Will We Ever Have a Recession Again?

The Political War on Reality

Written by Rebel Capitalist AI | Supervision and Topic Selection by George Gammon |August 7, 2025

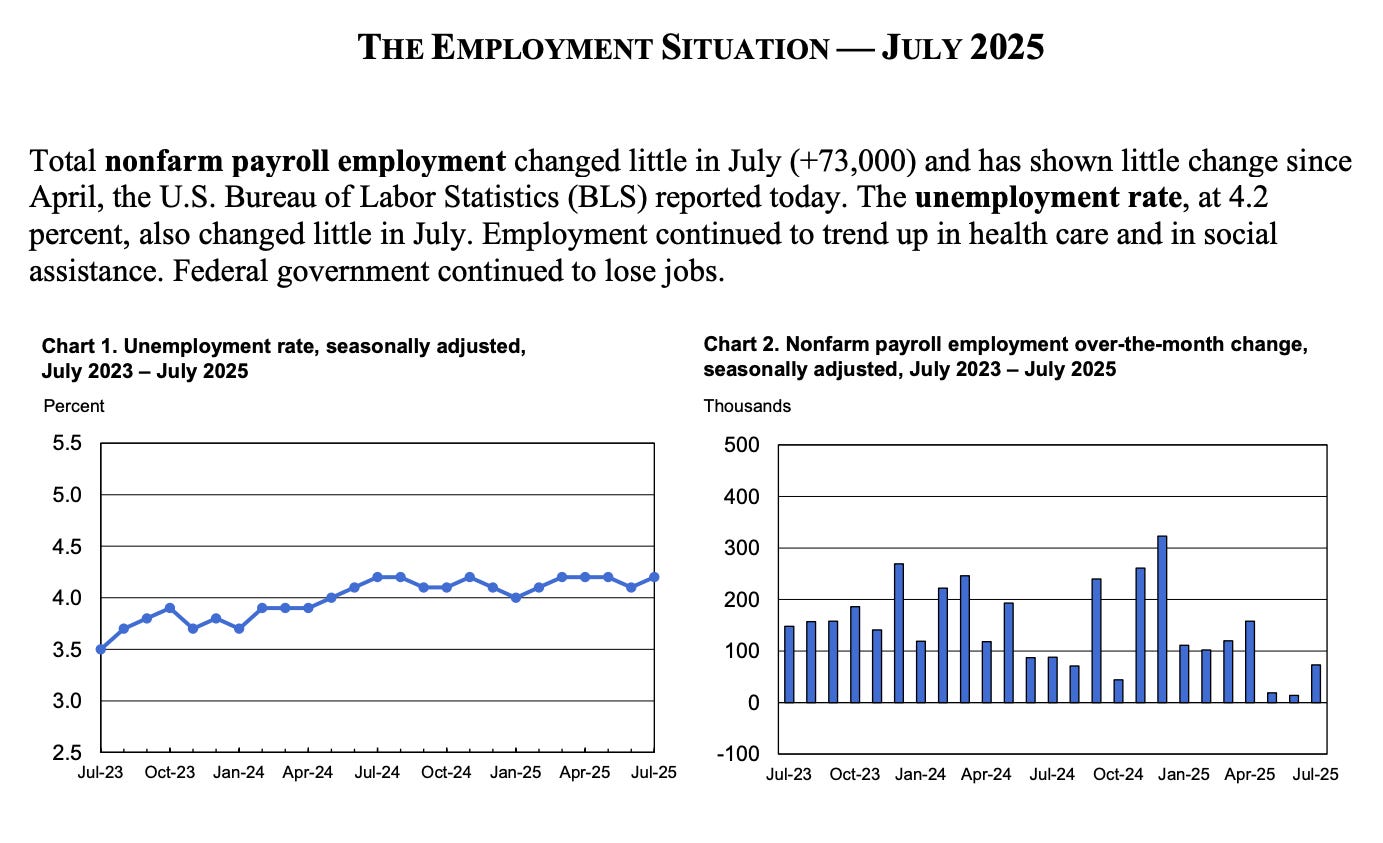

The July jobs report shocked markets for all the wrong reasons…an anemic 73,000 new jobs and historic downward revisions that rewrote the labor market narrative.

But perhaps more concerning than the numbers was the political response: Donald Trump fired the head of the Bureau of Labor Statistics.

And if the speculation proves true…that he’ll install a loyalist with an eye on “spinning the numbers”…then we may be entering a new era in which America never has an official recession again, no matter how dire things get.

This isn’t a post about tinfoil hat theories.

It’s a sober analysis of how political incentives, central planning, and narrative control have combined to threaten the most basic economic truths.

And it raises the chilling question: If official unemployment data is gamed, will we ever again get a clear signal that the economy is in recession?

It All Comes Down to the Labor Market

The National Bureau of Economic Research (NBER) is the official scorekeeper of recessions.

And while they consider a range of indicators, one reigns supreme: the labor market.

Specifically, the unemployment rate.

Here’s the problem: if the unemployment rate never rises, NBER will never call a recession.

It doesn’t matter if GDP contracts for two straight quarters. It doesn’t matter if millions of people lose their jobs or businesses shutter across the country.

If the unemployment rate stays at 4.2%, then according to the official data, the economy is just fine.

And that data? It comes from the Bureau of Labor Statistics.

Now Trump has fired the BLS chief.

If the unemployment rate is the keystone holding the official narrative together, what happens when the person in charge of measuring it is incentivized to lie?

We’re not just talking about data tweaks…we’re talking about turning the labor market into a political weapon.

What Happens When a Loyalist Runs the Data?

Let’s be fair. The previous BLS head was arguably incompetent.

The revisions to May and June’s job reports were catastrophic…worse than during the Great Financial Crisis and COVID.

These revisions were so extreme that, had they been reported initially, they would have caused a market panic.

So maybe a shake-up was needed. But what happens when the person in charge has a political incentive to make sure the numbers look good…regardless of reality?

If the new BLS head is a yes-man (or yes-woman), here’s what you might see:

The establishment survey (headline job number) will never print below 100,000.

The unemployment rate will magically stay pinned to 4.2% or lower.

Birth-death adjustments…the most opaque part of the jobs data…will be used to justify hiring growth even when none exists.

Labor force participation will quietly fall, pushing down the unemployment rate artificially even as people stop looking for work.

None of this is a conspiracy theory.

These are all tools already used to shape the narrative. The difference is the intent behind how they’re applied.

The tools for deception are already built into the system.

But if political loyalty becomes the guiding principle, those tools won’t just be misused…they’ll be weaponized.

And when the numbers no longer reflect reality, how do we even know when the economy is in crisis?

Can We Have a Recession Without One?

Imagine this: unemployment stays low, the jobs number stays above 100k, but everything else deteriorates.

Your friends are out of work.

Your town sees stores close down.

Food and energy prices rise while wages stagnate.

GDP contracts. Real disposable income falls.

But the unemployment rate? Still 4.2%.

In that world, are we in a recession?

According to NBER? No.

According to CNBC? No.

According to your lived experience? Absolutely.

We’ve entered a post-truth economy, where narrative trumps numbers and perception replaces reality.

As Ron Paul put it perfectly, we live in a post-reality world. And that has profound consequences for markets, policy, and freedom.

When perception is manufactured and dissent is dismissed, you don’t just lose trust in data…you lose your bearings entirely.

And the scariest part? This isn’t theoretical.

We’ve already seen the playbook in action.

We’ve Been Here Before

Remember 2022? Q1 and Q2 both posted negative real GDP, meeting the textbook definition of a recession. But NBER didn’t call it.

Why? Because unemployment was still low.

And now that precedent has been set: so long as the labor market doesn’t visibly crack, no recession will be officially acknowledged.

And now, the White House controls the data.

If they could dismiss two quarters of negative GDP in 2022, what else are they willing to rewrite? When the rules are bent once, they’re rarely unbent.

Which brings us to the core deception hiding in plain sight…

What’s Really Going On Under the Hood?

While headline jobs may say “moderate growth,” the household survey paints a darker picture. Two of the last three months showed job losses over 250,000. That’s a million jobs gone.

But none of it moves the market because investors, pundits, and even the Fed only care about the establishment survey and the unemployment rate. Everything else is ignored.

This is why so many Americans feel gaslit. They’re told the economy is booming…but their bank account says otherwise.

It’s not just that the establishment survey and unemployment rate are misleading…it’s that everyone knows it, and yet nothing changes. So how exactly are they cooking the books?

Time to examine the most abused mechanism of all…

The Birth-Death Loophole

One of the easiest ways to manufacture job growth is through the birth-death model. This part of the jobs report estimates how many businesses were created or closed in a given month.

It’s completely subjective.

If you want to juice the number, just estimate that 300,000 new businesses were born last month and assume each hired 10 workers. Voilà…3 million jobs.

This isn’t a conspiracy. It’s how the sausage is made. The only question now is whether the new BLS chief will use it to manipulate rather than estimate.

A statistical shortcut has become a political sledgehammer. If the birth-death model is turned into a jobs printing press, what happens to market expectations?

The answer lies in the growing gap between Main Street reality and Wall Street delusion…

The Market’s Blind Spot

If the BLS data is politicized, and NBER won’t declare a recession without a higher unemployment rate, then what is the trigger for a Fed pivot?

Historically, rate cuts and QE came after the Fed “realized” the economy was in trouble. But if the data no longer reflects reality, the pivot may be delayed…or never happen.

The market, reliant on that pivot, could be blindsided.

Meanwhile, those watching real-time data…credit card delinquencies, real wages, household surveys…will know the truth. But will that truth matter to Wall Street?

When the market worships flawed data, pivots get delayed, risk builds quietly, and reality hits like a freight train. So how does this movie end?

Not with a bang…but with an eerie, manipulated calm…

How It All Ends: Recession Without Acknowledgement

Let’s take the logic to its extreme. Imagine a full-blown depression:

Soup lines.

Empty shelves.

Crashing asset prices.

Surging bankruptcies.

But the unemployment rate is still 4.2%.

Would the stock market sell off? Maybe not. Maybe the S&P soars on hopes of more stimulus. Maybe the media declares it a “soft patch.” Maybe politicians argue the depression is a myth pushed by the opposition.

If the public buys the narrative, markets might too.

That’s the danger of a post-truth system.

When the scoreboard is rigged, winning or losing doesn’t matter…perception does.

But if the system demands delusion to survive, what’s your defense as an investor trying to see clearly through the fog?

How to Prepare: Truth as an Investment Edge

In this environment, seeing through the spin is your edge.

Don’t rely on headline data.

Watch real indicators: tax receipts, shipping volumes, energy demand, credit card balances, delinquencies, job openings.

Be cautious of sudden “miracle” data improvements right before elections.

Hedge against fiat distortions with hard assets: gold, silver, bitcoin.

Remember: once data is politicized, all bets are off.

In the age of narrative warfare, your ability to separate signal from noise becomes a survival skill.

And the most dangerous illusion of all?

That we’ll never have another recession…not because the pain isn’t real, but because they’ve buried the proof.

The “Never Again” Recession

Will we ever have a recession again?

The real economy? Absolutely. Recessions will continue as cycles ebb and flow.

But officially? As declared by the government and reinforced by the media?

Not if they control the data.

This new era isn’t just about politics. It’s about trust. In institutions. In markets. In truth itself.

And once that trust is gone, it doesn’t come back easily.

That’s why you must learn to think critically, follow independent voices, and prepare for the world as it is…not as they say it is.

Because in a post-truth economy, your greatest asset isn’t capital.

It’s clarity.

This isn’t just about politics…it’s about the collapse of objective reality in financial markets. When the data becomes a tool of propaganda, your ability to think independently becomes your greatest edge.

Join the thousands of liberty-minded investors who’ve chosen clarity over consensus. Subscribe to the Rebel Capitalist News Desk on Substack for exclusive insights, real macro analysis, and the truth behind the numbers.

Because in a world built on illusion… clarity is power.

That pirate ship permanently set sail in 2008 and never looked back.

It seems that every analyst is missing the point of firing the head of BLS. It’s not loyalty Trump wants, it’s accuracy. He hates revised numbers and he hates bad information. Good decisions can’t be made on bad information-period. Read the Art of the Deal. Part of the strategy is to vet the information and verify its accuracy. If the adversary has bad intel, use it against them. If you have bad intel, it’s always to your detriment. Don’t over analyze the simple facts.