The U.S. Declares Housing a “National Emergency”

Here’s Why That Should Terrify You!

Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | September 3, 2025

The White House is preparing to declare housing a national emergency.

Treasury Secretary Scott Bessent all but confirmed it this week, and the framing sounds eerily familiar: politicians riding in on a white horse to “save” the middle class by making housing “more affordable.”

If that feels like déjà vu, it’s because it is.

We saw this movie in the early 2000s, when George W. Bush launched a bold agenda to “expand homeownership.”

The result wasn’t affordable housing.

It was the Great Financial Crisis, which wiped out trillions in wealth and devastated the very working families these programs were supposed to help.

Fast forward to 2025, and the government is dusting off the same playbook. Only this time, the stakes are even higher.

The Political Theater of Housing “Emergencies”

When a government declares a national emergency, two things always happen:

The problem doesn’t get solved.

Government power expands permanently.

Whether it’s wars, pandemics, or housing, the pattern is the same: central planners create distortions, then present themselves as the firefighters who can put out the blaze.

But here’s the truth…they’re also the arsonists.

Bessent’s rhetoric fits perfectly into this cycle.

He’s pitching “solutions” that sound compassionate but boil down to financial engineering designed to buy votes.

Lower mortgage rates, standardized codes, “affordability initiatives”…all measures that make demand easier while doing nothing about the supply problem.

And when you increase demand without increasing supply, you don’t make housing cheaper. You just make it more expensive.

Politicians love the optics of rushing in as saviors, but if you strip away the speeches, what you see looks less like compassion and more like a pre-scripted financial trap.

The real question is: whose pocket is being lined while voters are distracted by the word “emergency”?

The answer becomes clearer once you revisit the last time this exact playbook was run…

History’s Warning: Bush’s “Ownership Society”

Let’s rewind to 2004. President Bush rolled out a plan to expand affordable housing.

The language was almost identical to what we’re hearing today: dignity, security, independence through homeownership.

The result?

Lower lending standards.

More households stretched into homes they couldn’t afford.

Rising prices fueled by easy credit.

And ultimately, a spectacular collapse in 2008–2009.

Far from helping the middle class, these policies wiped them out. Families lost not only their homes but also their life savings tied up in home equity.

The lesson should have been clear: when politicians manipulate the housing market to curry favor, it ends in disaster.

The “ownership society” wasn’t about dignity or security…it was about pumping asset prices until the entire system snapped.

If we learned anything from 2008, it’s that demand-side tricks don’t just fail…they blow up catastrophically.

But here’s the kicker: today’s policymakers are doubling down with an even bigger bubble.

What happens when the fuse they’re lighting burns all the way to the powder keg?

The Real Affordability Problem: Supply, Not Demand

Here’s the uncomfortable truth that no politician…Trump included…wants to admit:

The only way to make housing sustainably affordable is to increase supply.

That means:

Reducing federal, state, and local regulations that add tens of thousands to the cost of every new home.

Cutting red tape that delays construction for years.

Eliminating tariffs and subsidies that distort building material markets.

But supply-side reform has a problem: it lowers prices, and lower home prices hurt the very constituency politicians need most…older homeowners whose wealth is tied up in housing equity.

So instead, the government turns to demand-side gimmicks: lower rates, lower down payments, and subsidies. The illusion of affordability. And that illusion is exactly what inflates bubbles.

Everyone knows supply is the missing piece…but no one in power dares touch it.

Why? Because the very people politicians rely on for votes are also the ones who would see their housing wealth shrink.

So instead of confronting the math, leaders keep selling the illusion of affordability.

The dangerous part? Illusions always crack under pressure…and when this one breaks, it could be uglier than anything we’ve seen before.

Financial Engineering = Bubble Fuel

Consider the most sacred cow in U.S. housing: the 30-year fixed-rate mortgage. It doesn’t exist in free markets like Canada or the UK.

It only exists here because of government backstops through Fannie Mae, Freddie Mac, and the FHA.

Without those subsidies, no bank would take on the risk of lending at a fixed rate for 30 years. It’s political engineering….not capitalism.

And when you lower down payments, subsidize interest rates, or reduce closing costs, you’re not solving affordability. You’re just pushing more buyers into the market, driving prices higher and setting the stage for the next collapse.

It’s the same cycle that led to 2008. Only this time, the bubble is bigger.

A 30-year fixed mortgage might feel like stability, but it’s really just a financial Frankenstein held together with government duct tape.

Remove the subsidies, and the entire structure collapses overnight.

But as long as the illusion holds, it keeps funneling fresh buyers into a bubble already stretched to the breaking point.

The question nobody wants to ask: what happens when the market finally calls the bluff?

The Propaganda Layer

What makes this even worse is the propaganda machine that sells it.

Bessent’s Labor Day tweets thanking restaurant workers for “serving omelets” and crediting Trump for cheaper eggs is pure political theater.

It’s designed to frame every small improvement in daily life as a gift from the President, rather than the result of millions of individuals producing, competing, and trading in the marketplace.

This is how free-market capitalism gets replaced…slowly, subtly…by a cult of government dependency.

When omelets and egg prices become campaign talking points, you know we’ve left the world of economics and entered the realm of pure theater.

But here’s what’s hiding behind the curtain: a systematic effort to condition voters into believing prosperity is granted by decree.

The tragedy? Once people buy into that narrative, they won’t see the trap until it snaps shut.

The Voter Trap

Here’s why nothing ever changes:

If politicians really wanted to make homes affordable, they’d strip out regulations and subsidies. That would increase supply and lower prices.

But lower prices anger existing homeowners, who make up the bulk of the voting base.

So instead, politicians promise “affordability” while actually keeping prices high and making new buyers even more dependent on government programs.

It’s a political trap with no exit…at least not one any politician is willing to risk.

That’s why every housing initiative ends up being a short-term vote-buying scheme that leads to long-term pain.

This is the cycle politicians can’t escape…pretend to make housing cheaper, while quietly keeping prices inflated to appease homeowners. But cycles don’t last forever.

At some point, political expediency collides with economic reality. The only question is: who gets crushed when the trap finally springs?

The Coming Blowback

If history is any guide, here’s how this ends:

Government declares housing an emergency.

Demand-side subsidies push more buyers in.

Prices rise faster than incomes.

A recession hits, buyers default, and equity vanishes.

The middle class…the very group these policies claim to help…is left holding the bag.

Sound familiar? That’s because it’s the same blueprint we saw in 2008.

The difference is that today’s starting point is far worse. Home prices are already at record highs relative to incomes. Mortgage rates are volatile. And the national debt is $37 trillion, leaving less room for another round of bailouts.

We’ve seen this movie before, but never with stakes this high: record home prices, unstable rates, and a debt load that makes another 2008-style bailout far less likely.

When the cycle breaks this time, the fallout could spread far beyond housing.

Which brings us to the bigger danger: the systemic shock this bubble might unleash across the entire financial system.

What They Could Do Instead

If politicians were serious about fixing the housing crisis, here’s what they’d do:

Slash federal regulations: Roughly 25% of the cost of a new home is tied to regulatory compliance. Cut that in half, and you immediately make homes more affordable.

End subsidies for 30-year mortgages: Let the free market set terms that actually reflect risk. That means fewer buyers, but also healthier buyers who aren’t stretched to the limit.

Eliminate tariffs on building materials: If lumber costs more because of tariffs, it’s the American buyer…not foreigners…footing the bill.

Let states experiment: Instead of federal mandates, allow local markets to innovate in zoning and construction.

Of course, these reforms would lower prices, which is precisely why they’ll never happen.

Real reform is possible. The blueprint is simple: deregulate, cut subsidies, slash tariffs, and let markets set prices.

But don’t hold your breath.

The very reason these ideas will never be adopted is the same reason the bubble will keep inflating.

Which leaves one final, chilling truth: if government insists on playing firefighter and arsonist at once, the only way out may be a full-blown inferno.

The Arsonist-Firefighter Routine

Every time the government declares a national emergency, it expands its power and distorts the market. Housing is no exception.

By pretending to help, politicians are setting up the very crisis they’ll later claim to fix.

And when it all comes crashing down, it won’t be the Treasury Secretary or the President who pays the price. It’ll be the poor and middle class who lose their savings, their homes, and their trust.

The government shouldn’t be declaring housing a national emergency. It should be declaring itself a national emergency.

Until that happens, expect more bubbles, more propaganda, and more destruction of wealth disguised as “help.”

Housing isn’t broken because of capitalism…it’s broken because government refuses to let capitalism work.

Every new “emergency” declaration is just another excuse to layer on distortions, buy a few votes, and kick the can further down the road. But bubbles don’t last forever.

When this one pops, it won’t just be housing that gets hit…it could be the trigger that takes down everything tied to household wealth.

And here’s the kicker: you won’t hear this from CNBC, Bloomberg, or the Wall Street Journal until it’s far too late. By then, the damage will already be done.

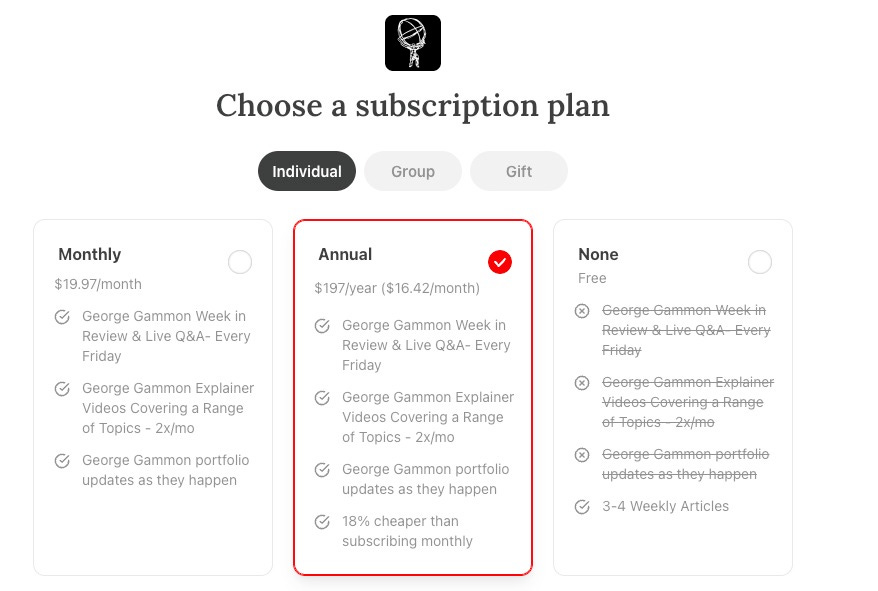

That’s why we built the Rebel Capitalist News Desk…to give you the unfiltered macro insights you won’t find anywhere else.

While the mainstream sells you “solutions,” we show you the playbook they don’t want you to see…and more importantly, how to position yourself before the fallout begins.

👉 Thousands of contrarian investors are already reading Rebel Capitalist News Desk for daily breakdowns of what’s really moving markets.

The question is: are you going to keep relying on the same headlines that missed 2008… or finally get ahead of the curve?

Subscribe today and join the growing community of liberty-minded investors preparing for what comes next.

What about all the PE firms and the Black Rocks buying homes at exhorbitant prices, all cash, artificially increasing the valuations?

I'm usually trackin with you. But don't understand what you mean by lack of housing supply. The inventory levels in 70% of the states are demonstrably up 15-55% yoy. Only the north/north east states have low inventory levels. Can you clarify what you mean?