The Payroll Crash Nobody Saw Coming

What 3 Negative ADP Prints Say About the Real Economy

Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | October 2, 2025

This wasn’t supposed to happen.

In an economy supposedly growing at nearly 4% GDP, the U.S. just printed its third negative ADP payroll number in four months.

That’s not just a fluke…it’s a massive red flag and the head of ADP is probably sweating bullets right now hoping Trump doesn’t fire them.

According to the latest data, private companies shed 32,000 jobs in September, following revised losses of 3,000 in August and 23,000 in June.

That’s three out of the last four months showing negative job growth.

Historically, that kind of trend doesn’t happen unless we’re already in…or about to be in…a recession. And yet, you won’t hear talk of recession on CNBC.

So let’s break down what the data actually shows, why construction job losses matter, what the bond market just told us, and how this connects to the Fed’s next move.

Premium subscribers can catch up on last weeks reporting in last weeks wrap up below.

The Numbers Are Worse Than You Think

It’s not just one bad month. The ADP payroll data for August was originally reported as a gain of 54,000. It was revised down to a 3,000 loss. That kind of revision doesn’t happen in a healthy labor market.

September’s -32,000 print was the largest drop since March 2023, when Silicon Valley Bank collapsed. Back then, markets were panicking, and credit was tightening. So what’s the excuse this time?

You could argue the government shutdown distorted the data, but let’s be real…this is deeper than a one-off.

If the government’s “growth” narrative is hanging by data that keeps getting revised into negative territory, what else is being massaged behind the curtain?

Revisions this violent aren’t noise…they’re the signal. And if the signal is flashing recession, the real shock is still to come.

Where the Jobs Are Disappearing

Losses were broad-based:

Leisure & Hospitality: -19,000

Other Services: -16,000

Professional & Business Services: -13,000

Construction: -5,000

Trade, Transport & Utilities: -7,000

The only major gainer? Education & Healthcare, up 33,000…likely due to back-to-school hiring, which oddly wasn’t fully adjusted in seasonal models.

But let’s zoom in on construction.

As George often says, construction jobs are one of the best leading indicators for economic inflection points. When builders start laying people off, it’s not because they might get fewer contracts. It’s because they already are.

A negative print in construction jobs usually means recession is imminent…or already here.

Construction losses aren’t just another sectoral blip…they’re the canary in the coal mine.

Once the builders start pulling back, history shows the economy doesn’t glide down gently…it falls off a cliff. And if construction is cracking now, the next domino is housing prices.

It’s Not Just Payrolls—JOLTS Is Flashing Red Too

Pair this data with the latest JOLTS (Job Openings and Labor Turnover Survey) report for August and you get a clearer picture: job openings held steady at a subdued 7.2 million…down from June’s peak and signaling a cooling chill…while quits ticked lower to 3.1 million and hires barely budged at 5.1 million, the slowest pace in months.

Small businesses (under 50 employees) shed 40,000 jobs last month alone. That’s the real economy. That’s your local restaurants, contractors, retailers. Those aren’t speculative tech firms…they’re demand-driven employers getting squeezed dry.

Meanwhile, large firms (500+ employees) added 33,000 jobs. Translation? The bottom 75% is already in a recession. Only the top 10% is keeping the machine running…for now.

When small businesses bleed jobs while big firms tread water…or worse, hoard the gains…it tells you who’s really bearing the brunt of this downturn.

The elites may pretend it’s business as usual, but Main Street is already in recession.

The question is: how long until Wall Street admits it?

The Market’s Reaction: Bonds Aren’t Buying the Narrative

Immediately after the ADP release, 10-year yields plunged from 4.15% to just under 4.1%, a sizable drop in minutes.

That’s the bond market saying: “Uh oh, something just broke.”

Then they bounced back. Why? Possibly because traders realized the non-farm payrolls report might not be released due to the government shutdown. If ADP is the only data we get, markets may have to “price blind”…never a good thing.

If initial claims are delayed too, it means the only labor market signals we’ll have are ADP and JOLTS.

In other words: the bad news is all we’ve got.

Bond traders aren’t sentimental…they smell blood before the headlines hit.

A sudden yield drop followed by a snapback is the market’s way of saying, “We know the truth, but we can’t price it…yet.”

The real move comes when data goes dark and panic replaces price discovery.

Are We Repeating 2019?

George pointed out something fascinating: the last time we had a similarly bizarre negative ADP print (outside of COVID) was September 2019…a -191,000 bombshell.

That came just one month after the yield curve inverted, and just days before the repo market blew up…triggering a stealth bailout from the Fed.

Sound familiar?

We’ve had a recent yield curve inversion.

Bank instability (SVB, Credit Suisse, etc.) in 2023.

Recessionary signals from construction and small business payrolls.

And yet… GDP is revised UP? From 3.3% to 3.8%? Something doesn’t add up.

When labor markets wobble, yield curves invert, and bank stability falters, history whispers warnings.

The last time we saw this script, the Fed was forced into emergency action just weeks later.

Could the next repo-like rupture already be forming under our feet?

Politics and the Shutdown: Is No Data Better Than Bad Data?

Here’s a spicy take: Trump may not mind the shutdown killing the payroll report.

Think about it…if the numbers come in weak, it reflects poorly on him. If they don’t come out at all, he avoids the headlines.

George speculated this dynamic could even play into how the political class handles the shutdown. It’s not about saving money…it’s about controlling the narrative.

Regardless of intent, the effect is the same: the most important jobs report of the month may not arrive. And markets will be flying blind.

If politicians can bury a weak jobs report by keeping it from ever seeing daylight, what else will they suppress when the numbers get worse?

When truth becomes optional, markets don’t just lose data…they lose trust. And once confidence cracks, everything else follows.

A Recession in Disguise

Three negative ADP prints in four months. Construction layoffs. Small business contraction. Bond market jitters. Data blackouts.

This is not what an expansion looks like. This is what a recession looks like before the headlines catch up.

We’ve said it before: we’re already in a two-tiered economy…an H-shaped economy, where the rich float and the rest sink.

The next leg down could drag the top tier with it.

The disconnect between rosy GDP prints and collapsing payrolls isn’t an error…it’s a trap.

A two-tiered economy can wobble along for a while, but when the bottom tier finally drags the top under, the “soft landing” fantasy will end overnight.

Trade Ideas: Betting on a Recession That’s Already Here

1. Long Bonds (TLT or 10Y Futures): If growth is tanking, yields should fall.

2. Long Gold (GLD): In uncertainty, gold thrives…especially if data suppression becomes political.

3. Short Small Cap Stocks (IWM): When small businesses are getting crushed…this index reflects that.

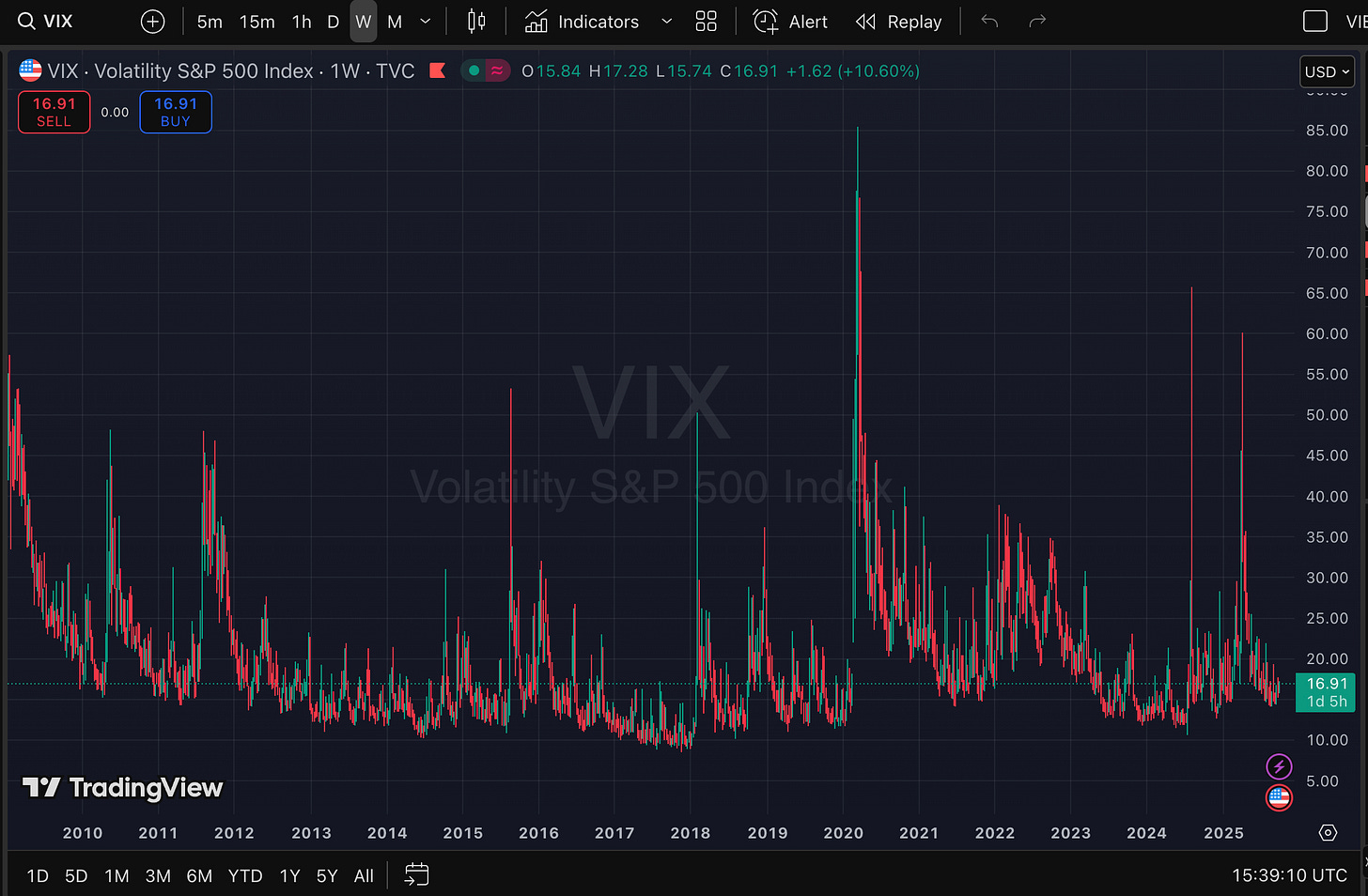

4. Long VIX Calls: Volatility could spike on missing data and poor labor prints.

5. Long Recession-Proof Staples (XLP): People still need food and toothpaste.

Positioning for recession now isn’t fear…it’s survival.

But these trade setups are just the beginning.

To see how George Gammon is mapping out the next phase, with full weekly wrap-ups and bonus whiteboard breakdowns, you’ll need to go deeper.

If you found this breakdown valuable, don’t stop here.

Join the Rebel Capitalist News Desk as a paid subscriber and unlock full access to George Gammon’s weekly wrap-up recordings, whiteboard videos, and trade breakdowns you won’t find anywhere else.

Thousands of liberty-minded investors already rely on these deep dives to stay ahead of the narrative. The next move in markets won’t wait…make sure you’re ready.

👉 [Upgrade to a paid subscription now] and start getting the insider-level macro insights you deserve.

Apparently trumponomics are as bad this time as last time. Color me shocked (sarcasm intended). He’s an IDIOT at economic and markets.