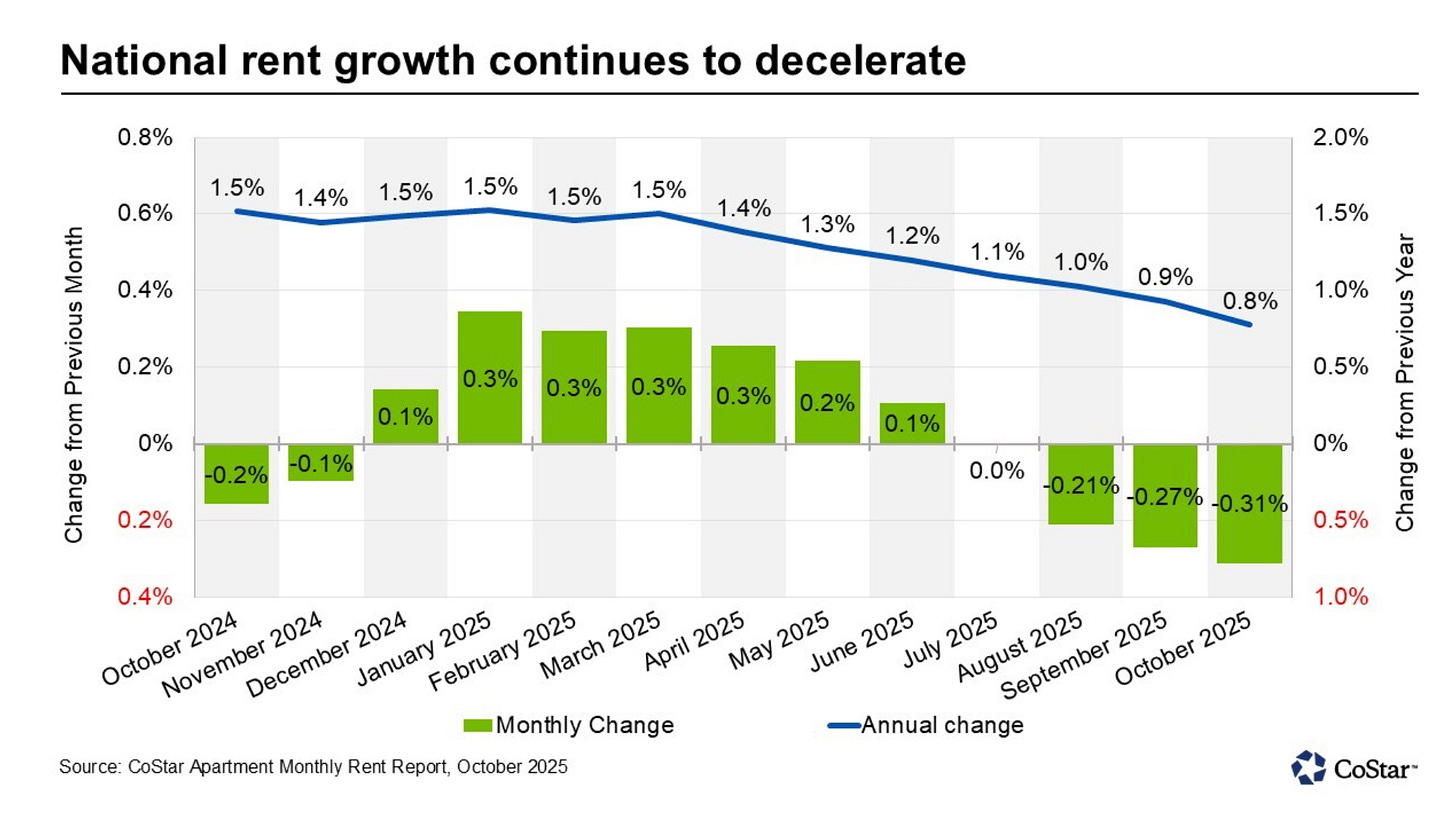

Rents Are Actually Falling

According to Apartments.com, October 2025 saw the largest monthly drop in U.S. apartment rents in over 15 years. We’re not talking about a slowdown in rent growth, or disinflation. We’re talking about outright deflation.

National average rent fell to $1,708, down 3% from September’s revised figure of $1,713.

This marks the fourth straight month of flat or negative rent changes.

The West led the declines with a 0.53% month-over-month drop, followed by the South (-0.28%), Northeast (-0.24%), and Midwest (-0.18%).

And it’s not just seasonal. Typically, rents cool in the fall, but they don’t go negative. This year, every U.S. region posted monthly rent declines. Even more shocking: metro areas like Denver, Austin, and Seattle saw drops of up to 1.3% in just one month.

For years, the story was housing shortage. Now it’s housing surplus. And when narratives flip that fast, balance sheets follow.

Why This Is Happening: A Supply Tsunami

The root cause is simple: massive oversupply driven by bad forecasts and cheap debt during the 2021–2022 boom.

Remember when the narrative was “we’re perpetually short on housing”? That spurred a wave of multi-family construction funded by near-zero interest rates. But developers didn’t build based on current rents...they built based on projected rent increases of 10%+ per year.

Now, with that rent growth stalling or reversing, many of these properties are cash flow negative. And that puts enormous pressure on:

Developers, who are seeing their pro forma dreams implode.

Regional banks, who financed a large chunk of this boom.

Liquidity in the broader economy, as distressed assets start to crack balance sheets.

When the cranes stop, the defaults start. But the real story isn’t just construction...it’s contagion. Where does the pain migrate next?

Why This Matters for the CPI

Most Americans (and even many economists) don’t realize that 33% of the CPI is made up of shelter costs, specifically something called Owner’s Equivalent Rent (OER).

The problem? OER lags real-time rent data by months.

So right now, while real rents are dropping, OER is still showing positive growth.

According to BLS data from September, shelter inflation was still running at +3.6% year-over-year. But as George Gammon pointed out, if real-world rents stay negative, OER will eventually catch down.

And when it does, the CPI will plunge.

When that lag closes, the illusion of “sticky inflation” will evaporate overnight...and the Fed’s credibility might vanish with it.

The Fed Is Behind The Curve (Again)

This matters because the Fed isn’t basing policy off of Apartments.com. They’re looking at that outdated, lagging BLS data. So as long as the CPI appears “sticky,” they’ll delay rate cuts...even though the real economy is already rolling over.

But here’s the kicker: by early 2026, OER will likely start showing declines, which could drop CPI below 2%, especially when combined with base effects.

That changes everything:

The Fed will be forced to cut rates faster than the market expects.

Bond yields...especially at the front end...will collapse.

Real yields will fall.

In fact, the Fed Funds futures market is already mispriced. The market currently places only 11–12% odds of no rate cut by March 2026. That’s absurd.

If rent deflation persists, those odds should be closer to 1%.

Every time the Fed fights the last war, markets hand them a new one...and this next battle may already be lost.

And Here’s Where It Gets Scary

The implications go well beyond macro charts.

If multifamily properties continue to decline in value (because they were priced based on rising rents), then:

Loan defaults on commercial real estate (CRE) will spike.

Regional banks, already exposed from earlier rate hikes, will take more balance sheet hits.

Liquidity will dry up, especially in shadow banking and private credit markets.

And as George always says: when liquidity evaporates, the tide goes out...and you start seeing cockroaches.

This is how a benign-sounding datapoint like falling rent turns into a systemic risk. And no one at the Fed seems to get it.

The first cracks never look catastrophic. But zoom out far enough, and you realize the dam’s already breaking.

AI Bubble = Last Stand?

Interestingly, the only places still seeing significant annual rent increases are AI bubble hubs:

San Francisco

San Jose

Chicago (data center boom)

Norfolk, VA (one of the largest data center regions in the U.S.)

But what happens if the AI bubble bursts?

Those rents will collapse just like Denver or Austin. And that could be the final leg lower for the national CPI shelter component.

If AI is the last pillar holding up this market, what happens when it stops hallucinating growth?

The Trade Setup: Go Long Duration, Short Delusion

If you believe this setup, here are a few trade ideas:

Long the 2-Year Treasury: Yields are still pricing in a much more hawkish Fed. If CPI drops, these yields have a long way to fall.

Long gold: Lower real yields + Fed pivot = major tailwind.

Short REITs or regional bank ETFs: They’re still not priced for a multi-family real estate bust.

None of this is investment advice.

But when the herd still trades yesterday’s inflation, the contrarians are already positioning for tomorrow’s deflation.

A Market Still Obsessed With The Wrong Data

The Fed and mainstream economists are still focused on the wrong things. They’re staring at lagging CPI data while real-time indicators are flashing bright red warning lights.

Rent deflation isn’t just a curiosity...it’s a leading indicator for the entire inflation complex. And it’s tied directly to liquidity, systemic risk, and ultimately, monetary policy.

By the time the Fed reacts, it will be too late. But for those watching closely, the opportunities...and the risks...are already here.

The real story isn’t inflation or deflation...it’s distortion. And if you can see through it before the mainstream does, you’ll own the next cycle.

Stay Ahead of the Next Cycle

If you’re reading this, you’re already ahead of 99% of investors. But if you want to stay ahead...to understand what George Gammon is watching every week before it hits the headlines...join the Rebel Capitalist News Desk.

Subscribers get George’s weekly breakdowns of macro trends, early warnings on systemic risks, and actionable insights to protect and grow their capital when the Fed, the media, and Wall Street get it wrong.

👉 Subscribe today ... because in a world this fragile, being early isn’t luck. It’s survival.

The reason for the sudden supply is that the illegals are self deporting and getting kicked out of government funded housing. The result is the same but this is the root cause.