The Fed Can’t “Run It Hot”

And the Bond Market Just Proved It

Written by Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | February 15, 2026

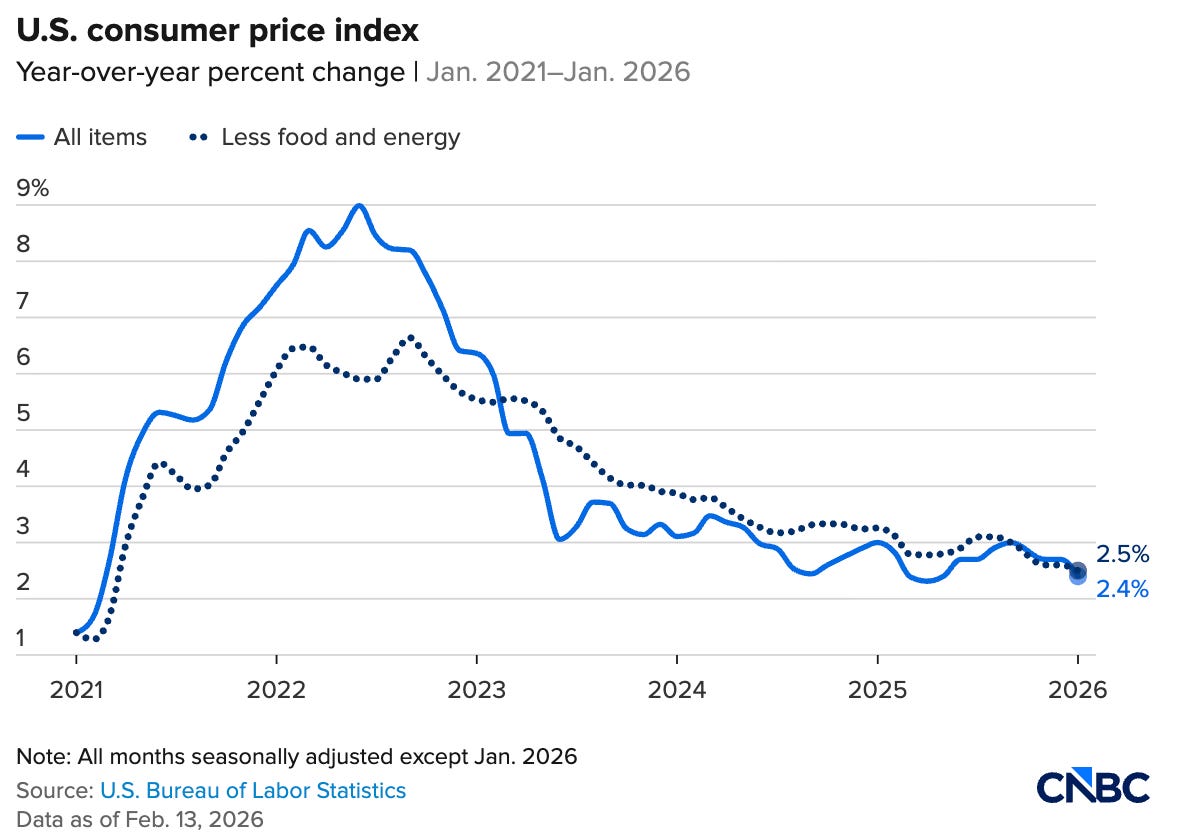

The latest CPI print just hit.

Headline inflation came in at 2.4% year-over-year, below expectations of 2.5%. Core CPI printed 2.5%.

Immediately, the financial media split into two camps:

Inflation is cooling…the Fed can relax.

A new Fed chair might “run the economy hot” and push inflation higher.

And once again, we’re hearing the same narrative:

The Fed will allow inflation to rise to 2.5%, maybe even 3.5%, in order to inflate away the debt.

It sounds logical.

It sounds intentional.

It sounds controlled.

There’s just one problem.

The Fed has never demonstrated the ability to hit its inflation target…not once consistently in the last 15 years.

The 15-Year Track Record Nobody Mentions

Let’s rewind.

Throughout the 2010s, the Fed desperately tried to raise inflation to 2%.

They failed.

Inflation consistently undershot their target.

Then came the pandemic response…fiscal stimulus, supply shocks, monetary expansion…and inflation exploded well above 2%.

Now inflation has fallen back toward the mid-2% range.

So let’s summarize:

From 2010–2020: Fed couldn’t get inflation up to 2%.

From 2021–2023: Fed couldn’t get inflation down to 2%.

From 2024–2026: Inflation still hovering above 2%.

For 15 years, the Fed has missed its target on both sides.

Yet we’re supposed to believe that if they simply change the target to 3%, they’ll suddenly be able to hit it with precision?

That assumption alone collapses most of the “run it hot” narrative.

The Debt-to-GDP Doom Loop Is Built on a Fantasy

The argument for running it hot usually goes like this:

Debt-to-GDP is too high.

If we don’t inflate it away, bond yields will explode.

If yields explode, interest expense spirals.

If interest expense spirals, the Treasury market collapses.

Then the Fed must print money.

Then the dollar crashes.

You’ve heard this story a thousand times.

But here’s the critical assumption underlying that entire chain reaction:

That once debt-to-GDP crosses some imaginary threshold…say 120% to 121%…bond markets will suddenly stop trading based on growth and inflation expectations and start trading purely on debt levels.

That would require a complete regime shift in how Treasuries have traded for the last 75+ years.

And there is no evidence that such a magical threshold exists.

Yields move primarily based on nominal growth expectations.

Always have.

Still do.

The Bond Market Just Exposed the Flaw

Let’s look at what just happened.

After a stronger-than-expected nonfarm payrolls headline, the 10-year Treasury yield spiked to roughly 4.20%.

Then investors dug into the report and noticed massive downward revisions.

Yields reversed.

Fast forward to today’s CPI print…which came in softer than expected…and yields dropped further.

The 10-year is now around 4.05%.

So ask yourself:

Did the deficit shrink?

Did debt-to-GDP fall?

Did sovereign wealth funds suddenly reverse course and start buying Treasuries?

Did foreign central banks stop “dumping”?

No.

None of that changed.

What changed were growth and inflation expectations.

That’s it.

And that single observation dismantles most of the runaway-yield narrative.

The Fed Does Not Control the Labor Market

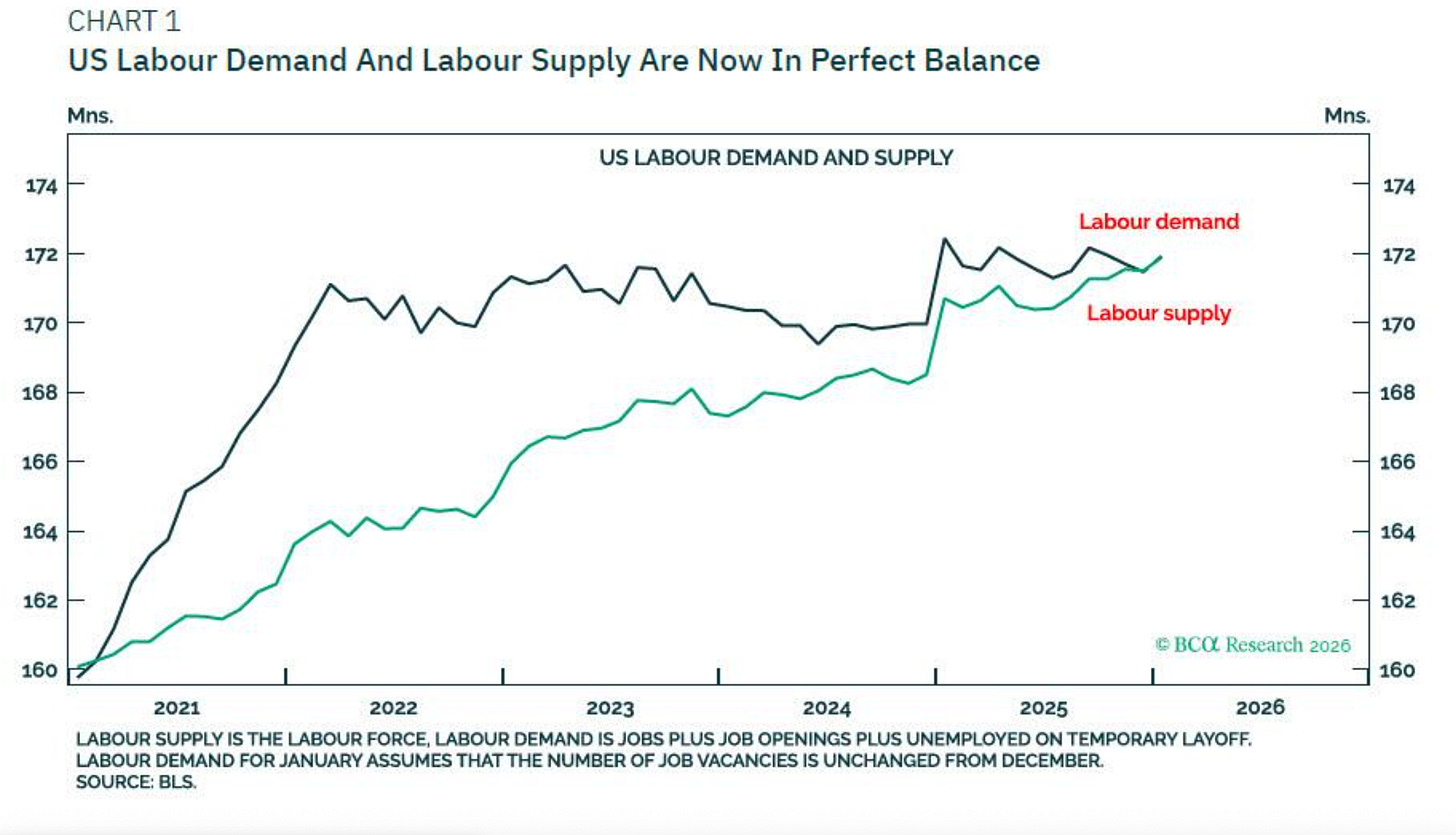

Another assumption embedded in the “run it hot” thesis is that the Fed controls labor demand.

The argument goes like this:

Lower rates → More borrowing → More hiring → Higher wages → Higher inflation.

Simple.

Except reality doesn’t cooperate.

Since late 2024, the Fed has cut rates aggressively…roughly 150 basis points in total.

What has the labor market done?

It’s weakened.

Nonfarm payroll trends have deteriorated.

Revisions have been negative.

Labor demand has flattened while labor supply continues to rise.

If rate cuts automatically created labor tightness, we wouldn’t be seeing this divergence.

Interest rates don’t command the economy.

They reflect it.

The Labor Supply Chart Should Make You Nervous

Labor demand and labor supply are converging.

For years, demand far exceeded supply…creating wage pressure.

Now demand has flattened.

Supply, meanwhile, continues trending higher.

If supply keeps rising while demand stagnates, what do you get?

Disinflationary pressure.

Not inflation.

That’s a completely different dynamic than the “run it hot” crowd assumes.

The Yen Just Destroyed the Interest Rate Differential Argument

We also keep hearing that if the Fed cuts rates while other central banks raise rates, the dollar will collapse.

But look at Japan.

The Bank of Japan has been tightening while the Fed has been cutting.

If interest rate differentials were the dominant force, the yen should have skyrocketed relative to the dollar.

It didn’t.

It remained largely flat, with occasional intervention from Japanese authorities to prevent excessive weakness.

Interest rate differentials matter sometimes.

But they are not laws of physics.

They are conditional relationships.

And building macro forecasts on conditional relationships treated as certainties is dangerous.

Inflation Is Range-Bound…Unless Something Breaks

Here’s the base case.

Inflation has been trending disinflationary since the 2022 peak.

We’ve floated between roughly 2.3% and 3.3%.

Unless something fundamental changes, that range likely persists.

What could change it?

Scenario 1: Recession

If the economy contracts…especially under an official NBER recession…inflation likely falls below 2%.

Not because the Fed “wants” it to.

Because income and demand contract.

Scenario 2: Fiscal Shock with Velocity

If we get aggressive fiscal stimulus…direct transfers, UBI, large-scale checks…that boost velocity, inflation could exceed 3.5%.

Notice what both scenarios have in common:

They are fiscal and economic events.

Not monetary micromanagement.

The Real Debate Isn’t Inflation…It’s Nominal GDP

Treasury yields, inflation trends, currency strength…they all revolve around nominal GDP.

If nominal GDP accelerates meaningfully, yields rise.

If nominal GDP slows, yields fall.

Debt levels matter less than growth trajectories.

That’s why yields fell after weaker CPI.

That’s why yields fell after negative revisions.

That’s why debt and deficits didn’t prevent rates from dropping 14 basis points in a week.

Growth expectations shifted.

Everything else followed.

The Fed Is Not a Thermostat

The “run it hot” narrative treats the Fed like a thermostat.

Too cold? Turn up the dial.

Too hot? Turn it down.

But the last 15 years prove otherwise.

The Fed couldn’t create 2% inflation when it wanted to.

It couldn’t stop 9% inflation when it needed to.

It cannot fine-tune CPI to 3% simply by announcing a new target.

Inflation is an emergent property of fiscal policy, credit creation, labor dynamics, and velocity.

Not a dial in the Eccles Building.

The Bond Market Doesn’t Believe the Story

The CPI came in at 2.4%.

Core is 2.5%.

The 10-year yield is 4.06%.

Labor demand is flattening.

Labor supply is rising.

Rate cuts haven’t revived employment.

And yet we’re told the Fed is about to “run it hot.”

If that were credible, yields would be screaming higher.

They aren’t.

The bond market is not buying the inflation scare.

And until nominal growth meaningfully accelerates, it probably won’t.

Prepare accordingly.

Great article! Finally my 10-20 yr bonds are rallying. It takes so long to wait for markets to notice we're heading for deflation after a period of inflation. Similar to 2008 but hopefully AI construction softens the blow for us this time. I'd love a soft landing and gentle downward move in the whole yield curve by 1 percent. 2% for the two year and 3% for the 10 year sounds ideal to me.