The Merger That Could Break the Dollar

MMT, Central Planning, and the End of Fiscal Discipline

Written by Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | September 20, 2025

The headlines this week may seem boring…more signs of a slowing economy, more revisions to payroll data, another decline in the Conference Board’s Leading Economic Index…but buried in the noise is a policy proposal that could change everything: the potential merger of the Fed and the Treasury.

And no, this isn’t a tinfoil hat conspiracy. It’s being floated right now by former White House insiders.

If it happens, it will mark the official start of full-blown MMT…Modern Monetary Theory…in the United States. And the implications are staggering.

Let’s walk through what the data is saying, what the government is likely to do in response, and why this shift in policy architecture could send the dollar, the bond market, and your portfolio into uncharted territory.

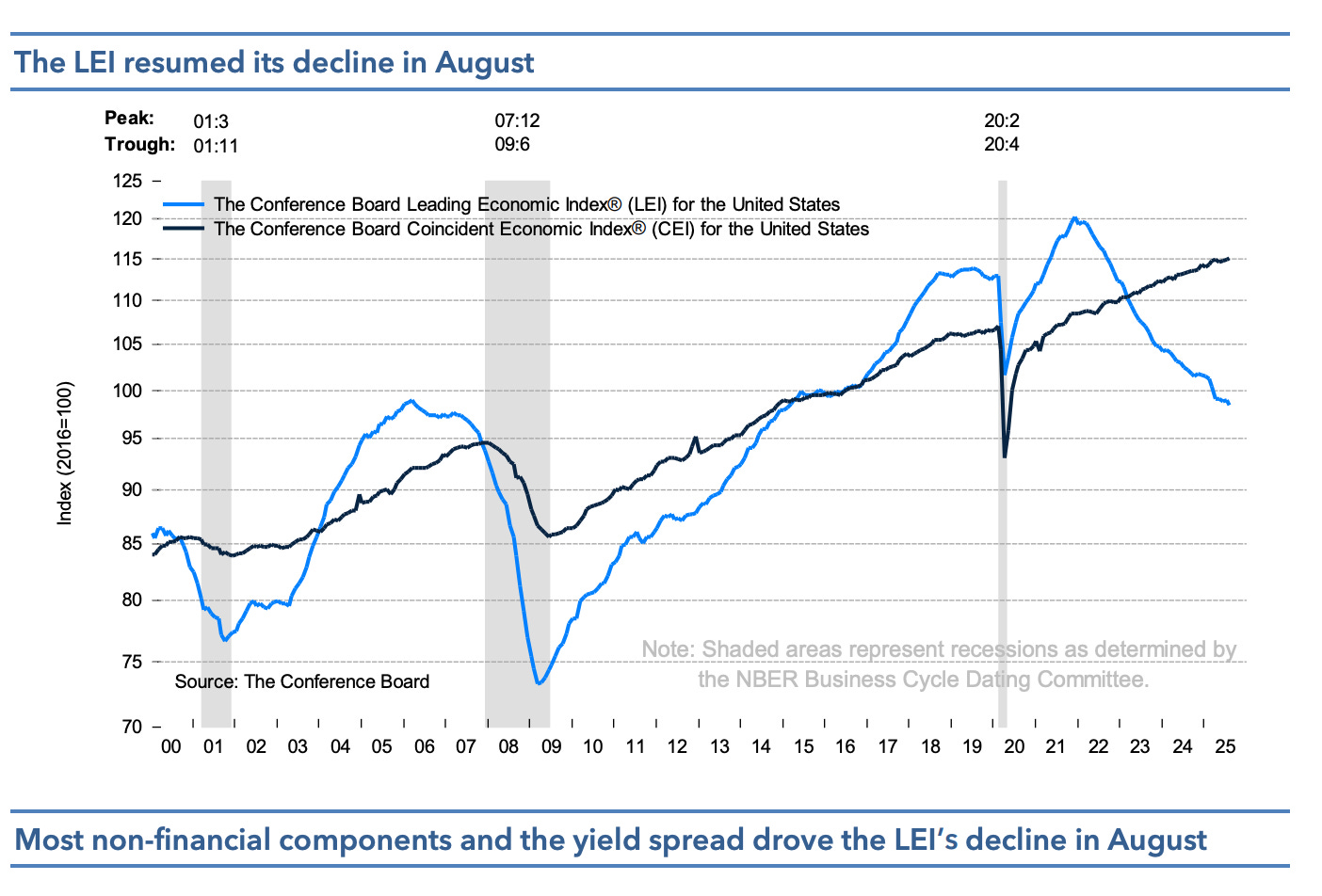

The Leading Indicators Just Flashed Red — Again

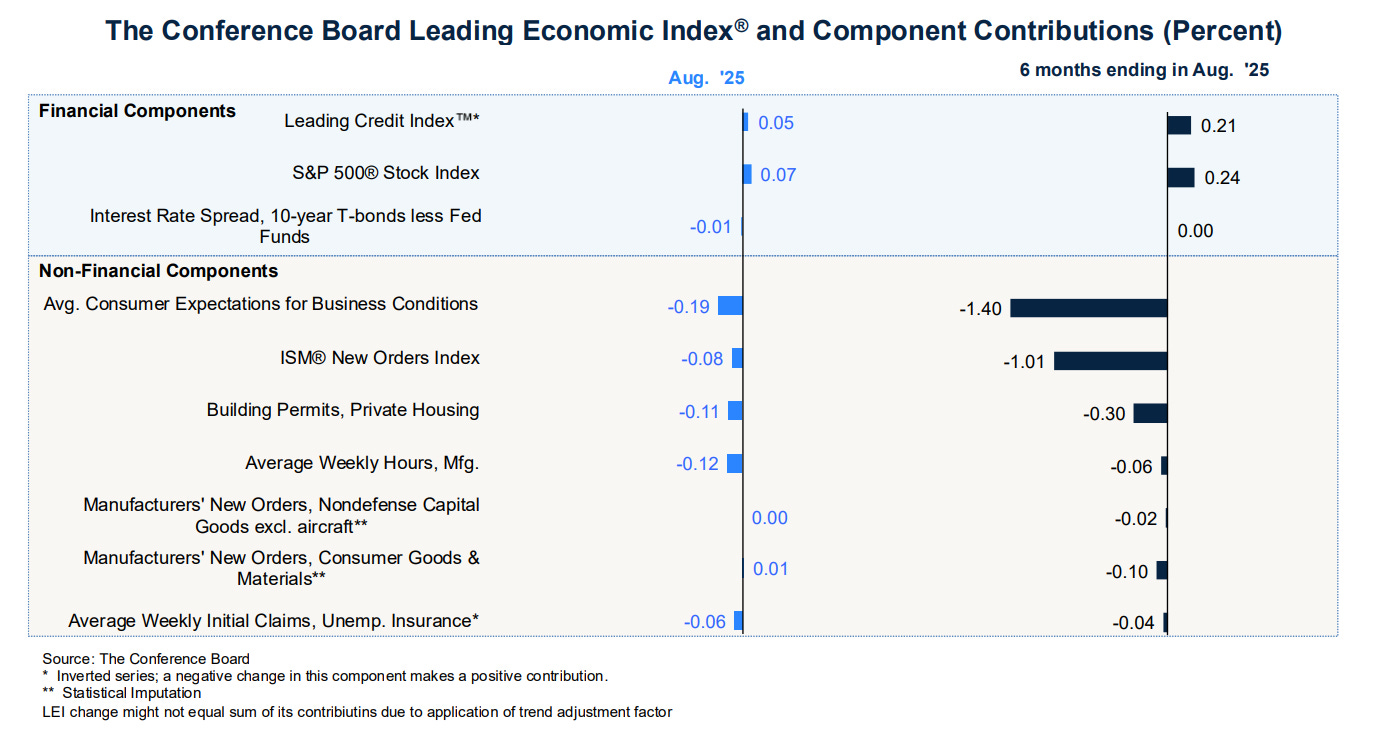

The Conference Board’s LEI (Leading Economic Index) declined sharply in August… the worst monthly drop since April.

Only two components were positive: the stock market and credit spreads.

Everything else — labor markets, manufacturing orders, consumer expectations, average hours worked — came in negative.

This matters because the LEI is designed to predict turning points in the business cycle.

Historically, when the LEI dips below -5%, recession odds rise significantly. And we’re now deep in that danger zone.

Yet Wall Street is still partying. The S&P 500 is up. Credit spreads are tight. The VIX is asleep. Why?

Because the market believes the Fed will cut. Again. And if that doesn’t work? Fiscal policy will save the day. Enter MMT.

If history is any guide, the LEI doesn’t just flash red for fun…it signals regime shifts.

Yet this time, the “solution” Wall Street expects may be more dangerous than the problem itself. Because what happens when cutting rates and juicing deficits aren’t enough? That’s where the Fed-Treasury merger steps in…

The Goldilocks Mirage: Weekly Wrap-Up (9/19/25)

Picture this: an economy that's "just right"…not too hot, not too cold, with retail sales sizzling and jobless claims holding steady.

MMT Isn’t a Theory Anymore — It’s the Blueprint

This week, political commentators like Steve Bannon floated a shocking idea: put the same person…Scott Bessent…in charge of both the Treasury and the Fed.

Sound absurd? It’s already being seriously discussed.

And if it happens, the Fed and Treasury effectively become one. The separation between monetary and fiscal policy collapses.

And you have the machinery for MMT:

Spend directly from the Fed’s balance sheet.

Fund deficits without issuing Treasuries.

Control the money supply through taxation, not interest rates.

That’s MMT in action. And it’s no longer theoretical.

Most investors still treat MMT like a thought experiment. But when serious power brokers start floating the idea of one man controlling both the Fed and the Treasury, the gameboard changes instantly.

And if that line between monetary and fiscal policy really disappears, the consequences will be far worse than the headlines suggest.

The real question is…how exactly would they pull it off?

How This Could Work Mechanically — And Why It’s So Dangerous

Under a Fed-Treasury merger, the government doesn’t need to issue debt to fund deficits. The Fed simply creates reserves, dumps them into the Treasury General Account (TGA), and the Treasury spends. No new Treasuries. No new debt on paper.

But here’s the catch:

These reserves increase the money supply (unlike QE).

There’s no productivity offset.

The spending is politically driven, not economically efficient.

The result? Massive inflation and a collapse in market discipline.

And once the central planners fully control money creation, it’s over. There’s no need for bond vigilantes, because there are no bonds. There’s no price discovery. No constraints. Just unlimited political spending…sterilized by accounting gimmicks.

Once you understand the plumbing, the danger becomes obvious: there’s no market discipline left.

No interest rates to restrain politicians, no bond vigilantes to send warning shots. Just endless reserves created with a keystroke.

But the real ticking time bomb isn’t the inflation everyone expects…it’s what happens to the global system that runs on Treasuries…

Treasuries Are More Than Debt…They’re Global Collateral

The biggest risk here is misunderstanding what Treasuries are in the global system.

They’re not just government IOUs…they are tier-one collateral in the repo markets, used by every major institution on Earth.

If we stop issuing them…or worse, if we issue them in shrinking quantity while massively expanding reserves…we create collateral scarcity while simultaneously driving inflation.

That’s a recipe for:

Exploding repo spreads.

Dysfunction in short-term funding markets.

Capital flight from the dollar system.

In short: if the Fed becomes the Treasury, the dollar may never be the same.

This is where the nightmare scenario unfolds. Treasuries aren’t just debt…they’re the scaffolding of the global dollar system.

Strip that away, and repo markets, collateral chains, and international funding markets all seize up.

And once foreign capital realizes the U.S. government is playing with the very foundation of global liquidity, the dollar’s credibility could implode.

So how should investors position before the walls shake?

From Tinfoil Hat to Baseline Risk

Two years ago, CBDCs were a fringe idea.

Today, they’re in development worldwide. MMT and Fed-Treasury mergers may seem equally outlandish…until they’re not.

If this merger happens, everything changes:

Fiscal policy becomes monetary policy.

Spending explodes without constraint.

Inflation becomes endemic, not cyclical.

The bond market loses its anchor.

The dollar becomes just another fiat free-for-all.

For investors, this isn’t a time to panic. It’s a time to prepare. Because the playbook of the last 40 years…bond vigilantes, fiscal restraint…may be ending.

The most dangerous ideas always start at the fringe…until policymakers adopt them under the cover of “crisis response.”

MMT and a Fed-Treasury merger may sound far-fetched today, but so did zero rates, negative yields, and trillions in QE before they became the norm.

The next phase won’t look like anything we’ve lived through before, which is why investors need to get ahead of it now. The trade ideas below are just the beginning…

Matrix Money Machine

“If you can’t win more often, win bigger. And if you can’t win bigger, bet smarter. Stack the math.” - George Gammon

Trade Ideas: IF The Fed Were To Merge With The Treasury

1. Long Precious Metals: Gold thrives when fiat credibility collapses. So does silver. These are your insurance policies.

2. Short Long-Term Treasuries (TLT): If the Fed absorbs the Treasury, bondholders are left holding the bag.

3. Short the Dollar (UUP): A weaponized Fed-Treasury merger undermines the USD’s credibility long term.

4. Long Commodity Currencies: CAD, AUD, and others with real resources and less political debt risk.

5. Bitcoin (Speculative): Still volatile, but in a world where fiat loses its brakes, crypto becomes relevant again.

Gold. Silver. Commodities. Bitcoin. The plays are obvious once you strip away the propaganda.

But timing them…and knowing when the Fed-Treasury merger chatter turns from theory to reality…requires constant monitoring. That’s exactly what we do inside Rebel Capitalist News Desk.

Don’t wait for the mainstream to catch up. Paid subscribers get George Gammon’s weekly wrap-up this weekend, plus subscriber-only whiteboard videos, trade breakdowns, and unfiltered Q&A sessions that prepare you before the headlines break.

👉 Join the thousands of contrarian investors who are already upgrading their playbook.

Subscribe now to the Rebel Capitalist News Desk and stay ahead of history in the making.

I have seen this movie before in Zimbabwe. I still have my hundred trillion Zimbabwe dollar note framed in my study to remind me what money printing does to a currency.

MMT More Money Today