AI Mania: The Party Before the Fall

Paul Tudor Jones just rang the bell. Everyone’s still dancing. Who hears it first...the pros or the bagholders?

Written by Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | October 7, 2025

Paul Tudor Jones just dropped a grenade on financial Twitter.

In a CNBC interview this week, the legendary trader said we’re headed for a “blow-off top” in markets…and most people heard that as a bullish sign.

But if you understand what a blow-off top really means, you know it’s a warning.

Loud. Clear. And about to be ignored by 99% of investors chasing tech, AI, and whatever other acronym can justify another melt-up in the S&P 500.

Jones didn’t say we’re in a sustainable bull market. He didn’t say to ride this thing for five years.

What he said, in essence, was: “This is going vertical. Play it if you must. But know when to jump.”

Here’s the real story behind the hysteria, why this AI mania smells exactly like the dot-com bubble, and how Ferraris, pets.com, and Paul Tudor Jones are telling you the same thing: this will not end well.

Everyone’s celebrating the rocket, but rockets don’t stop mid-air…they fall. The question isn’t whether this market flames out… it’s who gets torched first. Because when everyone’s on one side of the boat, history doesn’t whisper…it shouts.

Step Into the Time Machine: It’s 1999 Again

Let’s be clear: AI is real. It’s transformative. Just like the internet was.

But back in 1999, people weren’t wrong about the internet…they were just wrong about how quickly it would matter and what it was worth at the time.

Today, the bulls scream, “AI is the future!” And they’re right.

But here’s the problem: the economics still don’t work.

OpenAI is on track to lose billions a year.

Capex across the industry is exploding.

Everyone is “investing” because they think someone else will pay more later.

Sound familiar? That’s because it is. It’s 1999 all over again.

Back then it was dial-up, now it’s data centers. Same hype, different code. The danger isn’t that AI isn’t real…it’s that investors think reality always pays tomorrow’s bills. But just wait until liquidity tightens and this dream meets the cost of capital.

Paul Tudor Jones: Play the Game, Know the Risks

Jones isn’t just anyone. This is the guy who shorted the 1987 crash, made billions trading macro cycles, and built a reputation as one of the most tactical investors alive.

So when he says “blow-off top”, he doesn’t mean “we’re going higher forever.” He means:

“Ride the momentum, but know it’s all smoke and mirrors. Be ready to get out fast.”

For most retail investors, that’s impossible. They don’t have the tools, instincts, or risk controls to manage a melt-up. So they ride it up, then down…and get crushed.

Jones’ warning wasn’t for CNBC…it was for the few who can read between the lines.

The melt-up is a trap disguised as opportunity. The moment euphoria peaks, the exit door shrinks. The pros already see it. The question is…do you?

AI Economics: Selling Ferraris at a Loss

Here’s the analogy: imagine someone starts selling Ferraris for $20. Demand goes through the roof. Everyone wants one.

But eventually, you realize: they cost $200,000 to make.

That’s what’s happening with AI right now.

Companies like OpenAI are effectively giving away Ferraris (AI products) to build market share. They lose money on every unit but hope the demand explosion will eventually justify it.

Maybe it will. Maybe it won’t. But even in the rosiest scenario, the economics don’t justify the valuations today.

It’s easy to sell Ferraris for $20 when credit is free and investors don’t ask questions.

But every mania ends when someone finally does the math. And that’s when the stampede begins…not into profits, but out of the burning showroom.

Pets.com Had Jeff Bezos. AI Has Sam Altman.

Back in the dot-com bubble, one of the biggest flops was Pets.com. It became the poster child for absurd valuations and speculative excess.

But here’s the twist: Amazon invested in it. Jeff Bezos was a backer.

So no, not everyone involved was dumb. They were just caught up in a narrative that made sense on paper, but not in practice…at least not yet.

The bull arguments for Pets.com?

Massive total addressable market (TAM).

First-mover advantage.

Network effects.

Strategic partnerships (Amazon!).

Sound familiar?

Today’s AI bulls are using the exact same playbook.

The smartest people in every bubble look brilliant…until they don’t. The fact that Bezos backed Pets.com didn’t make it a winner…it made it a lesson. This time the cast has changed, but the plot is identical. And act two? It’s the crash montage.

The Illusion of Margin Expansion

Another fallacy: “Sure, AI is expensive now, but costs will drop, and profits will soar!”

Maybe. But lower costs don’t automatically mean higher profits—especially when the product becomes commoditized.

Once every company can provide decent AI tools, the price wars begin. Margins shrink. Winners emerge, but the rest go bust. And even the winners don’t always justify today’s sky-high valuations.

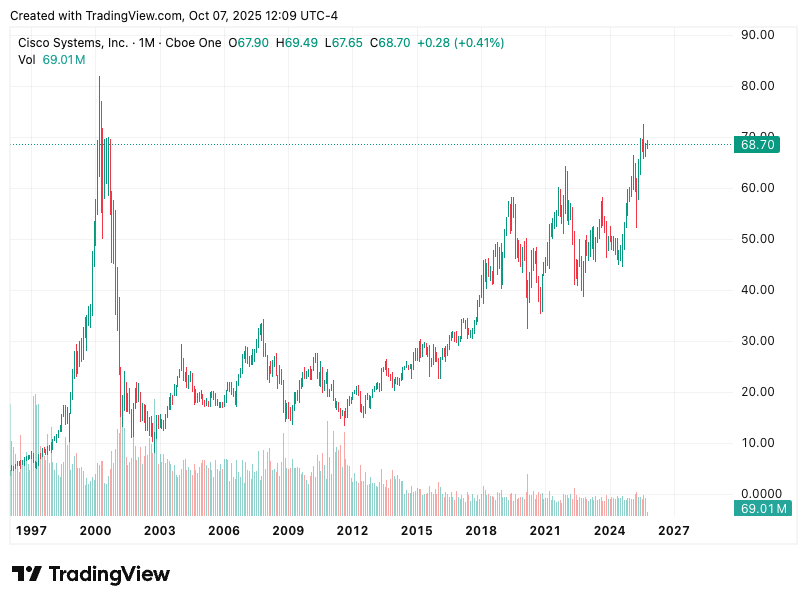

Remember Cisco? It was the infrastructure stock of the dot-com era. It soared to $80 in 1999… and crashed to $12. It still hasn’t come close to that all-time high, 25 years later.

Every bull market tells itself the same bedtime story: “Costs will fall, profits will rise.”

But the fairy tale always ends the same way…competition kills margins, and gravity returns. The moment the narrative shifts, the “future profits” vanish overnight.

AI as National Security? Sure. But That Doesn’t Help Shareholders.

Some argue that AI is a national security issue and will get government backing. Fine. But when has nationalization ever helped stockholders?

If Uncle Sam ends up buying stakes in AI companies to “protect the future,” they’ll do it at the bottom…not at the top.

You don’t want to be holding the bag when D.C. decides to “stabilize” the industry.

Government “support” is just another word for dilution. When politicians decide something’s too important to fail, shareholders get nationalized right along with it.

And that’s the moment “innovation” turns into bureaucratic capital destruction.

Hype vs. History: This Is Classic Bubble Behavior

There’s a fundamental difference between adoption and valuation.

AI can still become indispensable while the current crop of overvalued companies gets annihilated. That’s exactly what happened with the internet.

Amazon survived the dot-com crash…but it dropped 90% first.

Cisco survived…but it took decades to claw back.

Your average AI darling today? It’s priced as if it’s already 2035 and they’re minting cash hand over fist. That might happen eventually. But bubbles don’t care about “eventually.”

They pop when the story breaks, when the capital dries up, or when someone finally asks: “Does any of this make money?”

Every generation thinks their bubble is different. It never is. Technology changes, human nature doesn’t. And if you think this time’s special because it’s “AI,” just wait until the Fed tightens one turn too far and liquidity leaves the room.

Demand Doesn’t Equal Profits

One of the biggest mistakes people make: confusing demand with profitability.

Yes, demand for AI is exploding. Yes, every business wants a chatbot or an AI tool embedded in their workflow.

But unless these companies can charge enough to cover their massive fixed costs (data centers, chips, energy, water, cooling, etc.), it doesn’t matter.

They’ll burn through capital, raise more, rinse and repeat…until the capital runs out. Then the whole house of cards collapses.

There’s a fine line between growth and self-immolation. Demand is a vanity metric; profits are sanity. Once the funding tide goes out, only the companies with real economics will survive—and that list is much shorter than Wall Street thinks.

Ferraris for $200,001: The Commoditization Death Spiral

Even if you believe in long-term AI profitability, consider this:

When costs drop, so do prices. AI providers will undercut each other until they’re effectively utilities…low-margin, high-volume, price-capped businesses.

Sound familiar? That’s telecom.

Verizon and AT&T still exist. They still make money. But they trade at 6–8x earnings, not 100x revenue.

If OpenAI becomes the next Verizon, the stock isn’t going to the moon—it’s going to fair value.

Once the dust settles, AI won’t be a gold mine…it’ll be a utility.

Think less “tech miracle” and more “digital plumbing.” And when that realization hits the market, valuations won’t just correct…they’ll evaporate.

The Real Opportunity Is Later…After the Crash

Remember the Cisco example? Buying it at the peak was a disaster. But buying it after the crash…at a sane multiple…was a great trade.

That’s where the smart money waits. At the bottom. After the FOMO fades. When reality sets in.

Right now, retail is piling in. The media is cheerleading. Wall Street analysts are justifying the insanity with “discounted cash flows” based on numbers they can’t possibly know.

The smart move? Wait. Watch. Prepare.

Patience isn’t popular in manias…but it’s profitable. The best trades are born from ashes, not headlines. The next generational buying opportunity will come when everyone else has sworn off stocks for good. We’re not there yet… but it’s coming.

Learn from the Gals

One of the life’s best analogies that also works well for investing: “Women don’t care about your journey…they just pick the winners at the finish line. And always be careful when around the AOL guy.”

You should do the same. Let the hype run its course. Let the washout happen. Then step in and pick the winners…at a price that makes sense.

The women have it right…wait for the winner’s circle. Let the herd chase hype. The fortunes will be made by those watching from the sidelines, ready to strike when euphoria turns to despair. And that turn could happen faster than anyone expects.

This market’s moving at light speed, and Paul Tudor Jones just rang the bell that few are willing to hear. The question now is…what happens next?

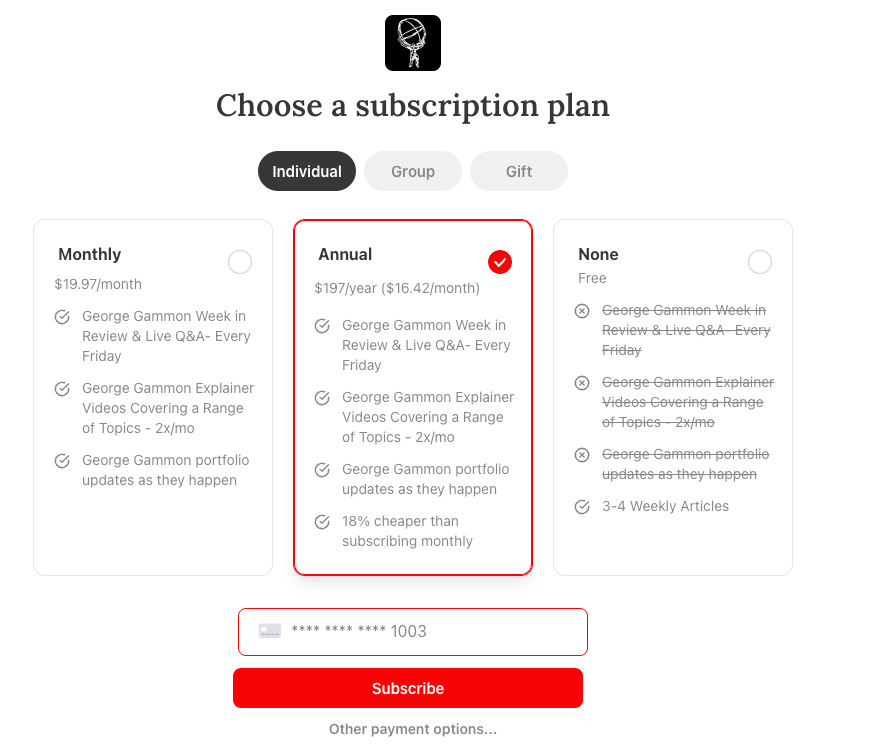

On Friday, George Gammon will break it all down live in the Rebel Capitalist Weekly Wrap-Up, connecting this blow-off top to the real economy, the Fed’s next move, and how to position yourself before the narrative flips.

👉 Upgrade to a paid Rebel Capitalist News Desk membership today and you’ll receive the hidden link and instructions (check welcome email) to join George live.

Drop your questions in the chat, challenge his thesis, and get real-time answers…straight from command central.

Thousands of contrarian investors are already in the room every Friday.

Don’t just watch the next crash—understand it before it happens.

Upgrade now to join this week’s live session with George Gammon →