Uh Oh…New Inflation Numbers Are Not Good

A Wake-Up Call on Inflation

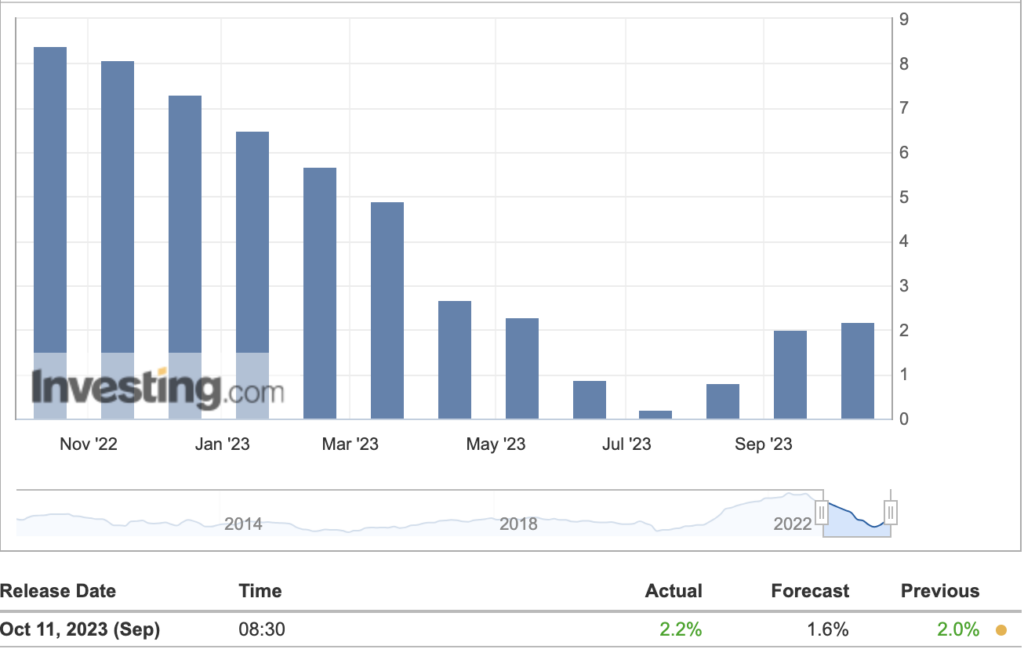

The latest Producer Price Index (PPI) data has sent shockwaves through the financial markets. Expected to rise by a modest 0.3%, the PPI for September surged by 0.5%, exceeding expectations and raising concerns about inflationary pressures. As we await the Consumer Price Index (CPI) data due tomorrow, let’s dissect the PPI numbers and examine their impact on various asset classes, including the 10-year Treasury yield, gold, oil, and the dollar.

The PPI Surge: More Than Just a Number

Breaking Down the Data

The PPI, which measures the average change over time in the selling prices received by domestic producers for their output, rose by 0.5% in September. Excluding food and energy, the core PPI was up by 0.3%, against a forecast of 0.2%. The primary contributors to this increase were final demand goods, which surged by 0.9%, and services, which rose by 0.3%.

The Gasoline Factor

Interestingly, the majority of this increase came from rising gas prices. Gasoline increased by 5.4%, making it a significant contributor to the PPI’s upside surprise. This could explain why Wall Street hasn’t reacted more dramatically to the news, as the increase is largely attributed to a single, volatile commodity.

Oddities in the Data

One peculiar data point was the cost for deposit services at commercial banks, which surged by 13.9% in a single month. This could indicate that smaller and regional banks are struggling and resorting to nickel-and-diming customers to stay afloat.

Market Reactions: A Mixed Bag

The 10-Year Treasury Yield

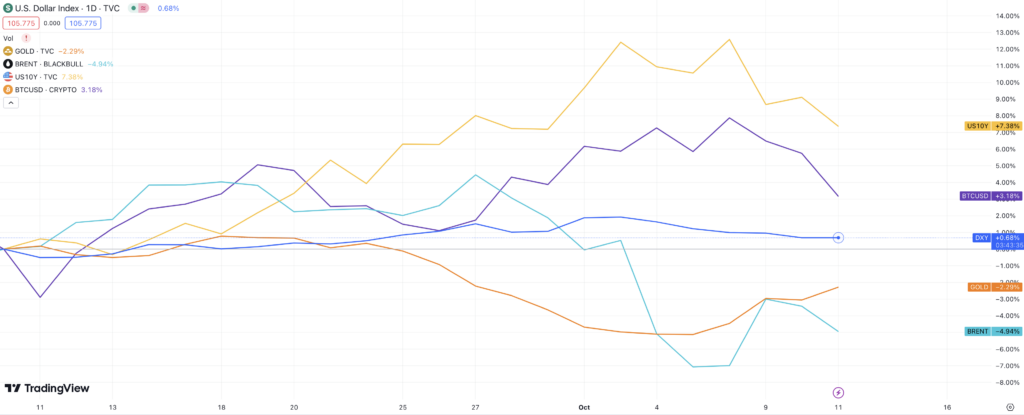

The 10-year Treasury yield, a key indicator of investor sentiment, has shown a mild reaction to the PPI data. Despite recent spikes, the yield has been trending downward, possibly due to geopolitical tensions in the Middle East and a flight to safety.

Gold, Oil, and the Dollar

Gold prices remain high, as one would expect in times of uncertainty. Oil prices, after initially spiking due to Middle East tensions, have retreated, relieving some pressure on dollar-denominated debt and commodity importers. The dollar index (DXY) has also declined from its recent highs, which could be reducing the need for foreign entities to sell Treasuries to acquire dollars.

The Fed’s Dilemma: Hawkish Talk vs. Actual Policy

The Federal Reserve has been talking tough on inflation, but will this latest PPI data force its hand? The PPI is a leading indicator for the CPI, and a surprise on the upside could compel the Fed to raise interest rates more aggressively. However, it’s crucial to separate the Fed’s hawkish rhetoric from its actual policy actions, especially given the complex interplay of variables affecting asset classes.

Conclusion: The Road Ahead

As we await the CPI data, the PPI serves as a cautionary tale. It’s a reminder that inflationary pressures are real and could force a policy response sooner rather than later. Investors and policymakers alike should keep a close eye on asset class responses and geopolitical developments that could further complicate the inflation narrative.

In these turbulent times, standing up for freedom, liberty, and free-market capitalism is more important than ever. The PPI data is not just a number; it’s a signal, and one that we can’t afford to ignore. Stay tuned for further analysis as we continue to monitor this evolving situation.