Payrolls Go Negative

Is the U.S. Labor Market Signaling Recession?

Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | September 6, 2025

For months, the mainstream narrative has been that the U.S. economy is “resilient.”

The labor market is supposedly holding firm, consumer spending is “solid,” and growth remains on track.

But the latest jobs report just tore a hole through that storyline.

August nonfarm payrolls came in at a pitiful 22,000 jobs versus expectations of 75,000.

On top of that, June was revised sharply lower…from a headline gain to a negative print of −13,000.

In other words, the U.S. economy actually lost jobs in June, even though the initial headlines painted a rosier picture.

That’s not a rounding error. That’s the kind of revision that historically shows up when an economy is already tipping into recession.

The Headline Numbers Are Bad…The Revisions Are Worse

Here’s the progression:

June originally looked like ~147,000 jobs.

It was later revised down to ~19,000.

Now, it has been revised again… to −13,000.

This isn’t an isolated fluke. It’s part of a downward trend across the past several months.

The U.S. has added only 598,000 jobs in 2025 so far…the weakest January–August performance since 2009 (excluding the pandemic distortions of 2020).

That’s in nominal terms. Adjust for population growth, and the weakness is even more pronounced. The U.S. simply isn’t creating enough jobs to keep pace with new entrants into the labor force.

The real story isn’t August’s weak print…it’s the silent revisions turning past “wins” into hidden losses.

But if this is just the opening act, the next revision wave could be far more devastating… and few investors are braced for it.

Unemployment and Underemployment Tick Higher

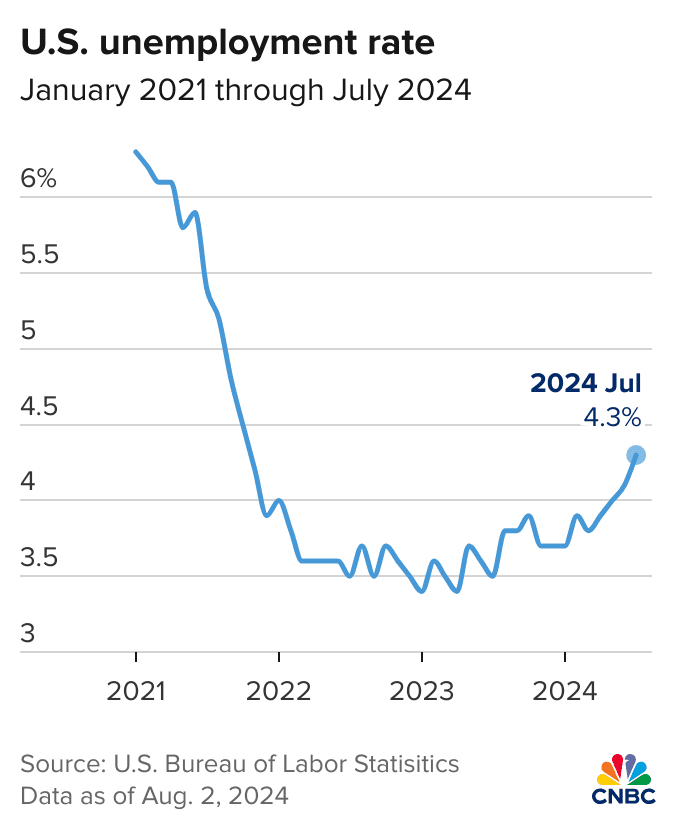

The unemployment rate rose to 4.3%, but that headline number (U3) doesn’t tell the full story.

A deeper look shows:

U6 underemployment…which includes discouraged workers and part-timers who want full-time work…jumped to 8.1%.

The net increase in jobs was driven almost entirely by part-time positions, while full-time employment actually fell.

The number of multiple job holders continues to climb, a classic sign that workers are struggling to make ends meet.

In other words, the labor market is deteriorating beneath the surface, even if the headline unemployment rate still looks manageable.

Headlines say 4.3% unemployment, but the reality is workers patching together part-time gigs and juggling multiple jobs to survive.

What happens when this fragile scaffolding gives way…and underemployment morphs into mass layoffs?

A Rare Historical Signal

Here’s the key question: Has the U.S. ever had negative nonfarm payroll prints outside of a recession?

Yes…but only under very specific circumstances:

Temporary anomalies like strikes, census hiring cycles, or weather disruptions.

Or immediately before or during recessions.

In other words, when payrolls go negative, it usually means one of two things:

A one-off quirk that explains the dip.

The economy is on the cusp of, or already in, recession.

Given the trend we’re seeing now…multiple weak months, widespread downward revisions, and corroborating weakness in ADP and JOLTS data…this doesn’t look like a quirky anomaly. It looks like a structural slowdown.

Negative payrolls outside of a recession are supposed to be rare quirks. Yet recent weakness looks eerily like the signals that flash right before downturns begin.

The question is: are we already past the point of no return?

Markets React: Rate Cuts Back on the Table

The bond market wasted no time re-pricing expectations:

The 2-year Treasury yield plunged more than the 10-year, a classic “bull steepener” that signals markets expect the Fed to cut rates.

The CME FedWatch tool now shows a 10% probability of a 50 basis point cut at the next meeting. Just a week ago, that probability was 0%.

The U.S. dollar weakened sharply as traders bet the Fed will ease faster than other major central banks.

This is the fastest shift in monetary policy expectations we’ve seen since the pandemic era.

Markets are suddenly betting the Fed will slash rates…fast. But here’s the twist: what if cutting rates into a slowdown doesn’t spark relief, but instead triggers the very crisis investors fear most?

Why Bad News Is (Finally) Bad News Again

For much of the last two years, bad economic news was treated as good news by Wall Street. Weak jobs? Great…it meant the Fed might cut sooner. Slower growth? Perfect…more stimulus on the horizon.

But that narrative is breaking.

The S&P 500 dipped on the jobs release, suggesting investors are beginning to view weak data as genuinely bearish, not just a trigger for more Fed support. If that attitude spreads, the “Fed put” may not be enough to keep risk assets afloat.

Wall Street’s reflexive cheer that “bad news is good news” may finally be dying.

But if weak data now means weak markets, what does that imply for an economy facing its softest labor backdrop since 2009?

Debt and Deficits: The Big Misunderstanding

Here’s where things get really interesting.

If you listen to mainstream commentators, bond yields move higher when the U.S. issues more debt and deficits explode. More supply equals lower prices, equals higher yields.

But look at today:

The U.S. debt and deficit picture hasn’t improved.

Yet yields fell sharply across the curve.

Why? Because growth and inflation expectations, not supply, are the true drivers of Treasury yields.

If banks can borrow short-term at 2% and buy Treasuries yielding 4% while nominal GDP is slowing, that’s free money.

They’ll step in as buyers no matter how much debt Treasury issues. The marginal buyer isn’t the foreign central bank…it’s the banking system itself, arbitraging spreads.

This is why yields rise during QE (when growth expectations are higher) and fall during QT (when growth expectations slow). Supply is secondary. Expectations rule.

Everyone fixates on debt supply. Yet today proved yields move on growth expectations, not issuance.

If that’s true, then the entire deficit-doom narrative is a distraction… but what does that mean for investors who have been trading on the wrong playbook?

The Narrative Is Cracking

Combine all this and the story is clear:

Payrolls are stalling.

Revisions are turning positive headlines into negative ones.

Underemployment is climbing.

Bonds are screaming “slowdown.”

Rate cuts are back in play.

This isn’t an economy “re-accelerating.” It’s one that’s sputtering, right as fiscal and monetary ammo looks increasingly limited.

The myth of “resilience” is unraveling, and every data point adds another crack. But the real danger isn’t what the headlines say today…it’s the structural weakness that becomes undeniable only in hindsight.

Investment Takeaways

If the jobs data is a true reflection of where we are headed, then positioning matters:

Likely beneficiaries:

Treasuries: Especially the front end, if cuts materialize.

Gold: Weak dollar + lower real yields = strong tailwind.

Defensives: Utilities, staples, healthcare…sectors that hold up in slowdowns.

Likely casualties:

Cyclicals: Industrials, consumer discretionary, travel.

High-yield credit: Rising delinquencies + slowing growth = higher default risk.

Overleveraged growth stocks: The cheap money era is gone.

Positioning defensively looks smart on paper. But markets rarely give investors the luxury of reacting calmly.

What happens if the first real shock forces a stampede into safe havens…before most have even noticed the exits?

Watch the Revisions, Not the Headlines

The biggest story here isn’t the 22,000 jobs gained in August. It’s the fact that June quietly flipped from a gain to a loss.

That’s how recessions sneak up on people. The headlines look fine at first. Then months later, the revisions reveal the truth. By then, markets have already moved.

History tells us negative payrolls rarely happen in isolation. They cluster around recessions. Unless this is a freak anomaly, the U.S. may already be slipping into one.

Don’t wait for the NBER to make it official. The bond market has already delivered the verdict.

Revisions are the silent assassins of market narratives. By the time they reveal the truth, it’s already too late.

The only question now is: how many more “quiet flips” are hiding in plain sight, waiting to rewrite the story of 2025?

The mainstream media will keep selling the “resilient economy” narrative until the very moment it breaks.

By then, it’s too late. The investors who survive downturns…and profit from them…are the ones who read the signals early and adjust before the herd.

That’s exactly why we built the Rebel Capitalist News Desk.

Every week, we cut through the noise and break down what’s really happening in the markets, the economy, and the political circus driving them.

And here’s the kicker: George Gammon has already given his live and unfiltered weekly wrap-up for premium subscribers.

If you’re a free reader, you’re missing the full story…and the chance to see George’s raw, no-holds-barred take on the data that’s shaking markets right now.

👉 Upgrade today and you’ll get access to the live stream and the replay…plus every premium deep dive going forward.

Join the thousands of liberty-minded investors already inside. Don’t wait for the recession headlines to hit…by then, the opportunity will be gone.