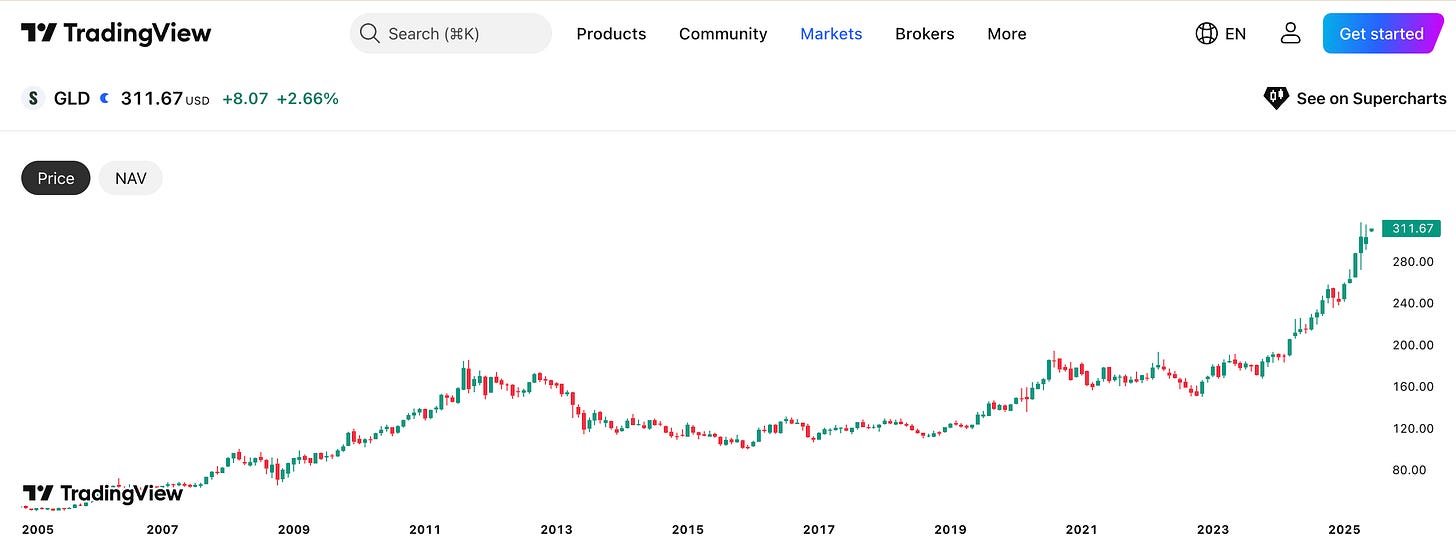

This Gold ETF Just Broke a 12-Year Pattern!

Gold’s breaking records...but the real fireworks may be coming from an overlooked corner of the market. What just triggered a 10-year breakout in junior miners?

By Rebel Capitalist News Desk

Gold just broke out to new all-time highs… and junior miners finally woke up.

That’s not hype…it’s happening.

And here’s the part nobody’s talking about: GDXJ, the junior gold miner ETF, just shattered a resistance level that’s acted like a concrete ceiling since 2013.

What comes next could be explosive.

We’ve all seen gold flirt with greatness before. But this time feels different.

This time, the juniors are confirming the move. And when junior miners play catch-up, history says they don’t just follow…they fly past the pack.

Let’s break down what’s happening… and why smart money is quietly positioning before the fireworks.

What Is GDXJ, and Why Should You Care?

GDXJ is an ETF (exchange-traded fund) that holds shares of junior gold mining companies. This is a basket of smaller miners that carry more risk…but also more upside (potentially) than the big gold mining companies.

Think of it this way:

Big gold companies are like giant ships. They move slow and steady.

Junior miners are like speedboats. When gold goes up, they go up faster.

So when gold is strong and junior miners break out, that can mean one thing:

A big, explosive move… might be coming.

But there’s something even more important than how GDXJ works… It’s the timing of this breakout that changes everything.

Gold Is Already Telling the Story

Gold prices have surged recently. Central banks are buying. Inflation worries are still here. Debt is through the roof. And people are looking for safety.

But here’s what really matters:

Gold has broken out to new highs.

It’s doing this even as the U.S. dollar stays relatively strong.

That’s rare. And powerful.

Gold is telling us something about the system. Something about trust, money, and what people want to hold when the future looks shaky.

And now, GDXJ is finally catching up.

When gold breaks out on a relatively strong dollar, something deeper is at play. And GDXJ may be the first to reveal what the market already suspects…

Breaking a Decade of Resistance

Look at the chart. Since 2013, GDXJ has struggled every time it got near the same level…around $50-$60.

It hit that wall in 2014. Failed.

Tried again in 2016. Failed.

Once more in 2020. Same story.

But now?

GDXJ just smashed through it.

That kind of move isn’t small.

It means new buyers are coming in.

It means people are finally believing that the gold bull market is real…and that the junior miners might be the best way to play it.

When you see a breakout like this…after years of failure…it's not just technical. It’s psychological. And it could unleash a flood of capital… few are prepared for.

Why Junior Miners Can Move Big

Junior miners are like leverage on gold.

Here’s why:

Their profits explode when gold goes up, because their costs stay mostly the same.

Many juniors aren’t even profitable until gold gets high enough. Then they suddenly look amazing.

They often get bought by bigger companies once their mines look valuable.

So when gold goes up 10%, juniors can go up 30%... 50%... even more.

Right now, many junior miners are still cheap. They haven’t moved as much as gold. But that could change soon.

If history repeats, junior miners don’t just follow gold. They catch up…and then pass it.

The question isn’t if juniors will move…it’s whether you’re positioned before they do. Because the window between confirmation and euphoria is short.

How Investment Legends Might Play This

Paul Tudor Jones would look at the breakout and ask: where's the asymmetry?

GDXJ just cleared a level that held for over 10 years. That means the downside may be limited, but the upside could be huge.

He might use options or call spreads to juice the trade. Or go long juniors outright, knowing that sentiment is just starting to shift.

Stanley Druckenmiller loves stories where few people are paying attention. He’d see the macro setup: debt, geopolitics, weak confidence in central banks.

Then he’d look at the technicals. Gold is telling the truth. Juniors are confirming. He might build a core position while keeping powder dry for pullbacks.

Michael Marcus made his fortune riding trends early. He’d see the breakout, buy it, and let the winners run. He wouldn’t overthink it. Just follow the momentum.

The legends don’t chase headlines. They front-run them. So if GDXJ really has bottomed, guess who’s already bought?

What to Watch Next

If GDXJ holds above this breakout level, it could act like a magnet for more buyers.

Chart watchers will jump in.

Momentum traders will pile on.

Hedge funds might rotate in, especially if inflation ticks higher again.

The next resistance zone is far above current levels. That means the runway is clear.

Of course, nothing moves straight up. There will be dips. Shakes. Scary headlines. But the trend changed has been confirmed.

And when trends change after 10+ years, that’s not something to ignore.

The pullbacks will come. The fake-outs will try to shake you out. But if this really is a new trend, you’ll want to hold your position when the next leg higher begins.

Don’t Sleep on the Miners

Everyone talks about gold. Few trade the miners. Even fewer trade the juniors.

That might be a mistake.

Because right now, GDXJ is doing something special. Something it hasn’t done in a very long time. And if gold stays strong…or even just flat at these levels…junior miners might lead the next big wave.

Stay alert. Manage your risk. But know this:

When gold breaks out, and GDXJ follows, fireworks often follow.

The breakout already happened. The market already voted. The only question now is: will you act, or will you watch?

Join the thousands of liberty-minded investors following the Rebel Capitalist News Desk.

We don’t just follow the headlines…we front-run them.

Subscribe for free on Substack to get macro insights, trade ideas, and behind-the-scenes research that others won’t touch until it’s too late.

Rebel Capitalist News Desk

May 30, 2025

I love it! So how would I make some money off of this trend sir? I can’t seem to find a dividend, and I’m new o stocks

At what price would you take profit? Where is your upside target? Thank you