The Fed's Zero Interest Rate Warning

What It Means for the Future of the U.S. Economy

Written by Rebel Capitalist AI | Supervision and Topic Selection by George Gammon

July 9, 2025

Just when the market thought it understood the trajectory of monetary policy, the Federal Reserve dropped a bombshell: a new research post on the New York Fed's Liberty Street Economics blog openly admitted that zero interest rates are not just a thing of the past, but a very real risk in the medium term.

This post isn’t coming from some obscure academic. It’s co-authored by John Williams, President of the New York Fed and one of the most influential voices inside the FOMC. And what they're suggesting is stunning.

The Zero Lower Bound (ZLB) Is Back on the Table

The post, titled "The Zero Lower Bound Remains a Medium-Term Risk," argues that while interest rates today may be relatively high, there's a significant chance the Fed will be forced to return to near-zero policy in the foreseeable future.

From the article:

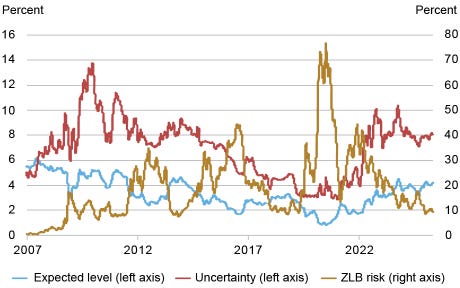

The expected level of interest rates has changed over time, tracking movements in the federal funds rate. It declined steadily from about 6 percent in 2007 to around 1 percent after the onset of the COVID-19 pandemic.

Since then, it has gradually increased, hovering around 3–4 percent since 2023. Uncertainty has also fluctuated, typically rising during periods of economic stress or major shifts in monetary policy.

Uncertainty spiked following the Great Recession and the COVID-19 pandemic and has remained elevated since.

The expected level of interest rates and uncertainty surrounding it tend to comove positively, as seen in the above chart, with a correlation of 0.64.

Theoretically, this comovement has ambiguous implications for ZLB risk: While a higher expected interest rate level decreases the probability of reaching the ZLB, a higher uncertainty increases it.

Empirically, shifts in the expected level of interest rates appear to be the primary driver of changes in ZLB risk.

Currently, seven-year-ahead ZLB risk is comparable to that observed in 2018, even though the expected interest rate level is higher. This reflects that uncertainty is higher today than it was in 2018.

The authors back this up using interest rate derivatives, particularly interest rate swaps, which currently reflect a growing expectation of rate cuts.

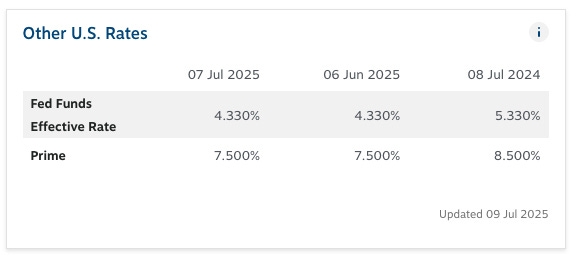

It’s worth pausing to reflect on this: the very people who set policy at the highest level are now admitting that they are preparing for a future where rates go back to zero…despite the Fed funds rate still sitting around 5.25% not long ago.

If the policymakers themselves are quietly laying the groundwork for zero rates…while the public still believes in higher-for-longer…what other assumptions might be dangerously outdated?

The Market Is Screaming: Rates Are Going Lower

What tipped off the Fed? Interest rate swaps. These instruments, used to hedge or speculate on future interest rates, have shown some unusual behavior.

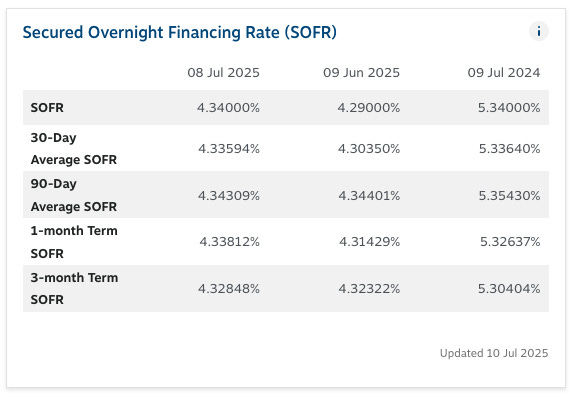

Specifically, the 10-year SOFR swap rate has been trading significantly below the equivalent Treasury yield…a discrepancy that suggests traders expect policy rates to be much lower in the years ahead.

For example, when the 10-year Treasury yield is at 4.38% but the swap rate trades down at 3.83%, that’s not just noise.

That’s the market telling you something.

It's implying that over a 10-year horizon, interest rates could fall substantially, possibly to zero again.

But this isn’t just a technical anomaly…it’s a window into how the most sophisticated players are front-running the next phase of Fed policy. And they’re not waiting for Powell to confirm it…

Trump Calls for Emergency Rate Cuts

As if the Fed's own research wasn't enough of a headline, Donald Trump has taken to social media to demand a 300 basis point rate cut…immediately. That's a 3% drop, which would bring the Fed funds rate down to 1.25%.

While some may dismiss this as political theater, it underscores the pressure the Fed could face in the run-up to the 2026 election.

And if Trump wins, he’s already promised to appoint the most dovish Fed chair in history.

Combine that with a recession, and the odds of zero rates suddenly look a lot less far-fetched.

Love him or hate him, Trump’s market instincts have often been uncannily early. But what happens when political incentives collide with central bank mandates…and the bond market is already leaning in?

What This Means for the Economy

The implications are profound. Returning to the zero lower bound isn’t just about making debt cheaper. It opens the door to another round of Quantitative Easing (QE).

Historically, when rates hit zero, the Fed turns to QE to stimulate the economy. While the efficacy of QE is debatable, its impact on asset prices, inflation expectations, and wealth inequality is not.

If we’re heading back to that world, investors need to start thinking now about how to position themselves.

QE may be coming back with a vengeance…but this time, the playbook won’t be the same. The ripple effects will be bigger, faster, and potentially far more destabilizing...

The Structural Signals in the Market

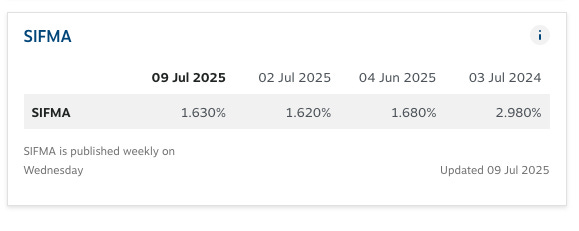

The Fed's new focus on interest rate derivatives represents a major shift in how it interprets market signals. Traditionally, the Fed has leaned on indicators like the 10-year/2-year yield curve, near-term forward spreads, or the unemployment rate.

But now, they’re listening to markets that price future expectations more dynamically. And those markets are flashing red.

This new awareness likely stems from past failures. Before both the GFC and COVID-19 recessions, traditional indicators missed the boat. But derivatives markets…particularly swaps…were more prescient.

If the Fed is finally starting to take these forward-looking markets seriously, then we have to ask: what are these signals saying right now that the mainstream still refuses to hear?

A Shotgun, Not a Rifle

It’s important to note that interest rate swaps don’t predict the exact level of future rates. They're not a rifle aimed at a precise forecast. They're more like a shotgun blast, giving us a general sense of direction and probability.

And right now, that blast is pointed squarely at the floor.

This isn’t just about rate cuts anymore…it’s about control of the central bank itself.

And the implications for markets, currencies, and global capital flows could be seismic…

The Political Backdrop: Trump and the Fed

The political dynamics can’t be ignored. Trump’s recent social media push for a massive rate cut may seem extreme, but it signals a broader trend: growing bipartisan pressure on the Fed to prioritize economic growth over inflation.

Trump has made it clear he favors negative interest rates and would pressure the next Fed chair to go as dovish as possible. Expect not just rate cuts, but a wholesale shift in Fed policy direction once Jay Powell is out.

Gold: The Default Hedge

If the Fed is going back to zero and resuming QE, there are few places investors will feel safe. But historically, one asset tends to shine in that environment: gold.

George Gammon has long advocated starting every portfolio with gold. But the challenge, especially as prices rise, is storage cost. That’s where alternatives like Monetary Metals come in, offering a yield on gold holdings through leasing programs.

If we are entering a period of renewed monetary debasement, the case for holding gold becomes even stronger. And if you can earn a yield in gold terms, all the better.

But gold isn’t just an insurance policy…it’s becoming a stealth yield play in a world where real returns are vanishing. The question now is: how do you front-run the next wave of capital seeking shelter?

What Would the Legends Do?

Stan Druckenmiller: Would likely be positioning in long-duration bonds and gold.

Paul Tudor Jones: Would be looking at gold, Bitcoin, and inflation hedges.

Ray Dalio: Would be assessing the implications through the lens of debt cycles and political instability.

If the most successful macro minds of our time are quietly preparing for a radical shift in policy…shouldn’t you be asking what they see that others don’t?

The Fed May Be the Last to Know

Despite all the noise, one thing is becoming increasingly clear: the market sees a return to zero interest rates as not only possible, but probable.

Interest rate swaps, political pressure, and structural economic weakness are all converging on one outcome. And now, even the Fed is acknowledging it.

If you wait until Powell rings the bell, you'll be too late. Now is the time to prepare.

Because by the time the headlines catch up to what’s already been priced in, the opportunity window will have slammed shut. The only question is: will you be on the right side of that door?

Don’t get blindsided by the headlines. Get ahead of the curve…like Druckenmiller, Jones, and Dalio would.

Join thousands of liberty-minded investors and insiders already preparing for what’s next inside the Rebel Capitalist News Desk.

Paid members get exclusive access to George Gammon’s Friday Q&A, his real-time portfolio updates, and in-depth explainer videos on topics like QE, AI disruption, and rate cycle pivots…content you won’t find anywhere else.