Stocks Are Priced Like a “19” in Blackjack

Great Until They Aren’t

Written by Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | September 16, 2025

Wall Street keeps saying the same thing: “Stocks always go up if you wait long enough.”

That sounds comforting.

But when you look at real numbers, right now looks less like a safe ride and more like sitting on a 19 in blackjack—good hand, terrible odds if you keep pressing it.

Today’s U.S. stock market is among the priciest we’ve ever seen by the measures that actually matter.

That doesn’t mean prices can’t climb more (late-stage bubbles often do).

It means the expected return from here, after inflation, is weak…and the downside risk is real.

Let’s lay out the facts, keep it simple, and show where the asymmetric opportunities may be hiding.

Valuations: Near Dot-Com Extremes

Three big gauges tell the same story:

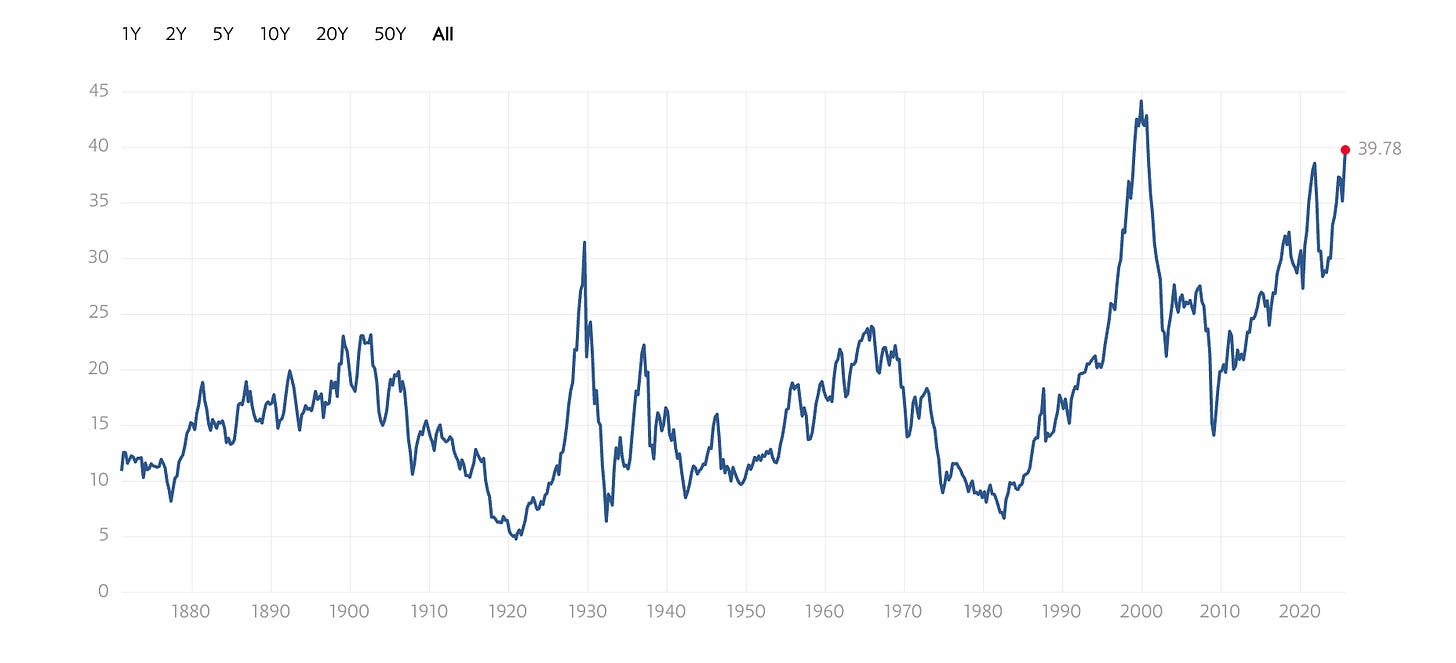

Shiller CAPE (the cyclically adjusted P/E) sits around 38–39, a level seen only a few times in history. That’s below the dot-com peak but above 1929 and far above long-run averages. (YCharts)

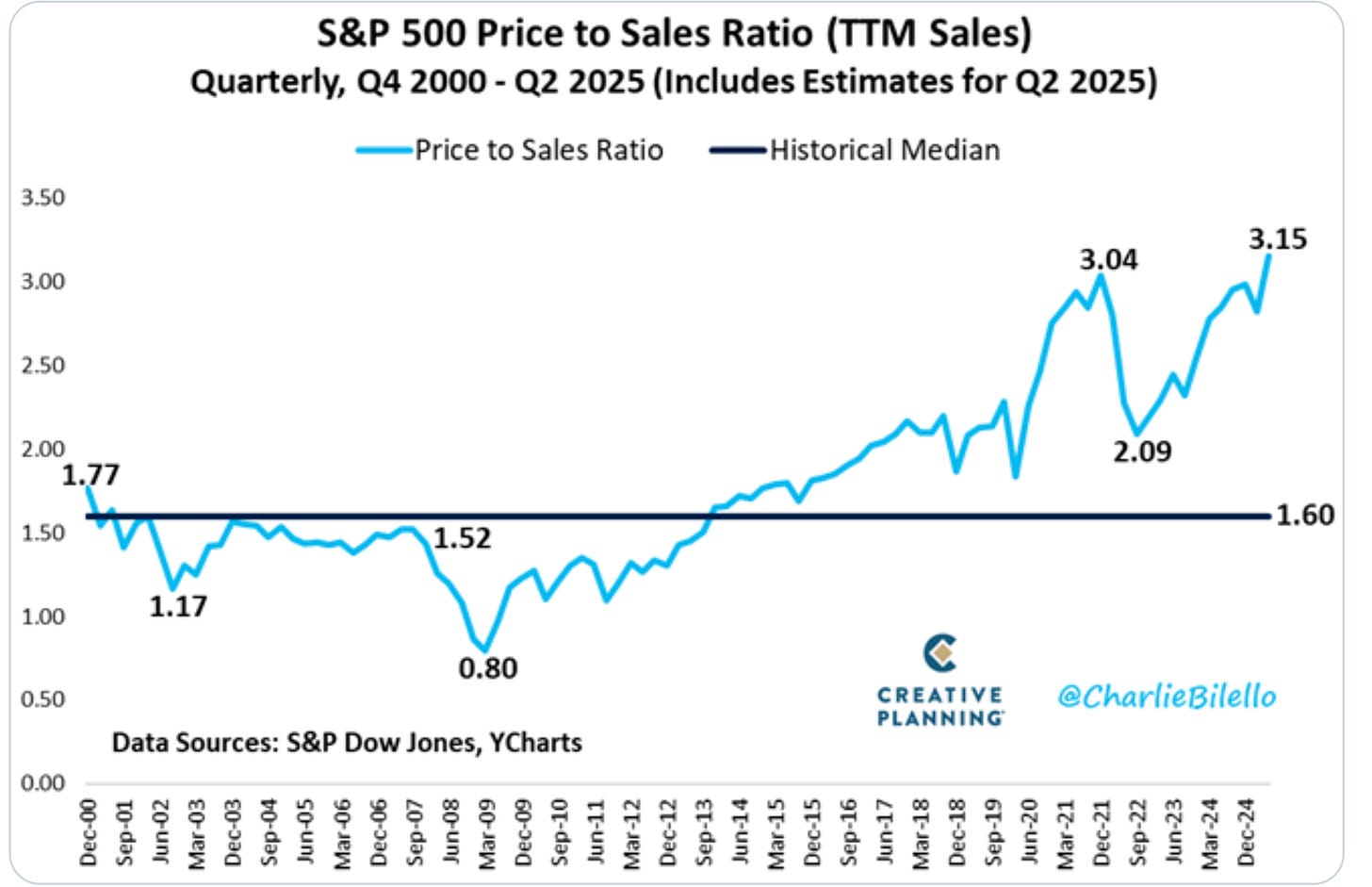

Price-to-Sales (S&P 500) is about 3.31–3.35—roughly double its long-term mean and near the highs set this year. When you’re paying over three dollars for one dollar of sales, everything has to go right. (Multpl)

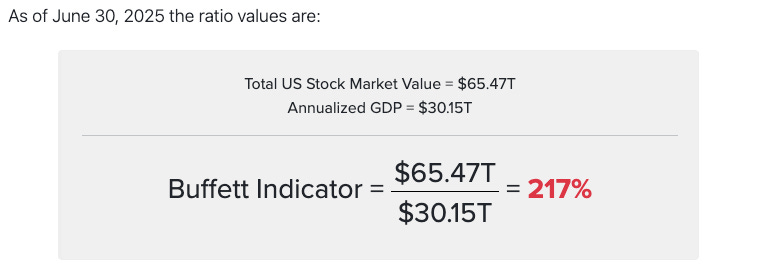

The Buffett Indicator (total U.S. market cap divided by GDP) is hovering near 215%–217%. That is historically extreme and well above levels tied to strong future returns. (Current Market Valuation)

High valuations don’t tell you what happens tomorrow. They tell you what tends to happen over the next 7–10 years.

From these levels, history says the average outcome is low real returns and higher crash risk…not because the economy fails, but because the starting price is so rich.

High valuations don’t guarantee an immediate collapse…but they quietly load the dice against you.

And if history is any guide, the real pain doesn’t show up in the headlines until years later, when investors realize their “long-term bet” has been nothing but dead money.

Which brings us to the uncomfortable truth Wall Street doesn’t advertise…

“Stocks Always Go Up”… In Nominal Dollars

Yes, the S&P 500 has been a winner over long stretches. But the path matters.

If you bought at very high valuations, you often spent a decade or more treading water after inflation:

1968–early 1980s: long, choppy stretch of weak real returns during an inflationary era. (Macrotrends)

2000–2013: the market took over a decade to make a durable inflation-adjusted comeback from the dot-com peak. (Wall Street Journal)

Lesson: your long-term result depends heavily on your entry price. Buying when markets are already priced for perfection turns “stocks for the long run” into “dead money for a long time.”

Sure, stocks rise in nominal terms over time. But when inflation and entry price are factored in, decades of waiting can still leave you behind.

And this isn’t just academic…recent history shows exactly what happens when investors buy into the dream at the wrong moment.

Concentration + Narrative = Fragility

Two forces pump today’s prices:

Narrative — AI will transform everything. Maybe! But paying 30–40x earnings across broad indices assumes a perfect runway.

Concentration — A handful of mega-caps drive index returns. That juiced the upside on the way up…but it also concentrates the downside if sentiment cracks.

Meanwhile, the U.S. now makes up about half of global market cap (~$62T of ~$127T). That’s great when money herds in.

If leadership rotates abroad…as it often does in new cycles…this concentration becomes a headwind for U.S.-only portfolios. (Visual Capitalist)

Narratives are intoxicating, and concentration feels like strength…until it suddenly flips to fragility.

When the crowd is all leaning on the same side of the boat, it doesn’t take much for balance to snap.

And right now, the odds look eerily similar to another game where the house usually wins…

The “19” Analogy: Why Odds Matter

In blackjack, taking another card on 19 is possible…but unwise. With today’s valuations, the S&P 500 is that 19. Could we run higher? Sure. But the expected payoff is poor, and the penalty for being wrong is big.

This doesn’t mean “sell everything.” It means don’t bet the farm on a stretched hand. Shift the game to places where the risk is capped and the upside can surprise.

Just like blackjack, the market rewards patience…until overconfidence convinces you to press your luck.

And that’s the danger today: not that markets can’t go higher, but that the payoff for holding everything in one stretched bet pales compared to the opportunities quietly emerging elsewhere.

Where Asymmetry Lives Right Now

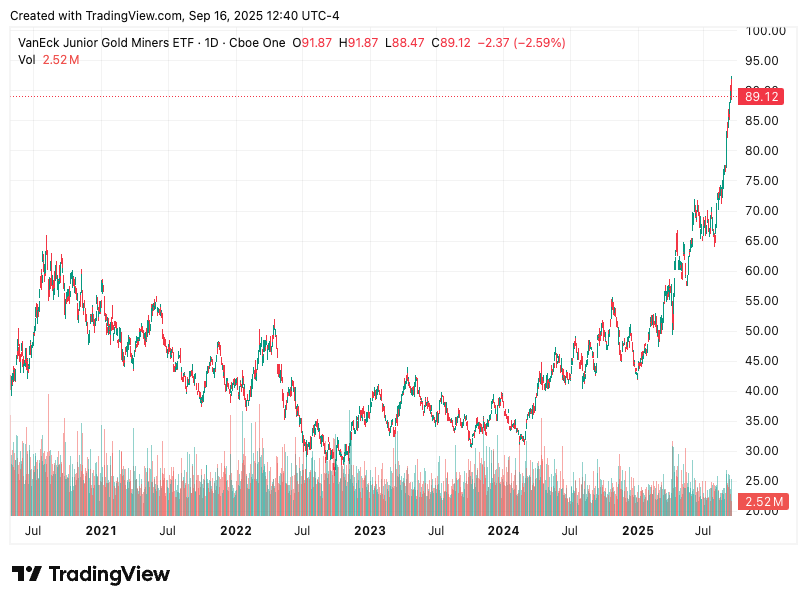

1) Gold & Junior Miners (GDXJ)

Gold is near all-time highs. Spot prices have pushed into the $3,650–$3,690 range, setting fresh records in recent sessions as yields and the dollar eased and markets priced more Fed cuts. (Reuters)

Junior miners…historically a leveraged way to express a gold view…are reflecting that strength. GDXJ shows a ~110%+ YTD total return as of mid-September, with fund sponsors and major data sites reporting similar figures. Volatile? Extremely. But that’s what leverage looks like when the underlying breaks out. (ETF & Mutual Fund Manager | VanEck)

Why it can work: even if inflation cools, gold often rallies on policy, confidence, and currency factors. If the Fed eases into a softening economy, gold can stay bid while miners keep playing catch-up.

Risk: miners are boom/bust. Size the position so a 30–40% drawdown doesn’t force you out.

2) Uranium (URA ETF)

Nuclear is back in favor, fuel supply is tight, and build-out talk keeps growing. URA shows a ~57% YTD return, signaling a secular theme with momentum—and one that isn’t tightly correlated to U.S. mega-cap tech. (Yahoo Finance)

Why it can work: policy tailwinds, supply constraints, and multi-year demand plans from countries hungry for base-load power.

Risk: cyclical commodity equity volatility and project execution risk. Tread with a plan.

3) Selective International Equities (Greece as a case study)

Rotation is a thing. The Athens Stock Exchange General Index is up roughly 40% YTD and ~50% over 12 months, powered by reforms, tourism, and earnings momentum. This is what leadership shift looks like outside U.S. mega-caps. (Bloomberg.com)

No, that doesn’t mean buy anything foreign. It means screen for improving policy + improving profits where valuations haven’t gone to the moon.

Each of these plays…gold, uranium, international equities…stands on different drivers than U.S. mega-cap tech.

But the real question is whether they need a crash to outperform, or whether they can quietly keep winning even if the S&P drifts sideways.

History suggests the answer might surprise you.

Why These Don’t Need a U.S. Crash to Work

If growth slows and the Fed eases, real yields tend to soften. That’s supportive for gold (and often miners). (Reuters)

If energy policy and geopolitics keep tightening uranium fundamentals, URA can work on supply/demand, not U.S. tech valuations. (Yahoo Finance)

If global leadership rotates, international markets with better starting valuations and improving macro can outrun the S&P…even if the S&P just meanders. (Bloomberg.com)

In each case, you aren’t relying on multiple expansion from already-stretched U.S. benchmarks. You’re relying on different drivers.

If the Fed blinks, if energy geopolitics tighten, if leadership rotates abroad…the outcomes compound in ways few portfolios are currently positioned for.

Which leads us back to the math that never lies: what happens when bubbles finally run out of room?

What History Actually Says About Bubbles

Bubbles don’t pop because the crowd stops believing. They pop when the math catches up…when earnings growth can’t justify the price, or when the cost of capital stops falling, or when liquidity tightens just enough.

From today’s starting point:

CAPE near high-30s has historically led to muted 10-year real returns for broad U.S. indices. (YCharts)

Price-to-sales > 3 leaves little cushion if margins mean-revert. Sales can grow and you can still lose if margins normalize and multiples compress. (GuruFocus)

A Buffett Indicator > 200% has rarely been the launchpad for strong real returns. It’s been the opposite. (Current Market Valuation)

None of this guarantees a crash. It does shift the odds.

Every bubble eventually finds its pin, but the script rarely plays out the way investors expect.

Sometimes the unraveling is slow bleed, sometimes it’s violent.

Either way, risk piles up long before the final pop. That’s why the smartest investors shift their mindset long before the crowd does.

Risk Management the Legends Would Respect

If we channel the “Market Wizards” mindset…risk first, return second…here’s a practical playbook:

Trim Concentration

If one or two mega-caps dominate your portfolio because of passive flows, rebalance. It’s okay to take a little career risk (or social-media risk) to cut portfolio risk.Barbell the Book

Own some duration (long Treasuries) as a hedge and own real-asset beta (gold/miners, uranium) for policy/credibility risk. You’re covering more macro paths.Add Uncorrelated Return Streams

Selective international exposure can give you different cycles, currencies, and policy mixes. Don’t buy “ex-U.S.” as a blob…curate it.Define Loss in Dollars, Not Feelings

Volatility isn’t risk. Permanent capital loss is risk. Set stops or “max loss” budgets before you press buy…especially in juniors and commodities.Stagger Entries

Big winners have big pullbacks. Use tiers (1/3-1/3-1/3) or time-based entries to avoid being the last buyer before a routine -20%.

Risk management isn’t about paranoia…it’s about survival. And survival is what sets the legends apart.

They cut risk when the odds stink and hunt asymmetry when others are still glued to the same trade. Which is exactly why their playbooks look so different from today’s consensus.

Answering the Pushback (Fair Questions)

“What if AI growth keeps surprising?”

Could. If earnings compound far faster than history, valuations can stay high. But you don’t need to ban U.S. tech to respect position sizing and diversification.

“What if gold’s only up because of ‘fear’?”

Exactly. Gold isn’t just an inflation hedge; it’s a confidence hedge. At new highs around $3,650–$3,690, the market is telling you something about policy credibility and real rates. (Reuters)

“Isn’t uranium already up a lot?”

Yes. Leaders lead. Momentum with improving fundamentals can keep working…until it doesn’t. That’s why sizing and rules matter. (Yahoo Finance)

“Why international now?”

Because leadership rotates. Greece’s tape is a live example of how valuation + reform + earnings can outrun crowded trades. (Bloomberg.com)

These objections aren’t wrong…they’re just incomplete.

AI might keep running, gold might stall, uranium might wobble, and foreign markets might stumble. But the point isn’t certainty…it’s probability. And when you line up the math, the probabilities today tell a story the mainstream refuses to admit.

The Simple Core Idea

You don’t have to predict the exact top. You just have to play the odds.

U.S. broad-market valuations are near historic extremes (CAPE high-30s; P/S ~3.3; Buffett Indicator ~215%). (YCharts)

History links those starting points to weak real returns over the next decade. (Wall Street Journal)

Meanwhile, other assets and markets are working now…gold at/near records, GDXJ triple-digit YTD, URA strong, Greece surging. (Reuters)

That’s not a call to panic. It’s a call to adjust.

When the math says your edge is gone, the game isn’t to argue…it’s to change tables.

The next move isn’t forecasting; it’s positioning. So how do the hitters who survive ugly innings actually line up their bats?

How Investment Legends Might Play This

Stan Druckenmiller would likely dial risk where the odds stink (overcrowded mega-caps) and rotate toward asymmetric macro themes (duration on growth scares; selective real assets).

Paul Tudor Jones might keep a core inflation hedge (gold), trade the rate path, and express the view with options to cap downside.

Ed Seykota–style trend followers would simply ride what’s working (gold/miners, uranium, certain international indices) and cut what breaks trend…no ego, just rules.

Different playbooks, same principle: respect the tape, respect the math.

Different styles, same rule: when odds shift, exposure shifts faster than the narrative.

That leaves one question you can’t outsource…what do you do before the bell? Let’s make the call and close the loop.

Bottom Line

Buying the S&P 500 today is like hitting on a 19. Could it work? Maybe. But the expected payoff is poor, and the risk of a sharp give-back is high.

You don’t need to call the top to be smart here. Trim concentration. Barbell with assets that win if policy shifts or growth slows. Hunt asymmetry where the crowd isn’t already all-in.

The goal isn’t to be right tomorrow. It’s to stack the odds in your favor for the next 3–5 years.

If you’re still pressing a crowded hand, that’s not conviction…it’s complacency.

Rebalance the concentration, barbell for policy risk, and hunt asymmetry where the crowd isn’t.