The Stagflation Myth Gets Busted...Again!

Headline inflation is falling. Core PCE is flat. So why is Wall Street still screaming “Stagflation”? What the data really says might shock you…

By Rebel Capitalist News Desk

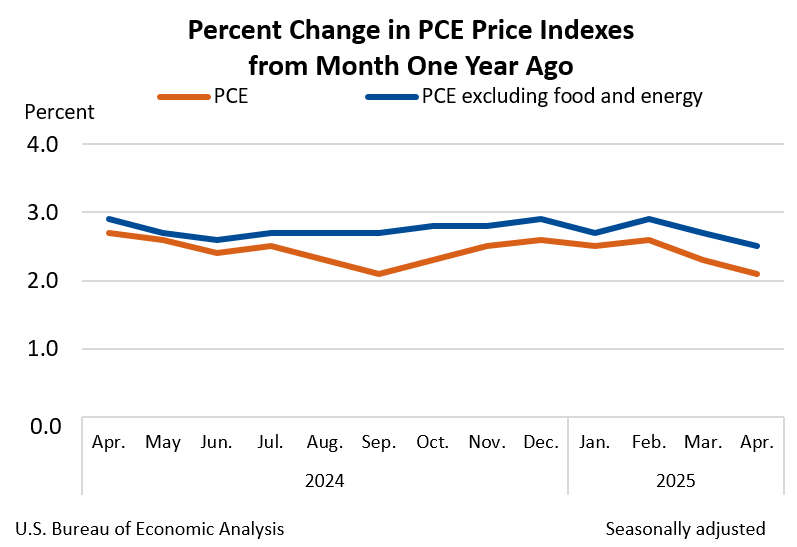

The April 2025 Personal Consumption Expenditures (PCE) report just dropped, and the headlines are telling: year-over-year PCE inflation came in at 2.1%, below expectations.

Core PCE (a measure of the change in consumer prices, excluding food and energy, in the United States) held steady at 2.5%.

This might sound boring. But beneath the surface, this data point drives a stake through the heart of a persistent narrative that's been haunting markets for over a year: Stagflation.

Let’s be clear: this is not stagflation. And if you understand macro history and how inflation actually works, you’ll see why this myth needs to be retired once and for all.

The Definition, and the Misuse

Stagflation means high inflation in a slowing economy.

The image it conjures is 1970s-style pain: surging prices, spiking unemployment, and stagnant output.

But for that to happen, you need inflation that keeps accelerating even as economic growth slows and jobs vanish.

That’s not happening.

Yes, the economy is cooling. Retailers are warning of soft demand. Consumers are trading down. The jobs market is loosening. But inflation?

It's not accelerating…it's decelerating.

Headline PCE at 2.1% is the lowest it's been since September 2024, and one of the lowest readings since the post-pandemic inflation cycle began. That’s not stagflation. That’s disinflation.

But here’s what most analysts still don’t understand: even the most textbook definitions of stagflation never appear without one crucial ingredient…rising inflation in the face of falling growth.

And when you look through history…

History Tells the Same Story

Let’s rewind. Go back 70+ years through U.S. economic history.

Search for a moment when:

The economy was slowing,

Unemployment was rising, and

Inflation was accelerating.

You won't find it.

In every major postwar recession, inflation either flattens or declines once the economy weakens and jobs get cut. Why?

Because wage growth slows. Demand drops. Consumers tighten belts. Businesses cut prices to move inventory.

Inflation is not independent of demand.

And that’s the fatal flaw in today’s narrative: it assumes inflation is this unstoppable, self-fueling beast.

But it’s not.

Inflation is downstream of money, wages, and credit.

No wage growth? No credit expansion? Then you don’t get accelerating inflation. It’s that simple.

And if this pattern holds, then the Fed's entire "stagflation caution" is a ghost chase.

But what might legendary investors like Stanley Druckenmiller be doing right now?

How Investment Legends Might Play This

Stanley Druckenmiller would read today’s PCE print and immediately think in terms of Fed positioning.

If inflation is cooling and growth is slowing, the Fed is done tightening. Maybe even on the verge of easing.

Federal Reserve "tightening" refers to raising interest rates, reducing the money supply, or selling assets to curb inflation and cool an overheated economy…typically through rate hikes, selling government securities, or quantitative tightening (QT).

Druckenmiller might start thinking about:

Long-duration bonds.

Growth equities (especially those hit hardest in the tightening cycle).

Undervalued tech.

He’d also look for asymmetric upside. If the market still fears inflation but it’s already rolling over, there’s a macro mispricing. He’d exploit that.

Paul Tudor Jones, the master of macro-inflection trades, would be watching the positioning in rates and commodities.

If traders are still bracing for stagflation, he might fade those trades. Short oil. Long Treasuries. Long gold if he thinks real rates are peaking.

He’d use trend signals and sentiment gauges to time the entry.

Bruce Kovner, with his global macro lens, would look beyond the U.S. He’d compare the PCE trend to European and Asian inflation metrics.

If global disinflation is synchronized, he might go long the dollar versus inflation-prone currencies. Or short commodity exporters.

He'd also be watching for capital flow shifts into risk assets if the Fed pivots.

The greats don’t wait for the headlines to catch up. They move when the data whispers and sentiment screams the opposite. That’s how turning points become profit engines.

Know the Narrative, Trade the Reality

Stagflation sells, but it doesn't hold up to scrutiny. You don’t get runaway inflation without strong wage growth and expanding credit.

And in a slowing economy with job softness and flat earnings, that's not the setup.

Today’s PCE report is just more evidence: inflation is cooling, not re-accelerating.

So don't fight the last war. Focus on the price signals. Watch the data. And trade the disconnect.

Because by the time the Fed admits the mistake, it won’t matter. The trade will already be gone…and those who saw it coming will be long gone with the gains.

If this kind of analysis helps you see through the headlines and position ahead of the pack, we’ve got a lot more where that came from.

Subscribe to the Rebel Capitalist News Desk on Substack (it’s free) for uncensored macro insights, tradeable contrarian setups, and in-depth breakdowns the mainstream won’t touch.

Thousands of independent thinkers are already with us. Don’t get left behind.

Rebel Capitalist News Desk

May 30, 2025

Stagflation will happen when AI takes over 40% of jobs.