Trump Now Says He Want's Sub 1% Rates

What Happens If He Gets Them?

Written by Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | July 18, 2025

Markets are pricing in a return to normalcy. But what if they’re wrong?

All week, we've seen volatility in the bond market. The narrative is simple: inflation is cooling, the Fed will eventually cut, and everything will be fine. But Donald Trump just threw a wrench into that story…and the market isn't taking him seriously.

They should.

Trump has escalated his calls for dramatically lower interest rates, suggesting not only a 300 basis point cut but pushing for rates below 1%. And behind the scenes, there are credible reports he’s on the verge of firing Jerome Powell.

Some say it’s political theater. But if you understand how markets work, especially under a Trump administration, you know that dismissing tail risks can be very expensive.

Trump Calls for Sub-1% Rates. Seriously!

Let’s cut through the noise. Trump isn't just calling for a standard rate cut. He’s advocating for something far more aggressive: a move from today’s 4.25% all the way down to 1.25% or lower.

In fact, he told Fox News that rates should be below 1%.

That’s not just a jab at Powell. That’s a policy threat.

And with White House insiders now confirming he’s considering firing the Fed Chair outright, the idea that Trump could replace Powell with a "yes man" becomes more plausible.

The most extreme rate cut the Fed has ever implemented in a single move was 100 basis points. Trump is calling for three times that. Maybe more.

But here’s the kicker: it’s not just the rate cut Trump wants…it’s the power to enforce it. And if he gets that power, the consequences could be far more destabilizing than the market is ready for…

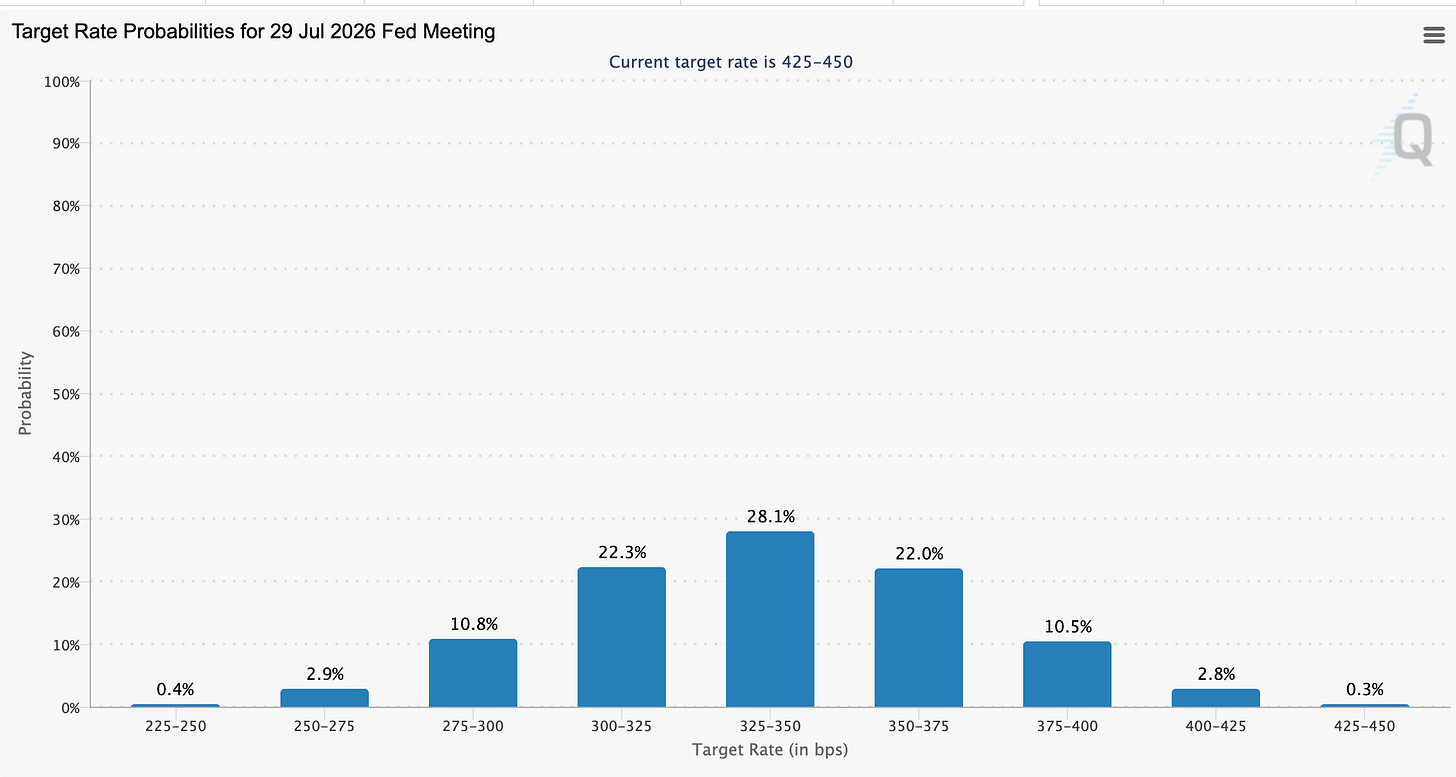

Market Isn’t Pricing It In

Despite these developments, the Fed Funds Futures market sees less than a 0.5% chance of rates going below 2.25% within the next year. That’s a glaring disconnect.

Even if the legal hurdles to firing Powell are significant, we’re talking about Trump…a man whose unpredictability is a feature, not a bug.

So ask yourself: is a 0.5% probability really the right way to model this scenario? Or is the market underpricing a major macro shock?

Betting against Trump’s unpredictability has never been a profitable strategy. So why is the bond market assuming this scenario is too far-fetched to hedge?

The next question is chilling: what happens if Powell really goes?

If Powell Goes, What Happens Next?

Let’s run the thought experiment.

Scenario: Trump fires Powell and installs a dovish loyalist who immediately slashes the Fed Funds rate to 1%. What happens?

1. The Dollar Tanks:

The DXY currently sits at 98. A 300 basis point cut would obliterate the interest rate differential with the ECB, which is holding steady at 2%. The result? A massive drop in the dollar, potentially down to the mid-80s on the DXY.

2. Gold Moons:

Gold is already strong at $3,346. A plunge in the dollar would likely send it soaring past $4,000 in short order. Bitcoin would follow.

3. Stocks Rip…But It’s a Trap:

In the short term, equities would likely explode higher…especially tech. Lower discount rates mean higher valuations, and Wall Street would celebrate.

But beneath the surface, the market would be flashing warnings. Replacing the Fed Chair would undermine central bank independence, increase political volatility, and raise questions about long-term inflation control.

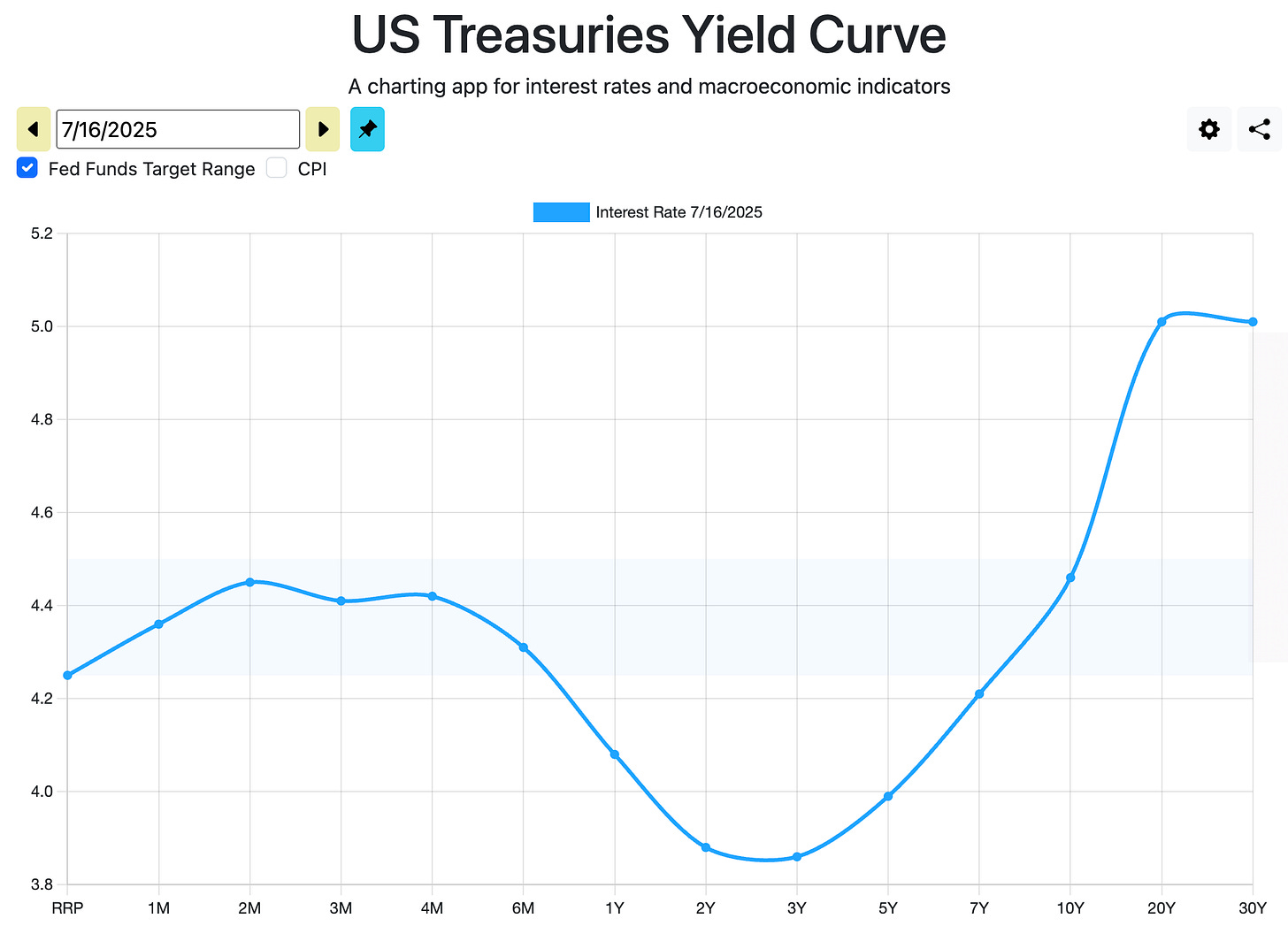

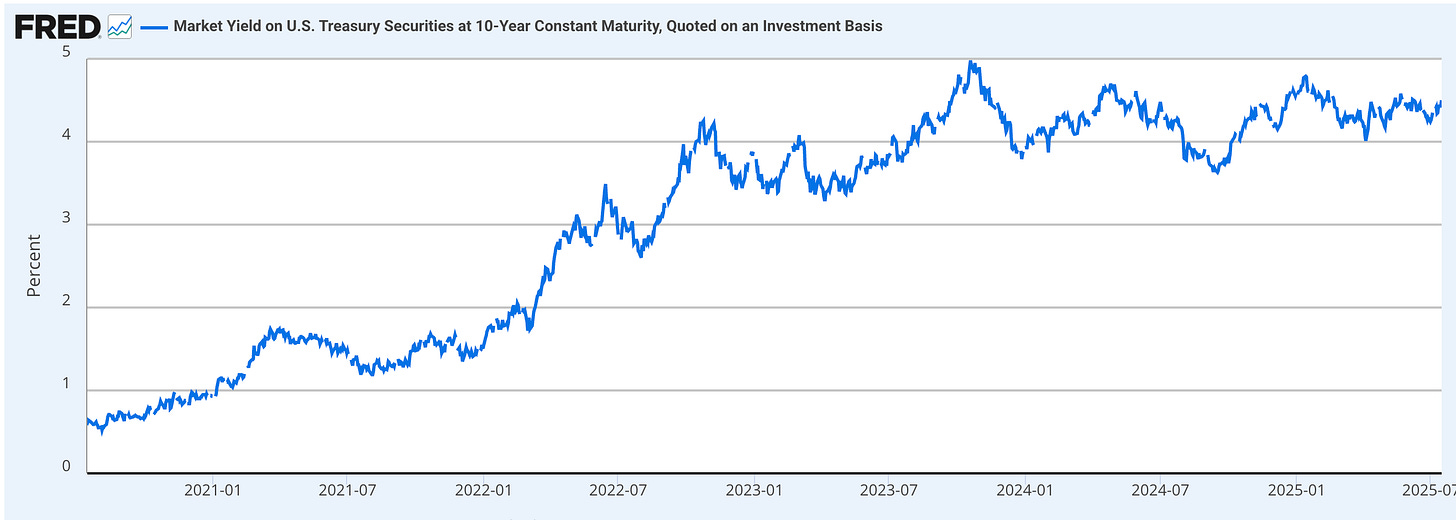

4. Yields Go Haywire:

Here’s where it gets tricky. You might think the 10-year Treasury yield would fall with such an aggressive rate cut. But that’s not a given.

Remember September 2024: the Fed cut rates by 100 basis points, yet the 10-year yield rose by 100 basis points. Why? Because growth and inflation expectations rose.

If markets sees rate cuts as inflationary, long-end yields could spike, even as the front-end collapses. That would steepen the yield curve dramatically.

5. The Real Economy? Not So Fast.

Aggressive front-end cuts don’t necessarily stimulate real growth. Most consumer credit…mortgages, car loans, etc.…is tied to longer-term rates.

If the 10-year doesn’t move much, or worse, rises due to inflation fears, then Powell’s replacement may not get the economic boost Trump is hoping for.

We’ve seen this movie before: cutting rates is not a panacea. And if the labor market continues to soften, lower rates alone won’t stop the slide.

In other words, you could get the sugar high without the nutrition. A market melt-up…followed by an economic letdown. And that brings us to a dangerous illusion markets are clinging to: that we’re still living in 2018.

Markets Are Acting Like It's 2018. It’s Not.

Back then, Trump pressured Powell to cut. He didn’t fire him. But this time feels different.

Trump's calls are louder, the legal risk is real, and his belief in rate suppression is deeper than ever. He views ultra-low rates not just as good policy, but as a patriotic imperative. "Other countries have negative rates, why not us?"

It’s not about economic nuance. It’s about a worldview.

And whether you agree or not, you must recognize that worldview matters to markets.

Back then, Trump rattled sabers. This time, he may draw real blood.

If he believes low rates are a weapon of national interest, then independence at the Fed could be the next casualty.

But there’s another, deeper issue few are talking about…the death of fundamentals.

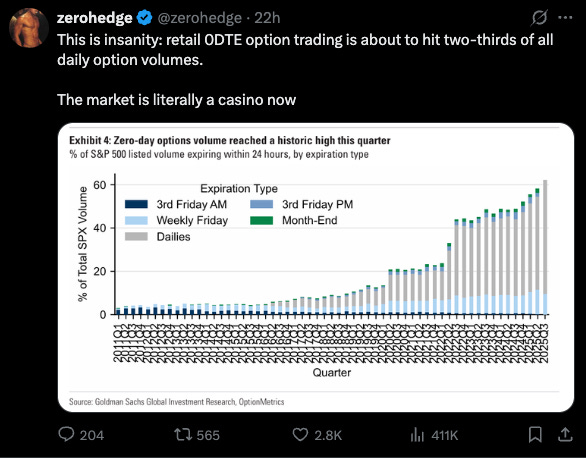

Zero Hedge Is Right: The Market's a Casino

As George pointed out, over two-thirds of options market volume now comes from zero-day-to-expiration trades. That’s not investing. That’s gambling.

Wall Street is chasing headlines, not fundamentals. That’s why even with record valuations and collapsing breadth, the S&P keeps climbing.

Meanwhile, people investing in gold or Treasuries get mocked…even though they’ve outperformed on a risk-adjusted basis.

This disconnect won’t last forever.

And in this casino, monetary roulette is the main attraction. The house might still be standing, but the floorboards are cracking. So the only question that matters now is: how do you play this game without losing your shirt?

So What Do You Do?

We’re not saying a Powell firing is the base case. But it’s no longer a fringe scenario.

Here’s how we’re thinking about positioning:

Long gold: If Trump installs a rate-cutting dove, gold will surge.

Short dollar: Especially vs. euro and Swiss franc.

Steepener trades: Bet that short-end yields fall faster than long-end.

Equities with caution: Ride the wave, but know it’s built on sand.

The biggest risk right now is complacency. Don’t fall for the narrative that everything is under control. Because if Powell is fired, everything changes.

And if you're waiting for Powell to be fired before you position...you’re already too late. The tail risk is real. And by the time the headlines confirm it, the trade will be gone.

Don’t Laugh Off Tail Risk

Trump firing Powell and slashing rates to zero isn’t likely. But it isn’t impossible.

The bond market, the dollar, and gold all have to start pricing that risk in. Because the consequences would be massive.

Currency volatility.

A credibility crisis for the Fed.

And a possible inflationary backlash if confidence breaks.

Sometimes the tail wags the dog. This could be one of those times.

Don’t get caught flat-footed.

When central bank credibility is in play, things don’t unwind in a straight line…they snap. And when they do, the biggest winners aren’t those who predicted it perfectly…they’re the ones who prepared anyway.

🚨 Become a paid subscriber and join George Gammon for his Friday weekly wrap-ups and more…