The Jobs Mirage

Why Yesterday's “Strong” Payroll Report Doesn’t Tell the Real Story

Written by Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | July 4, 2025

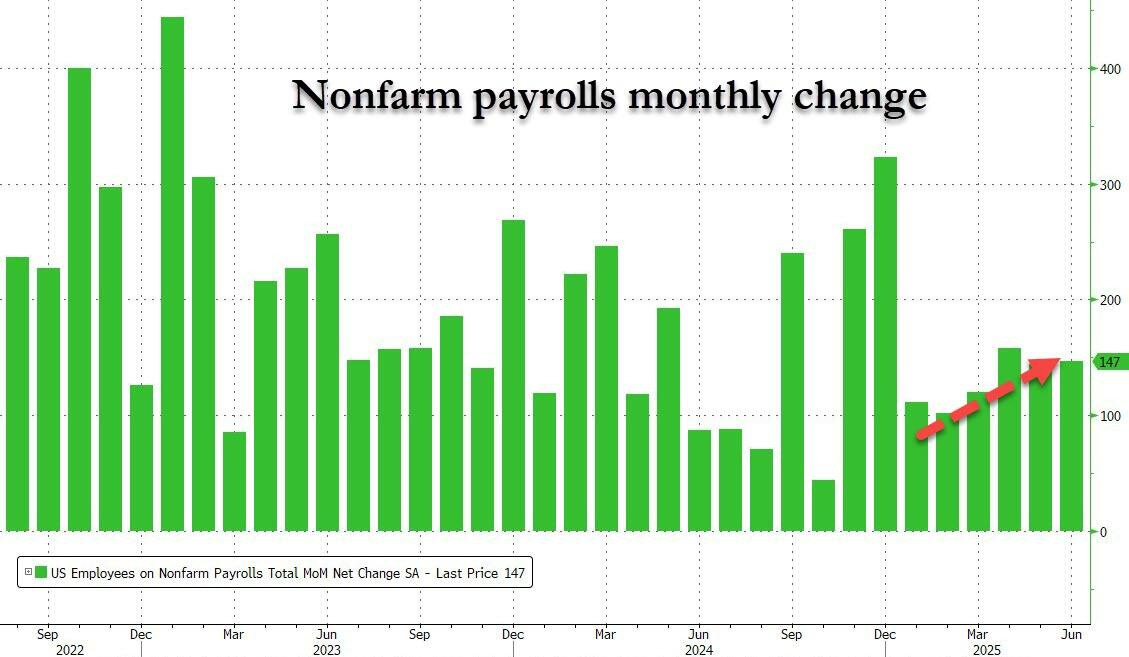

Yesterday’s jobs data came in hot…at least, on the surface. Non-farm payrolls for June printed at 147,000, beating Wall Street expectations. The headlines wasted no time in calling it a "blowout" number.

But step back and look under the hood, and you’ll quickly realize this labor market isn’t roaring…it’s teetering. If you're just looking at the headline numbers, you're missing the big picture.

What's Really Going On?

The economy added 147,000 jobs. That beat expectations, sure…but we have a population of over 350 million. This level of job creation doesn’t even keep up with population growth. A truly “strong” print would be something in the 200,000–300,000 range at a minimum.

So, while it looks solid at first glance, the context paints a different story. We’re essentially flatlining, and much of the "growth" came from government hiring.

The headlines may be cheering, but the internals are screaming. And if you think the private sector is holding up just fine, wait until you see who’s actually hiring…

Government Propping Up the Numbers

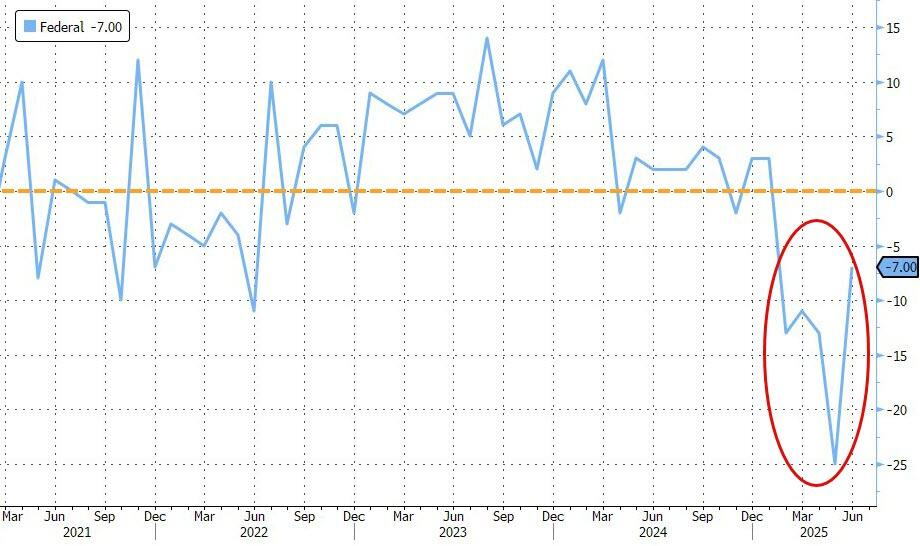

Of those 147,000 new jobs, 73,000 were government jobs…nearly 50%. Break that down further and you see that federal jobs actually declined by 7,000, while state and local government hiring surged.

If nearly half of the new jobs are taxpayer-funded, is this really economic strength? Or is it just another example of government masking the fragility of the private sector?

This isn’t organic growth…it’s fiscal smoke and mirrors. And beneath the surface, the sectors that truly matter for future prosperity aren’t growing… they’re barely breathing.

Private Sector Still Struggling

Private sector growth remains weak. Health care added 39,000 jobs…thanks in large part to aging demographics, not organic economic expansion. Most other categories are flat or falling.

And remember, this data comes a day after the ADP report showed the private sector lost 33,000 jobs. The contrast between the two reports should give you pause.

So what explains the disconnect between the ADP report and the official narrative?

To answer that, we need to turn to the one dataset the mainstream media never wants to talk about…

The Household Survey Tells a Different Story

Most investors only follow the establishment survey (the headline number), but the real insights often lie in the household survey. And that’s where things get ugly.

The household data showed that only 93,000 people gained employment.

Meanwhile, 130,000 people left the labor force entirely.

That’s how the unemployment rate ticked down to 4.1%…not because more people are working, but because fewer people are even trying to find work.

In a healthy economy, you want to see the labor force growing, not shrinking.

If fewer people are working and even fewer are looking, how can this possibly be called a strong labor market? The cracks are widening…and the most worrisome signs are still ahead.

The Labor Market Is Losing Its Mojo

Here’s where it gets worse:

Long-term unemployment (27 weeks or more) increased.

The number of people working part-time for economic reasons remains stubbornly high at 4.3 million.

6 million people outside the labor force say they still want a job.

The number of “discouraged workers” surged by over 250,000…a 50% jump.

These are not signs of a tight labor market. These are signs of a system under duress.

It’s not just about how many are working…it’s about how many have stopped trying. But the deeper crisis brewing isn’t cyclical... it’s existential. And it's coming from a force most policymakers still don’t fully understand.

Participation Declining

Labor force participation fell again. This is critical, because it means fewer people are being productive, creating value, or even attempting to contribute to the economy.

Sure, some of this is due to demographics (retirements), but a large part is likely disillusionment. When millions of people feel they have no shot at finding a job, that’s not a labor shortage…it’s a crisis of opportunity.

This isn’t just a downturn…it’s a structural breakdown in how the labor force functions. And as technology accelerates, millions more could be pushed to the sidelines…

Is AI the Silent Job Killer?

One emerging factor is artificial intelligence. CEOs across industries are increasingly open about the fact that AI will eliminate millions of white-collar jobs.

Ford’s CEO said half of white-collar jobs will be gone. Amazon’s Andy Jassy warned his corporate workforce will shrink dramatically. And Anthropics’ CEO predicted unemployment could hit 10–20% outside of a recession due to AI disruption.

That’s a structural change. And it means any cyclical recovery in the labor market could be quickly offset by technological job destruction.

This isn’t a theory. It’s already happening. And markets are beginning to wake up to what it means for Fed policy, interest rates, and asset prices.

Market Reaction: Repricing the Fed

Markets reacted immediately. The dollar surged. Yields, especially on the 2-year, spiked. Rate cut expectations for July plummeted from 23% to under 5%.

This confirms what we've been saying over the last month: The dollar's recent crash was all about narrowing interest rate differentials. A stronger-than-expected jobs number suggests the Fed may not cut as soon, widening that differential again.

But remember: one hot print doesn't make a trend. And even this one isn’t that hot once you dig into the internals.

But here’s the twist: the data the Fed says it’s watching is now giving it cover to do nothing…even as the real economy cries out for help. And that's where the danger lies.

The Real Message from the Market

Zoom out, and you’ll see a pattern:

The labor market is weakening in key areas.

Private sector job creation is anemic.

Participation is falling.

And AI is the new black swan looming over the labor force.

These trends won’t reverse overnight. And if you're the Fed, your dual mandate is employment and inflation.

Inflation is cooling. Employment is deteriorating. That means the bias should be toward easing, not hiking or even holding.

The mainstream is still chasing lagging indicators. But if you study the legends of macro, you’ll see they’re already positioning for what comes after the illusion fades.

What Would the Legends Do?

Stan Druckenmiller would likely be watching the short end of the curve like a hawk. He’d already be positioned for a bond rally and a weaker dollar.

Paul Tudor Jones might be betting on gold and Bitcoin. He knows monetary policy pivots tend to follow labor market deterioration…and those assets typically benefit first.

Ray Dalio would be asking whether we’re nearing the end of the long-term debt cycle and preparing for a world where printing returns as the default policy tool.

Because while Powell waits for “official confirmation,” the insiders are already making moves. And the next big shift could catch the unprepared flat-footed.

Final Thoughts

Yesterday’s jobs number is not the bullish signal the mainstream media is selling. If anything, it’s a carefully constructed illusion…a mirage of stability propped up by government hiring and a shrinking labor force.

When you dig into the data, the signal is clear: private sector weakness, falling participation, and looming job destruction from AI.

This is not a time for complacency. It’s a time for preparation. Because if the Fed keeps looking at the headline number while ignoring the internals, the risk is not runaway inflation. It’s a policy lag that fails to address the real economic pain setting in.

Don’t get blindsided by the headlines. Get ahead of the curve…like Druckenmiller, Jones, and Dalio would. Join thousands of liberty-minded investors and insiders already preparing for what’s next inside the Rebel Capitalist News Desk.

Paid members get exclusive access to George Gammon’s Friday Q&A, his real-time portfolio updates, and in-depth explainer videos on topics like QE, AI disruption, and rate cycle pivots…content you won’t find anywhere else.

🔴 Click here for Today’s live and uncensored market wrap-up with George Gammon at 4 PM EST.