U.S. Gets a Debt Downgrade… and Yields Fall? Here’s Why the Market Doesn’t Care

Yields fell after the U.S. got downgraded...again. Why would investors rush into Treasuries right as headlines scream "fiscal doom"? The answer might surprise you…

By Rebel Capitalist News Desk

On Friday, the U.S. government had its credit rating downgraded…again.

You’d think something like this would spook investors, send interest rates soaring, and cause panic in the bond market.

But guess what happened instead?

Yields actually fell from their intraday highs as investors bought Treasuries, reflecting a flight to safety rather than a panic sell-off.

That’s right. After the downgrade, the market ultimately responded by buying Treasuries, not selling them.

Long-term yields fell. Which tells us something very important:

The market doesn’t care much about debt downgrades or scary deficit headlines.

What really matters to bond investors is growth and inflation expectations.

Let’s break it down in simple terms.

What Is a Debt Downgrade?

When a credit rating agency like Fitch or S&P lowers the U.S. credit rating, it means they think the U.S. is a little less likely to pay back its debt on time. This sounds like a big deal…and technically it is.

But U.S. Treasuries are still considered the safest and most liquid assets in the world. When people get scared, they run toward Treasuries, not away.

So why did yields fall today?

What Are Yields, and Why Do They Matter?

A bond yield is the interest rate investors earn by buying a bond. When people buy bonds, their prices go up…and yields go down.

So falling yields today mean that more investors were buying Treasuries, even though the U.S. just got downgraded. That tells us something very important:

Bond markets are focused on growth and inflation, not credit ratings.

What Really Drives Yields: Growth and Inflation

Bond investors care about two big things:

Inflation – If prices are rising fast, investors want higher yields to protect their purchasing power.

Growth – If the economy is booming, interest rates tend to rise as people and banks are willing to take more risk, borrow more, and invest in expansion.

But if inflation is falling and the economy is slowing, people buy bonds because they expect:

Lower inflation

Slower growth

Potential rate cuts by the Fed

That’s what we’re seeing right now.

Even though the U.S. got a downgrade, inflation data is softening and signs of an economic slowdown are growing.

That’s why bond buyers stepped in…they think the Fed might be done hiking rates, and possibly even cutting soon.

A Look Back: What Happened in Past Downgrades?

This isn’t the first time the U.S. has been downgraded. Let’s look at the last two major examples and see how long-term Treasury yields responded.

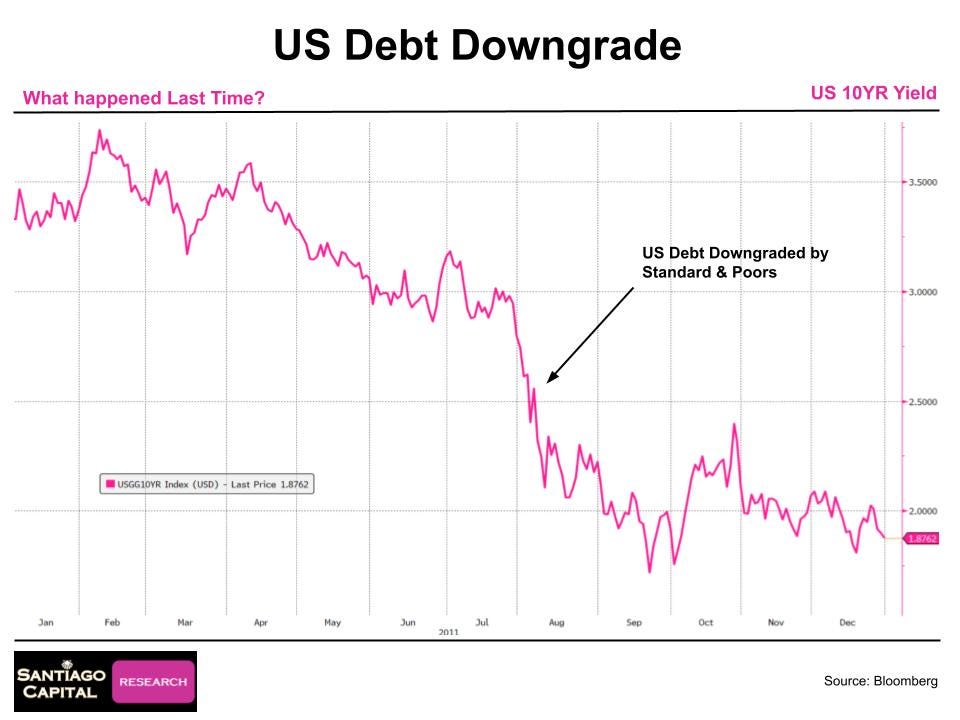

1. S&P Downgrade in August 2011

Event: S&P downgraded the U.S. from AAA to AA+ on August 5, 2011.

Expected Reaction: Investors would panic. Rates would rise.

What actually happened:

10-year Treasury yields fell from 2.57% to 1.89% in just a few weeks.

Stocks dropped, and investors fled into Treasuries.

Despite the downgrade, Treasuries became more popular, not less.

Why? Because 2011 was a time of global fear: the Eurozone crisis, weak U.S. recovery, and concerns about deflation. Investors were worried about growth…not the U.S.’s ability to pay its bills.

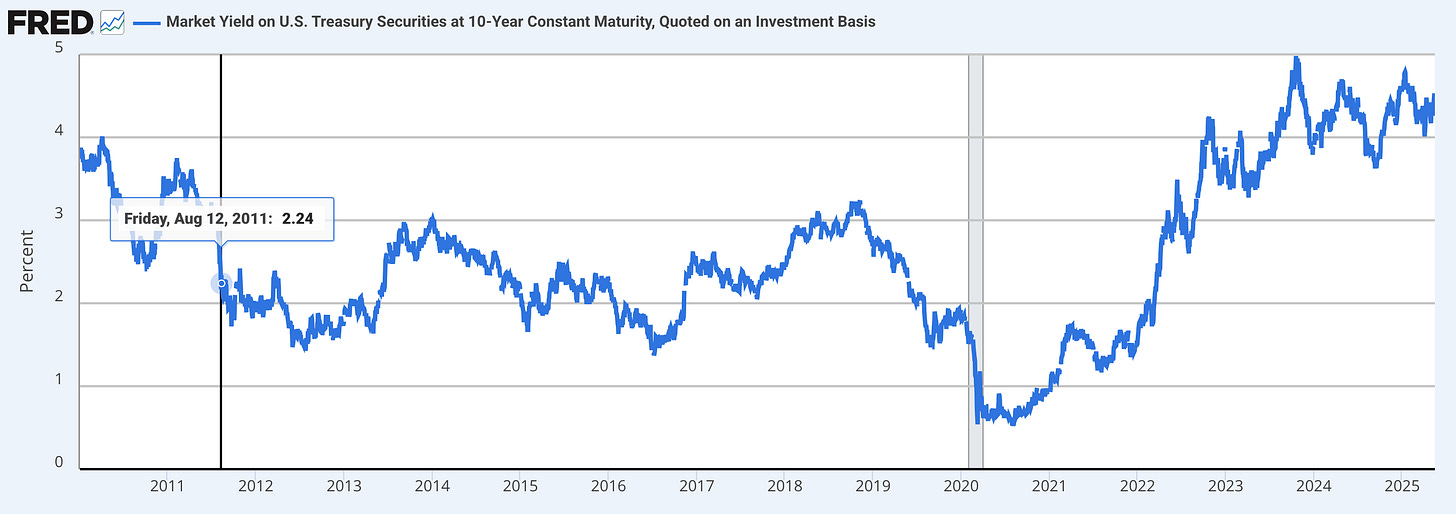

The chart above shows the Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity from 2011 to 2025.

It confirms the article’s claim: yields dropped significantly after the 2011 downgrade, falling to 2.24% by August 12, 2011, as indicated on the chart.

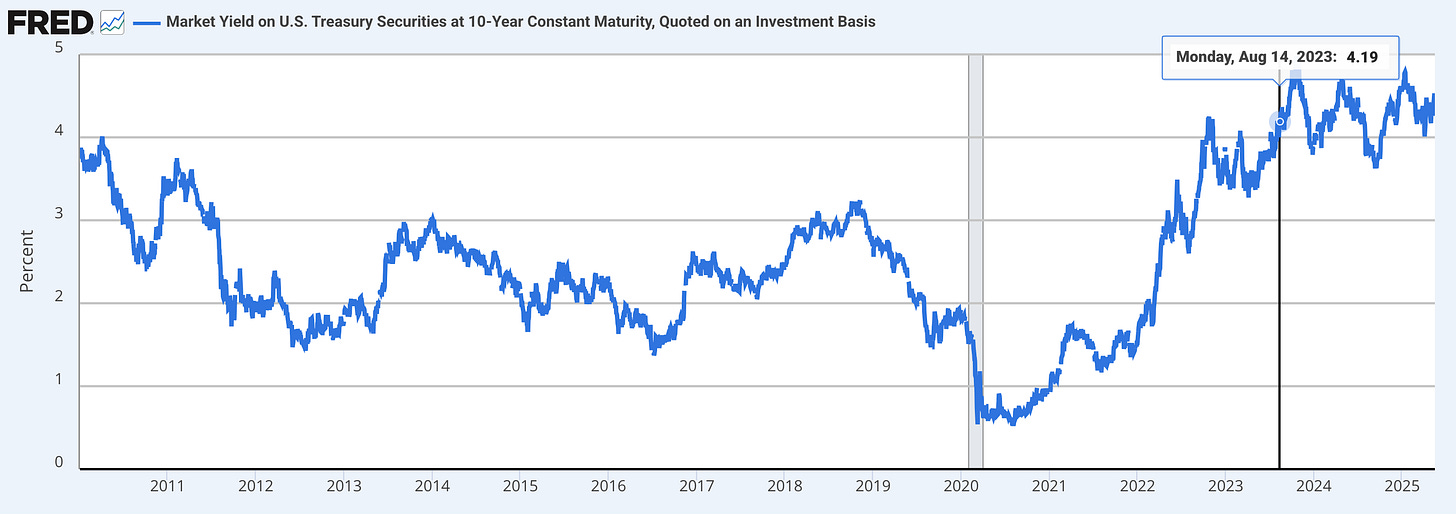

2. Fitch Downgrade in August 2023

Event: Fitch downgraded the U.S. on August 1, 2023, citing rising debt and political dysfunction.

Market reaction:

Yields were already rising in July 2023 due to strong economic data.

But after the downgrade, yields briefly spiked, then flattened out as markets turned their attention to inflation and Fed policy.

The key takeaway? Even in 2023, with debt levels much higher, the bond market didn’t collapse. Why?

Because inflation was cooling.

Because the Fed was closer to pausing rate hikes.

Again, the downgrade made headlines, but inflation and growth expectations drove the actual yield moves.

The chart above illustrates the yield trend around the 2023 Fitch downgrade, showing a peak at 4.19% on August 14, 2023, followed by a stabilization, supporting the article’s description of the market’s reaction.

Why the Market Still Buys U.S. Debt

Even with more debt and downgrades, the U.S. still has huge advantages:

Deep, liquid markets

Dollar as the world’s reserve currency

Legal control over its own currency

That means the U.S. can always “make payments” — even if it has to print to do so. And for global investors, there’s still no better place to park money than long-term Treasuries when uncertainty rises.

So when there's fear or a slowdown coming, big money flows into Treasuries, pushing yields down.

What This Means for Investors

Don’t let headlines fool you. Debt downgrades sound scary, but markets don’t move just because of ratings agencies. They move based on the real economy:

Are prices rising or falling?

Is growth strong or slowing?

Today’s reaction…yields falling…shows that the bond market is focused on cooling inflation and weaker economic momentum, not credit ratings.

That’s not to say deficits don’t matter. Over the long run, too much debt can lead to problems, but these problems show up in a less efficient economy due to the economic distortions of government spending, not long end rates.

Final Thoughts: The Market Sends a Clear Signal

We just saw another downgrade. But instead of freaking out, the bond market sent a different message:

“We’re more worried about a slowdown than about a default.”

In 2011 and 2023, long-term yields weren't impacted significantly by U.S. downgrades.

So next time you see a scary headline about deficits or ratings cuts, remember this:

The bond market cares about growth and inflation, not political drama, credit rating changes, or deficits for that matter.

And right now, the message from yields is clear: Inflation is falling. Growth is slowing. The Fed might be done tightening.

In that world, Treasuries look good…even after a downgrade.

Reporting by Rebel Capitalist News Desk