Is the Fed About to Merge With the Treasury?

Why It Matters More Than You Think!

Written by Rebel Capitalist AI. Supervision and Topic Selection by George Gammon

Imagine if the U.S. Treasury and the Federal Reserve became one and the same.

Sounds wild, right?

But if Scott Bessent becomes the next Fed Chair, this merger…in spirit if not on paper…might actually happen. And if it does, it could permanently reshape our entire monetary system.

Let’s dive into why this is a big deal, what it tells us about America’s financial future, and what smart investors should be watching.

Who Is Scott Bessent and Why Is This Important?

Scott Bessent is currently the U.S. Treasury Secretary.

Recent reports suggest he's being considered to replace Jerome Powell as Chair of the Federal Reserve when Powell's term ends in 2026.

Here’s the kicker: Bessent is already a top lieutenant of Donald Trump.

Placing Bessent at the Fed means the central bank could become a direct extension of the White House.

This would erase the already-blurry line between fiscal policy (run by the Treasury) and monetary policy (run by the Fed).

And it gets deeper.

Here’s what almost no one is talking about: if Trump plants Bessent at the Fed, he won’t just influence monetary policy…he could control it outright.

What that unlocks next will shock even seasoned investors…

The Fed Is Already Insolvent

Yes, you read that right. The Fed is technically insolvent. Why?

Because it's paying more on its liabilities (like interest on reserves) than it's earning on its assets (like bonds).

But instead of showing negative equity, the Fed uses an accounting trick called a "deferred asset."

This deferred asset represents the Fed's belief that it will make enough profits in the future to offset its current losses.

In other words, the Fed is using make-believe profits to balance its books. Sound sketchy? That’s because it is.

Now imagine putting someone like Bessent…who's fully aligned with the President…in charge of that balance sheet.

A central bank using future make-believe profits to stay afloat?

That’s bad enough.

The real danger isn’t that the Fed is broke…it’s what comes next when a politically loyal Fed chair gains full control of this broken institution.

There’s a hidden mechanism already in place, and it’s about to be activated…

If You Owe Yourself Money, Are You in Debt?

Here’s where things get wild. The Fed currently holds $4.2 trillion in U.S. Treasuries.

If the Treasury and Fed were merged, the government would effectively owe money to itself.

That means the national debt would shrink instantly, at least on paper.

In fact, this one move could reduce the debt-to-GDP ratio from 123% to around 100%.

Even better (from a politician’s standpoint): the government could keep making payments to itself, and call it "monetary policy."

Think about it:

No more worries about bond vigilantes.

No more need to raise taxes.

No more fights in Congress over the debt ceiling.

Just a nice, smooth path to Modern Monetary Theory (MMT).

Erasing debt on paper may look clean, but the fallout won’t be.

Once markets catch on to the shell game, the real cost could come in the form of currency destruction…

This isn’t just accounting gimmickry…it’s a blueprint.

Once you see what this maneuver allows the government to do next, you’ll understand why some insiders are calling this “the stealth reset”…

Why This Is the First Step Toward MMT

In an MMT world, the government doesn’t need to issue debt to spend money. It can just credit accounts using central bank reserves.

And if Bessent becomes both the spiritual head of the Treasury and the Fed, you’re almost there.

Instead of funding spending with taxes or borrowing, the government just "prints" the money electronically.

Yes, this can cause inflation…eventually. But until then, it solves the "debt problem" everyone’s screaming about.

Everyone fears inflation…but few realize how this quiet merger between the Fed and Treasury sets the stage for something much bigger: the end of debt ceilings, spending limits, and maybe even bond markets as we know them…

What Today’s Smart Investors Should Be Watching

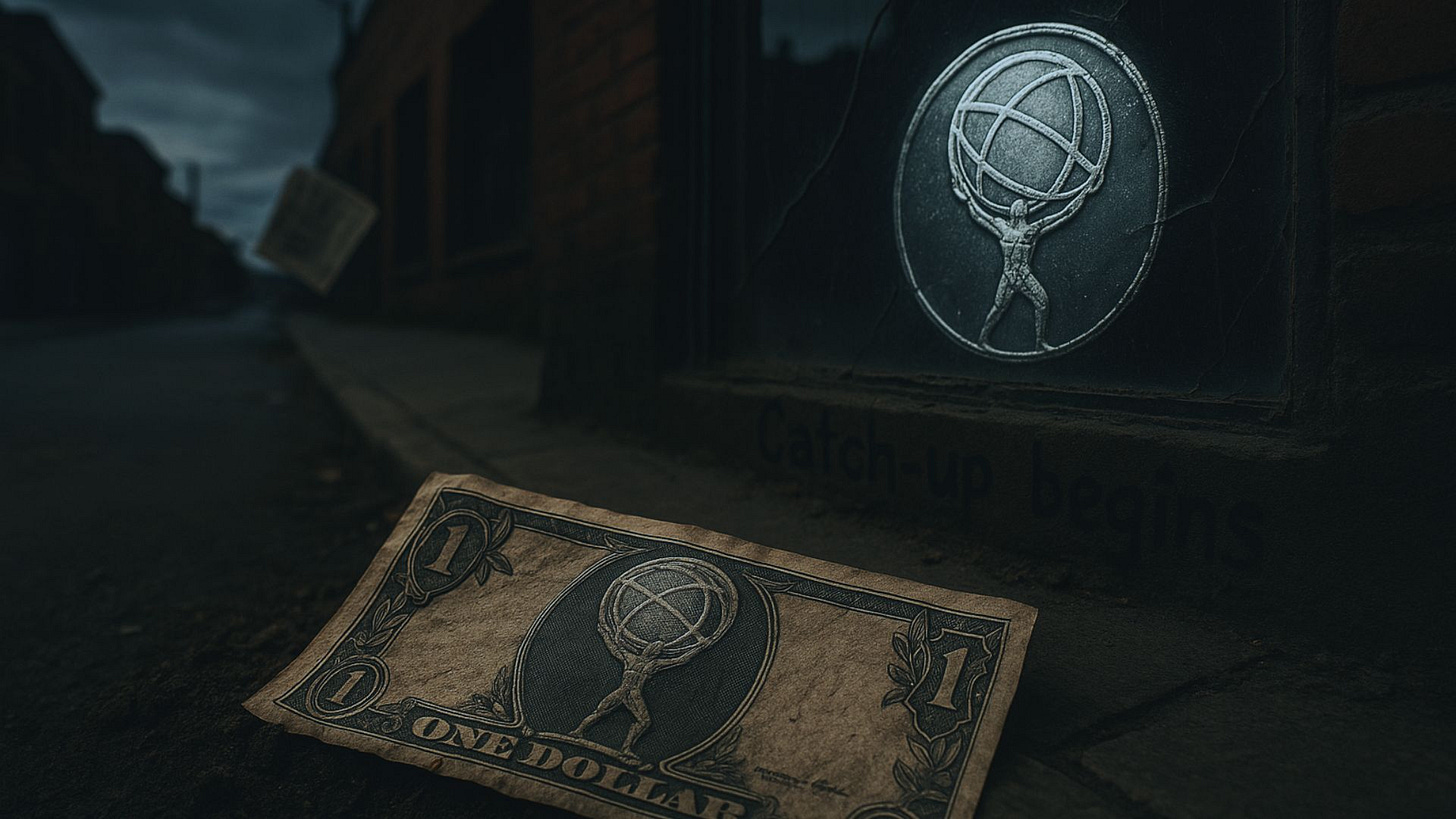

Precious Metals: If monetary and fiscal policy become one, expect major uncertainty and currency debasement risk. Gold and silver are historical safe havens. Silver especially has been on a tear lately and could have more room to run.

Interest Rates: If Bessent takes over, expect lower rates to come quickly. Trump has always wanted near-zero rates. That means bonds and interest-rate-sensitive assets could rally.

Risk Assets: Short-term, equities could surge on easier monetary policy. But long-term, stagflation risks rise if money printing gets out of hand.

Global Markets: This kind of policy shift won’t go unnoticed abroad. Expect currency volatility, especially in emerging markets.

The signals are already flashing.

A once-in-a-generation shift is underway, and the playbook for capital preservation is about to be rewritten.

But most investors won’t see it coming until it’s too late. So how might the investing legends play this signal?

How Investment Legends Might Play This

Stanley Druckenmiller would likely spot the political alignment between fiscal and monetary policy as a long-term inflation risk. He’d position into hard assets and possibly short long-term Treasuries once the Fed's dovishness becomes obvious.

Paul Tudor Jones would see this as a macro regime change. He’d be looking for momentum plays in commodities, gold miners, and currencies.

Ed Seykota, ever the trend follower, would likely be long silver and gold. The charts are bullish, and the macro backdrop is only adding fuel to the trend.

The Line Between Fed and Treasury Is Blurring Fast

Putting someone like Scott Bessent in charge of the Fed could effectively merge monetary and fiscal policy.

This isn't a theoretical debate anymore…it's a real possibility.

Whether or not the balance sheets formally merge, the policies could become one and the same. And that’s what smart investors need to understand.

You don’t need to wait for the merger to be official. The market will move based on expectations. And right now, those expectations are shifting fast.

Stay sharp, stay skeptical, and stay informed.

If silver’s 40-year breakout is just getting started ( a dip buying opportunity is forming as we speak)… what happens when the capital stampede spills over into the rest of the market?

Here’s the thing: When silver moves, it doesn’t move alone. Miners multiply the gains. Ratios snap back hard. And retail always shows up late.

But there’s one signal that could front-run them all…and it’s already flashing.

We’ve just uncovered the next domino in the metals market. And if this chart breaks, it could trigger a vertical move that makes silver’s run look tame.

Read on to see what just broke—and what the smartest money is watching next.

Rebel Capitalist AI (supervision and topics by George Gammon)

June 10, 2025

Just a heads up. I guess this was written by AI because has the line "If Trump wins reelection, " He cant run again?

The Fed is a banking cartel owned by unknown billionaires through a network of shell companies. Congress is also owned by billionaires. Under the constitution Congress, not the president, is in charge of the money supply. In the Federal Reserve Act of 1913 Congress delegated their responsibility to the cartel. The Fed chairman is just a pawn and needs to be approved by Congress. Do you really believe Trump will get control of the cartel against the wishes of the owners and the constitution?