Picture this: an economy that's "just right"…not too hot, not too cold, with retail sales sizzling and jobless claims holding steady.

It's the stuff of central bankers' dreams, a delicate balance where inflation cools without tipping into outright contraction. But what if that perfect porridge is starting to curdle?

This week, a barrage of data painted a picture that's equal parts encouraging and alarming, leaving investors scratching their heads.

Retail sales beat expectations by a whisker, clocking in at 0.6% growth, while initial jobless claims hovered around 264,000…stable, if uninspiring.

Yet beneath the surface, cracks are widening in the housing market, labor indicators are flashing warnings, and a key recession signal just lit up like a Christmas tree.

As the Federal Reserve eyes rate cuts, one burning question lingers: Is this the calm before the storm, or just another head fake in a market addicted to narratives?

Housing's Hidden Implosion: When the Dream Home Becomes a Nightmare

Let's start where the rubber meets the road…or rather, where the hammer stops swinging. The housing sector, long a pillar of American prosperity, delivered a gut punch this week.

Empire State manufacturing swung wildly negative, missing forecasts of 4.5 with a dismal -8.7 reading, but it was the homebuilders' confidence survey that stole the show. Expectations were for modest gains; reality hit like a sledgehammer.

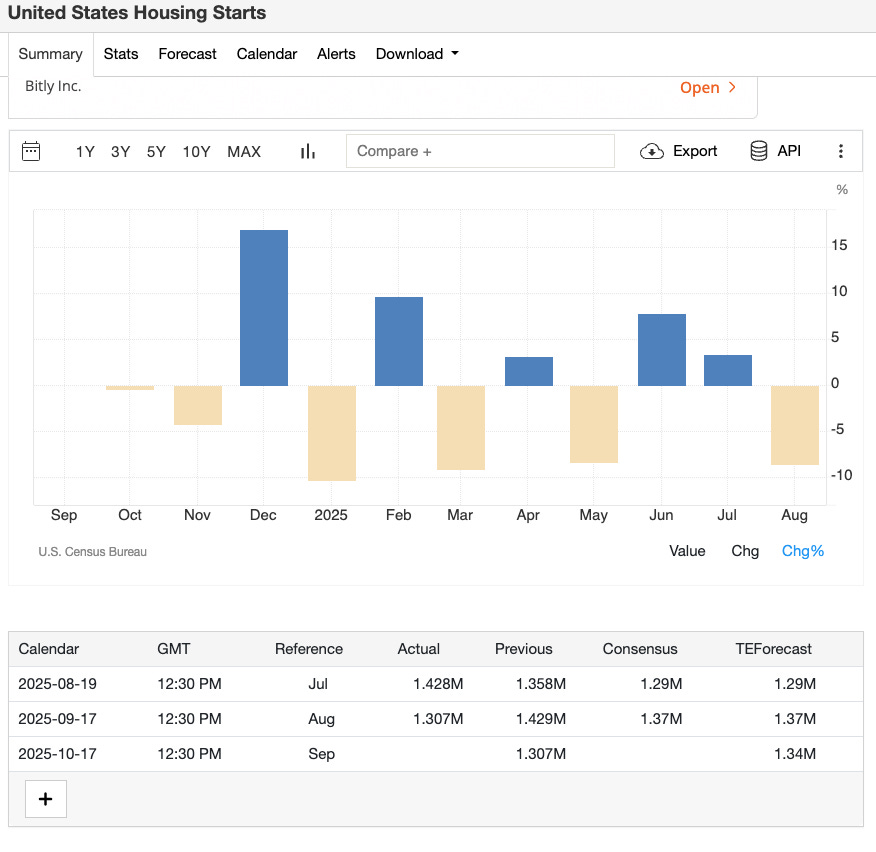

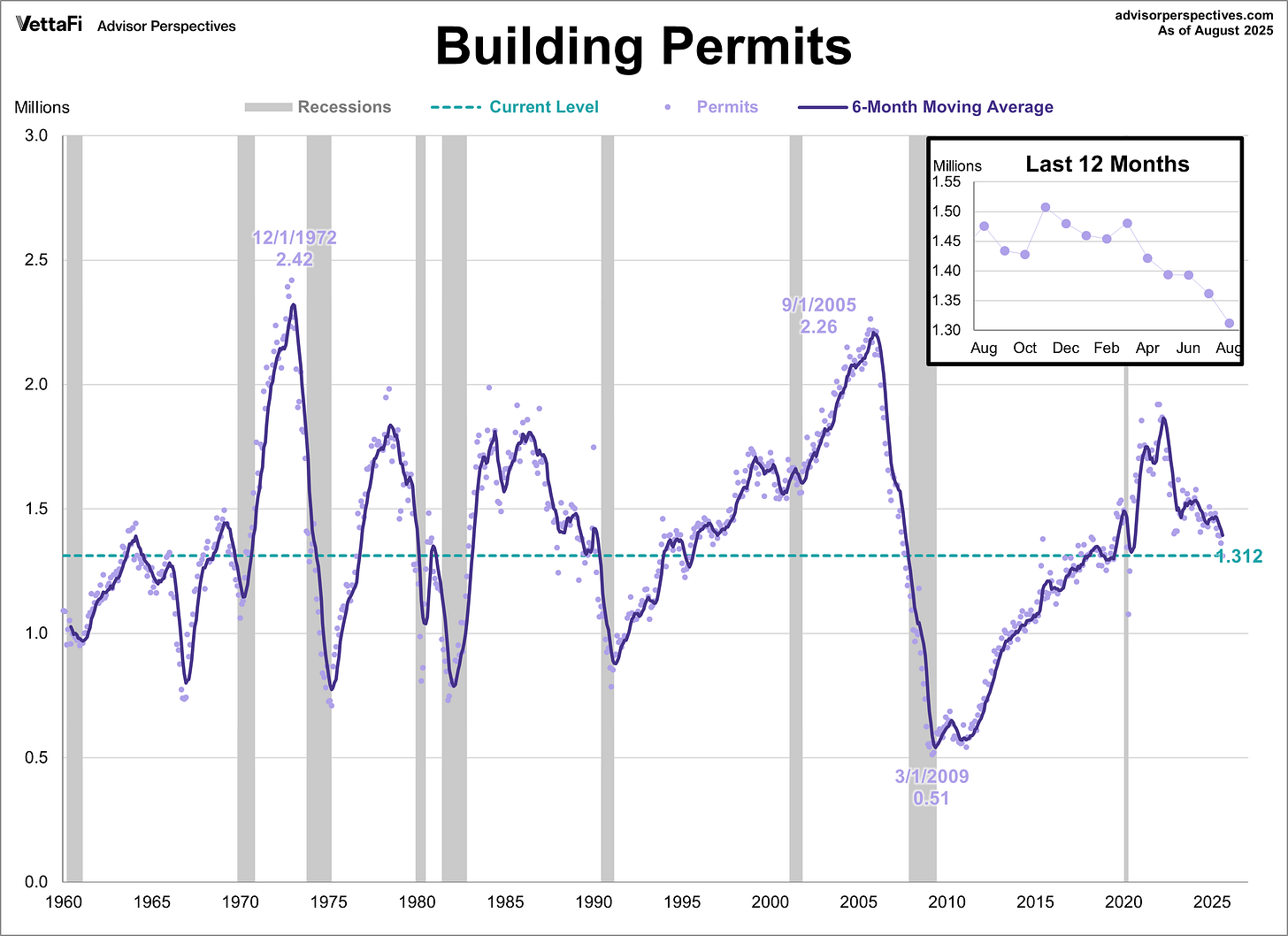

Building permits and housing starts?

They plunged in August, with permits authorized for private total housing tumbling across the board…month-over-month and year-over-year figures painted a sea of red.

Forecasts called for 1.37 million starts; we got 1.31 million. Permits fared no better.

This isn't just numbers on a screen; it's a seismic shift. Fewer permits mean fewer shovels in the ground, and in an industry built on momentum, that's a recipe for trouble.

Construction jobs have been one of the few bright spots propping up the labor market, defying gravity amid broader softening. But how long can that last when the pipeline of projects is drying up faster than a desert creek?

Historical patterns don't lie: In the 1990s, the Great Financial Crisis, and even the dot-com bust, construction employment led the charge into recessionary territory, peaking months before the broader downturn.

We're seeing flatlining now, a stubborn holdout that's starting to look more like denial than resilience.

Zoom in on the builders themselves, and the story gets grimmer.

Gross margins are eroding as incentives pile up…think rate buydowns, closing cost credits, even outright price slashes disguised as "perks."

One major player anticipates just 22,000 home deliveries in Q4, averaging $380,000 per unit, with margins scraping near 18%…well below analyst hopes. Why? Because without these sweeteners, no one's biting.

It's financial engineering at its finest: Drop the headline price from $380,000 to $330,000, and it tanks comparable sales data for future listings. Hand out a $50,000 credit instead? Same math, cleaner books. But at what cost?

"They're having to do that to such a degree that it's impacting the margins," one industry watcher noted wryly. And as these props buckle, the entire structure wobbles.

But here's the hook that keeps Wall Street up at night: If housing's the leading edge of the consumer economy…accounting for everything from appliances to landscaping…how much longer can the rest of spending hold up when homeownership feels like a trap?