Written by Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | November 25, 2025

If you’ve spent the past two years listening to housing bulls repeat their favorite mantras...“There’s no supply,” “Homeowners won’t sell,” “Prices can’t fall”...then the last few weeks should feel like whiplash.

The data coming out now isn’t subtle, and it isn’t regional. It’s systemic. The U.S. housing market is cracking, and the shift is happening far faster than most analysts expected.

The latest Zillow report makes that painfully clear. Nearly half of all U.S. homes have now fallen in value from their peaks.

That’s the largest synchronized nationwide decline since the Great Recession.

And it’s not happening in just one or two boomtowns...it’s hitting Denver, Austin, Sacramento, Tampa, Dallas, San Antonio, Orlando, Jacksonville, and dozens more.

The markets that skyrocketed the most are now unwinding the fastest.

At the same time, Lennar...one of America’s largest homebuilders...is doing something unprecedented. Their homepage is plastered with Black Friday discounts offering up to $75,000 off new homes, plus down payments as low as one dollar.

Builders only roll out incentives like this when demand evaporates. It’s the industry’s version of pulling the fire alarm.

What we’re seeing now is a classic early-stage housing reversal.

In the beginning, sellers resist cutting prices. They cling to the past. But builders don’t have that luxury. They live and die by inventory turnover.

When interest rates froze buyers out of the market, builders responded with the only tools they have: incentives, discounts, and aggressive marketing.

Those discounts create new comps, and those comps pull down the value of every similar home in the neighborhood.

Before long, even stubborn homeowners have to adjust.

The pressure isn’t coming only from the buy side. Costs of ownership have soared...insurance premiums, maintenance expenses, and property taxes have all climbed sharply.

Even households with low mortgage rates are beginning to buckle.

A 3% mortgage doesn’t help when your insurance jumps 40% or your HVAC system needs replacing.

People who felt comfortable eighteen months ago are starting to feel squeezed, especially in states like Florida, Texas, and California, where costs are climbing fastest.

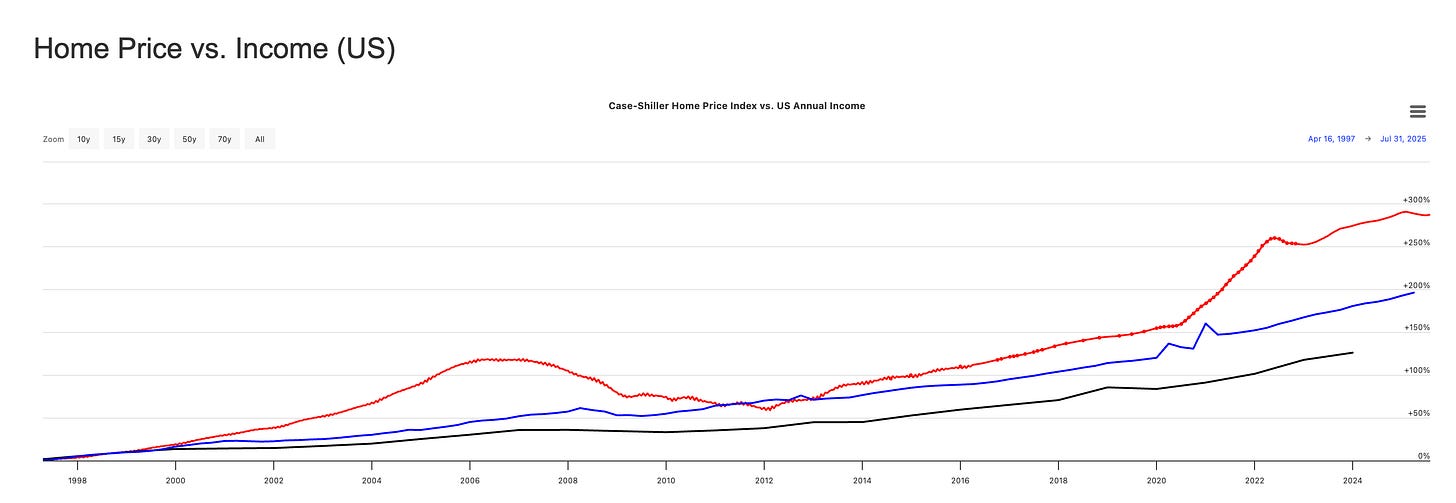

This brings us to the most important point of all: the relationship between home prices and incomes.

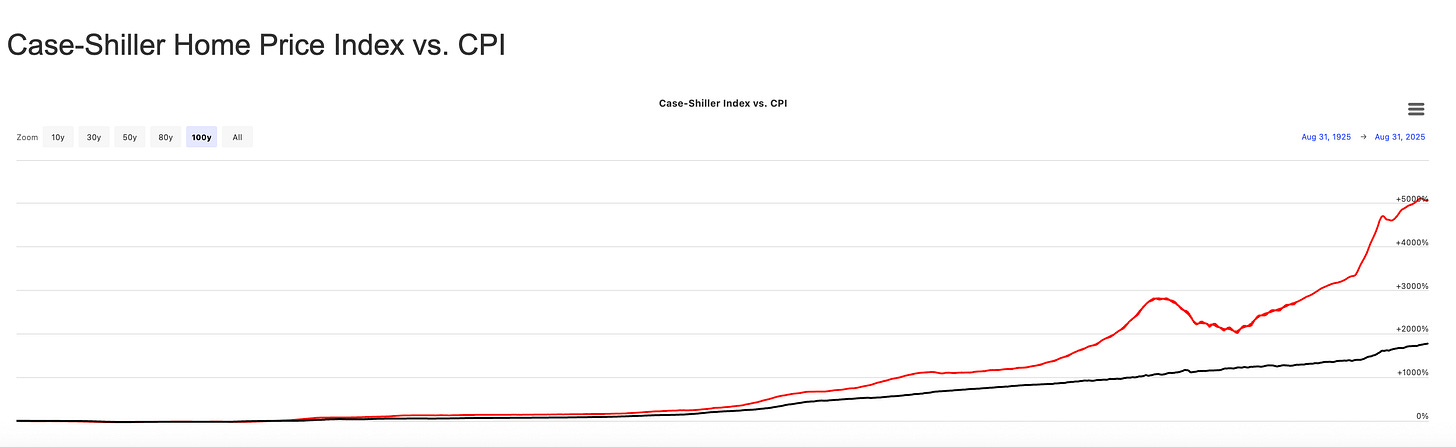

George recently highlighted a long-term chart showing inflation-adjusted home prices going back more than a century.

Outside of a few temporary deviations, home prices always reverted back to their historical relationship with wages.

That historical anchor snapped in the late 1990s, and the disconnect has only widened since.

Today, the gap between incomes and housing costs is larger than anything we’ve ever seen. For the market to normalize, something has to give...and it won’t be wages rising. Prices have to adjust.

Housing bulls keep insisting the market can’t fall because supply is low. But supply is not a fixed variable...it reacts to economic conditions.

People become “locked in” only temporarily.

When the labor market deteriorates, when savings dry up, when early retirees have to return to work, and when investors decide to cut losses, listings rise.

And when mortgage rates eventually fall again, mobility returns.

People who felt trapped by their low-rate mortgages suddenly feel free to move, and that unlocks even more supply.

Meanwhile, the labor market is quietly weakening.

Behind the headline payroll numbers, we’re seeing negative revisions to non-farm payrolls and rising unemployment. A deteriorating jobs market is the spark that turns a housing slowdown into a housing downturn.

In every cycle, it’s job losses...not interest rates...that trigger forced selling. People don’t list their homes because they want to take advantage of some magical arbitrage.

They list because they have to. And once forced selling begins, it becomes self-reinforcing.

Falling home equity then translates into weaker consumer spending. The so-called wealth effect reverses. Retail sales soften. Default rates begin to creep higher. Businesses respond with layoffs. Those layoffs create more home listings. And the cycle feeds on itself.

It’s tempting to interpret today’s market as a soft landing. But soft landings don’t come with nationwide home-value declines, builders slashing prices, and widespread affordability stress.

Soft landings don’t come with the steepest cost-of-ownership increases in decades or a wage-growth slowdown. And they certainly don’t come with declining home values in nearly half the country.

This isn’t 2008...not yet. We’re not looking at a foreclosure-driven crash. We’re looking at a gradual structural unwind driven by affordability, costs, and weakening economic fundamentals. It starts slowly, then accelerates. First the comps shift. Then sellers capitulate. Then the data gets worse. Then the psychology flips.

Housing is not just an asset class...it’s the backbone of American wealth. When prices rise, people feel richer. When prices fall, they pull back. With half the country already slipping and the labor market softening, the next phase of this cycle will likely feel very different from the frenzy of 2021 or the denial phase of 2023.

The fundamentals have spoken. Prices got too high relative to wages. Ownership costs exploded. Builders broke ranks and slashed aggressively. And now the cracks are spreading across the country.

This isn’t the end of housing. But it is the end of the fantasy that prices can defy gravity forever.

Prepare accordingly. And that’s where Rebel Capitalist News Desk comes in.

If you’ve been relying on CNBC or Bloomberg to tell you when to act, you’re already behind. The real signals…the ones that matter…rarely make the headlines until it’s too late.

At Rebel Capitalist News Desk, we cut through the noise and deliver the kind of analysis you just read…every single week.

Subscribers get:

George Gammon’s Weekly Wrap-Up (straight talk, no fluff).

Actionable trade ideas before they hit the mainstream.

Macro insights you won’t find anywhere else…from credit cracks to global liquidity shifts.

Thousands of contrarian investors already use Rebel Capitalist News Desk to protect and grow their wealth.

Don’t wait until the weird indicators become the front-page story.

👉 Subscribe today and join the movement of liberty-minded investors who see what’s coming…and position for it before anyone else.