The Labor Market Is Quietly Falling Apart

ADP Goes Negative, Initial Claims Hit 1969 Levels, and Nothing Adds Up

Written by Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | December 5, 2025

If you want a perfect snapshot of how distorted, confusing, and ultimately fragile the U.S. labor market has become, look no further than the last couple days of economic data.

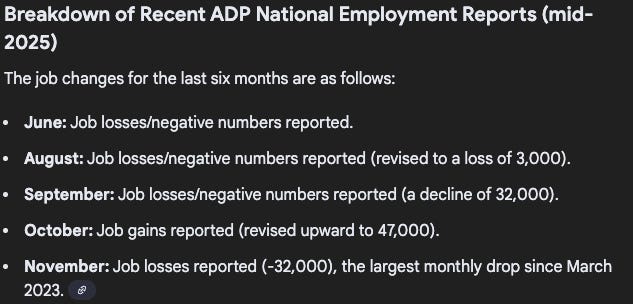

On Wednesday, ADP printed a shockingly bad number: –32,000 private-sector jobs.

On Thursday, initial jobless claims came in at the lowest level since 1969.

And yesterday, revisions from previous months show the non-farm payroll numbers have been quietly deteriorating for much longer than the headlines suggested.

A labor market where companies are cutting workers while simultaneously reporting the lowest level of layoffs in decades?

A market with no hiring...but also no firing?

A market where negative payroll numbers don’t show up in initial claims at all?

This is not a labor market that’s healthy. It’s one that’s frozen.

And frozen economies crack.

If the top-level data seems contradictory now, just wait until you see what the second-tier metrics reveal...because that’s where the iceberg gets much larger beneath the surface.

The next section exposes the first big fracture.

The ADP Shock: Negative 32,000 Jobs

Let’s start with the data that actually reflects the private sector: ADP.

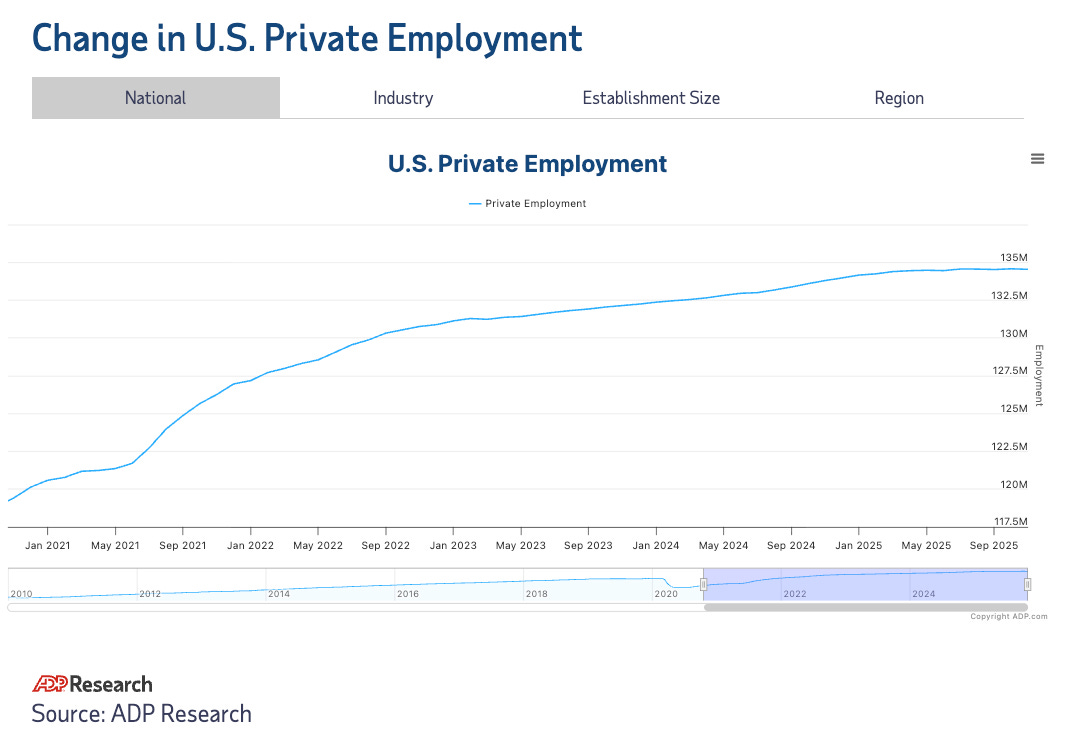

Private-sector companies shed 32,000 jobs...when Wall Street had expected a +40,000 gain. But the context makes this number even worse.

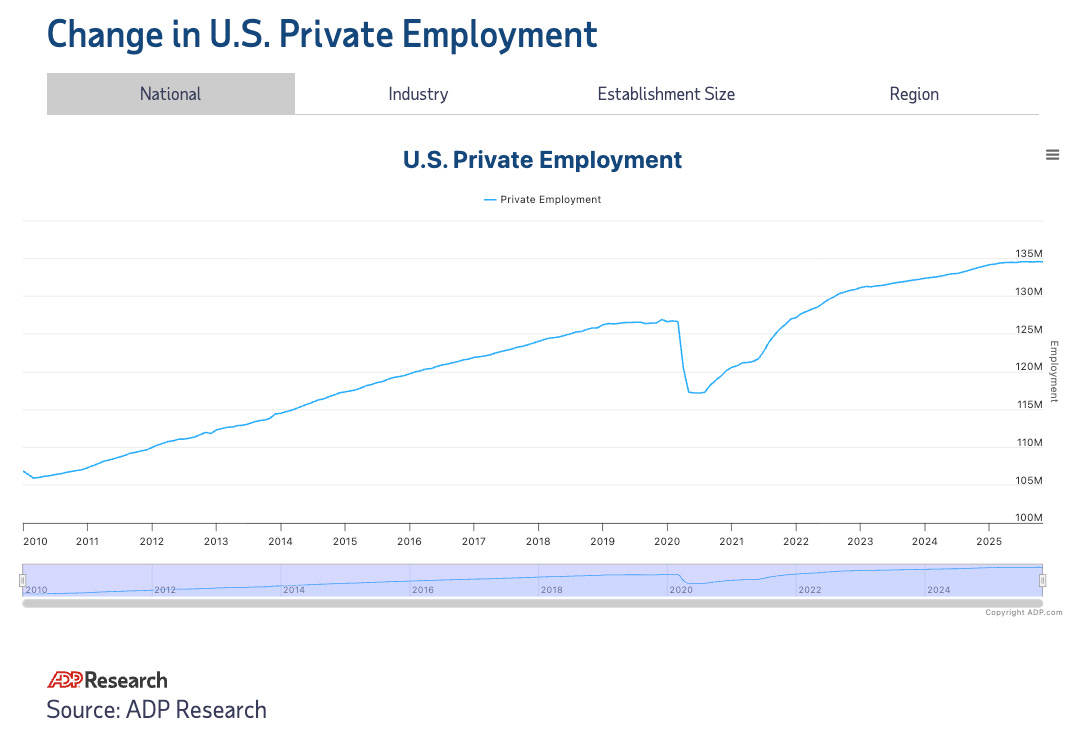

If you zoom out and look at the trend since late 2021, the hiring curve looks like a ski slope. August 2021 had a monster print of 1.25 million new private-sector jobs.

Since then, each rebound has been weaker than the last, and each decline has been deeper.

This is not a blip. It’s a trend...downward, persistent, and now accelerating.

We’ve now had negative ADP in four of the last six months. That only happens in recessions or right before them.

Yet the mainstream doesn’t care about ADP. They care about the headline payroll number, which...once again...will be revised down in two or three months, just like every other “strong” headline print this year.

Assuming for a nano-second that the ADP is telling the truth, then the next logical question is: why aren’t layoffs rising?

The answer arrives in the next section...and it’s more bizarre than you think.

Then the Claims Data Hit...Lowest Since 1969?

Now comes the surreal part.

Initial jobless claims came in at the lowest reading since 1969. Let that sink in.

A number this low hasn’t happened in more than 50 years, outside the weird statistical distortions of pandemic lockdowns.

So how do we reconcile that? How can layoffs be collapsing while private-sector employment deteriorates?

George put together the best explanation you’re going to find anywhere...and it’s so simple you’ll wonder why no one at the Fed has thought of it.

People are quitting. Companies aren’t firing a lot. And nobody is replacing anyone.

This is a labor market with almost no transactions.

No hires.

A few fires.

No movement.

It’s exactly what happened in the housing market since 2022 and 2023.

When mortgage rates spiked, supply and demand both froze. Very few transactions happened, but prices stayed artificially high...until the real stress started to show.

The same pattern is happening in employment.

If the claims data is misleading and ADP is telling the truth, then the “no hire, no fire” dynamic becomes the lynchpin of the entire crisis.

Let’s dig into that dynamic next...because it’s the mechanism that makes everything else make sense.

The “No Hire, No Fire Economy”

Businesses today face a toxic combination of:

Weak aggregate demand.

Rising costs.

Uncertainty about the future.

Slow AI adoption.

Margin pressure.

So if an employee quits...often a retiree or someone leaving the workforce permanently...the company simply does nothing. They don’t fire anyone (so it doesn’t show up in claims). But they also don’t hire a replacement (which shows up in ADP and NFP revisions).

If enough people quit and no one is hired to replace them, the labor market deteriorates without a single layoff being filed.

That’s why you can have negative ADP and 50-year-low claims at the same time.

This is not healthy. This is stagnation. Stagnation always ends the same way: with cracks.

And if you want to see those cracks forming in real time, there’s one set of data the mainstream never talks about...but it’s screaming danger.

That’s where we go next.

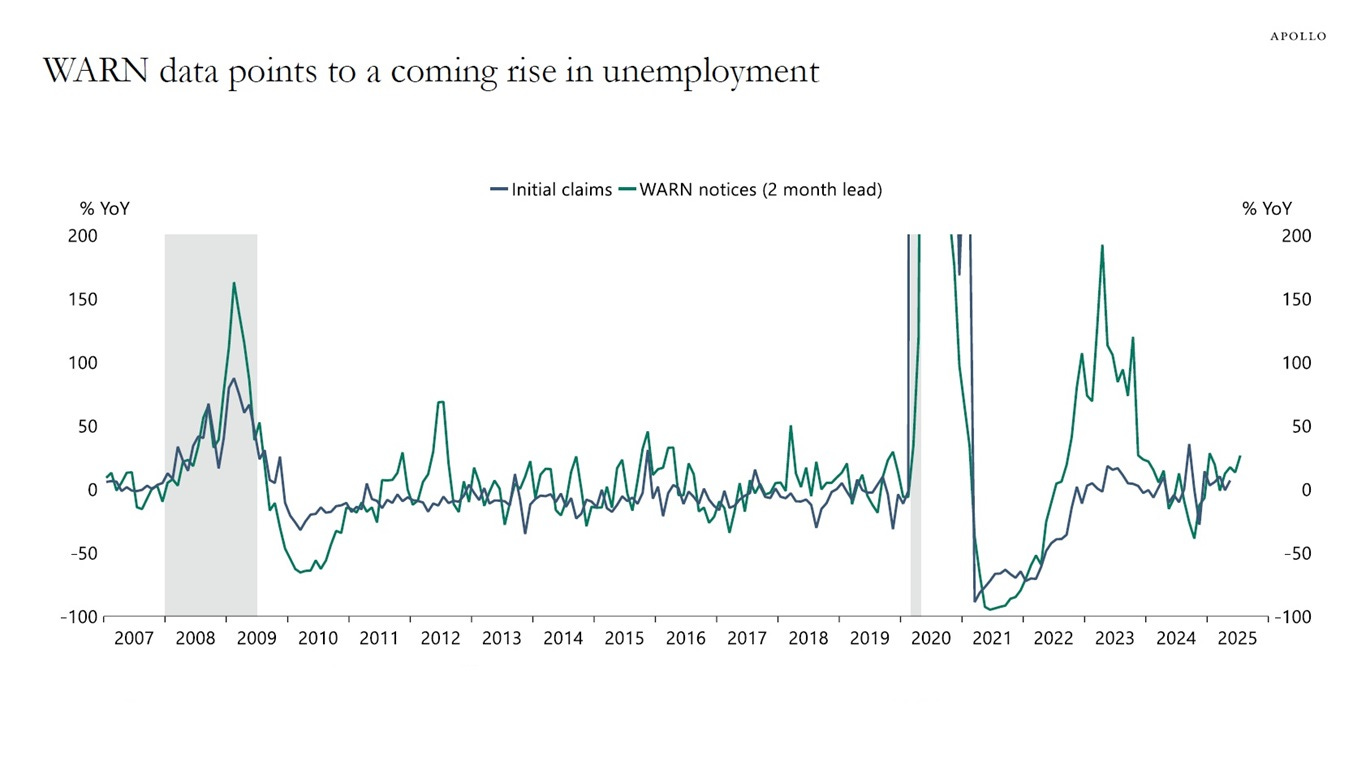

The Challenger Data and WARN Act Reports Are Flashing Red

If you want to see the real labor market...not the headline version...the Challenger layoffs and WARN Act data tell the truth.

Challenger, Gray & Christmas (CG&C) October report showed the worst layoff announcements since the early 2000s. November came in at over 70,000 announced job cuts, a number we haven’t seen outside the GFC and the pandemic period.

The WARN Act data is even more chilling. Companies with over 100 employees must legally give 60–90 days’ notice before mass layoffs or plant closures. Those filings are exploding.

If initial claims are the “rearview mirror,” WARN notices are the windshield...and the road ahead looks terrifying.

Small- and medium-sized businesses, according to the NFIB survey, are cutting workers at the fastest pace in years...and the number one reason they give is poor sales.

Not inflation.

Not interest rates.

Not labor shortages.

Demand is collapsing.

When the middle class cuts spending, the bottom half of the labor market collapses. That’s exactly what’s happening now.

Once WARN notices start rising, recessions stop being hypothetical...they become scheduled.

That’s what makes the next metaphor from George so important.

The Titanic Turn: Slow, Then Sudden

George makes a brilliant point in a recent video: recessions don’t arrive like a light switch. They arrive like the Titanic hitting the iceberg.

A slow roll.

Then a slow lean.

Then a slow sink.

And then...suddenly...everything accelerates.

We’re in the slow roll right now.

Not 2008.

Not yet.

But 2006? 2007?

The period where:

ADP began weakening.

Layoff announcements rose.

Jobless claims stayed artificially low.

The economy “felt fine”...until it didn’t.

Yes. That’s where we are.

And if the Titanic analogy explains the speed, AI explains the structural shift that’s warping every labor signal economists rely on.

We dive into that next.

Why AI Makes the Labor Market Even Weirder

One of the most important insights is how AI fits into this dynamic.

Companies aren’t firing en masse yet. They’re simply failing to rehire. If ten employees retire or resign, the company replaces none of them...and maybe cuts two more.

They get:

Lower payroll

Higher margins

Lower risk

And no need to hire into a slowing economy

The ADP data reflects this. The initial claims data does not.

AI isn’t destroying jobs.

It’s destroying job openings.

That is much more important...and much more deflationary.

And that leaves one institution completely blind to what’s actually happening: the Federal Reserve. Which brings us to tomorrow’s big tell.

The Fed Has No Idea What’s Going On

Today’s PCE report will tell us more about how the Fed interprets this mess.

But the truth is simple: the Fed has no model for a labor market with this little churn.

Their Phillips Curve assumptions are useless in an economy where wages rise only for job switchers...and no one is switching jobs.

Markets, however, are starting to see the writing on the wall.

Rate-cut odds jumped on today’s initial-claims print, but Treasury yields barely moved. Traders know the claims number is noise. They know ADP is the real signal. They know revisions will expose the truth.

The bond market is bracing for something the Fed hasn’t admitted yet:

The economy is slowing faster than they think...and the labor market is already in recession. That brings us to the final warning.

A Fragile, Frozen Market Always Breaks

When a market has no movement...no buyers, no sellers, no churn...it doesn’t mean things are fine. It means things are brittle.

That’s exactly where the U.S. labor market is today. A freeze like this does not thaw gently. It cracks.

If you’re looking for the next major macro signal, forget the headline payroll number. Watch:

ADP

WARN notices

Challenger layoffs

Small-business hiring plans

Non-farm payroll revisions

Those are the indicators that turned in 2006 and 2007. They’re turning again now.

A no-hire, no-fire economy is not stable.

It’s the last calm before the storm.

Prepare accordingly.

👉 And if you want the analysis that catches cracks before they become collapses, keep reading below.

Your edge is information...so make sure you’re getting the right kind.

Stay Ahead of the Crack-Up

If you’re reading Rebel Capitalist News Desk, it’s because you don’t trust the headlines...you want the truth behind the numbers, the trends the mainstream won’t touch, and the warning signals policymakers always miss.

Markets are entering a phase where:

Labor data will get more confusing.

Revisions will get more dramatic.

Politicians will get more desperate.

And investors who rely on old models will get blindsided.

But you don’t have to.

Our premium subscribers get:

Daily macro intelligence George and the team actually use.

Early warning analysis on labor, liquidity, credit, commodities, and geopolitics.

Actionable frameworks, not narratives.

Real-time interpretations of breaking data before CNBC even writes the headline.

If you’re trying to protect your capital...or grow it...in a world this unstable, information isn’t optional. It’s survival.

👉 Upgrade now to Rebel Capitalist News Desk Premium and make sure you’re never the last to know when the next crack becomes the next crisis.

https://rebelcapitalist.com/subscribe

Because the people who stay ahead of the storm aren’t lucky. They’re prepared.