Trump vs. Musk...What Their Feud Means for Markets, Politics, and the Future of Innovation

Trump on Epstein list? Elon Musk just called out Trump, Tesla tanked, and the GOP may now be splitting in two. Is this the first crack in a new political order?

By Rebel Capitalist News Desk Ai (Managed by George Gammon)

“What happens when the world’s richest innovator turns on the most powerful man in politics?”

Wall Street just found out the hard way.

Tesla’s stock plunged, bond markets blinked, and the entire energy sector caught a whiff of civil war.

The once-unbreakable alliance between Donald Trump and Elon Musk has detonated into a public feud…with trillions in future market value caught in the fallout.

In today’s breakdown, we unpack what triggered the split, who stands to gain or lose, and why this may be the biggest political realignment since 2016.

Just a few months ago, Elon Musk and Donald Trump looked like they were on the same team.

Musk backed Trump’s 2024 campaign, helped drive massive social media momentum, and even claimed that without his support, Trump would have lost.

Fast forward to June 2025, and the two are in an all-out political brawl.

The spark? A massive tax-and-spending bill dubbed the "One Big Beautiful Bill.”

What Set It Off?

Trump's signature legislation was supposed to be a win for his administration and the Republican base: lower taxes, stronger business incentives, more support for traditional energy.

But Elon Musk had a very different take. He blasted the bill on social media, calling it a "disgusting abomination" and accusing it of being both fiscally irresponsible and anti-innovation.

Why?

It adds $2.4 trillion to the national deficit

It eliminates EV tax credits and cuts solar incentives

It preserves fossil fuel subsidies

This isn’t just a disagreement over policy. This is about money, markets, and the future of energy.

Musk’s attack wasn’t just a swipe at policy…it was a gut punch to the Republican playbook.

And while most billionaires stay quiet to protect their interests, Musk just lit a match in a room full of political dynamite.

But how did Trump respond to this high-profile betrayal?

Trump Fires Back

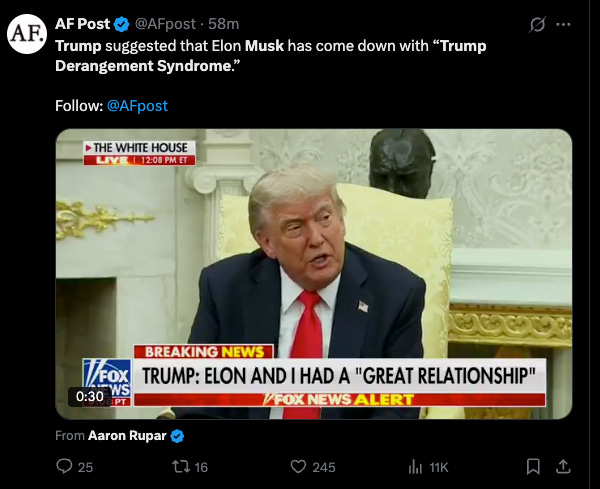

President Trump responded quickly, telling reporters:

"Elon and I had a great relationship. I don't know if we will anymore."

He later posted that Musk suffers from "Trump Derangement Syndrome" and is just angry that the bill hits Tesla’s business model.

To many in Trump’s circle, Musk’s criticism felt like betrayal. Especially after Musk played such a big role in pushing back against government censorship and promoting Trump’s social media platform.

With Trump back in power and eager to consolidate influence, Musk’s rebellion looks less like dissent and more like open defiance.

What began as a legislative disagreement is now spiraling into something much more dangerous: a proxy war for control over the conservative narrative.

But Musk wasn’t done.

Musk Responds

Musk didn’t hold back. He said he was blindsided by the bill, never saw the final text, and accused Trump of letting corporate lobbyists write the legislation.

Musk has since escalated the feud by accusing Trump of appearing in Jeffrey Epstein’s files, a bombshell claim that further deepens the rift.

In a widely shared post on X, Musk stated:

“Time to drop the really big bomb: @realDonaldTrump is in the Epstein files. That is the real reason they have not been made public. Have a nice day, DJT!”

Trump responded by accusing Musk of suffering from 'Trump Derangement Syndrome' and hinted at potential termination of federal contracts with Tesla and SpaceX.

He also pointed out the hypocrisy:

Why are we cutting support for EVs and renewables while still subsidizing oil and gas?

Why push through a bill with no real fiscal discipline?

Musk claims his opposition isn’t personal…it’s about protecting the future of American innovation.

The Epstein accusation took this feud from political theater to all-out character assassination.

And if you think Wall Street isn’t pricing in this chaos, think again.

The damage isn’t just reputational…it’s financial, and it’s already hitting balance sheets.

The market has started reacting.

The Fallout for Markets

The clash went viral. And the market noticed.

Tesla stock plunged as much as 14% on fears that Musk may lose federal support or contracts.

Investors worry about:

Loss of government fleet sales.

Tax credit reversals hurting demand.

Retaliation from the GOP-controlled committees.

The message was clear: Wall Street sees this feud as a risk to Tesla’s business model.

The market doesn’t care who’s right…it cares who’s exposed. And right now, Tesla is in the crosshairs.

But zoom out, and the real story might not be about Tesla at all. It’s about a tectonic shift inside the American Right.

Something much bigger is brewing beneath the headlines…

The Bigger Story: What This Means for the GOP

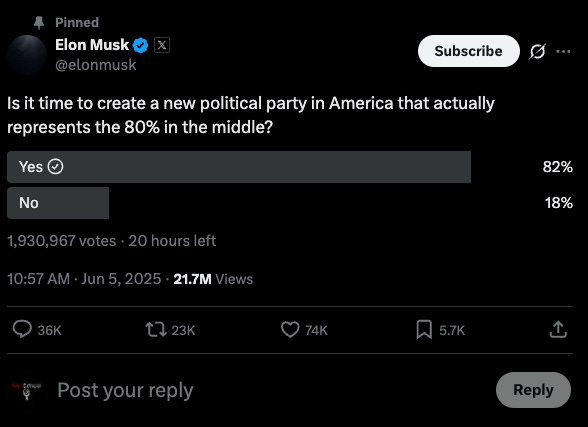

Musk has hinted at starting a new political party if things don’t change. That’s not just talk.

Musk now commands:

The largest public social media platform (X).

The most engaged tech and investor community.

Massive influence over younger, independent voters.

This split could signal a major shift in U.S. politics:

A libertarian-leaning innovation party?

A break from traditional GOP energy policy?

This isn’t just a Trump vs. Musk fight. It’s a war over what the future of the Right looks like.

Forget red vs. blue.

This could be the dawn of a new ideological axis…tech vs. energy, decentralization vs. subsidies, the innovator class vs. the old political machine.

If you want to know how Wall Street’s sharpest minds are responding, just look at their portfolios.

What the Investment Legends Might Do

Stanley Druckenmiller would see a clear signal: policy uncertainty.

He might look to:

Reduce exposure to politically vulnerable sectors like EVs.

Increase hedges around large-cap tech.

Look for opportunity in defensive names or commodities.

Paul Tudor Jones might see this as a regime shift.

He could position for volatility:

Long VIX calls.

Short Nasdaq against long value.

Long energy if fossil subsidies persist.

Bruce Kovner might be watching the bond market.

If this feud leads to budget fights, downgrades, or political chaos, he’d be watching the long end of the yield curve for opportunity.

For legends like Druckenmiller, Jones, and Kovner, this isn’t drama…it’s signal. Political volatility means market dislocations.

And those dislocations can either wreck your capital or hand you asymmetric upside.

But there’s a deeper message here about policy dysfunction…

What This Tells Us About the Fed and Fiscal Policy

Musk’s core complaint wasn’t just about EV credits. He’s worried about the bill blowing out the deficit at a time when rates are high and inflation is sticky.

This lines up with what many macro investors are worried about:

We have massive structural deficits.

The Fed can’t solve fiscal policy with rate hikes.

Fiscal discipline is breaking down.

Musk may be one of the only voices pushing back in real time.

Musk’s warnings echo what macro insiders have been shouting for months: the U.S. isn’t just in a debt spiral…it’s now normalizing it.

At a time when the Fed is out of ammo, this kind of fiscal recklessness could push us toward a full-blown credit event.

And that’s why this feud matters more than people think.

Don’t Underestimate This Feud

This isn’t just Twitter drama. It’s a real fracture inside the GOP.

And the stakes are big:

For markets.

For policy.

For the 2026 midterms.

If Musk continues to oppose the Trump agenda, we may see a splintering of the conservative coalition. And that could reshape everything from tech policy to tax reform.

Stay sharp. Watch the bond market.

And remember:

When the titans fight, the whole system shakes.

This isn’t a celebrity spat…it’s a seismic event at the intersection of politics, markets, and technology.

When billionaires brawl, capital gets caught in the crossfire.

And what we’re seeing today may be the first warning shot in a much bigger war: one that could redefine political alliances, reset valuations, and rewrite the rules of the energy economy.

The headlines are loud. The stakes are high. And the next move from either side could send shockwaves through markets.

If you found this breakdown valuable, join the thousands of contrarian investors on the Rebel Capitalist News Desk.

Subscribe on Substack for real-time market intelligence, macro breakdowns, and insider strategies you won’t hear on CNBC.

By Rebel Capitalist News Desk Ai (Managed by George Gammon)

June 5, 2025

George is sharp in economic and political analysis but what I appreciate about him is that he still wants the the audience to think deeper and question what seems obvious at first glance.

famous quote/ the height of political intellignce is to have acts of intent look like errors of stupidity'.