The Tide Is Going Out...Again

Why Regional Banks Are Crashing and What It Really Means

Written by Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | October 17, 2025

They told you 2023 was a one-off.

That Silicon Valley Bank, Signature, and First Republic were “isolated incidents.”

That the banking system was “fortress strong.”

They lied.

This week, regional banks are crashing…again…and if you’re paying attention, this looks a whole lot like March 2023 all over again.

Only this time, the rot is deeper, the losses are bigger, and the cover-ups are harder to maintain. Welcome to the next phase of the credit unraveling.

So, let’s break it down:

What’s happening in the regional banks (again).

Why First Brands may be the next Archegos or Enron.

How private credit is masking systemic risk.

What the Fed can…or can’t…do this time.

And most importantly: what it all means for your money.

Déjà Vu: The Regional Bank Wreck Redux

Let’s start with the facts. The popular KRE regional bank ETF is getting crushed…again.

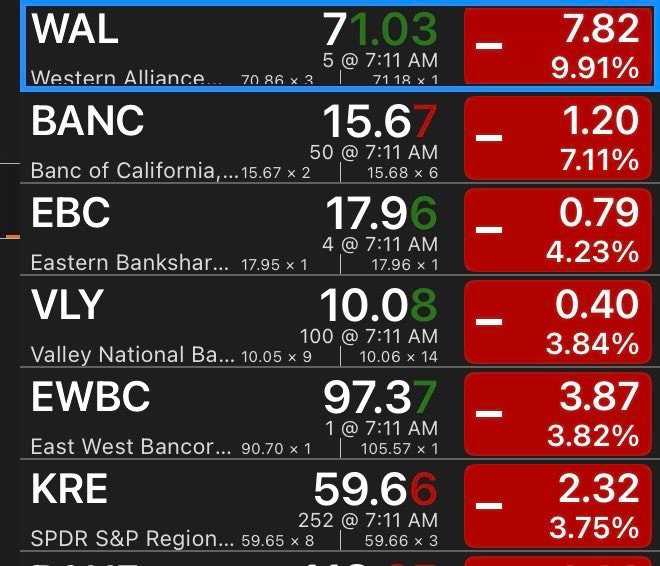

As of this writing:

Zion Bank: Down 13%.

Western Alliance: Down 10%.

Jeffries (Jeff): Down over 25% this month alone.

KRE ETF: Down more than 6% in a day, even lower after hours.

This isn’t volatility. This is contagion.

These names should sound familiar…Zion, Western Alliance…they were on the watchlist during the 2023 crisis. Back then, the media called it a “confidence issue.”

Now it’s a credit quality issue. Translation? These banks made garbage loans, and now the garbage is stinking up the entire financial system.

What’s unfolding now isn’t just a rerun…it’s the sequel that exposes what the first film hid.

The same balance-sheet games, the same complacency, the same denial. But this time, the credits roll on the entire financial system.

And what’s coming next makes 2023 look like the trailer.

From “Isolated Incidents” to Systemic Rot

Here’s how the dominoes are falling:

First Brands, an auto-parts manufacturer, went from being worth $10 billion (they were planning a $6B refi!) to completely bankrupt.

Jeffries has $715 million in exposure to companies tied to First Brands.

Zion Bank just took a “sizable charge” for bad loans.

Western Alliance admitted one of their borrowers committed outright fraud.

Every single bank says it’s an “isolated instance.”

But here’s the thing:

They said that in 2008. They said that in 2023. They’re saying it now. And they’ll keep saying it…until the entire house of cards collapses.

The “isolated” narrative is the lullaby Wall Street sings before every crisis. But behind the lullaby lies panic…because insiders know what comes next. And if you think the Fed can plug this hole, wait until you see where the real cracks are forming.

Where There’s Smoke, There’s Fire

Remember the saying: “When you see one cockroach, there are probably more.” That’s not just George Gammon wisdom…that’s Jamie Dimon talking.

Dimon, the JPMorgan CEO, came out this week and basically confirmed what we’ve all suspected: the banking system is full of hidden risks.

First Brands was just the canary in the coal mine. The tide is going out. And what we’re seeing now? Is just the beginning.

Dimon’s warning isn’t an act of humility…it’s pre-emptive damage control. When the biggest shark in the water admits there’s blood, it’s because he already smells it. The question isn’t if more bodies surface…it’s whose.

The Buffett Rule in Action: The Tide Is Out, and They’re Naked

When the economy is humming, when asset prices are rising, and when liquidity is flowing, everyone looks like a genius. That’s when banks start lending to zombie companies. That’s when private equity firms start betting on anything with a pitch deck.

But when the tide goes out?

Bad loans blow up.

Credit quality collapses.

Bank balance sheets implode.

And that’s exactly what’s happening now. The Fed tightened. Liquidity dried up. Real growth disappeared. And now the true risks are coming to the surface.

“First Brands wasn’t a mistake. It was the norm. It’s just the first one to get caught.”

The curtain’s been pulled back…and the so-called “smart money” has been swimming naked the entire time. The next reveal won’t be about bad loans…it’ll be about bad collateral. And when that happens, the Fed’s magic wand turns into a live grenade.

Shadow Banking and the Private Credit Time Bomb

Why did all these garbage loans get made in the first place?

Because the Fed encouraged it.

With rates at zero and a tsunami of liquidity, traditional banks couldn’t lend to the riskiest borrowers directly…so they found a workaround: private credit.

Here’s how it works:

The Fed regulates banks.

Banks want yield.

So they lend to shadow banks (like Jeffries).

Shadow banks lend to garbage companies with triple-F balance sheets.

Everyone gets paid…until someone defaults.

And guess what? First Brands defaulted. And now everyone’s pretending to be shocked.

The private-credit boom was Wall Street’s way of laundering risk in plain sight.

But as defaults mount, that off-balance-sheet “innovation” is about to become the next global contagion.

What happens when the unregulated part of the system demands a bailout too?

What’s the Fed Going to Do Now?

The big question: Will the Fed step in and bail everyone out again?

After the March 2023 regional banking crisis, the Fed introduced the Bank Term Funding Program (BTFP)…a fancy acronym for “print money and give it to failing banks.”

But here’s the problem:

Jeffries isn’t a depository bank.

Shadow banks don’t have access to the Fed window.

The plumbing of this system is outside the traditional banking framework.

So even if the Fed wants to bail them out, it may have to break the law again…just like it did in 2020.

“Will they do it? Probably. But they’ll need another special purpose vehicle and a whole lot of legal gymnastics.”

If the Fed bends the law again, it confirms what every Rebel Capitalist already knows: there are no free markets…only managed illusions. The real question is whether the illusion still works when confidence finally breaks.

The Market Is Catching On

The selloff isn’t just limited to banks. The entire private credit complex is getting hammered:

Apollo: Down 6%.

Carlyle: Down 3%.

Blackstone: Down 5%.

KKR, Ares, and the rest: same story.

Why?

Because everyone is realizing that the shadow banking system is built on a foundation of sand. The losses at Jeffries aren’t unique…they’re the tip of the iceberg. And when the iceberg starts melting, nobody wants to be the last one holding the bag.

Liquidity can hide risk…but only until the selling starts. When Wall Street’s darlings start melting, the panic spreads faster than the Fed can print. And this time, the “buyers of last resort” might be the ones begging for bids.

The Real Lesson: This Is the Endgame of Financialization

Here’s the big takeaway:

We’ve replaced sound banking with Ponzi lending. We’ve replaced capital markets with political bailouts. We’ve replaced price discovery with moral hazard.

This isn’t just about regional banks. It’s about the entire financial system being built on the assumption that the Fed will always step in. That the bubbles will never pop. That bad loans will always get rolled.

But history says otherwise.

The machine’s running on fumes…and belief. Once either runs out, the unwind begins.

The same leverage that built the illusion of prosperity becomes the wrecking ball that ends it. And the few who see it coming aren’t panicking…they’re positioning.

What Should You Do?

If you’re reading this and wondering, “Okay, great…but what do I do with my portfolio?”…you’re not alone.

Here’s where the contrarian strategy comes into play:

Avoid financials like the plague.

Watch the yield curve.

Stay away from the debt junkyard.

Look for asymmetrical bets (commodities, energy, gold, uranium, select international plays).

Be liquid and flexible.

This is not a time for passive investing. This is a time for active risk management.

The game now is survival, not speculation. Those who understand liquidity cycles…not headlines…will come out the other side stronger. Everyone else? They’ll learn the hard way what “counterparty risk” really means.

We’re Not in Kansas Anymore

The U.S. financial system isn’t just “fragile.” It’s a highly-leveraged, tightly-coupled, opaque machine running at max speed with no brakes.

The regional bank collapse of 2023 was just the preview. This? This is the main act.

And just like in 2008, by the time the public realizes what’s happening…it will be too late.

So if you’re reading this now, you’re ahead of the curve. Use that edge wisely.

Because timing is everything…and the people who understand this system before it breaks are the ones who thrive after it does. That’s why George Gammon’s Weekly Wrap-Up is happening today after market close…a weekly session where premium Rebel Capitalist subscribers get George’s real-time macro take, portfolio positioning insights, and the chance to ask him questions directly.

If you’ve ever wanted to understand how liquidity, credit, and policy really shape markets…or how to protect your savings from what’s coming…this is your moment.

👉 Upgrade now to Rebel Capitalist News Desk Premium and join thousands of contrarian investors getting George’s unfiltered analysis every Friday. Because when the tide goes out, you don’t want to find out you’ve been swimming naked.

Carvana is next.

The entire idea of the Fed pushing digital bits around to choose winners and losers is the

epitome of moral hazard. Pushing these digital bits around ends with normal people not advancing in real quality of life. The Fed needs major reform.