Why U.S. Debt Is Headed to $100 Trillion...

...and Nobody Understands Why It Matters!

Written by Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | July 25, 2025

Forget the headlines. Forget the pundits warning for the 97th time that "this time" the bond vigilantes are coming.

If you truly understand how the global monetary system works…especially the role of commercial banks…you'll realize something extraordinary: not only is $100 trillion in U.S. debt possible, it might already be baked into the cake.

This post isn't about scaremongering. It's about clarity. And once you see how the plumbing works, you'll never look at Treasury auctions, interest rate spikes, or debt-to-GDP ratios the same way again.

The Path to $100 Trillion: It’s Not Just Possible, It’s Probable

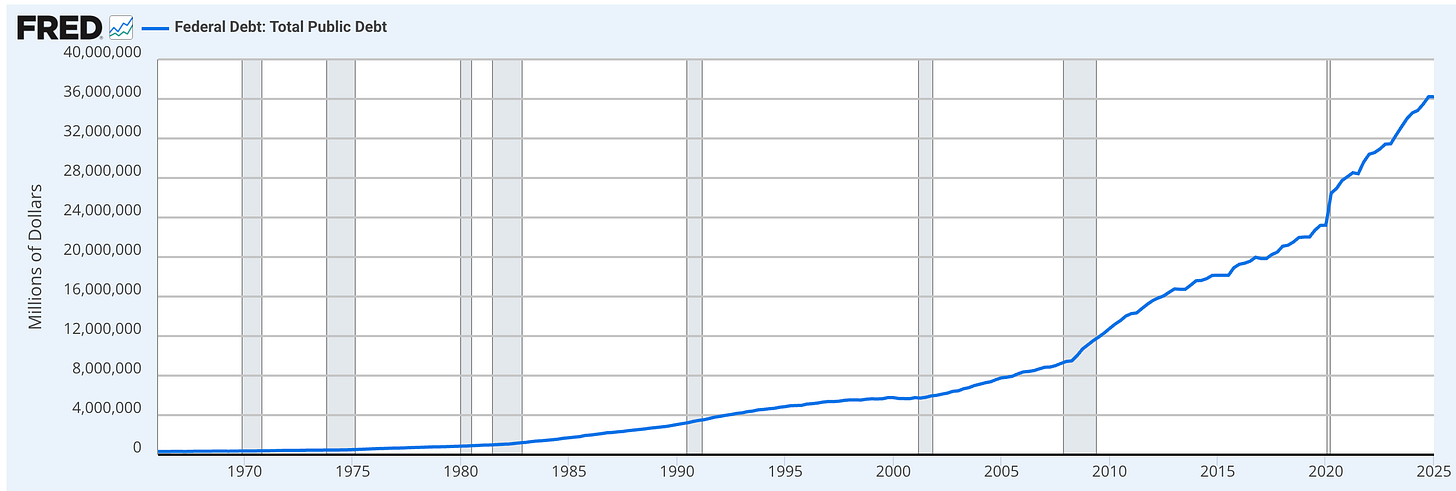

Let's begin with a chart showing U.S. government debt from 1970 to today.

In 1980, we were at a quaint $900 billion. Now? Over $37 trillion. And this isn't a straight line, it's an exponential curve...kind of.

But even that chart is misleading.

When you switch to a log scale, you see that while the debt is growing rapidly, the percentage growth has actually slowed since the 1970s and 1980s.

Back then, we were 3x-ing debt every decade. So why can’t we do the same from $37 trillion to $100 trillion?

Answer: we absolutely can. And we likely will, in under 10 years.

But raw debt levels tell only part of the story.

To truly understand why $100 trillion isn’t just feasible but likely, we need to dig deeper into who’s actually buying this debt….and how they’re doing it.

Because once you understand how the system manufactures demand, the scale of future issuance becomes far less mysterious...

The Misunderstood Role of Commercial Banks

When people talk about who will buy all this debt, they usually picture the Fed doing QE or foreign governments recycling trade surpluses. But that misses the real money engine: commercial banks.

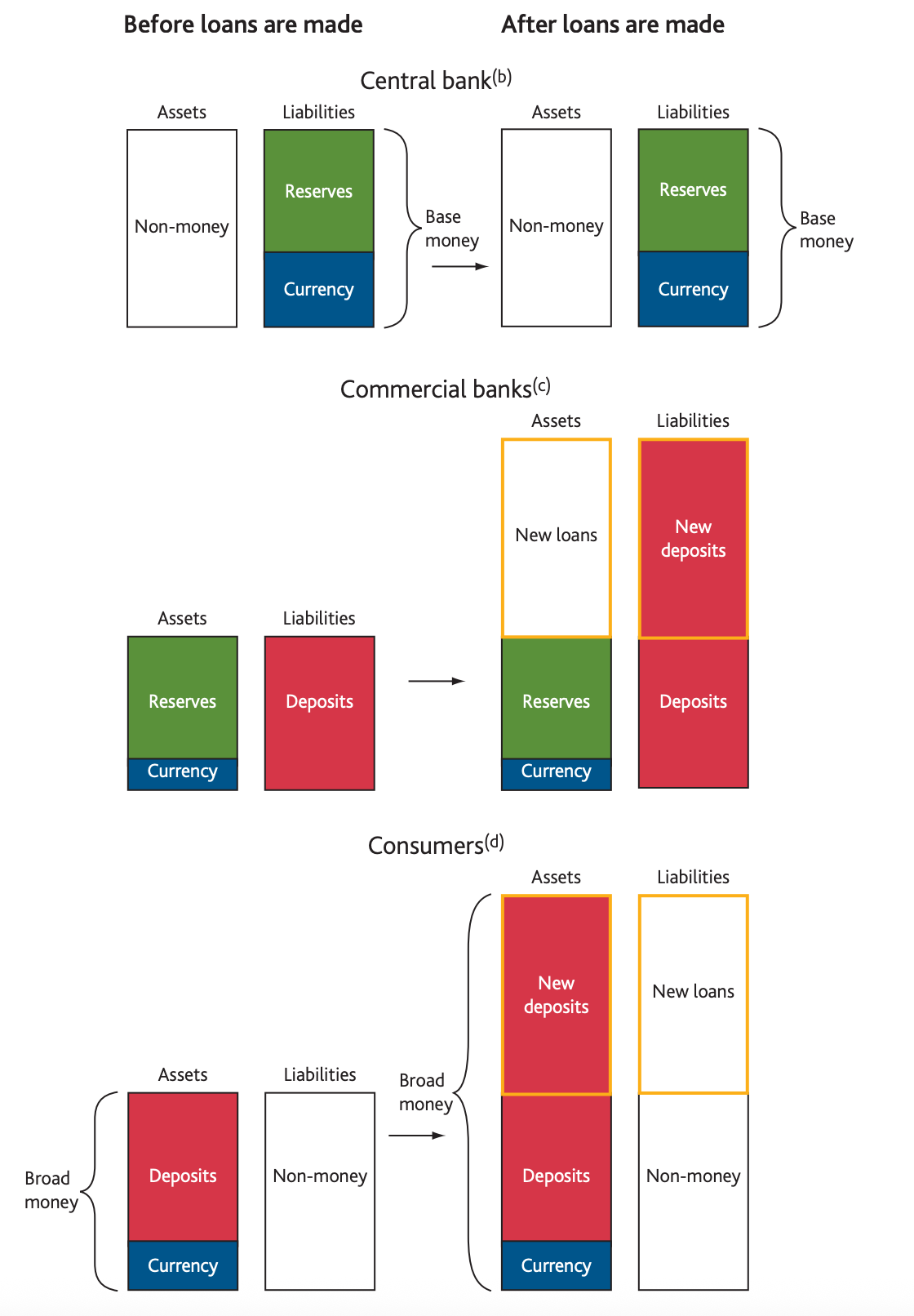

Banks don’t lend out deposits. They create new money when they issue loans or when they buy assets…including Treasuries.

The balance sheet effect is the same. A bank buys a $1 million Treasury from a non-bank entity, credits the seller’s deposit account $1 million, and adds the Treasury to its assets. Voila, new money.

This process has zero dependence on pre-existing money. The bank creates both the asset and the liability.

This isn’t theory…it’s daily operational reality. Banks are the hidden gear-works of modern finance, and their ability to conjure deposits from thin air is what makes sovereign debt issuance so seamless.

But if they’re the real buyers…why hasn’t this triggered a monetary explosion?

The answer lies in the system’s expanding capacity.

History Proves the Capacity is There

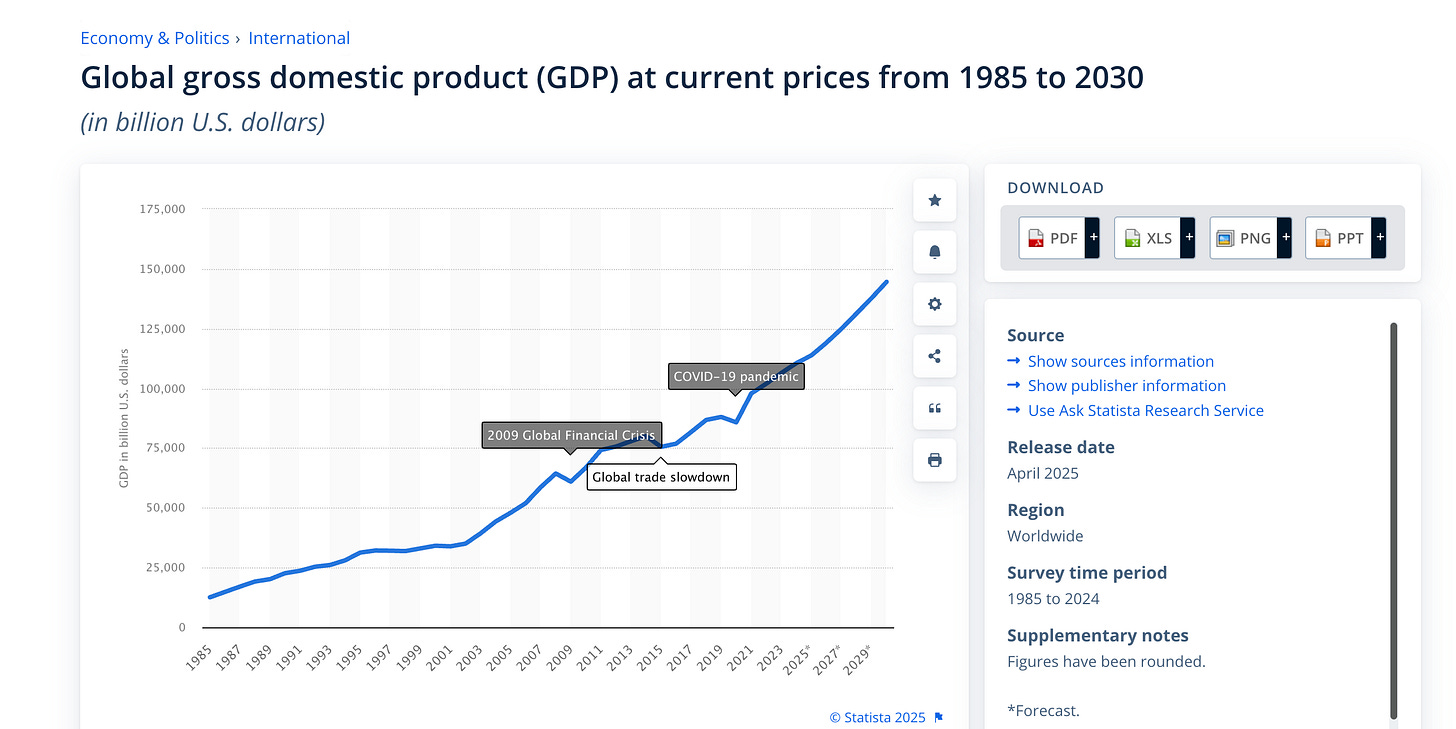

In 1985, global GDP was about $12 trillion. U.S. debt was $1.7 trillion. Today, global GDP exceeds $100 trillion, and the U.S. debt is $37 trillion.

Despite this massive increase, we haven’t seen runaway inflation (excluding recent COVID shocks) or spiking long-term rates. Why? Because the capacity to absorb Treasury issuance has grown with the banking system's ability to create money.

This is the missing link in virtually every mainstream macroeconomic model.

The lesson here isn’t that debt doesn’t matter…it’s that most people misunderstand how it’s financed.

And as long as commercial banks remain willing participants in this dance, the system can expand far beyond what most consider “sustainable.”

But even then, skeptics will point to rising yields as a sign the music is about to stop…

"But Interest Rates Spiked!" (Yes, But That’s Not the Point)

Critics will point to rising yields and say, "See! Supply does matter!"

Not really.

Yields are primarily driven by growth and inflation expectations. Supply impacts short-term moves, but over the long run, the price of money is determined by what banks think the economy will do.

If a bank believes nominal GDP will grow at 4.5% over the next decade, they’ll gladly buy 10-year Treasuries yielding 5.5%. That’s easy arbitrage.

And remember: they're creating money to buy these. They’re not giving up anything. It's not like you or me deciding to spend our savings.

Interest rates tell a story, but it’s not the one you think.

While headlines scream “debt crisis,” the banking system is quietly arbitraging future growth expectations and creating new money in the process.

Still, a fair question remains: if banks can do this so easily, what’s stopping them from gobbling up every asset on Earth?

What Stops the Banks From Buying Everything?

This is the natural next question. If banks can create infinite money, why don't they buy all the real estate, stocks, and gold in the world?

Because when they create money, they also create liabilities.

Unlike a counterfeiter printing money in a basement, a bank issuing a loan or buying an asset must match that with a deposit liability. That liability might be withdrawable on demand, or it might require interest payments. Either way, it creates risk.

That’s why banks still make risk-adjusted decisions. Treasuries are attractive not because they never lose value (they do, if sold early), but because they can be held to maturity and guarantee principal return.

Plus, they match up well with deposit liabilities in terms of maturity (more so in Eurodollar market).

So no, banks can’t simply binge on assets without consequence.

Every asset bought creates a matching liability, which introduces risk and constraints.

That’s why Treasuries remain the asset of choice…they’re predictable, liquid, and match maturity profiles. But even this doesn’t eliminate the concern everyone fixates on: inflation.

But What About Inflation?

Won’t all this money creation be inflationary?

Maybe. But not necessarily.

A lot of it depends on how much money is also being destroyed.

Remember if more loans are being paid off than created the money supply in total shrinks. So you have to consider the net difference by looking at not just money creation but money destruction.

Inflation isn’t just about printing…it’s about flow.

The net effect of money created versus money destroyed determines pressure on prices. That means debt expansion doesn’t automatically trigger inflation. But if that’s the case…what exactly should we be worried about? Here’s the real risk…

The Real Risk: Not Collapse, But Misunderstanding

Here’s the kicker. Everyone from CNBC anchors to TikTok macro bros continue to warn that "this is unsustainable."

And yet, the debt keeps growing. The world keeps turning. Treasury auctions keep clearing.

The real risk isn't a bond market collapse. The real risk is policy makers, investors, and the public making decisions based on a flawed understanding of money.

When the world’s most powerful institutions misread how money is actually created, they set policies that can backfire catastrophically.

Misunderstand the plumbing, and you misallocate resources, misjudge risks, and mislead the public. That’s why the final piece of this puzzle isn’t financial…it’s educational.

Understanding the Machine

The U.S. debt will hit $100 trillion. It’s not a question of if, but when. And when it does, the world will still spin, banks will still lend, and Treasuries will still find buyers.

Because the real engine of money creation isn’t the Fed or the Treasury. It’s the commercial banking system.

And until the incentives for banks change (the stop wanting free money) or until risk/reward profiles flip, they will continue to fund the U.S. government without blinking.

This is the reality most miss. But now, you know.

🚨 Become a paid subscriber and join George Gammon for his weekly wrap-up at 4 PM EST on Friday…We’ll see ya on Friday!

When commericial bank buys treasuries from non-bank entity:

The after diagram shows the liability for the treasuries, but doesnt show the Asset of the treasuries?

Brilliantly articulated. I view digital ledger systems including my own accounts completely differently now. Thanks to you and snider.