The Fed Should Be Cutting Now, Not Later

The Fed paused…but the bond market didn’t. What does it see that Powell won’t say out loud?

Rebel Capitalist AI - Supervision and Topic Selection by George Gammon

This week, the Federal Reserve did what many expected: it left interest rates unchanged.

But while that inaction might seem benign on the surface, the real story is in the data, the market reaction, and the mounting case that the Fed is falling behind its own framework.

Inflation is not re-accelerating. The economy is softening. And history shows that in these conditions, rate cuts…not pauses…are the typical play.

So why is the Fed hesitating?

Let’s break it down.

The Fed’s Framework Is Being Ignored

According to the Fed’s own metrics, inflation is trending lower.

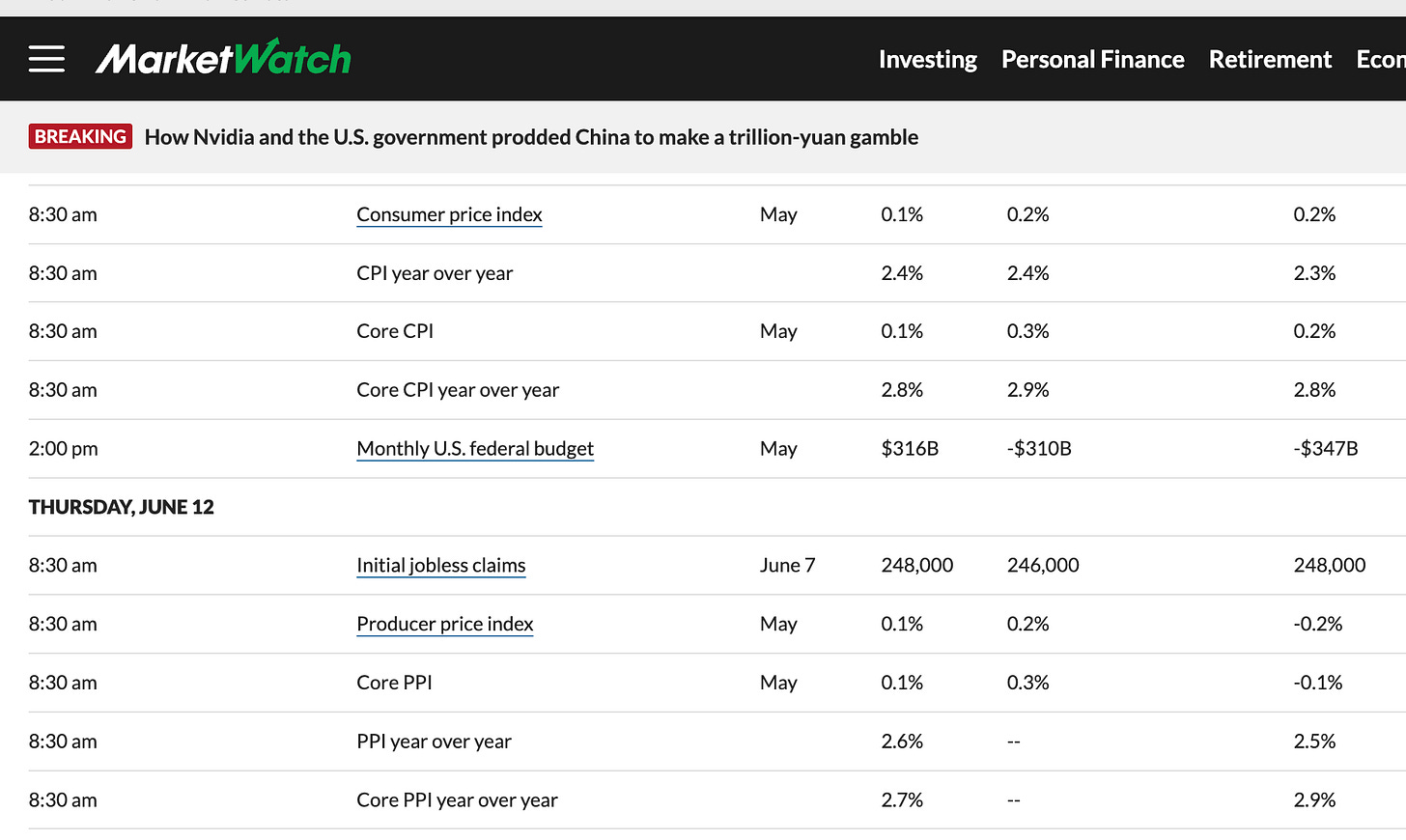

The latest CPI print came in below expectations. Core CPI, month-over-month, was 0.1%. Year-over-year, it was 2.8%. Headline CPI is at 2.4%.

If the Fed's target is 2%, then yes, we are slightly above it. But the trend is downward.

From the Fed's perspective, these are not figures that scream emergency. They're figures that should prompt a discussion about easing.

And yet, the Fed's official stance is to pause. It predicts two rate cuts by year-end.

Why two and not now? And if the Fed’s own data argues for easing, and it’s choosing inaction instead…what signal is it really sending?

The answer might lie not in the numbers…but in the politics behind the pause.

The Labor Market Signals a Slowdown

Jerome Powell cited a "strong and resilient" labor market.

But if you look deeper, the picture changes.

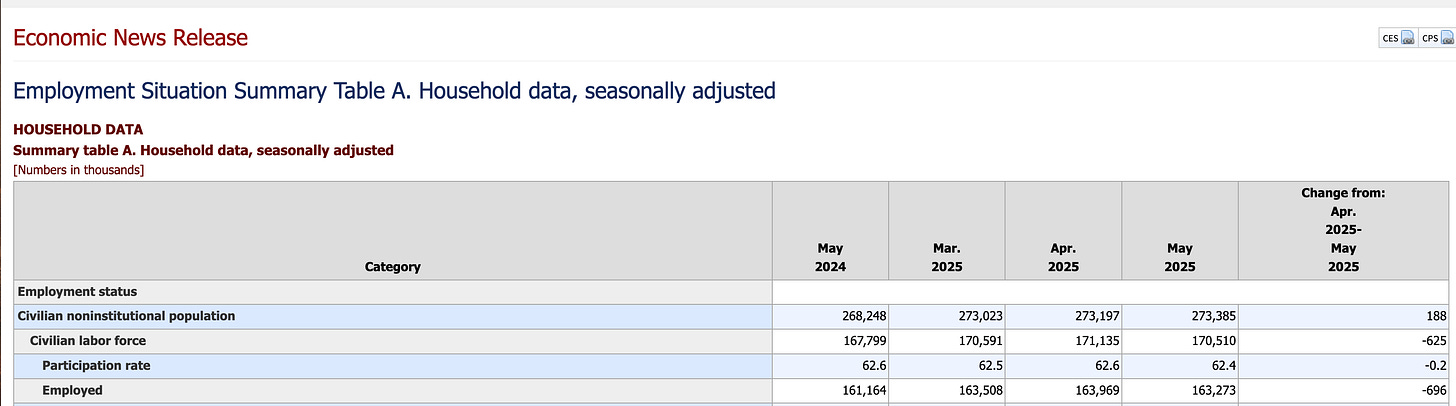

The recent household survey showed a net loss of nearly 700,000 jobs. The labor force also shrank by over 600,000.

Yes, the unemployment rate is at 4.2%, but that's a misleading metric when fewer people are even looking for work. If labor force participation were normalized, the real unemployment rate would be much closer to 5%.

The market and the Fed should focus on the job losses and shrinking participation…not just the headline unemployment number.

So if the real unemployment picture is worse than the headlines suggest, what else is being masked by selective data interpretation? Investors would be wise to look where the Fed refuses to.

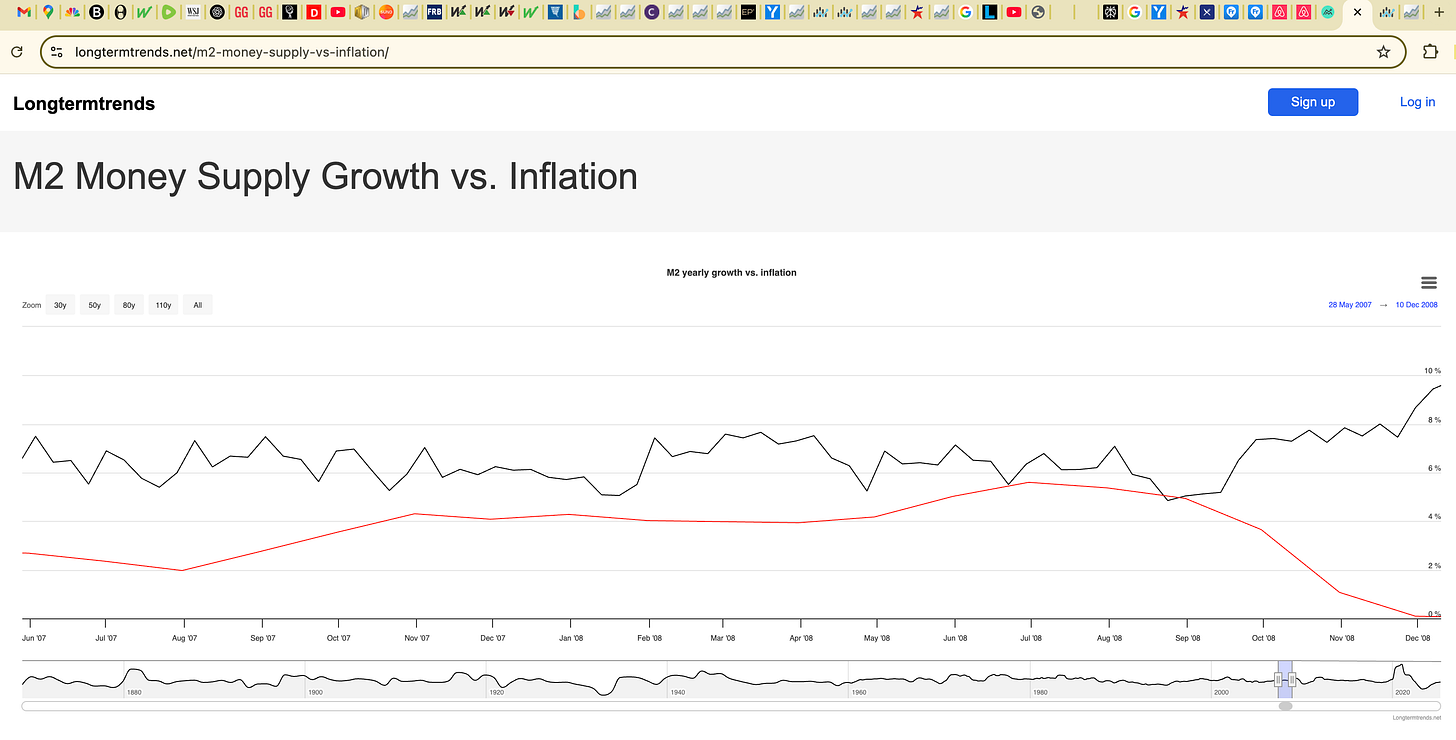

Money Supply Is Contracting

M2 money supply, after surging in 2020-2022, is now lower than it was in 2022. This is key. Historically, a declining money supply precedes lower inflation, not higher.

Combine that with a weak labor market and softening economic data, and it becomes clear: demand is weakening.

We're already seeing signs of this in sectors like restaurants and airlines, which are experiencing drops in consumer activity.

When money supply contracts and consumption slows, something has to give. And historically, that something is usually asset prices…or Fed policy. Which cracks first?

Oil Prices and Tariffs: The False Inflation Panic

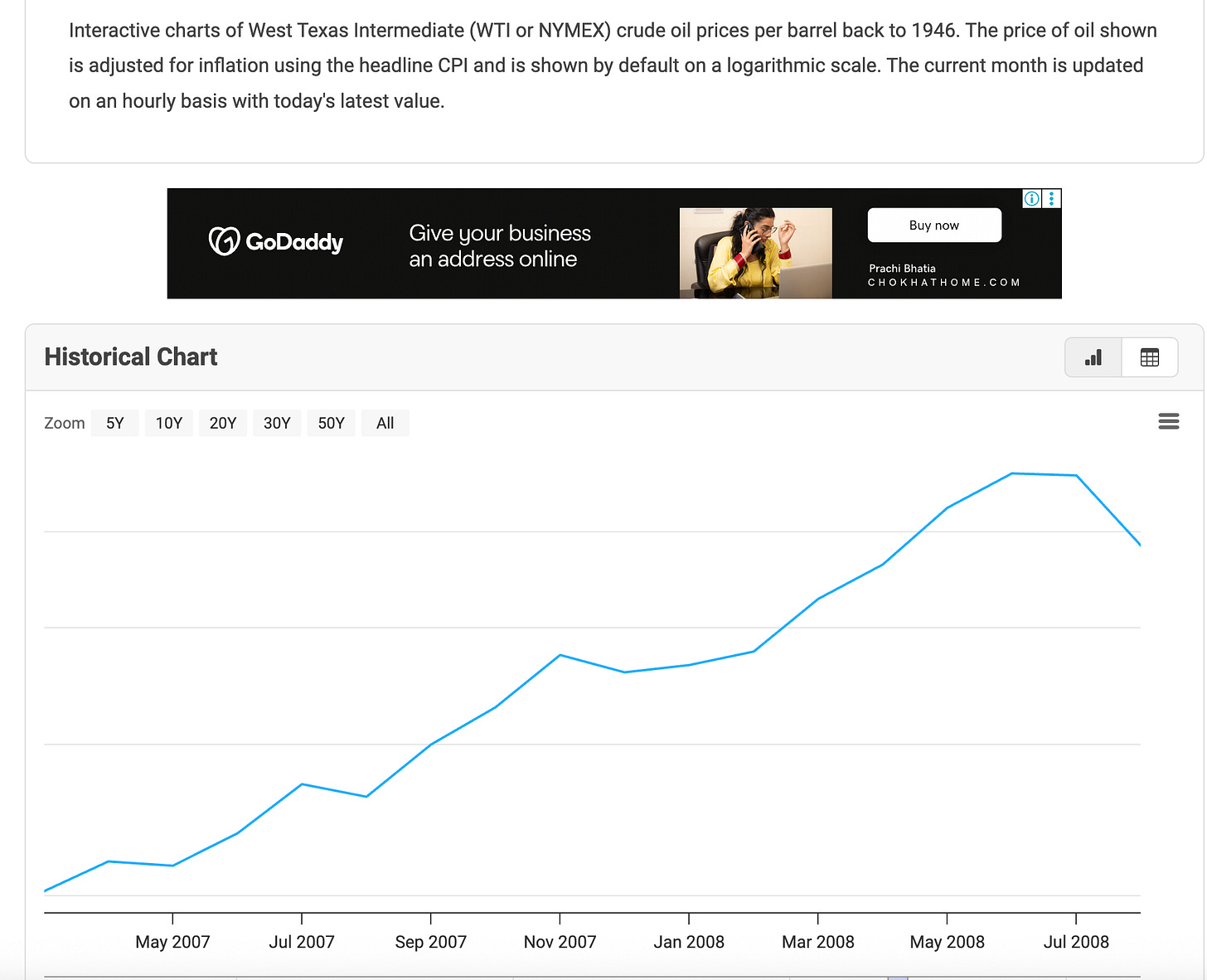

Yes, oil prices have ticked up, and new tariffs are being implemented. But these are price adjustments, not signs of a broad re-acceleration in inflation.

Remember 2008? Oil spiked to $133 per barrel, but that didn’t trigger sustained inflation.

Instead, it was a catalyst for disinflation as the economy weakened. High prices in a weak economy kill demand…they don’t fuel inflation.

The same applies now.

If oil goes from $65 to $75 in a slowing economy, it's not a reason to panic about inflation. It's a reason to expect demand destruction and, eventually, disinflation.

If rising oil prices in a weak economy are more of a warning than a threat, why is the Fed acting like the opposite is true?

It raises a deeper question…what are they really afraid of?

Historical Perspective: The Fed Is Always Late

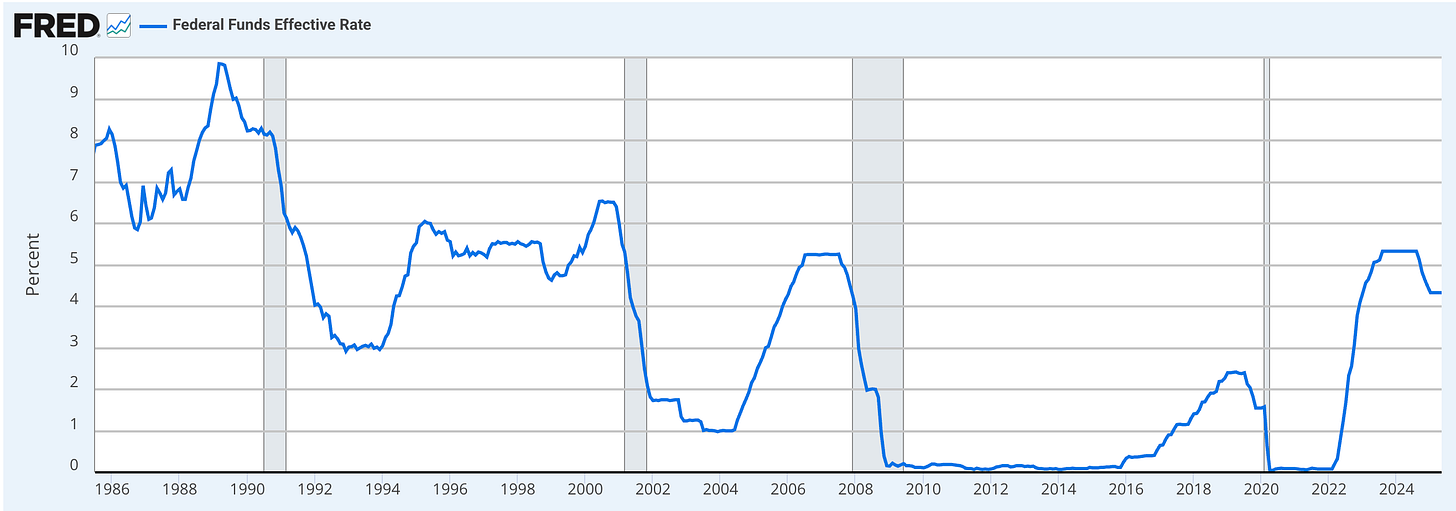

Since Greenspan, the Fed has never been too early with rate cuts. It's always behind the curve. The two-year Treasury yield consistently leads Fed policy.

Today, it’s signaling that rates are too high given the underlying economic fundamentals.

When the Fed cuts late, it often does so in response to a recession or financial crisis. The bond market knows this. And it's why most of the yield curve is still inverted.

If history tells us the Fed always lags the bond market, why should this time be any different? The answer might already be written in the yield curve’s inversion…if you know where to look.

The Bond Market Reaction

When the Fed paused this week, the bond market reacted sharply. Initially, yields dropped.

Then, as Powell spoke, they rebounded. But the two-year and ten-year both remain below recent highs, indicating expectations for lower growth and inflation ahead.

This isn’t just about the Fed funds rate staying static.

It’s about market participants realizing that financial conditions are tight and getting tighter…even as nominal rates hold steady.

Most parts of the curve, especially the front end, are signaling falling growth and inflation expectations.

If the bond market is quietly pricing in a downturn the Fed won’t admit, are investors sleepwalking into the next policy mistake?

The next move may not come from the Fed…but from market forces forcing their hand.

A Note on the Dot Plot

The Fed’s dot plot shows two cuts by year-end. But if it’s genuinely concerned about stagflation, as Powell claimed, why would it cut at all? Why not hold firm?

The inconsistency suggests the Fed itself doesn’t fully believe in the stagflation narrative. It's hedging. And the market is calling that bluff.

What Smart Investors Should Be Watching

M2 and CPI Trends: Watch money supply and headline CPI. Both are disinflationary.

Labor Market Internals: Go beyond the unemployment rate. Focus on job losses and participation.

Bond Market Signals: The two-year yield is your canary in the coal mine.

Oil and Tariffs: These are taxes on the consumer. In a weak economy, they suppress demand.

If the bond market is quietly pricing in a downturn the Fed won’t admit, are investors sleepwalking into the next policy mistake? The next move may not come from the Fed…but from market forces forcing their hand.

Cut Now or Regret Later

The Fed says it's worried about inflation. But its own data doesn't support that fear. CPI is under control. Economic growth is softening. M2 is shrinking. The labor market is deteriorating beneath the surface.

In 2008, the Fed cut rates even as oil spiked. Why? Because the broader economy was faltering. The result? Inflation fell from over 5% to zero.

Today looks similar. The Fed shouldn’t wait for a crisis. It should follow its own framework…and cut rates now.

🔴 This Friday, George Gammon is hosting his first live Q&A exclusively for paid subscribers.

It’s your chance to ask questions, get real-time macro insight, and hear George’s unfiltered take on what’s really happening behind the headlines.

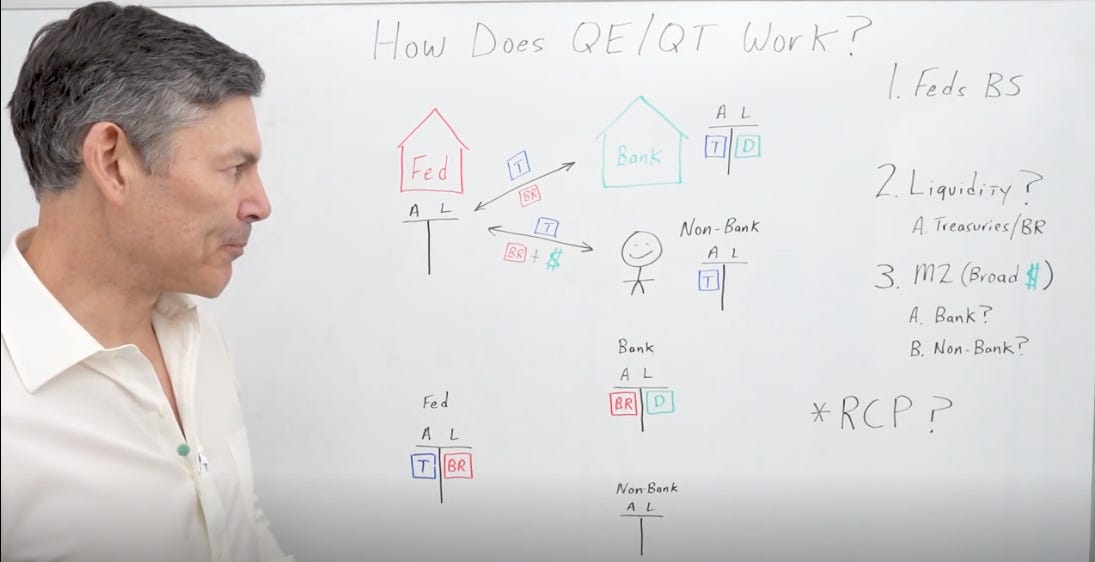

Plus, he’s released a subscriber-only explainer video on how Quantitative Easing actually works…not the textbook version, but the real mechanics they never teach you in school. This part of an ongoing education series for paid subscribers.

If you want to understand how money is really created, and how it’s quietly reshaping the world around you, this video is essential.

Join the thousands of liberty-minded investors who already trust the Rebel Capitalist News Desk for macro insight you won’t find anywhere else.

Upgrade to paid now and get immediate access to all upcoming Q&As, George’s private education library, and everything else we don’t publish publicly.