Smoke, Mirrors, and a Surprise Twist

“The numbers never lie. But the people who publish them often do.”

The U.S. economy was supposed to be limping toward the finish line.

Layoffs stacking up. Recession whispers spreading. Confidence fading.

Then…bam.

Last Thursday’s data drop landed like a Hollywood jump scare. Initial jobless claims plunged to 218,000…well below expectations.

At the same time, third-quarter GDP got a makeover, revised up to a muscular 3.8% from a softer 3.3%.

The headlines wrote themselves: “Resilient!” “Robust!” “Significantly Stronger!”

Bond yields spiked. Stocks barely blinked. Commentators rushed to declare that Uncle Sam had rediscovered his swagger.

But here’s the question lurking in the shadows: Are we watching a comeback…or just a cover-up?

Because when the surface looks too smooth, the cracks beneath are usually growing wider.

Bonds Send a Warning Shot

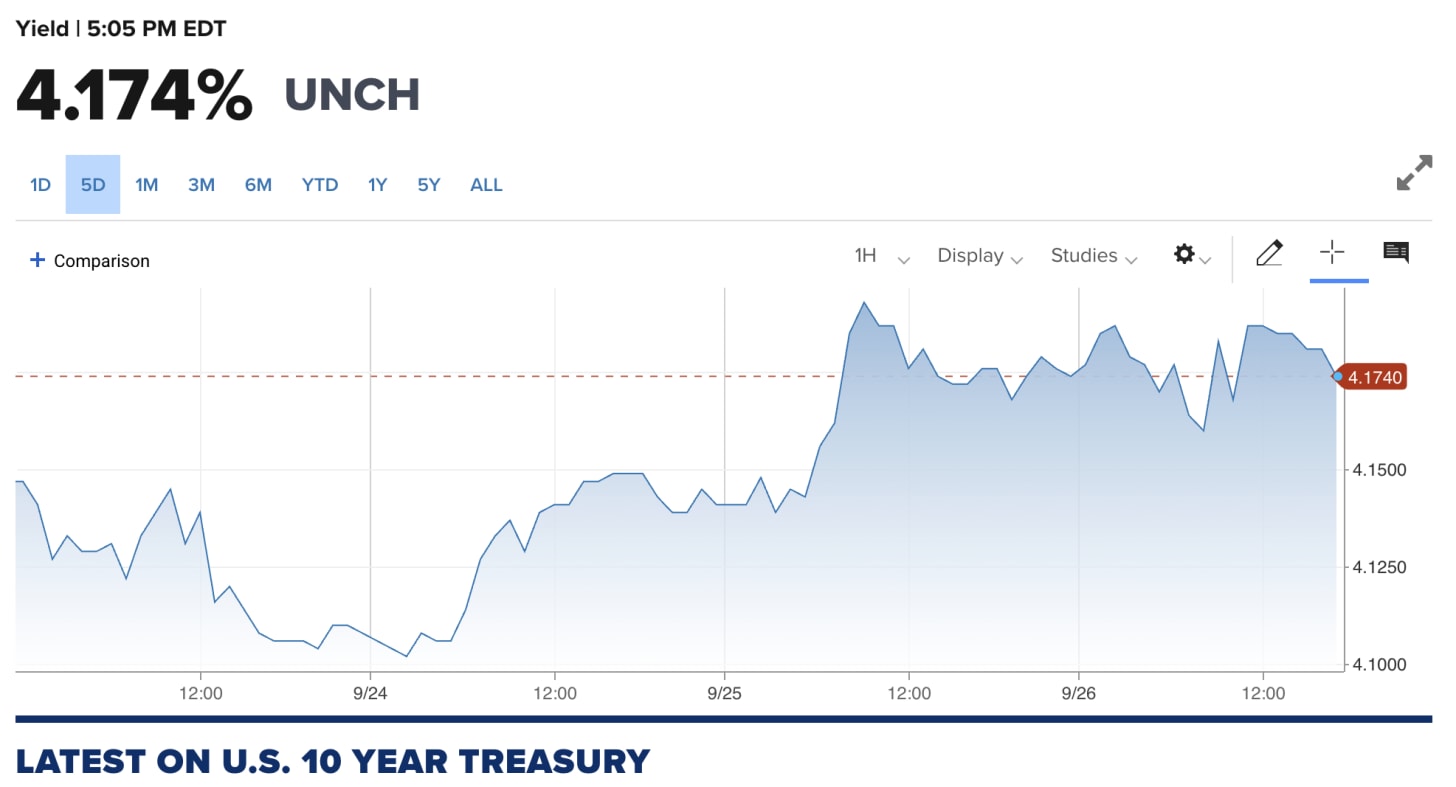

Wall Street didn’t waste time reacting. Ten-year Treasury yields shot up on the news, like a sprinter caught off guard by the starter’s pistol.

The two-year did the same…an instant knee-jerk jump before drifting back.

On a five-day chart, the move looks like a V. Up on shock. Down on digestion.

But why the whiplash?

Markets had been bracing for weakness…more cracks in the labor wall, more justification for the Fed to loosen the screws.

Instead, the data pulled the rug out from that narrative, at least for now.

Still, traders know the real test comes next week: JOLTS job openings, ADP private payrolls, initial claims again, and the big kahuna…Non-Farm Payrolls.

Forecast? A tepid 45,000.

If reality matches the hype, maybe the party continues. If not, brace for whiplash of a different kind.

But what about the labor market itself…does it really look this healthy? Or are we staring at a carefully staged mirage?

Cracks in the Employment Facade

Zoom out, and the labor fortress starts to look like a house of cards.

Yes, weekly claims dipped.

But the Bureau of Labor Statistics has been serving up some ugly surprises:

June’s Non-Farm Payroll print went negative.

Benchmark revisions flipped August and October 2024 into contraction too.

That’s three or four duds in less than a year…a pattern usually reserved for recessions, not recoveries.

In the 1970s, a big strike at UPS or a freak storm could tank payrolls for a month. But sustained negatives? That’s not weather. That’s climate.

And the cracks aren’t just in the government’s numbers. Household surveys and ADP private payrolls echo the same slowdown story.

So why does the initial claims series look rosier?

Some say it’s just timing. Claims are immediate. Payroll revisions lag.

Others whisper something darker: maybe the bean-counters are “polishing” the stats to protect jobs during an election-charged environment.

Cynical? Sure. But when data sets diverge this much, suspicion isn’t paranoia…it’s pattern recognition.

Still, optimists spin a different yarn. They point to tariff drama and immigration chaos earlier this year.

Businesses froze hiring amid the fog. Why bring on new staff if your costs could skyrocket tomorrow?

Now that tariffs are tempered and borders stabilized, maybe confidence is creeping back.

A neat story. But does it really explain the months of weakness we saw in 2024? Skeptics aren’t buying it.

And the next twist in this labor saga won’t come from Washington. It will come from the checkout aisle.

This article continues for paid subscribers…

Want full access to the rest of this article, every deep-dive macro breakdown, and exclusive Q&A sessions with George Gammon?

Upgrade to paid to keep reading and get immediate access to the full archive.