The Worst Jobs Revision in U.S. History

Just Shattered the “Resilient Economy” Narrative. How are you preparing?

Written by Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | September 12, 2025

For the past 18 months, politicians, pundits, and mainstream economists have repeated the same phrase like a mantra: “The U.S. labor market is strong. The economy is resilient.”

This week, that narrative collapsed.

The Bureau of Labor Statistics just published its annual benchmark revision…the “truth check” where payroll data is reconciled against hard payroll tax filings.

The result? Nearly one million jobs erased from the record books.

This is the largest downward revision in U.S. history, worse even than during the depths of the 2008 financial crisis.

911,000 Jobs Erased

The benchmark revision showed that from April 2024 through March 2025, the U.S. economy created 911,000 fewer jobs than originally reported.

Put simply: every monthly jobs report for the last year was overstated.

In some cases, months that were reported as strong payroll gains were actually negative once corrected.

For comparison:

2008–09 (GFC): −902,000 revision

2024–25: −911,000 revision

This isn’t a minor adjustment. It’s a rewriting of economic history.

The very data that “proved” the U.S. economy was strong has now been revealed as flat-out wrong.

What’s more dangerous than bad data? Building an entire narrative of “resilience” on top of it.

Nearly a million phantom jobs didn’t just vanish…they never existed.

And while the headlines were cheering fake strength, one indicator was quietly screaming the truth.

The question is: why did the bond market see it when policymakers didn’t?

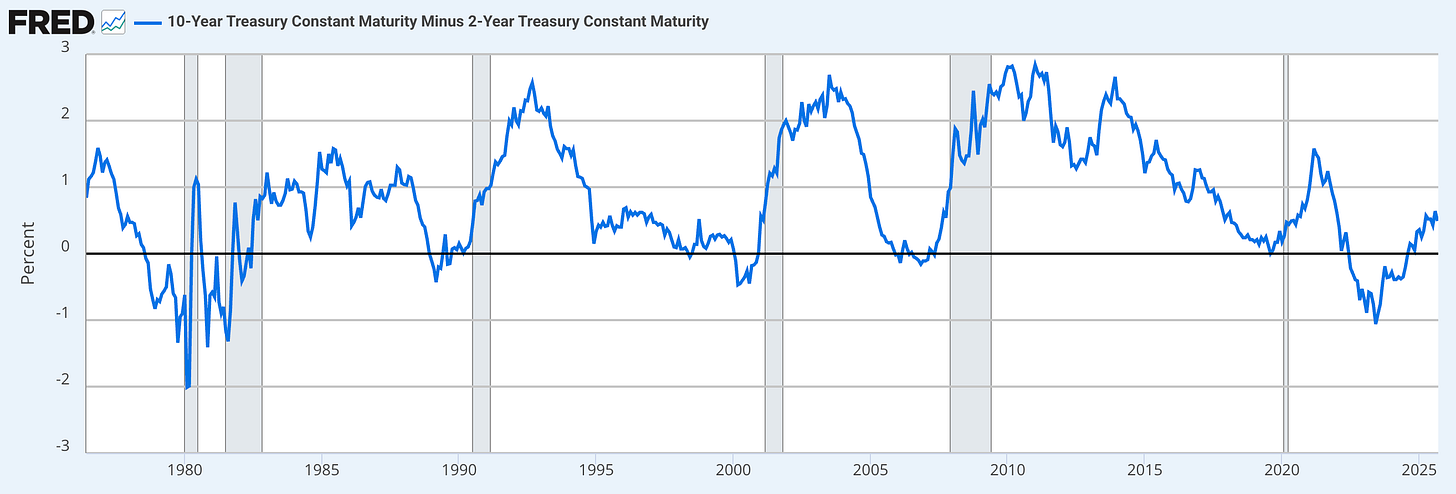

The Yield Curve Was Right All Along

While economists and politicians used “jobs strength” as their favorite talking point, the bond market never bought it.

The 2s/10s yield curve inversion — one of the most reliable recession signals in modern history — has been flashing red for almost a year.

Remember, usually the stuff hits the fan after the curve has “uninverted.”

Now the revisions confirm what the curve was already saying: the U.S. economy isn’t resilient. It’s rolling over.

If the inversion was the canary in the coal mine, then these revisions are the collapse of the shaft. But not all parts of the economy are getting crushed equally.

Some sectors are bleeding jobs faster than others…and the ones hit hardest reveal where demand is truly drying up. The cracks aren’t random. They’re systemic.

Sectors Hit Hardest

The revisions weren’t evenly spread across industries.

Leisure & Hospitality: Initially reported as a powerhouse of job growth, this sector saw some of the heaviest downward revisions. That lines up perfectly with what airlines, hotels, and restaurants have been telling investors about weaker demand.

Professional & Business Services: Supposedly another strong job creator, but much of that “strength” just vanished.

Government Employment: One of the only categories to hold up, underscoring how much of recent GDP growth has been government-driven rather than private-sector led.

This isn’t just an academic exercise. It means households and businesses were far weaker than the headlines suggested.

When leisure, hospitality, and business services are quietly bleeding out, it’s no longer about a “soft patch.”

It’s a structural slowdown. But here’s the kicker: the very agency tasked with measuring these shifts is consistently misfiring.

Which raises the bigger question…how many other parts of the economy are policymakers flying blind on?

Why the BLS Keeps Getting It Wrong

Here’s the uncomfortable truth: the BLS methodology is broken.

Their models rely on assumptions about business formation, seasonal adjustments, and survey data that simply don’t hold up in real time.

Every year, the benchmark revision exposes just how wrong the monthly reports are. But this year was different…it wasn’t just off, it was catastrophically off.

And yet markets, the Fed, and policymakers were making decisions based on this bad data.

Broken models produce broken data. But instead of fixing the system, politicians do what they always do…turn the failure into a weapon.

Each side spins the revisions as proof the other is lying. Yet the real danger isn’t in the partisan squabble.

It’s that nobody wants to admit the foundation itself is rotten.

Political Spin vs. Reality

Already, both sides of the political aisle are trying to weaponize the revisions.

Republicans are pointing to the nearly 1 million phantom jobs as proof the Biden administration manipulated the numbers.

Democrats are trying to downplay the revisions, arguing that all administrations deal with adjustments.

The truth is simpler and more troubling: the system itself is flawed.

These aren’t partisan errors. They’re structural. The models the BLS uses are outdated, and in an economy dominated by services, gig work, and rapid business turnover, their surveys are increasingly detached from reality.

If the data is flawed and the politics are toxic, what’s left to anchor investor confidence? Nothing but the cold math of GDP and payrolls.

And that math now suggests something Washington is desperate to deny: the U.S. might already be in a recession.

But by the time the “official” call comes, what will markets have already priced in?

Recession Risk: We May Already Be In One

Here’s why this matters for investors:

Q1 GDP was already negative (−0.5%).

Q2 GDP faces pressure from falling inventories and a wider trade deficit.

Now we find out the labor market wasn’t adding jobs, it was losing them.

Put it all together, and there’s a real chance the U.S. is already in a technical recession.

And remember: recessions are only declared in hindsight. By the time the NBER makes it official, markets will have moved.

Once you connect the dots…negative GDP, fake payrolls, and a labor market rolling over…it’s no surprise that bonds and the dollar are already moving.

The market isn’t waiting for an NBER press release. But the real danger isn’t what’s happening now…it’s what these signals imply about what comes next.

Bond Market and Dollar Confirm the Shift

The revisions didn’t just hit economists…they hit markets too.

The 2-year Treasury yield dropped sharply, pricing in earlier Fed cuts.

The 10-year yield also moved down, confirming growth and inflation expectations are weakening.

The dollar fell, reflecting expectations that U.S. rates will converge lower with Europe and Japan.

Markets don’t buy the “resilient economy” spin anymore. They’re pricing in slowdown.

Falling yields and a weaker dollar might sound bullish to those nostalgic for the 1980s.

But the people drawing that parallel are missing the most important piece of the puzzle: valuations.

Back then, stocks were cheap.

Today, they’re priced like nothing can go wrong…exactly when everything is starting to.

What the Investment Legends Might Say

If we look at this through the lens of history’s greatest traders:

Stan Druckenmiller would likely be positioning long on Treasuries, anticipating Fed cuts as growth collapses.

Paul Tudor Jones might look for asymmetric short opportunities in equities, especially in overvalued tech stocks most vulnerable to recession.

Ed Seykota, a trend follower, would already be watching the steep drop in yields and payroll revisions as the start of a larger downtrend to ride.

The common theme? Don’t fight the bond market. Don’t ignore the data. Position for what’s coming, not what the headlines say.

When Druckenmiller, Tudor Jones, and Seykota would all be leaning the same way, ignoring the signal becomes an act of willful blindness.

But translating that into action requires more than copying trades…it requires understanding the principles behind them.

That’s where investor discipline either saves or destroys a portfolio.

Investor Takeaways

Here’s how to think about this moment:

The labor market was never strong. The data just caught up with reality.

Recession risk is real. GDP, yields, and payrolls all point in the same direction.

Markets are priced for perfection. High valuations leave no margin for error.

Risk management matters more than ever. This isn’t the time for blind buy-and-hold.

Real assets, cash flow–positive businesses, and safe-haven Treasuries look increasingly attractive compared to overvalued equities.

The lessons are clear: the jobs weren’t real, the resilience was fake, and the risk is now.

But there’s one last, uncomfortable question investors need to wrestle with…if the data that shaped the last 18 months was this wrong, what else are we getting wrong today?

The Bottom Line

The worst jobs revision in U.S. history just confirmed what many of us have been saying: the U.S. economy is not resilient.

It’s fragile.

The bond market has known it all along. Now the data is catching up.

By the time mainstream headlines admit we’re in a recession, it’ll be too late. The time to prepare is now.

The biggest downward jobs revision in U.S. history just pulled the mask off the “resilient economy” narrative.

The labor market wasn’t strong…it was smoke and mirrors. The bond market knew it. The yield curve knew it. Now the data confirms it.

This isn’t just another headline. It’s a signal that recession risk is no longer a possibility…it’s a probability. And when stocks are priced for perfection at nearly 29x earnings, the margin for error is gone.

That’s why staying ahead of the narrative isn’t optional. It’s survival.

And there’s no better time to get plugged in than today…because George Gammon is hosting his Weekly Wrap-Up right after market close.

Premium subscribers will get his unfiltered take on what these revisions really mean for the Fed, the dollar, and your portfolio.

If you’re still on the free list, you’ll miss it…and by the time the mainstream catches up, it could already be too late.

👉 Join the thousands of contrarian investors who already rely on the Rebel Capitalist News Desk.

Upgrade today to get full access to George’s live Weekly Wrap-Up (and the replay), plus in-depth analysis you won’t find anywhere else.

Don’t wait for CNBC to tell you what happened. Get ahead of it…starting now.

I remember the joke from a year ago when the buzz was all the jobs available and the reply was, yes I know, I have three of them.