The Jobs Numbers Shock That Could Change Everything

Massive job revisions. Political firings. Gold surging. Are the numbers broken...or is the system rigged? The next jobs report may shatter more than expectations…

Written by Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | August 5, 2025

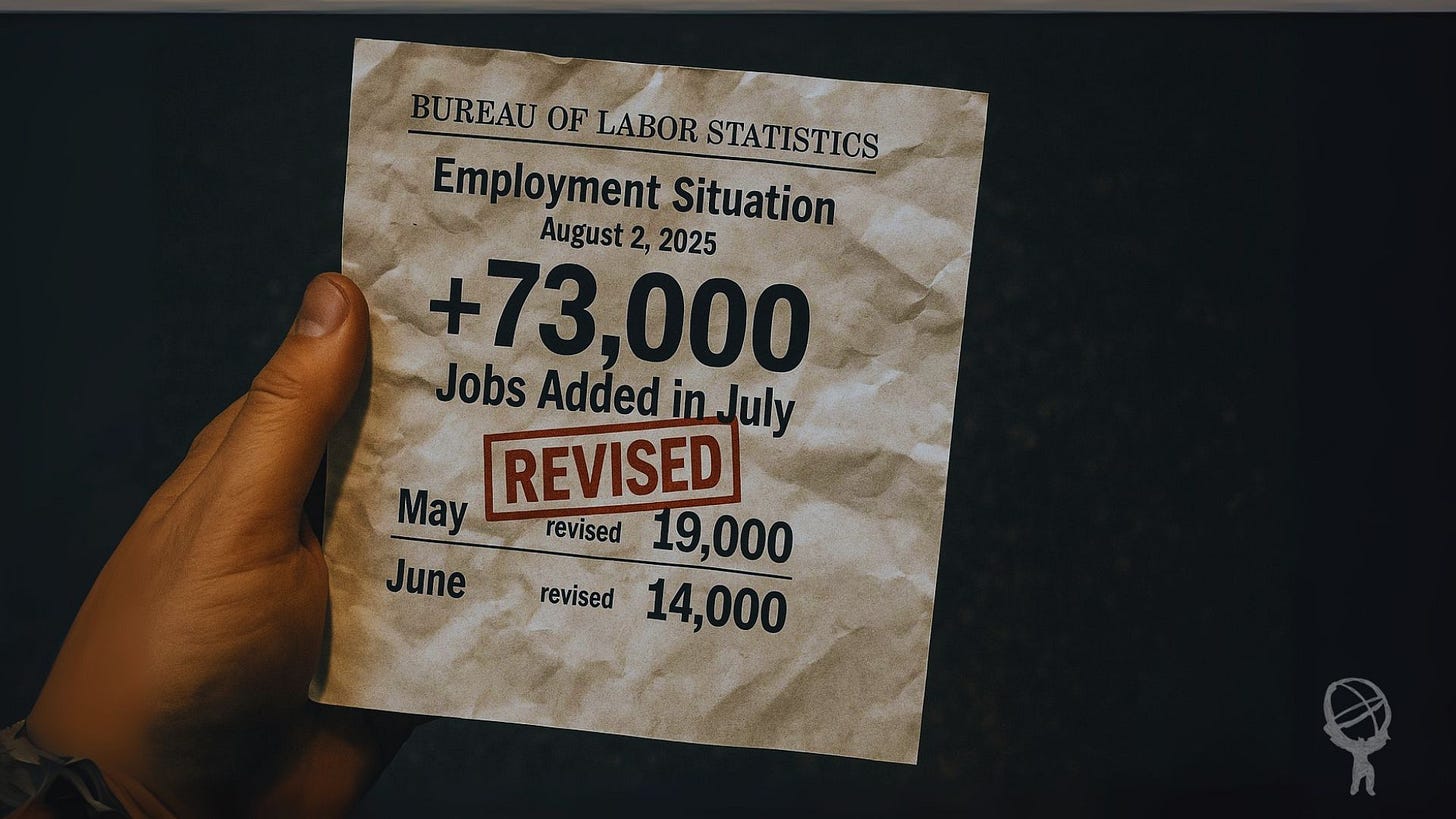

When the July jobs report dropped, most headlines zeroed in on the top-line number: 73,000 jobs added.

That already missed expectations.

But what came next should have stopped the market cold: massive downward revisions to the two previous months…May and June…that now rival the Great Financial Crisis and the COVID crash.

This post isn’t just about the latest jobs report.

It’s about how much trust we can put in the data that markets and policy depend on, and what the implications are when politics and perception begin to skew the most important economic indicator of all: the labor market.

The Biggest Labor Market Revision Since 2020

Let’s start with the facts. The Bureau of Labor Statistics (BLS) revised:

May from 144,000 to just 19,000 jobs.

June from 147,000 to 14,000.

That’s a combined downward revision of 258,000 jobs.

If those had been the original headline numbers, the market reaction would have been severe. Interest rates would have plummeted. Stocks likely would have sold off hard.

But because they were hidden as revisions, the impact was muted.

What’s more alarming? There has never been a two-month combined revision this large outside of a recession.

That’s not opinion. That’s historical fact. Even during 2008, the GFC, we didn’t see revisions this sharp. The only other period that compares is the pandemic crash in 2020.

Every time we’ve seen revisions of this magnitude, the U.S. has either been in or entering a recession.

These aren’t just technical adjustments. They’re red flags…ones that would’ve set the market on fire had they been published up front.

But buried in revisions, they were conveniently ignored.

So the real question becomes: Was the top-line number any better?

The Headline Number Is a Mirage

73,000 jobs added in July sounds better than it is. First, it was well below expectations of 100,000+.

But more importantly, based on the revision trend, there’s a high probability this number will be revised downward next month.

If it follows the recent pattern, it could easily turn negative.

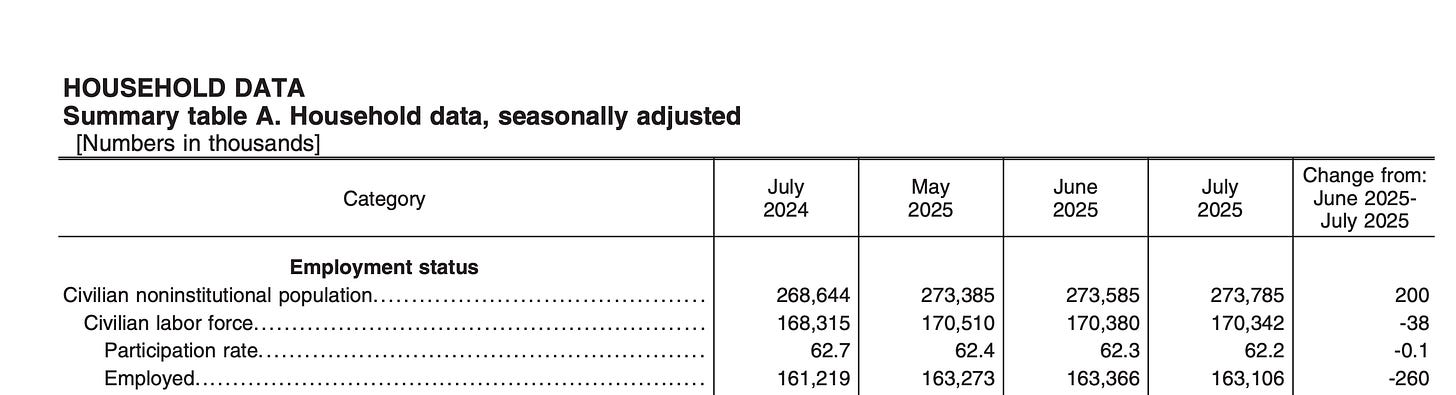

Worse still, the household survey (a separate but critical measure of employment) showed a decline of 260,000 jobs.

So while the establishment survey gave us a weak positive, the household data screamed recession.

Every single month this year…January through June…has been revised downward. That’s not random. That’s systemic.

If the July number gets revised down again, the probability the U.S. is already in a technical recession skyrockets.

It’s not just the downward trend…it’s the pattern.

Month after month, the BLS walks back its initial optimism, and markets barely flinch.

But what happens when this statistical rot collides with political fire?

Trump Fires the BLS Chief: A Dangerous Precedent

In the wake of the July jobs report, President Trump fired the BLS Commissioner.

Some argue this was long overdue due to incompetence. Others believe it was politically motivated retaliation for unfavorable revisions.

But either way, the implications are serious: Can we trust the data going forward?

If the next BLS Commissioner knows their job depends on making the boss look good, how much faith can markets have in future jobs reports?

Even if you're a Trump supporter, you have to ask: What happens to credibility when the person overseeing the most important economic report is incentivized to politicize the numbers?

Whether you believe Trump is draining the swamp or corrupting the plumbing, the damage to data integrity is already done. And the market?

It’s starting to notice…but not where most people are looking.

Market Response: Risk-Off, But Gold Rips Higher

Despite the headline jobs number being weak, gold spiked. Why?

First, the weak labor print signaled that a recession is more likely.

Second, if the Fed sees these revisions and household job losses, they may pivot dovish sooner than expected.

Third, investors are moving into hard assets as they lose confidence in official data.

The dollar dropped. Treasury yields dipped. And gold jumped over $50 in a single day.

That’s not noise. That’s a signal that markets are starting to sense something deeper is wrong.

This wasn’t a panic bid. It was a trust bid. The kind of quiet but forceful move that says more than any press release. And if faith in economic data keeps crumbling, gold might not just shine…it might blind.

What Investors Should Watch Next

The biggest question now: What happens when the next jobs number comes out?

If the number is unusually strong, will anyone believe it?

If revisions suddenly flip positive after months of downward changes, how much trust will remain?

Will market participants start ignoring BLS data entirely?

We’re entering a phase where labor market data may become too politicized to rely on. And that would force investors to seek alternative signals: real-time credit card spending, payroll processor data, tax receipts, and more.

In a world where the scoreboard can be rewritten after the fact, smart money will abandon the box score altogether.

And when that happens, they’ll look for the one asset class that doesn’t lie, spin, or get revised.

Gold As a Safe Haven? More Than Ever

With uncertainty around labor data, and a Fed that’s caught between a slowing economy and inflation optics, gold becomes increasingly attractive.

It doesn’t have counterparty risk.

It can’t be manipulated like a data print.

It’s trusted across borders and political cycles.

No surprise then, that central banks keep accumulating it, and now retail investors are following suit.

As George Gammon frequently says: Gold isn’t an investment, it’s insurance. But in times like these, it might be both.

Central banks already figured it out. Now retail is waking up. And if we really are slipping into recession…masked by manipulated data…then gold’s next move might not be defensive. It might be explosive.

We May Already Be in a Recession

Forget the 3% GDP headline. With non-farm payrolls potentially already negative on a revised basis, and the household survey cratering, the labor market is sending a clear message.

Every previous time we’ve seen this level of revision, the NBER later confirmed a recession. We might be living through that call right now…it just hasn’t been officially announced yet.

The next jobs report won’t just be another data point. It’ll be a test of trust.

Trust in our institutions.

Trust in the markets.

Trust in reality.

And if that trust breaks, the implications go far beyond this business cycle.

You can only cook the numbers for so long before the smell gives it away.

The next jobs print might be the last gasp of credibility for the BLS…and for the market that still pretends to believe it.

If you want to stay ahead of the next pivot, next recession, and next opportunity, start by questioning everything you're told.

Join the thousands of liberty-minded investors on the Rebel Capitalist News Desk for real-time macro analysis, exclusive market insights, and the uncensored truth behind the numbers.