Shocking New Jobs Numbers Just Released…You Won’t Believe This

The Shocking Revelation

Hold onto your hats, folks! The latest job numbers have just been released, and they’re nothing short of jaw-dropping. A staggering 336,000 jobs were added last month, blowing past all expectations. But before we pop the champagne, let’s pause. Is this a sign of an economy on steroids, or is there more than meets the eye? Let’s dissect this enigma, layer by layer, and see if we can reconcile these booming job numbers with other economic indicators that seem to tell a different story.

The Job Market: A Closer Look

The Numbers

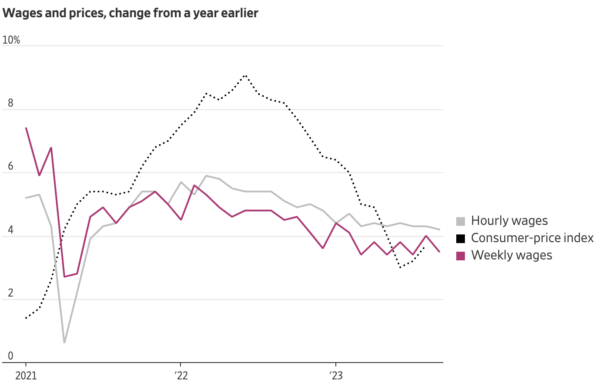

According to the Wall Street Journal, the U.S. economy added a whopping 336,000 jobs last month, marking the most significant increase since January. Wage growth, however, has slowed, and unemployment rates have held steady. So, what gives? If unemployment is stable, then labor force participation must have surged as well, right? Well, the data is conspicuously silent on that front.

The Leisure and Hospitality Enigma

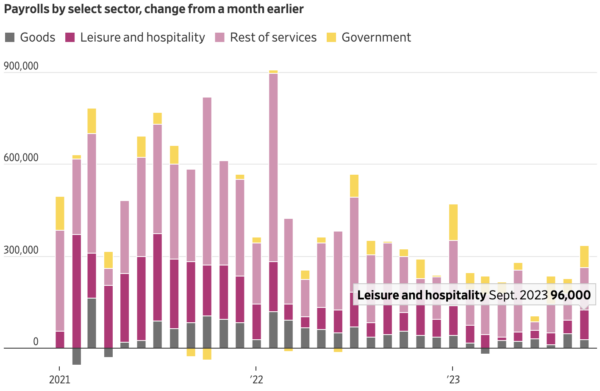

Here’s where things get puzzling. The leisure and hospitality sector, which had been adding around 40,000 jobs per month, suddenly doubled its hiring to 96,000 jobs. This hiring spree is perplexing, especially when you consider that additional savings are being depleted and student loans are resuming. Could this be a second wave of “revenge travel,” fueled by mass student loan forgiveness? Or is something else at play?

The Economic Landscape: Conflicting Signals

The Homeless Crisis vs. “Accelerating Economic Momentum”

The job numbers suggest “accelerating economic momentum,” but is that what we’re seeing on the ground? Take Los Angeles, for example, where homelessness and drug use are rampant, even within the confines of the airport. Does this square with an economy that’s supposedly booming?

The Shutdown Paradox

If shutting down the economy for a year led to this economic boom, why not do it every three years? Let’s lock everyone up, stop all production, and then enjoy an endless cycle of economic miracles! Sounds ludicrous, right? Then how did a year-long shutdown lead to an “economic boom”?

The Yield Curve: The Elephant in the Room

The yield curve, often touted as the most reliable economic indicator, is conspicuously absent from the discussion. Why? Because acknowledging it would mean admitting that the market, not central planning, is correct. And that’s a pill too bitter for Keynesian economists to swallow.

The Small Business Conundrum

Bankruptcies vs. Hiring

Small businesses, the backbone of the U.S. economy, are reportedly filing for bankruptcy at an alarming rate. Yet, we’re led to believe that they’re also on a hiring spree. How can both be true? It defies logic and common sense. Another puzzling data point is the growing reluctance among Americans to quit their jobs. If the job market is so robust, why the hesitancy? Could it be that workers sense a declining job market, contrary to what the hiring numbers suggest?

The Inflation and Wage Dilemma

While wages have recently outpaced inflation, this follows a two-year period where purchasing power declined. So where is the aggregate demand coming from? How are people affording to live, let alone spend, in a way that would incentivize such massive hiring?

The Unresolved Paradox

The booming job numbers present a paradox that’s hard to reconcile with other economic indicators. From the homeless crisis to small business bankruptcies and the yield curve, something doesn’t add up. As we celebrate these blockbuster job numbers, let’s also keep our eyes wide open, questioning the narrative and seeking the truth. After all, in an economy filled with contradictions, the only thing we can be sure of is that nothing is as it seems.